Legislative Conference begins 3-day run on Monday

Nearly 300 county leaders, policy experts and others will converge on Lansing on Monday for the start of the 2023 Michigan Counties Legislative Conference, the first major conference of MAC’s 125th Anniversary year.

Nearly 300 county leaders, policy experts and others will converge on Lansing on Monday for the start of the 2023 Michigan Counties Legislative Conference, the first major conference of MAC’s 125th Anniversary year.

Attendees may check in for the conference starting at noon at the Radisson Hotel in downtown Lansing. Light snacks will be available in the registration area.

Policy breakouts get under way for MAC members at 2 p.m., with sessions on Michigan’s trails system, the trial court funding crisis and the impact of electric vehicles on road funding in our state.

Plenary sessions on Tuesday and Wednesday will feature:

- Matthew Chase, CEO of the National Association of Counties

- Chris Harkins, Michigan’s state budget director

- A legislative leadership panel

Commissioners attending the conference also will participate in MAC caucus elections on Tuesday to fill five seats on the MAC Board of Directors.

A Legislative Reception on Tuesday evening will feature the presentation of MAC’s County Advocate Awards to Rep. Julie Rogers (D-Kalamazoo) and Sen. Jon Bumstead (R-Muskegon).

See conference agenda.

See full conference program.

For more information on the conference, visit MAC’s website.

MAC-backed public notices bill filed in House

Legislation creating the framework to allow public bodies to post their notices digitally to save time and money is back before the Legislature.

Legislation creating the framework to allow public bodies to post their notices digitally to save time and money is back before the Legislature.

Under House Bill 4428, by Rep. Kevin Coleman (D-Wayne), local units would no longer be required to post their notices in a newspaper but only share them online. This would modernize public notices law, save counties time and money and create more avenues for our citizens to receive public notices.

HB 4428 is identical to a bill he sponsored last term that was not enacted. MAC supported this legislation the last time around, with MAC’s Deena Bosworth testifying before the House Oversight Committee on its behalf.

The Michigan Press Association has long opposed this concept because its members rely on the fees they charge locals for publishing such notices.

This bill is just the first of more than 100 bills that will be necessary to implement the change. HB 4428 will serve as the framework, while the trailer bills will amend each statute requiring the notice to be published in a newspaper.

HB 4428 has been referred to the House Committee on Local Government and Municipal Finance. MAC plans to support the bill.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Legislative panels cut governor’s request on indigent defense

There would be fewer dollars for the Michigan Indigent Defense Commission (MIDC) in fiscal 2024 than the governor has requested under spending plans approved by House and Senate subcommittees this week.

There would be fewer dollars for the Michigan Indigent Defense Commission (MIDC) in fiscal 2024 than the governor has requested under spending plans approved by House and Senate subcommittees this week.

Gov. Gretchen Whitmer’s Executive Budget included a $72 million increase to MIDC grant funding as a response to the state’s approval of Standard 8, the Attorney Compensation Standard. However, the subcommittees rejected this approach.

House Bill 4280 includes a $57.2 million increase, totaling their MIDC budget to $206 million. Senate Bill 195 includes a $59 million increase, totaling the Senate version of the MIDC budget to $208.7 million. The governor’s recommended full funding for MIDC is $220 million.

The MIDC grant funding that is allocated to counties, so long as they comply with the state-approved Standards 1-8.

MAC is continuously working to ensure the state provides full funding to counties via MIDC grant dollars, as they are mandated to do. While it is still early in the budget process, and there is potential for the MIDC appropriation to increase, it is important to note that without full funding provided by the state, counties are not mandated to comply with Standard 8.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Financial strains on legal staffing are subject of special podcast episode

In a special episode, Podcast 83 delves into the growing financial strain on counties imposed by directives of the Michigan Indigent Defense Commission.

In a special episode, Podcast 83 delves into the growing financial strain on counties imposed by directives of the Michigan Indigent Defense Commission.

Host Stephan Currie and MAC staffers Deena Bosworth and Samantha Gibson discussed the state panel’s work and its impacts with two of its members:

- Margaret McAvoy, former Isabella County administrator

- Andrew DeLeeuw, interim deputy county administrator for Washtenaw County

The pair talked about their experience on the commission, which “was created by legislation in 2013 after an advisory commission recommended improvements to the state’s legal system. The MIDC works to ensure the state’s public defense system is fair, cost-effective and constitutional while simultaneously protecting public safety and accountability,” and the importance of its work.

Gibson reviewed the of MIDC’s new standard 8 on prosecuting attorney offices and staffing.

See the full video of the session, taped on April 12, 2023.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

Additional templates posted to assist with opioid settlement planning

MAC has released additional supplemental documents to the Michigan Opioid Settlements Funds Toolkit: A Guide for Local Spending. The new templates include:

MAC has released additional supplemental documents to the Michigan Opioid Settlements Funds Toolkit: A Guide for Local Spending. The new templates include:

- Request for Proposals and Associated Budget Template (PDF)(Word) (Excel)

- Files created to assist counties with looking to solicit proposals for funding from community-based organizations, entities and groups.

- Vendor/Contractor Agreement (PDF)(Word)

- Modeled after Monroe County contract; created to accompany the funds that would be allocated to entities outside the County and govern the terms and conditions and requirements. This serves as financial management practice to ensure funds disbursed are utilized in alignment with the settlements and county constraints.

- Pass Through Entity Agreement (PDF)(Word)

- File created to aid with contracting with pass-through entities, whether utilizing the external organization to subcontract all or a percentage of the settlement funds.

- Public-facing Planning Process Document (PDF)(Word)

- Document created to share publicly for counties looking to inform community members of the planning process undertaken by the county. This document is also intended to inform the community of anticipated stakeholder engagement and request for proposals processes.

If you have specific templates that you would like created, or questions, contact Amy Dolinky at dolinky@micounties.org.

Environmental spending plans head in different directions

Subcommittees in the Michigan House and Senate this week took notably different avenues on plans for water infrastructure and other items advanced by Gov. Gretchen Whitmer in her fiscal 2024 budget.

Subcommittees in the Michigan House and Senate this week took notably different avenues on plans for water infrastructure and other items advanced by Gov. Gretchen Whitmer in her fiscal 2024 budget.

The House Appropriations Environment, Great Lakes and Energy Subcommittee got creative, recommending $100 million more than the governor did by replacing hundreds of millions in state General Fund dollars with federal funding.

Most notably, the governor proposed $225.8 million in General Fund for replacing lead service lines and providing technical assistance to communities, but the House reduced that amount to $110 million, supplemented by $100 million in federal Coronavirus State Fiscal Recovery Fund dollars.

Also from the Coronavirus State Fiscal Recovery Fund, the House EGLE subcommittee recommended new line items for drinking water asset management, drinking water filtration devices in schools and child-care centers and infrastructure improvement projects for drinking water, storm water and wastewater.

By contrast, the Senate Appropriations Environment, Great Lakes and Energy Subcommittee reduced the governor’s original proposal from $1.3 billion to $1.08 billion. The main reductions came from her recommendations for regional renewable energy facilities, groundwater data collection and contaminated site clean-up.

The subcommittee chairs will meet shortly to concur on one version. The budget must be finalized before the end of June, though legislators can finish earlier.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Senate Democrats introduce renewable power bills

Michigan utilities would have to produce 100 percent of their electricity from renewable sources under legislation introduced in Lansing this week.

Michigan utilities would have to produce 100 percent of their electricity from renewable sources under legislation introduced in Lansing this week.

To achieve this, the seven-bill package, Senate Bills 271-277, would also eliminate coal-fired electricity-generating plants by 2030. Sens. Sam Singh (D-Ingham) and Sue Shink (D-Washtenaw) are leading the efforts to eradicate all greenhouse gas emissions from power generation as part of the Clean Energy Future Plan.

The bills also make the Michigan Public Service Commission will be responsible for evaluating the utility’s integrated resources plan. Their plans must demonstrate progress toward phasing out greenhouse gases, eliminating adverse effects on human health and reducing harm to the health, safety, and welfare of communities subject to environmental injustice.

Other provisions in the package include:

- reducing carbon intensity of transportation fuels by 25 percent by 2035;

- creating a Michigan Construction Decarbonization Strategic Plan to reduce emissions from heating homes and businesses by 17 percent by 2030; and

- allowing farmers in the state’s PA 116 program to preserve farmland to rent their properties for solar operations and stay in the preservation program.

While this may appear a massive undertaking, Consumers Energy already has announced a plan to eliminate coal in its operations by 2025.

The bills have been referred to the Senate Committee on Energy and Environment. MAC has not taken a position on the legislation.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Bill would restore local control over plastic bag regulations

Local control over the retail use of plastic bags would be restored under a bill introduced in March.

Local control over the retail use of plastic bags would be restored under a bill introduced in March.

Senate Bill 228, by Sen. Sue Shink (D-Washtenaw), would allow local governments to determine whether to allow plastic bags in their communities. The legislation stems from concerns over the impact plastic bags can have on our environment, as they tend to end up as litter or non-recycled waste. SB 228 will grant locals the authority to weigh the environmental impacts and regulate their use as they see fit.

Banning plastic bags outright is not the only option permitted in this bill; locals could impose a fee or tax for using them.

SB 228 would reverse the state restrictions on local action adopted in Public Act PA 389 of 2016 signed by Gov. Rick Snyder.

Several states currently allow municipalities to regulate bag use, and major cities such as Chicago, Boston and Los Angeles have plastic bag bans on the books. Eight states have statewide bans: California, Connecticut, Delaware, Hawaii, Maine, New York, Oregon and Vermont.

The bill was sent to the Senate Committee on Energy and Environment. MAC has not yet taken a position on this legislation.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

State offers grants for town halls on mental health, substance use issues

Throughout the COVID-19 pandemic, concerns about substance use and mental health conditions have grown.

Throughout the COVID-19 pandemic, concerns about substance use and mental health conditions have grown.

The Michigan Department of Health and Human Services’ (MDHHS) Substance Use, Gambling and Epidemiology Section (SUGE) is seeking applications from organizations to conduct Community Town Hall meetings that:

- Address the impact of this public health crisis on populations, especially disparate or underserved populations.

- Help raise awareness about coping with COVID-19 by sharing informational materials based on the latest research.

- Determine community concerns and disseminate relevant resources to address priority areas: underage drinking, marijuana, prescription drugs/opioids, tobacco and mental health.

Apply now to conduct a Community Town Hall Event!

The Community Town Hall must occur on or before Aug. 31, 2023.

- Applications will be accepted through May 31, 2023, on a first-come, first-served basis.

- Limited to 75 organizations.

- $1,500 per Community Town Hall. You will be reimbursed for actual costs up to $1,500 through a contract with our training logistics contractor: Community Mental Health Association of Michigan (CMHAM).

- MDHHS has the ability to deny an organization’s application.

Funding can be used for expenses such as:

- Speakers

- Panel discussions

- Venues

- Evaluation efforts

- Technology (if applicable)

Funding cannot be used for:

- Promotional items, including but not limited to clothing, commemorative items such as pens, mugs/cups, folders/folios, lanyards, and conference bags.

- Direct payments to individuals to participate in prevention services. Note: Prevention provider may provide up to $30 non-cash incentive to participate in data collection follow-up.

- Meals are generally unallowable.

Community Needs Assessment resources for your reference:

- Michigan Substance Use Disorder Data Repository (SUDDR)

- S. Census

- Michigan School Health Survey System

- Youth Risk Behavior Surveillance System (YRBSS)

- Behavioral Risk Factor Surveillance System (BRFSS)

If there are any questions or if you are experiencing technical issues with the application, please contact Lisa Coleman at ColemanL7@michigan.gov and Jamie Meister at MeisterJ1@michigan.gov.

Capital assets are focus of April 24 Treasury webinar

The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) are hosting the next Fiscally Ready Communities training opportunity on April 24. This FREE training is a 90-minute webinar that’s designed to assist appointed and elected officials.

The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) are hosting the next Fiscally Ready Communities training opportunity on April 24. This FREE training is a 90-minute webinar that’s designed to assist appointed and elected officials.

Capital Asset Management and Planning

Recurring annual expenses are simple to budget, but repair and replacement of big-ticket items can be much more difficult. A Capital Improvement Program (CIP) will help your local government organize those major projects and forecast the expenses to make long-term planning simpler. This session will cover the basics of a CIP, best practices, and give participants a chance to share techniques that have worked for their community, as well as policies, procedures, and accounting for capital asset management and plan.

The webinar runs on Monday, April 24 from 10 a.m. to 11:30 a.m. (EST).

For more information about Fiscally Ready Communities, please check out the Treasury Fiscally Ready Communities webpage. This webpage includes Treasury’s 32-page Fiscally Ready Communities Best Practices document, which we encourage all local officials to review.

If you have any questions, email TreasLocalGov@michigan.gov with the subject line “Fiscally Ready.”

Staff picks

Staff picks

- Facing up to facial recognition (American City and County)

- The true dangers of long trains (Governing)

- Panel Database on Incentives and Taxes (W.E. Upjohn Institute for Employment Research)

- Freeze-dried candy to salami chips: 5 products that wowed at Make It In Michigan (MLive)

New, stricter rules on acquiring and using mineral brine on roadways were delayed by the state after a group of legislators and stakeholders, including MAC, convinced the Department of Environment, Great Lakes and Energy (EGLE) to further study the matter.

New, stricter rules on acquiring and using mineral brine on roadways were delayed by the state after a group of legislators and stakeholders, including MAC, convinced the Department of Environment, Great Lakes and Energy (EGLE) to further study the matter. “Earlier this week,

“Earlier this week,  In a special episode of Podcast 83 released this week, MAC details the long-simmering crisis in trial court funding that soon may come to a boil in Lansing.

In a special episode of Podcast 83 released this week, MAC details the long-simmering crisis in trial court funding that soon may come to a boil in Lansing. Got an opinion on Michigan’s roads? The Michigan Infrastructure Council (MIC) is seeking input from Michigan residents on the status of our state’s infrastructure.

Got an opinion on Michigan’s roads? The Michigan Infrastructure Council (MIC) is seeking input from Michigan residents on the status of our state’s infrastructure.

Two bill packages were introduced in Lansing in late March that could serve to stabilize revenues for counties and create more predictability in revenues.

Two bill packages were introduced in Lansing in late March that could serve to stabilize revenues for counties and create more predictability in revenues.  Leaders from the majority and minority parties in both chambers of the Michigan Legislature will join MAC for a discussion on their priorities and what has changed in Lansing since Democrats gained the majority in the House and Senate for the first time in 40 years. They also will be asked for their views on a variety of county priorities in 2023. The discussion will be moderated by Deena Bosworth, MAC’s director of governmental affairs.

Leaders from the majority and minority parties in both chambers of the Michigan Legislature will join MAC for a discussion on their priorities and what has changed in Lansing since Democrats gained the majority in the House and Senate for the first time in 40 years. They also will be asked for their views on a variety of county priorities in 2023. The discussion will be moderated by Deena Bosworth, MAC’s director of governmental affairs.

The deadline for the

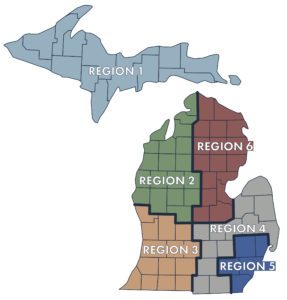

The deadline for the  Fourteen county commissioners from across Michigan have filed to fill five vacant board seats on the MAC Board of Directors in elections to be held at the 2023 Legislative Conference, April 24-26.

Fourteen county commissioners from across Michigan have filed to fill five vacant board seats on the MAC Board of Directors in elections to be held at the 2023 Legislative Conference, April 24-26. In a special episode of Podcast 83, MAC’s Deena Bosworth discusses the rising issue of inland lake levels with a legal expert on county responsibilities for lakes.

In a special episode of Podcast 83, MAC’s Deena Bosworth discusses the rising issue of inland lake levels with a legal expert on county responsibilities for lakes. The Michigan Department of Treasury will host the initial webinar to review the Protecting MI Pension: Michigan Local Pension Grant Program on April 6. This initial webinar will focus on the processes that local governments will use to complete and submit an application, along with the process for review and award distribution. Subsequent webinars will focus on technical aspects related to the Protecting MI Pension Grant program, as well as frequently asked questions.

The Michigan Department of Treasury will host the initial webinar to review the Protecting MI Pension: Michigan Local Pension Grant Program on April 6. This initial webinar will focus on the processes that local governments will use to complete and submit an application, along with the process for review and award distribution. Subsequent webinars will focus on technical aspects related to the Protecting MI Pension Grant program, as well as frequently asked questions. Two different packages of bills that create a state Revenue Sharing Trust Fund and direct the expenditures of such a fund have been introduced in the Legislature.

Two different packages of bills that create a state Revenue Sharing Trust Fund and direct the expenditures of such a fund have been introduced in the Legislature. Members of the Michigan Task Force on Juvenile Justice Reform testified before the Senate Committee on Civil Rights, Judiciary and Public Safety this week on the 32 recommendations

Members of the Michigan Task Force on Juvenile Justice Reform testified before the Senate Committee on Civil Rights, Judiciary and Public Safety this week on the 32 recommendations  On March 29, new state legal provisions kick in requiring counties to update their Materials Management Plans (MMP) and increase recycling rates in Michigan.

On March 29, new state legal provisions kick in requiring counties to update their Materials Management Plans (MMP) and increase recycling rates in Michigan. Wayne County officials were called to

Wayne County officials were called to  Major changes are looming for three significant areas of county responsibility, MAC’s Podcast 83 team said this week.

Major changes are looming for three significant areas of county responsibility, MAC’s Podcast 83 team said this week. The Michigan Opioid Advisory Commission released its

The Michigan Opioid Advisory Commission released its