By Stephan Currie, Executive Director, Michigan Association of Counties

The citizens now serving in the Michigan Legislature did not create the fiscal crisis that now grips our 83 counties and other local governments.

The crisis is so large, so complex, it took decades to create — decades of poor choices, often made with good, or at least not malicious, intentions.

Nevertheless, time after time, legislators eased their own financial challenges by deepening the hole that our 83 county governments are trapped in. Revenue-sharing cuts. Unfunded mandates. Restrictions on raising and using revenue. The encroachments are many, the effects enormous.

Nevertheless, time after time, legislators eased their own financial challenges by deepening the hole that our 83 county governments are trapped in. Revenue-sharing cuts. Unfunded mandates. Restrictions on raising and using revenue. The encroachments are many, the effects enormous.

Today, we are urging them to take the first step to better fiscal health: Stop making it worse.

Four years ago, state leaders briefly noticed the problem around them and convened a task force to study the pension and retiree health care pressures squeezing local governments. I was proud to sit on that panel, which produced a series of limited but practical recommendations to ease the strain.

All the Legislature managed to do, unfortunately, was to require locals to generate more reports (i.e., more work for locals) for the state to look at.

And if you look at those reports, you will see an unsurprising fact: Counties are still squeezed. In fiscal 2019, for example, county governments had at least $3.5 billion in unfunded liabilities for retiree pensions and health care coverage.

And what has the Legislature been doing in the meantime? Not helping.

In 2013, it enacted an exemption on property taxes to help Michigan veterans — a laudable goal. But they did it without compensating local governments. That exemption has carved $1.7 billion in taxable value off local accounts.

In the last three legislative sessions, 2015-2020, legislators filed no fewer than 140 separate bills involving exemptions to the property tax, the central revenue source for Michigan counties.

Many of these bills were motivated by noble purposes (job creation) or targeted for worthy groups (disabled veterans, charitable groups), but what they all lacked was any recognition of, or response for, the resulting cuts to local resources and local services.

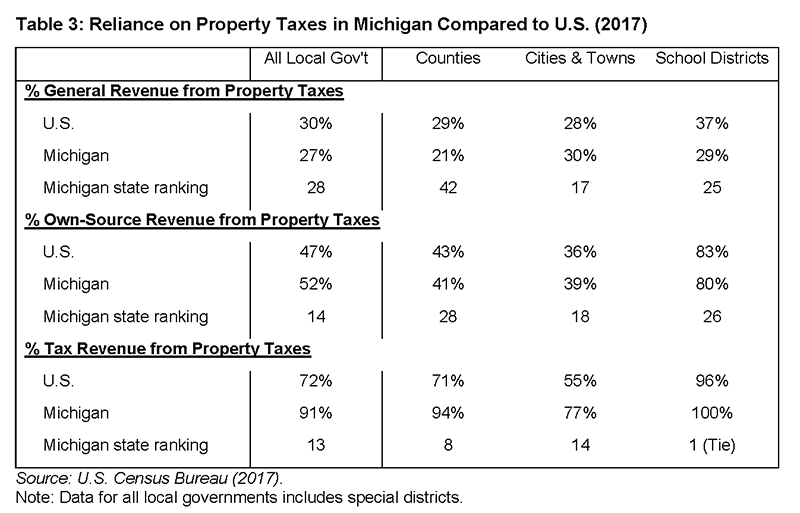

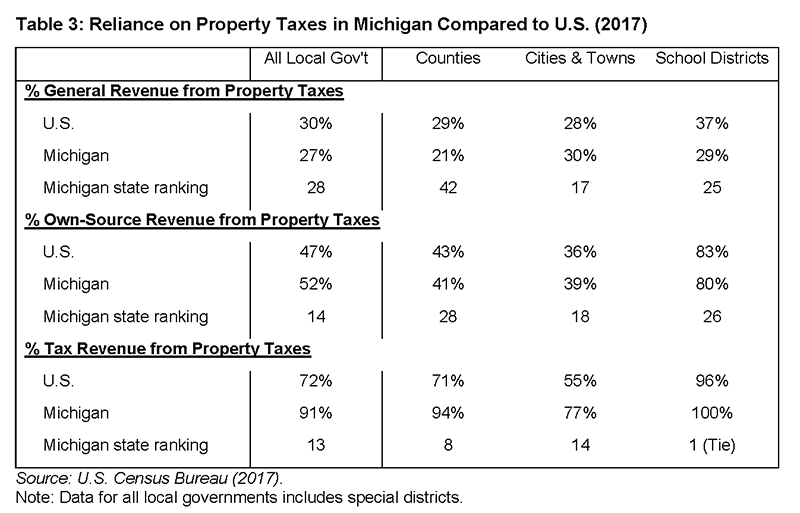

And consider, a recent analysis by the nonpartisan Lincoln Institute of Land Policy found that not only is Michigan “unique in the restrictiveness of the state’s property tax limits,” but “the property tax is particularly important for local governments’ fiscal health in Michigan because they have little access to other types of taxes to raise revenue.”

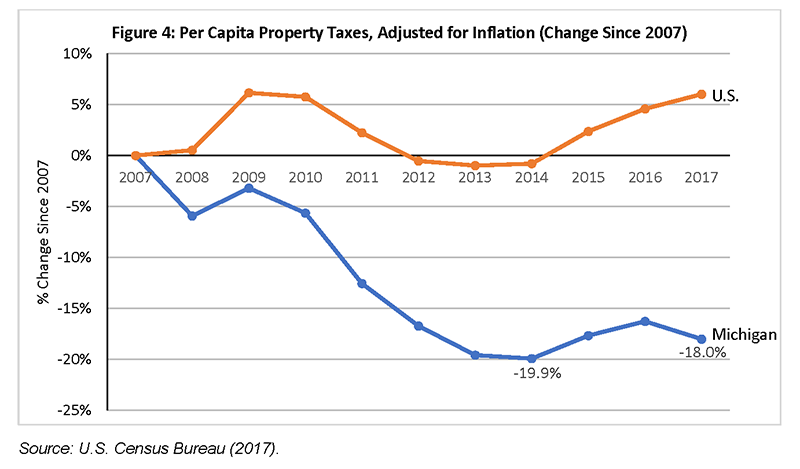

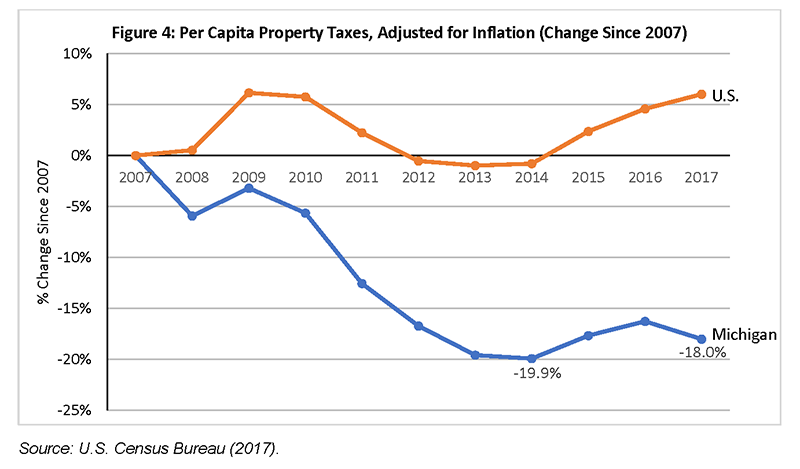

Our crisis only worsened in the aftermath of the Great Recession a decade ago. As the state’s economy and resources bounced back, Michigan’s local governments, trapped underneath two interlocking state restrictions on property taxes (Proposal A and the Headlee Amendment), saw their resources plunge and never really return.

Our crisis only worsened in the aftermath of the Great Recession a decade ago. As the state’s economy and resources bounced back, Michigan’s local governments, trapped underneath two interlocking state restrictions on property taxes (Proposal A and the Headlee Amendment), saw their resources plunge and never really return.

It took 11 years for nominal property tax collections to recover to their 2008 level. Worse, adjusting for inflation, counties are now collecting almost $1 billion less than they did in 2008.

Then, of course, COVID hits.

Across the state, county leaders worked to ensure the continued delivery of public services while doing their best to protect the health of residents and county employees. The strains have been severe, but counties have met the challenge – so far.

But we’ve all seen what COVID has done to local economies, with empty storefronts and unutilized office buildings a common sight. Those images will, at some point, translate into lower property values and lower property taxes (used to pay for those local services and cover those local liabilities to public servants).

Despite this, some legislators are backing more ideas that will create more problems.

They are pointing to the historic investment to counties in the American Rescue Plan as proof the state can further reduce its commitment — even though the ARP funds cannot, by law, be used to address pension or retiree health care needs.

And they continue to file and tout property tax exemptions (10 bills so far in 2021).

With each of these special breaks, more of the burden for public services shifts to everyone else, the small businesses and households that constitute the majority of the state’s taxpayers.

So, until the Legislature can engage in a good-faith discussion on how to address the local government fiscal crisis, we have one simple request to lawmakers: Stop making it worse.

NOTE: This commentary originally appeared in Crain’s Detroit Business on May 23.

A bill that would impose a legislative procedure to prohibit the enactment of unfunded mandates, a long-held goal of MAC, received a hearing this week in the Senate Committee on Oversight.

A bill that would impose a legislative procedure to prohibit the enactment of unfunded mandates, a long-held goal of MAC, received a hearing this week in the Senate Committee on Oversight. A two-bill package “modernizing” public notice postings passed out of the Senate Committee on Local Government this week.

A two-bill package “modernizing” public notice postings passed out of the Senate Committee on Local Government this week.  New legislation clarifying the custody of those convicted of murder in Michigan received the support of MAC this week.

New legislation clarifying the custody of those convicted of murder in Michigan received the support of MAC this week. Legislation to extend authorization for 9-1-1 operations and funding was introduced this week by Rep. Julie Calley (R-Ionia). Currently, the Emergency 9-1-1 Service Enabling Act expires at the end of this year.

Legislation to extend authorization for 9-1-1 operations and funding was introduced this week by Rep. Julie Calley (R-Ionia). Currently, the Emergency 9-1-1 Service Enabling Act expires at the end of this year.  MAC’s Podcast 83 team resumes its weekly live sessions on state and federal policy issues at 3 p.m. on Monday, June 21.

MAC’s Podcast 83 team resumes its weekly live sessions on state and federal policy issues at 3 p.m. on Monday, June 21. After gaining broad support and bipartisan passage in the Michigan Senate, legislation to adopt four-year terms for county commissioners awaits initial action in the House of Representatives.

After gaining broad support and bipartisan passage in the Michigan Senate, legislation to adopt four-year terms for county commissioners awaits initial action in the House of Representatives. An amended version of

An amended version of  A reported COVID outbreak with the partnering vendor has delayed shipment of U.S. flag retirement boxes to Michigan counties that requested them via a new NACo program.

A reported COVID outbreak with the partnering vendor has delayed shipment of U.S. flag retirement boxes to Michigan counties that requested them via a new NACo program. The

The  The trends on Michigan’s roadways continue to be poor, said the Michigan Transportation Asset Management Council (TAMC) recently in publishing its

The trends on Michigan’s roadways continue to be poor, said the Michigan Transportation Asset Management Council (TAMC) recently in publishing its  Staff picks

Staff picks With the release of a new U.S. Treasury FAQ sheet and aggregated language on interim spending rules, Michigan counties now have substantial guidance on how they can use the $1.9 billion in direct investments via the American Rescue Plan.

With the release of a new U.S. Treasury FAQ sheet and aggregated language on interim spending rules, Michigan counties now have substantial guidance on how they can use the $1.9 billion in direct investments via the American Rescue Plan. Commissioners and other county leaders can learn tips on how to utilize American Rescue Plans and be briefed on the affordable housing crisis and its effects on counties during MAC’s 2021 Regional Summits in late July.

Commissioners and other county leaders can learn tips on how to utilize American Rescue Plans and be briefed on the affordable housing crisis and its effects on counties during MAC’s 2021 Regional Summits in late July. MAC will be nominating two county commissioners to a new Task Force on Juvenile Justice Reform

MAC will be nominating two county commissioners to a new Task Force on Juvenile Justice Reform  Bipartisan legislation backed by the

Bipartisan legislation backed by the  In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share.

In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share. The next webinar in a series co-sponsored by MAC on local finance issues will run from 2 p.m. to 3:30 p.m. on June 17.

The next webinar in a series co-sponsored by MAC on local finance issues will run from 2 p.m. to 3:30 p.m. on June 17. The

The  Over the previous 12 months, the Michigan Department of Health and Human Services (MDHHS) and CedarBridge Group (CBG) have been conducting an environmental scan of the health information technology infrastructure within Michigan. The draft environmental scan findings and recommendations have been presented to MDHHS and the

Over the previous 12 months, the Michigan Department of Health and Human Services (MDHHS) and CedarBridge Group (CBG) have been conducting an environmental scan of the health information technology infrastructure within Michigan. The draft environmental scan findings and recommendations have been presented to MDHHS and the  By a vote of 32-4, the Michigan Senate approved Senate Bills

By a vote of 32-4, the Michigan Senate approved Senate Bills  A package of bills aimed at usurping local control in favor of state siting and regulation of sand and gravel mining operations passed out of the Senate Committee on Transportation and Infrastructure this week. MAC joined a large group of other local government stakeholders in opposing the legislation.

A package of bills aimed at usurping local control in favor of state siting and regulation of sand and gravel mining operations passed out of the Senate Committee on Transportation and Infrastructure this week. MAC joined a large group of other local government stakeholders in opposing the legislation. MAC-supported

MAC-supported  The State Court Administrative Office recently

The State Court Administrative Office recently  In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share.

In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share. Nevertheless, time after time, legislators eased their own financial challenges by deepening the hole that our 83 county governments are trapped in. Revenue-sharing cuts. Unfunded mandates. Restrictions on raising and using revenue. The encroachments are many, the effects enormous.

Nevertheless, time after time, legislators eased their own financial challenges by deepening the hole that our 83 county governments are trapped in. Revenue-sharing cuts. Unfunded mandates. Restrictions on raising and using revenue. The encroachments are many, the effects enormous. Our crisis only worsened in the aftermath of the Great Recession a decade ago. As the state’s economy and resources bounced back, Michigan’s local governments, trapped underneath two interlocking state restrictions on property taxes (Proposal A and the Headlee Amendment), saw their resources plunge and never really return.

Our crisis only worsened in the aftermath of the Great Recession a decade ago. As the state’s economy and resources bounced back, Michigan’s local governments, trapped underneath two interlocking state restrictions on property taxes (Proposal A and the Headlee Amendment), saw their resources plunge and never really return.