MAC-backed safety bills advance from Senate committee

Three bills on local public safety were approved by the Senate Judiciary and Public Safety Committee this week that MAC supports.

Three bills on local public safety were approved by the Senate Judiciary and Public Safety Committee this week that MAC supports.

House Bill 4719, by Rep. Robert Bezotte (R-Livingston), a former sheriff and county commissioner, would require a person convicted of first-degree murder be immediately committed to the jurisdiction of the Michigan Department of Corrections (DOC) in a state correctional facility, pending sentencing. The county sheriff will have to transport the convicted person for final sentencing from the facility to the county and back again.

HB 4887, by Rep. Mike Mueller (R-Genesee), would also allow for transports of a juvenile under the age of 18 with an adult in limited circumstances. A transport could occur if all of the following apply in the situation: the juvenile was 16 or older; the adult was 25 or younger; the juvenile and adult were taken into custody at the same time; the juvenile and adult were taken into custody for the same offense or both occupied the same vehicle at the time the offense was committed; and the juvenile was taken directly to the appropriate location and then was separated from the adult at the earliest available time.

MAC supports both bills to ensure officer and public safety and save county time and resources.

MAC also supports HB 4173, introduced by Rep. Kara Hope (D-Ingham) that would delete the cap on the amount of a reward that a county may offer for the arrest and conviction of a person who committed a crime or escaped from a penal institution. Current law limits the amount a county board of commissioners could offer and pay out for the arrest and conviction at $2,000. The bill would change that limit and leave it to the county’s discretion.

For more information on this issue, send an email to Hannah Sweeney at sweeney@micounties.org.

Details released on getting second batch of federal ARP funds

The U.S. Treasury has begun the process of allocating the second tranche of ARP Recovery Funds.

The U.S. Treasury has begun the process of allocating the second tranche of ARP Recovery Funds.

The process for counties to receive the second installment of funding is provided below with the new SAM.gov registration requirements:

Section 603 of ARPA provides payments to eligible local governments in two tranches, with the second tranche payment being made no earlier than 12 months after the first payment.

Consistent with this requirement, Treasury expects to provide second tranche payments to local governments approximately 12 months after their first payment.

In the coming weeks, Treasury will open the submission portal in a phased approach, allowing counties to access the portal for 30 days prior to their second tranche payment date.

Counties will receive a notification from Treasury by email letting them know that they can enter the portal — it is very important to make sure that the assigned point of contact is still available to receive future communications.

The point of contact is the individual designated in the portal during the first tranche submission who will receive email notifications on submission status, including any issues found during the verification and communication regarding payments.

The individual entering the portal for the second tranche submission will be the same individual with the registered ID.me who submitted for the first tranche allocation.

If that individual is no longer with the county and you need to designate a new individual, email COVIDReliefITSupport@treasury.gov with the subject line “Entity Name – Update to Designated Individuals” and include the role that needs to be updated along with the full name, title, email and phone number of the new person designated.

After the email is received by the county, the point of contact will be able to update their entity information to include banking information in the portal.

In preparation for the second tranche payment, counties should ensure their SAM.gov entity registration is still active — all counties are required to have a SAM.gov registration to receive their second tranche payment.

Note that on April 4, 2022, the federal government changed service providers and stopped using the DUNS Number and began using the Unique Entity ID (UEI) in SAM.gov to identify entities.

All counties, even those already registered in SAM.gov, must validate their entity information through the new service provider.

Counties may need to provide additional supporting documentation through the new system.

The General Services Administration (GSA) released FAQs to support counties through this new process.

Counties are required to renew their SAM.gov registration every 12 months. If a county’s SAM.gov registration expired (12-month coverage) before it is due to receive its second tranche (and after April 4, 2022) the county is required to reactivate their SAM.gov registration, which will require them to adopt UEI (instead of a DUNS number) PRIOR to receiving their second installment.

Keit-Corrion departs MAC government team

Meghann Keit-Corrion, MAC’s governmental affairs associate with specific responsibilities for court, health, human services, public safety and other issues, departs MAC on Friday, May 27.

Meghann Keit-Corrion, MAC’s governmental affairs associate with specific responsibilities for court, health, human services, public safety and other issues, departs MAC on Friday, May 27.

The Michigan State University graduate will be joining the Dykema law firm in Lansing.

Keit-Corrion joined MAC in September 2017 from the office of Sen. Jim Stamas. She also worked for Stamas when he served in the Michigan House and for the Midwest Strategy Group in Lansing, where she was a legislative analyst.

“Meghann has played an important role at MAC working on health and judiciary issues. We wish her the best of luck in the future,” said Stephan Currie, MAC’s executive director.

Bill for nonpartisan county elections introduced

Some county boards of commissioners would have the ability to create nonpartisan elections for countywide offices under a new bill introduced in the Senate.

Some county boards of commissioners would have the ability to create nonpartisan elections for countywide offices under a new bill introduced in the Senate.

Under Senate Bill 1050, by Sen. Ed McBroom (R-Dickinson), counties with a populations below 75,000 may adopt a resolution to create nonpartisan elections for the following offices: clerk, treasurer, register of deeds, prosecutor, sheriff, drain commissioner, surveyor, coroner and elected road commissions.

Incumbents will be noted on the ballot and the two candidates with the most votes in a primary would move on to the November general election. Counties will have the option to adopt this change within three years of a census.

MAC will continue to monitor the bill as it moves through the legislative process.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Fuel tax suspension bills clear full Senate

Bills to suspend state fuel taxes in a bid to lower prices at the pump advanced out of committee this week. A Senate committee and the full chamber this week reviewed and approved:

Bills to suspend state fuel taxes in a bid to lower prices at the pump advanced out of committee this week. A Senate committee and the full chamber this week reviewed and approved:

- Senate Bills 972, 973, 974, by Sen. Tom Barrett (R-Eaton), Sen. Aric Nesbit (R-Cass), and Sen. Dan Lauwers (R-St. Clair) respectively, suspend the collection of taxes on gasoline by exempting motor fuel from sales and use tax for the period of June 15-Sept. 15.

- Senate Bill 1029, by Sen. Roger Victory (R-Ottawa), which specifies that between June 15 and Sept. 15 the rate of tax on gasoline would be zero. The bill would appropriate $192.6 million from the state’s General Fund to county road commissions and $107.4 million to cities and villages to backfill any lost revenue from the sales and use tax suspension.

The package now moves to the House. MAC will continue to track the legislation.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Key measure for medical care facilities heads to governor

After months of steady progress, House Bill 5875 has cleared the Legislature. This week, the full Senate approved the three-year extension to the county maintenance of effort (MOE) rate for county medical care facilities (MCFs), a key legislative priority for the Michigan County Medical Care Facilities Council (MCMCFC).

After months of steady progress, House Bill 5875 has cleared the Legislature. This week, the full Senate approved the three-year extension to the county maintenance of effort (MOE) rate for county medical care facilities (MCFs), a key legislative priority for the Michigan County Medical Care Facilities Council (MCMCFC).

HB 5875, by Rep. Bronna Kahle (R-Lenawee), provides an extension to the MOE freeze until 2025, or until the Michigan Department of Health and Human Services (MDHHS) implements a new reimbursement model, whichever is sooner.

MDHHS has been studying and contemplating a new reimbursement model and policies for long-term care facilities. Should a new approach be implemented prior to Dec. 31, 2025, MCFs would transition to the new system under the bill.

MCMCFC had partners in support, including MAC, the Health Care Association of Michigan and LeadingAge Michigan. MCMCFC greatly appreciates the work of bill sponsor, Rep. Kahle, and her staff for championing this important issue for facilities.

The bill now heads to the governor for final approval.

Report outlines options on spending opioid dollars

In late 2021, the Michigan Department of Health and Human Services (MDHHS) contracted with the Center for Health and Research Transformation (CHRT) to analyze results from a survey of key Michigan respondents about the best ways to use opioid settlement dollars within state and federal guidelines.

In late 2021, the Michigan Department of Health and Human Services (MDHHS) contracted with the Center for Health and Research Transformation (CHRT) to analyze results from a survey of key Michigan respondents about the best ways to use opioid settlement dollars within state and federal guidelines.

CHRT’s team analyzed qualitative and quantitative survey results in collaboration with state partners then reported back to MDHHS to share its analysis, which is the first step toward making recommendations to support policymakers’ decision process.

Respondent priorities for the use of settlement funds included:

- Recovery support services, including peer support and wrap-around services for individuals with substance use disorder and co-occurring mental health diagnoses

- Prevention programming

- Expanding access to medications used to effectively treat opioid use disorder (MOUD) and other opioid-related treatment

The full report can be found here.

Two counties earn green recognition from state group

Two counties were recognized by the Michigan Green Communities program for taking the Michigan Green Communities Challenge. The program is designed to promote environmental sustainability and development in communities across Michigan.

Two counties were recognized by the Michigan Green Communities program for taking the Michigan Green Communities Challenge. The program is designed to promote environmental sustainability and development in communities across Michigan.

Local units of government that chose to participate in the challenge completed actions in 2021 related to energy efficiency, climate adaptation, resilience, recycling and environmental justice. Ten communities received bronze certification, 12 received silver certification and 22 received gold certification. Among them were:

- Oakland County, receiving silver certification

- Monroe County, receiving bronze certification

The program is open to all local governments in Michigan at no cost. For more information, contact Danielle Beard, Michigan Green Communities program coordinator, at dbeard@migreencommunities.com or Hannah Sweeney at sweeney@miounties.org.

State looking for foster care volunteers

Michigan needs more loving foster families to temporarily care for children while the state works to reunify them safely with their biological parents, a point made by Gov. Gretchen Whitmer in proclaiming May as Foster Care Month in Michigan.

Michigan needs more loving foster families to temporarily care for children while the state works to reunify them safely with their biological parents, a point made by Gov. Gretchen Whitmer in proclaiming May as Foster Care Month in Michigan.

The Michigan Department of Health and Human Services (MDHHS) is recognizing foster families for their contributions while raising awareness of the need for more foster homes. There are about 10,500 children in foster care in the state. There is a particular need for families to foster older children, sibling groups and youth with special needs.

“We are facing an increased need for foster families to provide stable and safe care for children due to the department’s commitment to provide family homes for children and reduce the use of congregate care settings, as well as a significant loss of foster homes during the pandemic,” said Demetrius Starling, executive director of the MDHHS Children’s Services Agency. “I want to thank the 4,928 foster families in Michigan who have stepped up because they want to help children who deserving loving homes.”

In most cases, MDHHS’s goal is to reunify the children with their families after providing resources to them. If that’s not safe, MDHHS looks to find them permanent homes through adoption.

Anyone interested in becoming a foster parent can call a Foster Care Navigator at 855-MICHKIDS or visit www.fcnp.org. Navigators are experienced foster care parents who can answer questions and guide prospective foster parents on their journey. Learn more at www.michigan.gov/hopeforahome.

MAC offices closed on Monday, May 30

MAC’s offices in Lansing will be closed on Monday, May 30 to observe the Memorial Day holiday.

MAC’s offices in Lansing will be closed on Monday, May 30 to observe the Memorial Day holiday.

Normal office hours will resume at 8 a.m. on Tuesday, May 31.

MAC joins our members and the rest of the United States in honoring the sacrifice of the men and women who gave their lives in service of their country.

Staff picks

Staff picks

- ‘Like somebody came back to life.’ Michigan teen reunites with lost dog after 11 months (MLive)

- On the Way the Criminal Justice System Fails Our Poor Communities (Literary Hub)

- Three Calhoun County entities work together to keep those needing mental health services out of jail (Second Wave Media)

- Dozens of rescuers help save dolphins stranded on Cape Cod (Associated Press)

In swift action this week, the House and Senate put forth and passed an income tax cut bill that would also allocate funding to local governments for their losses due to the veterans property tax exemption. Such reimbursements are a key MAC policy priority in 2022.

In swift action this week, the House and Senate put forth and passed an income tax cut bill that would also allocate funding to local governments for their losses due to the veterans property tax exemption. Such reimbursements are a key MAC policy priority in 2022. Tax dollars continue to flow into state coffers at unexpected high rates, the May session of the

Tax dollars continue to flow into state coffers at unexpected high rates, the May session of the

The Michigan Supreme Court (MSC) is still considering a case that challenges the authority of trial courts to impose costs on defendants.

The Michigan Supreme Court (MSC) is still considering a case that challenges the authority of trial courts to impose costs on defendants. Thirteen counties are among recipients of the First Responder Training and Recruitment Grant Program, the Michigan Treasury announced this week. The program was launched by Gov. Gretchen Whitmer in January to assist local governments in addressing critical needs in recruitment and retention of first responders.

Thirteen counties are among recipients of the First Responder Training and Recruitment Grant Program, the Michigan Treasury announced this week. The program was launched by Gov. Gretchen Whitmer in January to assist local governments in addressing critical needs in recruitment and retention of first responders. A MAC-supported bill to allow county mental health transportation panels received unanimous support in the Senate this week and has moved to the House.

A MAC-supported bill to allow county mental health transportation panels received unanimous support in the Senate this week and has moved to the House. MAC’s Podcast 83 team will again be live to discuss all the news and events out of Lansing on Monday, May 23 at 4 p.m.

MAC’s Podcast 83 team will again be live to discuss all the news and events out of Lansing on Monday, May 23 at 4 p.m. The Michigan Department of Natural Resources is updating the Statewide Comprehensive Outdoor Recreation Plan (SCORP). This plan, which is updated every five years, supports and directs Michigan’s use of its federal Land and Water Conservation Fund apportionment, among other things.

The Michigan Department of Natural Resources is updating the Statewide Comprehensive Outdoor Recreation Plan (SCORP). This plan, which is updated every five years, supports and directs Michigan’s use of its federal Land and Water Conservation Fund apportionment, among other things. The Michigan Legislature approved a ballot proposal this week that would let voters decide on term limit changes to House and Senate members in November. The House voted in favor, 76-28, of the proposal and the Senate voted in favor the same day, 26-6. Both chambers gave approval without debate or discussion.

The Michigan Legislature approved a ballot proposal this week that would let voters decide on term limit changes to House and Senate members in November. The House voted in favor, 76-28, of the proposal and the Senate voted in favor the same day, 26-6. Both chambers gave approval without debate or discussion. The Senate Health Policy Committee, chaired by Sen. Curt VanderWall (R-Mason), unanimously approved this week a three-year extension to the county maintenance of effort (MOE) rate for county medical care facilities (MCFs), a key legislative priority for the Michigan County Medical Care Facilities Council (MCMCFC).

The Senate Health Policy Committee, chaired by Sen. Curt VanderWall (R-Mason), unanimously approved this week a three-year extension to the county maintenance of effort (MOE) rate for county medical care facilities (MCFs), a key legislative priority for the Michigan County Medical Care Facilities Council (MCMCFC). Five Michigan counties were among those honored recently by the National Association of Counties in its 2022 Achievement Awards. The Achievement Awards program is a non-competitive awards program that seeks to recognize innovative county government programs. One outstanding program from each category will be selected as the “Best of Category.”

Five Michigan counties were among those honored recently by the National Association of Counties in its 2022 Achievement Awards. The Achievement Awards program is a non-competitive awards program that seeks to recognize innovative county government programs. One outstanding program from each category will be selected as the “Best of Category.” Seven Michigan county staff members recently finished their course work in the NACo Leadership Academy, a 12-week online program that empowers front-line county government employees with fundamental leadership skills. Across the country more than 4,600 county employees have participated; this includes 75 from Michigan.

Seven Michigan county staff members recently finished their course work in the NACo Leadership Academy, a 12-week online program that empowers front-line county government employees with fundamental leadership skills. Across the country more than 4,600 county employees have participated; this includes 75 from Michigan.

A May 24 webinar, part of the Interdisciplinary Partnership Series led by the Michigan Department of Health and Human Services (MDHHS), will focus on crisis response collaboration efforts within the state of Michigan. Representatives from MCOLES, MDHHS, the Center for Behavioral Health and Justice, CIT International and The Cardinal Group II will share information related to crisis response partnerships, associated data and information and training opportunities for first responders, law enforcement and behavioral health staff.

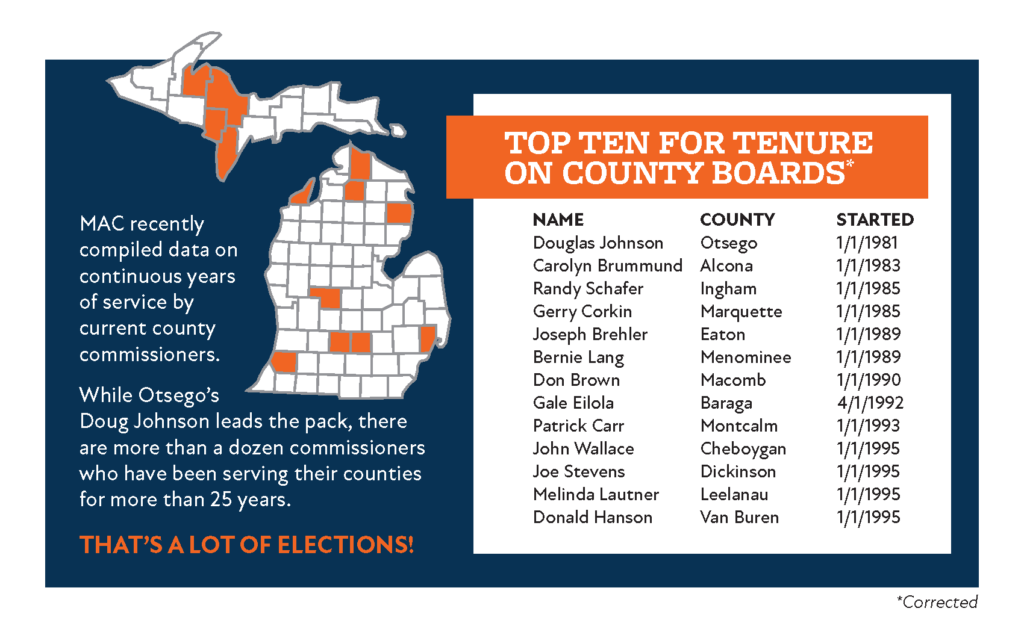

A May 24 webinar, part of the Interdisciplinary Partnership Series led by the Michigan Department of Health and Human Services (MDHHS), will focus on crisis response collaboration efforts within the state of Michigan. Representatives from MCOLES, MDHHS, the Center for Behavioral Health and Justice, CIT International and The Cardinal Group II will share information related to crisis response partnerships, associated data and information and training opportunities for first responders, law enforcement and behavioral health staff. Legislation that alters the Freedom of Information Act in ways detrimental to county government will be up before the House Committee on Oversight (Chair Steve Johnson) next week and MAC needs your voice to urge the House to set aside this ill-advised package.

Legislation that alters the Freedom of Information Act in ways detrimental to county government will be up before the House Committee on Oversight (Chair Steve Johnson) next week and MAC needs your voice to urge the House to set aside this ill-advised package. Long-sought legislation to properly reimburse local governments for losses due to the state’s property tax exemption for disabled veterans remain stalled in the Senate.

Long-sought legislation to properly reimburse local governments for losses due to the state’s property tax exemption for disabled veterans remain stalled in the Senate.  Michigan made some progress in addressing road conditions in 2021, says a new report from the Transportation Asset Management Council.

Michigan made some progress in addressing road conditions in 2021, says a new report from the Transportation Asset Management Council.

The Michigan Department of Health and Human Services (MDHHS) has expanded the

The Michigan Department of Health and Human Services (MDHHS) has expanded the

A 10 percent boost in county revenue sharing took another step to enactment this week when the Senate Appropriations Committee passed out the fiscal 2023 General Government budget.

A 10 percent boost in county revenue sharing took another step to enactment this week when the Senate Appropriations Committee passed out the fiscal 2023 General Government budget. A two-bill package to “modernize” public notice postings is headed to the governor after it gained final approval by the Michigan House of Representatives this week.

A two-bill package to “modernize” public notice postings is headed to the governor after it gained final approval by the Michigan House of Representatives this week. A bill to alter fees that county treasurers charge on parcel records is headed to the Senate after the full House approved it this week.

A bill to alter fees that county treasurers charge on parcel records is headed to the Senate after the full House approved it this week. The Michigan Department of Treasury is pleased to announce our next Chart Chat webinar at 2 p.m. on Tuesday, May 10.

The Michigan Department of Treasury is pleased to announce our next Chart Chat webinar at 2 p.m. on Tuesday, May 10.