MAC continues to gather answers, devise strategies on ARP spending

With the release of a new U.S. Treasury FAQ sheet and aggregated language on interim spending rules, Michigan counties now have substantial guidance on how they can use the $1.9 billion in direct investments via the American Rescue Plan.

With the release of a new U.S. Treasury FAQ sheet and aggregated language on interim spending rules, Michigan counties now have substantial guidance on how they can use the $1.9 billion in direct investments via the American Rescue Plan.

Meanwhile, MAC is working with state and local officials on a strategy to help magnify the impact of the billions of dollars coming to all levels of government in our state.

Among key elements in the new Treasury FAQ are:

- Costs of consultants: Recovery Funds CAN be used to cover the costs of consultants to assist with managing and administering the funds.

- Public jobs programs: Recovery Funds CAN be used to establish public jobs programs (I.e. subsidized employment, combined education an on-the-job training, job training to accelerate rehiring or address negative economic impacts, childcare assistance or assistance with transportation to and from a jobsite or interview).

- Revenue loss and audited financial data: If a county does not have audited data readily available when calculating its revenue loss, it is not required to obtain audited data.

- Revenue loss and Census data: When calculating general revenue, counties should use their own data sources and do NOT need to rely on published revenue data from the Census Bureau.

- Revenue loss on cash basis/accrual basis: When determining revenue loss, counties may provide data on a cash, accrual or modified accrual basis, so long as the county is consistent in their choice of methodology throughout the covered period and until reporting is no longer required.

For more context and guidance, counties also can consult documents created by MAC and by NACo that highlight critical issues and concepts.

And MAC continues to work on a plan to earmark close to $4 billion in state ARP funds as matching funds to enhance local efforts. For this plan, the Whitmer administration and legislative leaders have asked for ideas that:

- will be transformational in nature;

- do not create new programs; and

- strategically invest the one-time dollars in areas of greatest need for improvement.

MAC has been having multiple conversations each week with the administration, legislative leaders, business and community leaders and other stakeholders on this idea. Our hope is to create a groundswell of support that bridges the political gap in Lansing and truly provides the resources and value needed for strategic investments in Michigan. As part of that effort, MAC has created a resolution template that counties can use to express support for the matching funds concept.

For questions on this issue, contact Deena Bosworth at bosworth@micounties.org.

Registration is now open for MAC’s 2021 Regional Summits

Commissioners and other county leaders can learn tips on how to utilize American Rescue Plans and be briefed on the affordable housing crisis and its effects on counties during MAC’s 2021 Regional Summits in late July.

Commissioners and other county leaders can learn tips on how to utilize American Rescue Plans and be briefed on the affordable housing crisis and its effects on counties during MAC’s 2021 Regional Summits in late July.

In light of COVID-19, some changes have been made to the event. All food and beverage will be boxed/packaged, for example. And networking time will be minimized.

As usual, however, MAC will offer the summits at four sites across Michigan:

- July 19 – Grand Rapids

- July 22 – Frankenmuth

- July 26 – Escanaba

- July 29 – Gaylord

Start your registration process by visiting the events page at our website.

“Our summits are designed to provide the most important, most practical information for commissioners and other county leaders in the shortest possible amount of time,” explained Stephan Currie, MAC’s executive director. “This design is in deference to commissioners’ busy schedule and also, this year, to the realities imposed by COVID-19.”

Topics to be covered at all four sessions include:

- Using American Rescue Plan funds effectively

- Worker safety at the office and at home during COVID

- Why your county should be thinking about affordable housing

- The benefits of partnering with Michigan’s community foundations

The summit will run from 8:30 a.m. to 2:30 p.m.; a light breakfast and lunch will be included for the $35 fee.

MAC seeks volunteers for new Juvenile Justice Task Force

MAC will be nominating two county commissioners to a new Task Force on Juvenile Justice Reform created by Gov. Gretchen Whitmer this week.

MAC will be nominating two county commissioners to a new Task Force on Juvenile Justice Reform created by Gov. Gretchen Whitmer this week.

In announcing the new panel, Whitmer’s office explained the task force as “a partnership between the county and state leaders, as well as other leaders involved in the juvenile justice system. Additionally, the Task Force’s goal will be to develop an ambitious, innovative, and thorough analysis of Michigan’s juvenile justice system, complete with recommendations for changes in state law, policy and appropriations to improve youth outcomes.”

Alongside the governor for the announcement was Lt. Gov Garlin Gilchrist, who will chair the group. The task force will include members from the judicial and legislative branches. Sen. Sylvia Santana (D-Wayne) and Rep. Sarah Lightner (R-Jackson) also made comments during the announcement event.

Under the order, MAC will nominate two county commissioners, or their designee, to serve among appointees from other organizations representing countywide elected officials.

If a county commissioner wishes to serve or has a designee that would be a good fit, please let MAC know immediately by emailing keit@micounties.org. The deadline to submit names is June 18.

In other juvenile justice news, bills to eliminate the ability for courts to access and collect costs associated with juvenile justice services were introduced:

- House Bill 4987, by Rep Kara Hope (D-Ingham), would prohibit any court ordered fee or costs associated with consent calendar services. It removes the ability for any reasonable reimbursement, which under current law requires the court to take into account the juvenile’s income and resources, to be assessed for services under the consent calendar.

- HB 4988, by Rep. Bronna Kahle (R-Lenawee), would prohibit reimbursement for diversion services.

- HB 4989, by Rep. Sarah Lightner (R-Jackson), eliminates the assessment on a DNA sample for juveniles, in which revenues from assessments help support the jail reimbursement program fund and the court equity fund.

- HB 4990, by Rep. Joe Tate (D-Wayne), prohibits any reimbursement by the “juvenile or those responsible for the juvenile’s support” for cost of care outside of the juvenile’s home.

- HB 4991, by Rep. Julie Calley (R-Ionia), eliminates any late fees for juveniles.

MAC opposes all these bills in their current forms.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Housing package advances as MAC continues to express concern

Bipartisan legislation backed by the Michigan Housing Coalition passed unanimously, without MAC-requested changes, out of Senate Economic and Small Business Development Committee this week, chaired by Sen. Ken Horn (R-Saginaw). The bill package now moves to the Senate floor.

Bipartisan legislation backed by the Michigan Housing Coalition passed unanimously, without MAC-requested changes, out of Senate Economic and Small Business Development Committee this week, chaired by Sen. Ken Horn (R-Saginaw). The bill package now moves to the Senate floor.

Senate Bills 360–361, by Sen. Roger Victory (R-Ottawa), allow employers to claim an income tax credit equal to 50 percent of the total eligible contributions made during the tax year. Eligible contributions would include supporting a local impact housing trust fund or offering employees the option to participate in a qualified employer-assisted housing project that assists employees in securing affordable housing near the workplace.

SB 362, by Sen. Winnie Brinks (D-Kent), would allow a qualified local governmental unit, by resolution of its legislative body, to establish one or more “attainable housing districts.” Within 28 days of receiving a copy of the resolution establishing a district, the county could reject the establishment of the district by written notification to the qualified local governmental unit.

SB 422, by Sen. Horn, creates the “Residential Facilities Exemption” and would allow a temporary tax abatement on qualified new housing development in districts established by local units of government. Within 28 days of receiving a copy of the resolution, a county could reject the establishment of the district.

MAC supports those four bills.

However, MAC did not support two other bills in the package and is working to ensure counties are included in the process of making property tax exemption decisions and community development decisions under SBs 364, by Sen. Jeremy Moss (D-Oakland),and 432, by Sen. Wayne Schmidt (R-Grand Traverse). SB 364 would expand the area in which a Neighborhood Enterprise Zone could be developed. The committee passed version was amended to ensure the expanded NEZ area in a community is adjacent to existing development and a contains 5 or more existing residentials units per acre at the time of designation.

However, there is still no county oversight or involvement during the process under the bill at this point.

SB 432 allows local governments the ability to develop payment in lieu of taxes (PILOT) policies and enter into PILOT agreements with developers who are building or rehabbing affordable housing units. Again, there is currently no county oversight or involvement during the process which would affect property taxes supporting important county programs for growing populations. .

Please refer to MAC’s May 21 update for further information and our written testimony to the chair, committee members and bill sponsors.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Podcast 83 will resume live episodes on June 21

MAC’s Podcast 83 team continued to field questions about American Rescue Plan funds and the state budget during their most recent live episode on June 7.

MAC’s Podcast 83 team continued to field questions about American Rescue Plan funds and the state budget during their most recent live episode on June 7.

To see the video of the episode, click here.

The Podcast 83 team will take a break on Monday, June 14 and reconvene on the web on Monday, June 21 to discuss legislative action in Lansing and Washington, D.C.

Links to past episodes can be found on the podcast webpage, while every 2021 video episode is now available on MAC’s YouTube channel.

Keep up the emails, resolutions on 4-year terms

After gaining broad support and bipartisan passage in the Michigan Senate last week, legislation to adopt four-year terms for county commissioners awaits initial action in the House of Representatives.

After gaining broad support and bipartisan passage in the Michigan Senate last week, legislation to adopt four-year terms for county commissioners awaits initial action in the House of Representatives.

Senate Bills 242, by Sen. Ed McBroom (R-Dickinson), and SB 245, by Sen. Jeremy Moss (D-Oakland), would bring four-year terms for county commissioners to Michigan in the 2024 presidential election cycle.

The bills will be referred to the House Committee on Local Government and Municipal Finance on Tuesday.

MAC continues to encourage commissioners to add their voices to the four-year term effort. As of Friday morning, 79 county leaders had responded. Please add your voice to this effort today by clicking here.

MAC also requests that counties adopt official resolutions of support for the legislation. To download a template for this purpose, click here. If you pass such a resolution, please send a copy to Hannah Sweeney at sweeney@micounties.org.

As of Thursday, 27 counties had advised MAC of passage of such resolutions: Allegan, Alpena, Bay, Cheboygan, Clinton, Crawford, Dickinson, Emmet, Genesee, Houghton, Huron, Ionia, Isabella, Lenawee, Macomb, Manistee, Marquette, Mecosta, Newaygo, Oceana, Ogemaw, Ontonagon, Oscoda, Sanilac, Van Buren, Washtenaw and Wexford.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Survey in field for indigent defense services

In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share.

In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share.

The MIDC has asked Public Sector Consultants (PSC), a nonpartisan public policy firm, to conduct an evaluation to assist with the MIDC’s recommendation to the Legislature. PSC has developed a survey to gain broad feedback on topics raised during stakeholder interviews and preliminary data collection.

The MIDC is seeking feedback from stakeholders like counties to incorporate ideas and policy recommendations into the MIDC’s report. Please respond to this local share evaluation survey by June 15.

Questions related to the survey can be routed to Erin Lammers at elammers@publicsectorconsultants.com.

Next Michigan Treasury webinar set for June 17

The next webinar in a series co-sponsored by MAC on local finance issues will run from 2 p.m. to 3:30 p.m. on June 17.

The next webinar in a series co-sponsored by MAC on local finance issues will run from 2 p.m. to 3:30 p.m. on June 17.

The 13th event in the “Updates and Resources for Local Governments” webinar series, co-sponsored by MAC, the Michigan Municipal League, the Michigan Townships Association and the Michigan Department of Treasury, will cover:

- Updates on the American Rescue Plan Act, including eligible uses and receipting

- Strategically utilizing funds

Participants can register and submit questions on the webinar’s registration page.

Additionally, the Michigan Department of Treasury has developed a webpage with numbered letters, memorandums, webinars, and resources regarding COVID-19 updates for local governments and school districts. This webpage was created to ensure that Michigan communities have access to the most up-to-date guidance and is updated frequently with information and resources as they become available.

Redistricting Commission updates meeting schedule

The Michigan Independent Citizens Redistricting Commission (MICRC) has made some schedule changes to its ongoing series of public hearings for its work to redraw political lines for the 2022 elections.

The Michigan Independent Citizens Redistricting Commission (MICRC) has made some schedule changes to its ongoing series of public hearings for its work to redraw political lines for the 2022 elections.

Please note, the Independent Redistricting Commission will draw district lines for state legislative and federal congressional districts. The lines for county commissioner districts are handled by county Apportionment Boards. For details on the apportionment process, click here or view a recording of a 2021 Legislative Conference workshop on the process.

DETROIT

Tuesday, June 15

Start Time: 5 p.m. (doors open at 4 p.m.)

Follow link to sign-up or RSVP (virtual or in-person)

DETROIT

Thursday, June 17

Start Time: 5 p.m. (doors open at 4 p.m.)

Follow link to sign-up or RSVP (virtual or in-person)

PORT HURON

Tuesday, June 22

Start Time: 5 p.m. (doors open at 4 p.m.)

Follow link to sign-up or RSVP (virtual or in-person)

WARREN

Thursday, June 24

Start Time: 5 p.m. (doors open at 4 p.m.)

Follow link to sign-up or RSVP (virtual or in-person)

MUSKEGON

Tuesday, June 29

Start Time: 5 p.m. (doors open at 4 p.m.)

Follow link to sign-up or RSVP (virtual or in-person)

GRAND RAPIDS

Thursday, July 1

Start Time: 5 p.m. (doors open at 4 p.m.)

Follow link to Sign-up or RSVP (virtual or in-person)

State using webinars to report on health technology

Over the previous 12 months, the Michigan Department of Health and Human Services (MDHHS) and CedarBridge Group (CBG) have been conducting an environmental scan of the health information technology infrastructure within Michigan. The draft environmental scan findings and recommendations have been presented to MDHHS and the Health I.T. Commission. The time has come to present those findings and recommendations, and collect feedback from all of you, the health information technology stakeholders who have made it all possible.

Over the previous 12 months, the Michigan Department of Health and Human Services (MDHHS) and CedarBridge Group (CBG) have been conducting an environmental scan of the health information technology infrastructure within Michigan. The draft environmental scan findings and recommendations have been presented to MDHHS and the Health I.T. Commission. The time has come to present those findings and recommendations, and collect feedback from all of you, the health information technology stakeholders who have made it all possible.

To begin the effort, MDHHS and CBG will be hosting three webinars starting at 1 p.m. EST. Each will be 60 minutes and begin with a brief presentation of findings and recommendations lasting about 20 minutes. The remaining time will be used for discussion, real-time polling and electronic Q&A. Registration for the webinars is not mandatory and all stakeholders are welcome to attend.

- June 16: https://zoom.us/j/92701629803

- June 24: https://zoom.us/j/92475192797

- June 29: https://zoom.us/j/96190976264

To pre-register, go to http://bit.ly/roadmap_registration.

For questions, contact CedarBridge Group at miroadmap@cedarbridgegroup.com.

Staff picks

Staff picks

- Ottawa County conducting internet access survey (Wood-TV)

- Allergy season is bad this year in Michigan. And it’s going to get worse. (Bridge Magazine)

- Tax limitations and the Michigan property taxpayer (Citizens Research Council of Michigan)

- Photos: China’s wandering elephants become international stars (WLNS-TV)

Huge Senate majority approves 4-year terms for commissioners

By a vote of 32-4, the Michigan Senate approved Senate Bills 242, by Sen. Ed McBroom (R-Dickinson), and SB 245, by Sen. Jeremy Moss (D-Oakland), which would bring four-year terms for county commissioners to Michigan in the 2024 presidential election cycle.

By a vote of 32-4, the Michigan Senate approved Senate Bills 242, by Sen. Ed McBroom (R-Dickinson), and SB 245, by Sen. Jeremy Moss (D-Oakland), which would bring four-year terms for county commissioners to Michigan in the 2024 presidential election cycle.

The roles of a county commissioner and the level of expertise necessary to oversee county government functions have increased substantially since the Legislature abolished the board of county supervisors in 1966 and created the county board of commissioners.

The bills will be referred to the House Committee on Local Government and Municipal Finance on Tuesday.

MAC continues to encourage commissioners to add their voices to the four-year term effort. As of Friday morning, 73 county leaders had responded. Please add your voice to this effort today by clicking here.

MAC also requests that counties adopt official resolutions of support for the legislation. To download a template for this purpose, click here. If you pass such a resolution, please send a copy to Hannah Sweeney at sweeney@micounties.org.

As of Thursday, the following counties had advised MAC of passage of such resolutions: Allegan, Alpena, Bay, Cheboygan, Clinton, Crawford, Dickinson, Emmet, Genesee, Houghton, Huron, Ionia, Isabella, Lenawee, Manistee, Marquette, Mecosta, Newaygo, Oceana, Ogemaw, Ontonagon, Oscoda, Sanilac, Van Buren, Washtenaw and Wexford.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Senate panel votes to strip local control over sand, gravel operations

A package of bills aimed at usurping local control in favor of state siting and regulation of sand and gravel mining operations passed out of the Senate Committee on Transportation and Infrastructure this week. MAC joined a large group of other local government stakeholders in opposing the legislation.

A package of bills aimed at usurping local control in favor of state siting and regulation of sand and gravel mining operations passed out of the Senate Committee on Transportation and Infrastructure this week. MAC joined a large group of other local government stakeholders in opposing the legislation.

Although sand and gravel are essential aggregate materials for road repair and construction, and the cost to transport it long distances only adds to the expense of our crumbing roads, removing local control over the siting, operation and transport of the materials is detrimental to the residents of those host communities. Senate Bills 429-431 eliminate all existing local control and instead shift complete oversight to state officials who are far removed from the people and areas most affected by the operations.

Local involvement and oversight in gravel mining operations are critical to ensure issues are addressed to the benefit of all concerned. The current system works — allowing local officials and operators to address concerns or questions regularly as they arise.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

ARP funds arriving in county bank accounts; MAC working on collaboration plans

As more counties report the arrival of the first payment of American Rescue Plan (ARP) arriving in their accounts, MAC continues to advise all counties to hold off on committing the money for a bit longer if possible.

As more counties report the arrival of the first payment of American Rescue Plan (ARP) arriving in their accounts, MAC continues to advise all counties to hold off on committing the money for a bit longer if possible.

MAC has been working with the Michigan Municipal League to develop match program proposals for the state to consider. This comprehensive approach to amplify the impact of the ARP dollars will provide Michigan the opportunity for an unprecedented investment in water and broadband infrastructure, mental health services, capital improvements to facilities and jails, community and housing development and economic development. The proposal calls for $3.9 billion in state ARP funds as match money that the local governments can apply for to maximize their own ARP reserves.

MAC’s plan is to create a groundswell of support that bridges the political gap in Lansing and truly provides the resources and value needed for strategic investments in our state.

MAC does not anticipate these decisions to be made at the state level for several weeks yet, but we are hopeful that counties across the state can hold off on ARP fund allocation until the details of the match programs can be worked out.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Revisions to veteran grants program advance

MAC-supported House Bill 4122, by Rep. Annette Glenn (R-Midland), continued its advance to enactment this week after final, and unanimous, passage by the Senate.

MAC-supported House Bill 4122, by Rep. Annette Glenn (R-Midland), continued its advance to enactment this week after final, and unanimous, passage by the Senate.

In large part, the legislation would amend the distribution and expenditure of grants from the County Veteran Service Fund within the Department of Military and Veterans Affairs budget. Specifically, the bill requires funds to be disbursed 60 days after a grant agreement is signed by the county and permits an exemption to the 20 hours per week requirement so that counties that may coordinate services are not excluded from the grant.

The bill would allow grant funds to retroactively be expended for direct financial assistance for an emergent relief program and provides a limited reduction in the county maintenance of effort (MOE) requirement to support hard-pressed counties for fiscal years 2021 and ‘22 (counties are not able to reduce the funding and supplant the reduction).

It maintains the $50,000 base amount of funding, plus a per capita amount based on a county’s veteran population. While the FY22 state budget is not final, MAC anticipates the $4 million appropriation, as recommended by the House and Senate, will be included in the final budget agreement.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Podcast 83 resumes live sessions on Monday, June 7

MAC’s Podcast 83 team resumes its weekly live sessions on state and federal policy issues at 3 p.m. on Monday, June 7.

MAC’s Podcast 83 team resumes its weekly live sessions on state and federal policy issues at 3 p.m. on Monday, June 7.

Among issues to be addressed are American Rescue Plan spending, four-year terms for county commissioners and MAC’s work on the FY22 state budget.

To register for the session, click here.

Links to past episodes can be found on the podcast webpage, while every 2021 video episode is now available on MAC’s YouTube channel.

State courts office issues memo on operational issues

The State Court Administrative Office recently released a memo on “The Path Forward” for Michigan courts, outlining lessons learned from COVID-19 technology response that will be here to stay. The state court administrator highlighted four factors that the courts are relying on to use technology to create more accessible courts: the roadmap, technology, leadership and public support

The State Court Administrative Office recently released a memo on “The Path Forward” for Michigan courts, outlining lessons learned from COVID-19 technology response that will be here to stay. The state court administrator highlighted four factors that the courts are relying on to use technology to create more accessible courts: the roadmap, technology, leadership and public support

In fact, many of the administrative orders the (Supreme Court) adopted in the last year remain in full effect and prescribe the path forward. For example:

- Administrative Order No. 2020-19, which states that “[t]he technological tools courts used to ensure access during the closure should be maintained and indeed used more frequently to rebuild capacity,” and that “[c]ourts shall continue to expand the use of remote participation technology (video or telephone) as much as possible to reduce any backlog and to dispose of new cases efficiently and safely.”

- Administrative Order No. 2020-1 directs courts in civil cases to “maximize the use of technology to enable and/or require parties to participate remotely.”

- Administrative Order No. 2020-6 instructs that “all judges in Michigan are required to make a good faith effort to conduct proceedings remotely whenever possible.”

Additionally, the memo highlighted the latest Local Administrative Order: Plan to Return to Full Capacity – Phase Three Forward, which indicates “normal staffing will resume at worksites,” with additional guidance for more vulnerable employees.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Survey in field for indigent defense services

In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share.

In accordance with the Michigan Indigent Defense Commission (MIDC) Act, the Michigan Indigent Defense Commission (MIDC) must submit a report to the governor and Legislature that includes a recommendation regarding the appropriate level of local share.

The MIDC has asked Public Sector Consultants (PSC), a nonpartisan public policy firm, to conduct an evaluation to assist with the MIDC’s recommendation to the Legislature. PSC has developed a survey to gain broad feedback on topics raised during stakeholder interviews and preliminary data collection.

The MIDC is seeking feedback from stakeholders like counties to incorporate ideas and policy recommendations into the MIDC’s report. Please respond to this local share evaluation survey by June 15.

Questions related to the survey can be routed to Erin Lammers at elammers@publicsectorconsultants.com.

Treasury releases millage data on PPT reimbursements

The Local Community Stabilization Authority Act (LCSA Act), 2014 Public Act 86 requires the Michigan Department of Treasury to calculate and make available each municipality’s calculated millage rate eligible for personal property tax (PPT) reimbursement.

The Local Community Stabilization Authority Act (LCSA Act), 2014 Public Act 86 requires the Michigan Department of Treasury to calculate and make available each municipality’s calculated millage rate eligible for personal property tax (PPT) reimbursement.

The 2012-2020 Millage Rate Comparison reports are now available on Treasury’s PPT reimbursement website: www.michigan.gov/pptreimbursement. These reports are intended to be used by municipalities to verify the eligible millage rates to be used in the 2021 PPT reimbursement calculations.

Municipalities should review the 2012-2020 Millage Rate Comparison reports for accuracy. If the millage rate data is correct, the municipality does not need to take any further action to notify Treasury.

If there are any errors in the millage rate data, the municipality is required by the LCSA Act to notify Treasury of the error no later than Aug. 1, 2021. The millage rate correction should be reported to Treasury on the Millage Rate Correction for the 2021 Personal Property Tax Reimbursement Calculations (Form 5613).

Redistricting Commission continues to offer presentations to local groups

The Michigan Citizen Redistricting Commission is still looking for opportunities and invitations from county governments, service clubs, annual meetings, ministerial alliances, fraternities, sororities, associations, etc., to explain the panel’s work in redrawing congressional and legislative district lines.

The Michigan Citizen Redistricting Commission is still looking for opportunities and invitations from county governments, service clubs, annual meetings, ministerial alliances, fraternities, sororities, associations, etc., to explain the panel’s work in redrawing congressional and legislative district lines.

County leaders interested in such a presentation should contact Darci McConnell at McConnell Communications (darci@dmcconnell.com) for events in Southeast Michigan or Maureen Saxton of Van Dyke (maureen@vandykehorn.com) for events outside Southeast Michigan.

Staff picks

Staff picks

New workplace rules on COVID expected from state on Monday

By July 1, Michigan will have lifted all COVID-19 restrictions on the size of indoor and outdoor gatherings, Gov. Gretchen Whitmer announced this week.

By July 1, Michigan will have lifted all COVID-19 restrictions on the size of indoor and outdoor gatherings, Gov. Gretchen Whitmer announced this week.

On June 1, the outdoor restrictions lift, will indoor capacity limits increase to 50 percent. Whitmer cited ongoing progress in vaccinations against the virus for the latest modifications to the “Vacc to Normal” plan. As of Thursday, 57.1 percent of residents age 16 and up had received at least one dose of vaccine. That represents 4,623,805 people.

These changes did not directly address questions about workplace restrictions – a key issue for counties.

As of Friday, the state’s workplace regulator, MIOSHA, said it “is in the process of reviewing both the emergency rules and draft permanent rules. … Until then, MIOSHA will consider compliance with the MDHHS order as good faith to comply when responding to employee complaints or conducting investigations related to COVID-19.” (emphasis added)

That statement refers to the existing Michigan Department of Health and Human Services (MDHHS) order on gatherings and masks, issued on May 15.

MIOSHA and MDHHS, however, are expected to issue new rules on Monday, May 24 to adapt to what Whitmer announced this week.

The requirement to wear masks indoors for those who have not received a COVID-19 vaccine will remain in place through June 30, 2021, noted the Michigan Municipal Risk Management Authority (MMRMA), which continues to closely monitor the COVID-19 regulatory environment.

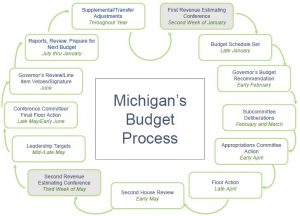

Budget panel increases state revenue forecast

The state of Michigan will have nearly $3 billion more in its General Fund for fiscal years 2021-23 than was expected just a few months ago, a state budget panel determined in its regular meeting on Friday.

The state of Michigan will have nearly $3 billion more in its General Fund for fiscal years 2021-23 than was expected just a few months ago, a state budget panel determined in its regular meeting on Friday.

The Consensus Revenue Estimating Conference (CREC) establishes revenue numbers that legislators and the governor use in building state budgets each year. After economic presentations at the Capitol on Friday, the panel determined:

- FY21 General Fund will be up $1 billion from the January estimate to a total of $11.3 billion.

- FY22 General Fund will be up $776 million to a total of $11.7 billion.

- FY23 General Fund will be up $1.1 billion to a total of $12.3 billion.

The General Fund is the account the state uses to cover county revenue sharing payments each year as well as many other line items appropriated to counties. These revenue estimates are in addition to the federal relief dollars that are flowing into the State.

Now that the CREC has been completed, and the governor and legislative leaders have agreed to sit down to negotiate a budget, the next step is to set mutually agreed upon priorities for the budgets as well as target numbers for each budget chair to meet. MAC will continue to push for revenue sharing back payments and revenue sharing increases for counties during this process.

For more information on MAC’s budget priorities, contact Deena Bosworth at bosworth@micounties.org.

Counties, be sure you are set up with Treasury on ARP funds

The U.S. Department of Treasury recently released documents to guide counties and local governments on using direct investment funds through the American Rescue Plan (ARP). In addition, MAC has been informed that funds are now starting to show up in county accounts, part of the $105 billion that Treasury says it has released so far in ARP funds.

The U.S. Department of Treasury recently released documents to guide counties and local governments on using direct investment funds through the American Rescue Plan (ARP). In addition, MAC has been informed that funds are now starting to show up in county accounts, part of the $105 billion that Treasury says it has released so far in ARP funds.

Michigan counties stand to receive about $1.9 billion in such aid.

Treasury has created a main landing page for this effort, noting that relief is intended to:

- Support urgent COVID-19 response efforts to continue to decrease spread of the virus and bring the pandemic under control

- Replace lost revenue for eligible state, local, territorial, and Tribal governments to strengthen support for vital public services and help retain jobs

- Support immediate economic stabilization for households and businesses

- Address systemic public health and economic challenges that have contributed to the unequal impact of the pandemic

It is important to familiarize yourself with the three Treasury documents listed below:

- Interim Final Rule

- “quick reference” fact sheet

- https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf

In addition, Michigan House Fiscal Agency has issued its own overview of the American Rescue Plan’s overall provisions.

Finally, as answered in the FAQs, administrative fees are an allowable expense when using the funds. That means counties can use third-party vendors to help with identifying, tracking, reporting or responding to various other needs counties may have. MAC has worked with Livingston County to prequalify four vendors to assist in that process. Once those agreements are finalized, we will be sharing them with members.

MAC argues for clear county participation in housing bills

Legislation relating to the goals of the Michigan Housing Coalition, of which MAC is a member, had its first hearing in the Senate Economic and Small Business Development Committee this week.

Legislation relating to the goals of the Michigan Housing Coalition, of which MAC is a member, had its first hearing in the Senate Economic and Small Business Development Committee this week.

Senate Bills 360–361 allow employers to claim an income tax credit equal to 50 percent of the total eligible contributions made during the tax year. Eligible contributions would include supporting a local impact housing trust fund or offering employees the option to participate in a qualified employer-assisted housing project that assists employees in securing affordable housing near the workplace.

SB 362 would allow a qualified local governmental unit, by resolution of its legislative body, to establish one or more “attainable housing districts.” Within 28 days of receiving a copy of the resolution establishing a district, the county could reject the establishment of the district by written notification to the qualified local governmental unit.

SB 422 creates the “Residential Facilities Exemption” and would allow a temporary tax abatement on qualified new housing development in districts established by local units of government. Within 28 days of receiving a copy of the resolution, a county could reject the establishment of the district.

MAC supports those four bills.

However, MAC did not support two other bills in the package and is working to ensure counties are included in the process of making property tax exemption decisions and community development decisions under SBs 364 and 432. SB 364 would expand the area in which a Neighborhood Enterprise Zone could be developed. There is currently no county oversight or involvement during the process under the bill as introduced. SB 432 allows a local governments the ability to develop payment in lieu of taxes (PILOT) policies and enter into PILOT agreements with developers who are building or rehabbing affordable housing units. There is currently no county oversight or involvement during the process under the bill, as introduced.

MAC explained its analysis on these issues to the chair and committee members via letter this week.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Podcast 83 continues live sessions on Monday, May 24

MAC’s Podcast 83 team will reconvene on the web on Monday, May 24to discuss legislative action in Lansing and Washington, D.C.

MAC’s Podcast 83 team will reconvene on the web on Monday, May 24to discuss legislative action in Lansing and Washington, D.C.

To register for the live event, which starts at 3 p.m., click here.

Links to past episodes can be found on the podcast webpage, while every 2021 video episode is now available on MAC’s YouTube channel.

Bills debated on new penalties for bottle fraud

Bipartisan bills on bottle deposits that criminalize bottle deposit fraud were reviewed by the House Regulatory Reform Committee this week.

Bipartisan bills on bottle deposits that criminalize bottle deposit fraud were reviewed by the House Regulatory Reform Committee this week.

House Bills 4780-83, by Reps. Mike Mueller (R-Genesee), Andrew Fink (R-Hillsdale), Tim Sneller (D-Genesee) and Tyrone Carter (D-Wayne) are designed to crack down on those who bring empties across state lines to collect Michigan’s 10-cent deposit for profit. The bills establish felony charges based on the dollar thresholds of the fraud and increase fines for the violation.

They also reallocate the first $1 million in unclaimed bottle deposit fund revenue to the Michigan State Police to enforce the newly created law. The remaining money in the fund would be distributed based on current law: 75 percent to the Cleanup and Redevelopment Trust fund for non-petroleum remediation and redevelopment activities and 25 percent to the dealers. Whether or not increased compliance efforts will result in more money in the unclaimed deposit fund to make up for the diversion is unclear at this time.

MAC is following the issue but has not taken a position at this time.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC studying bills on asbestos oversight

The House Natural Resources and Outdoor Recreation Committee took testimony this week on a bipartisan package of bills that create a “Public Entity Asbestos Removal Disclosure Act” to enhance abatement inspection requirements, establish a verification process for contractors and create reporting violations for asbestos removal.

The House Natural Resources and Outdoor Recreation Committee took testimony this week on a bipartisan package of bills that create a “Public Entity Asbestos Removal Disclosure Act” to enhance abatement inspection requirements, establish a verification process for contractors and create reporting violations for asbestos removal.

House Bills 4766-71, by Reps. Gary Howell (R-Lapeer), Abraham Aiyash (D-Wayne), Scott VanSingel (R-Newaygo) and William Sowerby (D-Macomb), prohibit a public entity from contracting for asbestos abatement with a contractor with a criminal conviction relating to compliance with environmental regulations.

A recent Auditor General report slammed the Department of Environment, Great Lakes and Energy (EGLE) for lack of oversight of asbestos abatement projects. In response to the lack of resources to comply with their requirements, the bills create an Asbestos Investment Fund, which would be administered by the department. A public entity would be required to submit a $100 fee to EGLE to assist with oversight efforts. A public entity could pass the cost for the notification fee to the asbestos abatement contractor, unless the pass-through would violate the terms of a contract signed before the effective date of the bill.

MAC is working on amendments to the bills before taking a position on the package.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC opposes workers’ comp legislation

A bill to direct workers’ compensation coverage on COVID-19 issues was opposed by MAC in committee this week.

A bill to direct workers’ compensation coverage on COVID-19 issues was opposed by MAC in committee this week.

House Bill 4288, by Rep. Mike Mueller (R-Genesee), amends the Worker’s Disability Compensation Act to include a first response employee’s injury or illness resulting from contraction of COVID-19 as a personal injury presumed to arise in the course of employment under certain circumstances.

In general, the Worker’s Disability Compensation Act provides compensation to employees who are injured on the job and provides that those benefits are the employee’s sole remedy for the injury. The bill would expand compensatory coverage if a first response employee met one of the following criteria:

- Is quarantined at the direction of his or her employer due to confirmed or suspected exposure to COVID-19

- Receives a COVID-19 diagnosis from a physician

- Receives a presumptive positive COVID-19 test

- Receives a laboratory-confirmed COVID-19 diagnosis

The Government Operations Committee did not vote on the bill this week, and the chair indicated changes are coming to provide definite timelines for coverage and ensuring a rebuttable presumption. MAC will review changes when available.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC still needs your voice on 4-year terms

While legislation to enact four-year terms for county commissioners awaits action on the Senate floor, MAC again asks members to add their individual and collective voices to the campaign.

While legislation to enact four-year terms for county commissioners awaits action on the Senate floor, MAC again asks members to add their individual and collective voices to the campaign.

Senate Bill 242, by Sen. Ed McBroom (R-Dickinson), and SB 245, by Sen. Jeremy Moss (D-Oakland) would bring four-year terms to Michigan in the 2024 presidential election cycle. Enactment of these bills would end Michigan’s status as one of just five states with two-year terms on all commissioners.

The bills are now on the Senate floor.

MAC continues to encourage commissioners to add their voices to the four-year term effort. As of Friday morning, 70 county leaders had responded. Please add your voice to this effort today by clicking here.

MAC also requests that counties adopt official resolutions of support for the legislation. To download a template for this purpose, click here. If you pass such a resolution, please send a copy to Hannah Sweeney at sweeney@micounties.org.

As of Thursday, the following counties had advised MAC of passage of such resolutions: Allegan, Alpena, Bay, Cheboygan, Clinton, Dickinson, Genesee, Emmet, Houghton, Ionia, Isabella, Manistee, Marquette, Mecosta, Newaygo, Ontonagon, Sanilac, Van Buren, Washtenaw and Wexford.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Leadership Academy class includes 11 from Michigan

Eleven Michigan county officials and staff members recently completed the NACo Leadership Academy, a 12-week online program that empowers front-line county government employees with fundamental leadership skills. Across the country, 812 county employees participated in the most recent class, which began in January.

Eleven Michigan county officials and staff members recently completed the NACo Leadership Academy, a 12-week online program that empowers front-line county government employees with fundamental leadership skills. Across the country, 812 county employees participated in the most recent class, which began in January.

Among the 11 were Deena Bosworth, MAC’s governmental affairs director, Wayne County Commissioner Melissa Daub, Ottawa County Clerk Justin Roebuck and Houghton County Administrator Ben Larson.

The rest of the Michigan class was Sheila Peters of Alger, Ted Somers of Alpena, Shawna Walraven of Bay, Sue Buitenhuis of Cheboygan, Karl Hauser of Clare, Timothy Mitchell of Osceola and Scott Miller of Washtenaw.

MAC congratulates all the participants in the program. To learn more about the academy, click here.

AG’s Office issues warning on COVID scam calls

Attorney General Dana Nessel is reissuing a consumer alert warning residents about scammers claiming to be from state or local health departments or vaccination clinics, asking for personal information.

Attorney General Dana Nessel is reissuing a consumer alert warning residents about scammers claiming to be from state or local health departments or vaccination clinics, asking for personal information.

Attorney General Nessel offers tips to avoid becoming a victim. Hang up if they claim to be from a government agency or vaccination clinic and:

- request personal information;

- make threats;

- demand you get vaccinated; or

- ask if you are vaccinated or where you received your vaccination.

The Department of Attorney General provides a library of resources for consumers to review anytime. Attorney General Nessel encourages everyone to review the COVID-19 vaccine scam alert for more information.

Your connection to consumer protection is just a click or phone call away. Consumer complaints can be filed online at the Attorney General’s website, or by calling 877-765-8388.

Collaboration on mental health is focus of June 1 webinar

The second in a series of webinars to underscore the ideas of continuously examining best practices, as well as taking the opportunity to enhance longstanding partnerships between law enforcement, mental health systems and communities throughout Michigan and to recommend strengthening those partnerships, will be held on June 1.

The second in a series of webinars to underscore the ideas of continuously examining best practices, as well as taking the opportunity to enhance longstanding partnerships between law enforcement, mental health systems and communities throughout Michigan and to recommend strengthening those partnerships, will be held on June 1.

The webinar is free and runs from 10:30 a.m. to noon. It will explore interdisciplinary partnership, collaboration and funding efforts from three innovative Michigan communities (Calhoun, Muskegon & Washtenaw).

To register, go to https://attendee.gotowebinar.com/register/4814437477097292047.

For information, contact J. Eric Waddell at jericwaddell@thecardinalgroup2.com.

Staff picks

Staff picks

- New federal program will help broadband users pay for internet (UpNorthLive)

- Bay County residents have shot at $18K in prizes — if they get Covid vaccine (Mlive.com)

- The problem of ad valorem special assessments continues to grow (Citizens Research Council)

- DTMB asks for public’s help in finding the 2021 Michigan Christmas tree (Michigan.gov)

Counties, be sure you are set up with Treasury on ARP funds

The U.S. Department of Treasury released a wave of documents Monday to guide counties and local governments on using direct investment funds through the American Rescue Plan (ARP).

The U.S. Department of Treasury released a wave of documents Monday to guide counties and local governments on using direct investment funds through the American Rescue Plan (ARP).

Michigan counties stand to receive about $1.9 billion in such aid.

Treasury has created a main landing page for this effort, noting that relief is intended to:

- Support urgent COVID-19 response efforts to continue to decrease spread of the virus and bring the pandemic under control

- Replace lost revenue for eligible state, local, territorial, and Tribal governments to strengthen support for vital public services and help retain jobs

- Support immediate economic stabilization for households and businesses

- Address systemic public health and economic challenges that have contributed to the unequal impact of the pandemic

“The Coronavirus State and Local Fiscal Recovery Funds provide substantial flexibility for each government to meet local needs—including support for households, small businesses, impacted industries, essential workers, and the communities hardest hit by the crisis. These funds can also be used to make necessary investments in water, sewer and broadband infrastructure,” Treasury stated.

Treasury has published an Interim Final Rule that implements the provisions of this program.

In addition, Treasury offers a “quick reference” fact sheet and the Michigan House Fiscal Agency has issued its own overview of the American Rescue Plan’s overall provisions.

State budget bills continue their advance in Legislature

The full House and full Senate this week voted on budget bills for fiscal 2022, with appropriations measures passing largely along party lines and with minimal floor changes.

The full House and full Senate this week voted on budget bills for fiscal 2022, with appropriations measures passing largely along party lines and with minimal floor changes.

Democratic House members did introduce amendments that would restore the 75 percent of funding withheld from various budgets due to the Republicans’ newly adopted approach of quarterly budgeting, but those amendments failed.

Now, the House budget bills go to the Senate, and the Senate bills go to the House. After the two chambers finish this stage, a joint conference committee will take up points of disagreement and offer up final numbers for final approval.

The Senate budget includes $231,516,700 for county revenue sharing, which would be a 2 percent boost from FY21. Additionally, the Senate proposal retains the requirement that any county with a retirement benefit system that was in an underfunded status must dedicate any county revenue sharing increase to that system.

The House provides for a 1 percent increase on revenue sharing, for $226,529,400 to counties. The funds, however, are tied to a requirement that the county must maintain public safety expenditures at an amount not less than FY21 to qualify for a payment.

MAC had asked legislators to eliminate strings attached to county revenue sharing payments. MAC will renew that request when budget bills reach the joint House-Senate conference committee stage.

The Michigan Indigent Defense Commission grants remain recommended at $148.9 million in both chambers; however, the House still moves that line item to the judiciary budget, a change that still raises constitutionality questions involving the separation of powers. Changes to the MIDC Act would have to be made in order to house the commission’s budget under the judiciary.

In other highlights, there is a $5 million increase to local public health under the Senate plan and $4 million in both the House and Senate to fully fund county veteran service fund grants. Please see previous MAC updates for additional budget information and more specific line items.

The Consensus Revenue Estimating Conference (CREC) is scheduled for next Friday. The CREC establishes an official economic forecast and projects revenues that appropriators use in the final stage of the budget process.

MAC opposes bills to alter property record fees

A bipartisan package of bills aimed at changing the process and fee schedule for accessing and copying records held by county registers of deeds and treasurers was up for testimony this week in the House Commerce and Tourism Committee.

A bipartisan package of bills aimed at changing the process and fee schedule for accessing and copying records held by county registers of deeds and treasurers was up for testimony this week in the House Commerce and Tourism Committee.

House Bills 4729-32, by Reps. John Cherry (D-Genesee), Julie Calley (R-Ionia), Mari Manoogian (D-Oakland) and Steve Marino (R-Macomb), were introduced to try to manage the cost of acquiring requested records. The proponents assert they are being overcharged for access to real estate records or even denied access in some cases because they are only asking for partial information.

The bills would limit the amount a county can charge for these fields of information, allow the requesting party to designate the medium by which they receive the information and allow the requesting party to gain information based on particular fields of information if they do not want the entire file.

MAC is working with the other organizations representing county-wide elected officials affected by this legislation and is currently opposed to the package.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Supplemental spending bill includes millions for county programs

The Michigan House this week passed, 65-42, a $3.3 billion supplemental appropriation bill, with $1 billion to be drawn from the state’s General Fund and $2.3 billion from the federal Coronavirus Response and Relief Supplemental Appropriations Act.

The Michigan House this week passed, 65-42, a $3.3 billion supplemental appropriation bill, with $1 billion to be drawn from the state’s General Fund and $2.3 billion from the federal Coronavirus Response and Relief Supplemental Appropriations Act.

Under the spending bill, $5 million would reimburse county jails for housing offenders at county jails who otherwise would have been transferred to correctional facilities if not for state emergency orders.

About $37.5 million is designated for infrastructure grants to address flooding, erosion and other coastal issues, while $2.5 million goes for planning grants to address severe weather impacts and changing climate effects. Also included is $25 million for PFAS remediation grants, $15 million of which must be allocated to municipal airports and independent airport authorities.

The bill applies $100 million to cover a $23 per Medicaid day increase to nursing facilities that have experienced a 5 percent or greater decline in their average daily census. Additionally, $215 million would go to mental health facilities, including $3 million for new psychiatric beds and emergency department needs through McLaren Northern Michigan.

The bill includes $7.5 million to support public access, through a website, to documents and digital images of documents filed in courts. Another $2.7 million would support the Secondary Road Patrol Program, which provides grants to county sheriff departments for the patrol of secondary roads.

Lastly, $150 million is allocated to the Broadband Expansion Act of Michigan, which provides for grants to private internet service providers to support infrastructure-related and other costs associated with expanding broadband internet service to unserved areas of Michigan.

A full summary of the bill can be found here.

MAC still needs your voice on 4-year terms

While legislation to enact four-year terms for county commissioners awaits action on the Senate floor, MAC again asks members to add their individual and collective voices to the campaign.

While legislation to enact four-year terms for county commissioners awaits action on the Senate floor, MAC again asks members to add their individual and collective voices to the campaign.

Senate Bill 242, by Sen. Ed McBroom (R-Dickinson), and SB 245, by Sen. Jeremy Moss (D-Oakland) would bring four-year terms to Michigan in the 2024 presidential election cycle. Enactment of these bills would end Michigan’s status as one of just five states with two-year terms on all commissioners.

The bills are now on the Senate floor.

MAC continues to encourage commissioners to add their voices to the four-year term effort. As of Friday morning, 68 county leaders had responded. Please add your voice to this effort today by clicking here.

MAC also requests that counties adopt official resolutions of support for the legislation. To download a template for this purpose, click here. If you pass such a resolution, please send a copy to Hannah Sweeney at sweeney@micounties.org.

As of Thursday, the following counties had advised MAC of passage of such resolutions: Allegan, Alpena, Bay, Cheboygan, Clinton, Dickinson, Emmet, Genesee, Houghton, Ionia, Isabella, Manistee, Marquette, Mecosta, Newaygo, Ontonagon, Sanilac, Van Buren, Washtenaw and Wexford.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC asks counties to pass resolutions on revenue sharing shortfalls

Part of MAC’s 2021 legislative agenda is to gain a one-time payment to compensate dozens of Michigan counties that were shorted proper revenue sharing funds prior to 2015.

Part of MAC’s 2021 legislative agenda is to gain a one-time payment to compensate dozens of Michigan counties that were shorted proper revenue sharing funds prior to 2015.

MAC has done extensive research into county revenue sharing and the impact the County Revenue Sharing Reserve Fund (CRSRF) has had. The research indicates the state has cumulatively shorted 61 counties more than $110 million between 2009 and 2014. We ask that you support an appropriation to restore those funds.

MAC is encouraging counties to add their voices to the one-time payment of the cumulative revenue sharing shortfall by adopting official resolutions of support. Here is a template you can use for this purpose. If you pass such a resolution, please send a copy to Hannah Sweeney at sweeney@micounties.org.

As of Thursday, the following counties had advised MAC of passage of such resolutions: Alpena, Dickinson, Huron, Livingston, Mecosta, Menominee and Wexford.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Videos from 2021 Legislative Conference are now available

MAC members can view hours of recordings packed with information on key county topics recently presented at the 2021 Michigan Counties Legislative Conference.

MAC members can view hours of recordings packed with information on key county topics recently presented at the 2021 Michigan Counties Legislative Conference.

The conference was held virtually due to pandemic restrictions on gatherings in late April.

In addition to recordings, members can review slides presented on topics ranging from how to leverage federal aid to threats to Michigan’s groundwater and screen shots captured during conference events.

MAC plans to return to in-person gatherings in late July with the Regional Summit series of single-day “mini conferences” at four locations around the state. Look for dates, locations and registration information for these events in late May or early June.

And planning is under way for the 2021 Annual Conference, to be held Sept. 26-28 at the Grand Hotel on Mackinac Island.

For the latest conference information, visit MAC’s conferences page.

Podcast 83 resumes live sessions on Monday, May 17

Podcast 83 resumes live sessions on Monday, May 17

After a one-week hiatus, MAC’s Podcast 83 team returns to the web on Monday, May 17 to discuss legislative action in Lansing and Washington, D.C.

To register for the live event, which starts at 3 p.m., click here.

Links to past episodes can be found on the podcast webpage, while every 2021 video episode is now available on MAC’s YouTube channel.

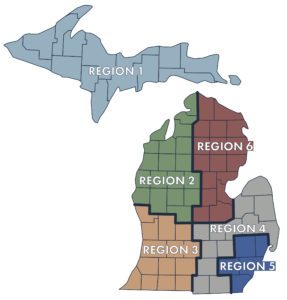

Candidate filing period opens for MAC Board elections in September

At the 2021 Michigan Counties Annual Conference (Sept. 26-28 on Mackinac Island), MAC members will vote on five seats on the MAC Board of Directors. Commissioners wishing to serve on the Board, whether incumbents or new candidates, have until Aug. 26 to file official notice of their intent to run. (The application form is found here.)

At the 2021 Michigan Counties Annual Conference (Sept. 26-28 on Mackinac Island), MAC members will vote on five seats on the MAC Board of Directors. Commissioners wishing to serve on the Board, whether incumbents or new candidates, have until Aug. 26 to file official notice of their intent to run. (The application form is found here.)

Seats representing regions are filled by a vote in regional caucuses at the conference. At-large seats are filled by the candidate that wins a majority of the six regional caucuses.

The MAC Board of Directors is the key body in guiding the legislative and organizational strategies of MAC. Board terms are three years in length and individuals may serve up to three terms.

2021 Board seats

- Region 1 – 1 seat

- Region 2 – 1 seat

- Region 3 – 1 seat

- Region 5 – 1 seat

- At-large — 1 seat

Any member wishing to run in the election must download the application form and return it by Aug. 26, 2021, at 5 p.m. to be eligible. Candidates are also encouraged to submit a statement of up to 400 words on why members should support them. These statements will be posted to the MAC website in late August.

If you have any questions about Board duties, please contact Executive Director Stephan W. Currie at 517-372-5374.

Many Michiganians are struggling, wellness webinar attendees told

Roughly 75 percent of those who participated in a recent survey in Michigan said they were somewhat or very lonely.

Roughly 75 percent of those who participated in a recent survey in Michigan said they were somewhat or very lonely.

That and other results on the state of “wellness” in Michigan were presented and discussed during a special MAC webinar on May 11 led by Louis Alloro of The Wellbeing Lab.

This spring, researchers at The Wellbeing Lab headed out into Michigan to measure the well-being of 1,500 people representative of the state. The survey revealed that while 13 percent reported they are really struggling, 10% are consistently thriving and 41.7% are living well, despite struggles.

MAC members may be interested in measuring their well-being using the PERMAH Wellbeing Survey. Individuals can access for free and communities can benefit from the aggregate data (for a small fee) at www.permahsurvey.com.

Alloro also can advise counties on setting up a well-being coalition as was done in Midland County. Contact him at 917-331-0785 or louis@thewellbeinglab.com for more information.

Redistricting Commission continues public hearings for May, June

The Michigan Independent Citizens Redistricting Commission (MICRC) is continuing its first series of public hearings for its work to redraw political lines for the 2022 elections.

The Michigan Independent Citizens Redistricting Commission (MICRC) is continuing its first series of public hearings for its work to redraw political lines for the 2022 elections.

The public hearings will run from 5 p.m. to 9 p.m. and are currently set for virtual sessions, though that is subject to change as the pandemic health orders change. Locations and dates are:

- May 18 – Marquette

- May 20 – Gaylord

- May 25 – Midland

- May 27 – Lansing

- June 1 – Flint

- June 3 – Pontiac

- June 8 – Novi

- June 10 – Dearborn

- June 15 & 17 – Detroit

- June 22 – Port Huron

- June 24 – Warren

- June 29 – Muskegon

- July 1 – Grand Rapids

Please note, the Independent Redistricting Commission will draw district lines for state legislative and federal congressional districts. The lines for county commissioner districts are handled by county Apportionment Boards. For details on the apportionment process, click here or view a recording of a 2021 Legislative Conference workshop on the process.

Free course to focus on ‘Dynamics of Addiction’

A May 27 webinar on substance abuse disorders will cover the basics on Substance Use Disorder (SUD) and provide participants with knowledge, skills and strategies to manage SUD-related situations as an emergency responder. Development and funding for this course is courtesy of the Michigan Department of Health and Human Services.

A May 27 webinar on substance abuse disorders will cover the basics on Substance Use Disorder (SUD) and provide participants with knowledge, skills and strategies to manage SUD-related situations as an emergency responder. Development and funding for this course is courtesy of the Michigan Department of Health and Human Services.

The free session will run from 10 a.m. to noon and is part of the “Managing Mental Health Crisis” series that is designed specifically for Michigan law enforcement, public safety and community mental health responders. Such sessions are endorsed by the State of Michigan’s Diversion Council, MCOLES-approved and meet with MCOLES-recommended annual officer trainings.

To register, click here. Seats are limited to 47 participants. Deadline to register is May 26.

For information, contact J. Eric Waddell at jericwaddell@thecardinalgroup2.com.

Staff pic ks

ks

- Storefront stagnation: Coping with neighborhood retail’s new realities (Governing)

- Michigan courts planning for systemic reform (WDET)

- Michigan redistricting: Making public hearings fair and effective (video) (University of Michigan Ford School)

- Paying with cash? Retailers must take your dollars in these states. (Stateline)

The U.S. Department of Treasury released a wave of documents today (May 10) to guide counties and local governments on using direct investment funds through the American Rescue Plan (ARP).

The U.S. Department of Treasury released a wave of documents today (May 10) to guide counties and local governments on using direct investment funds through the American Rescue Plan (ARP).

Michigan counties stand to receive about $1.9 billion in such aid.

Treasury has created a main landing page for this effort, noting that relief is intended to:

- Support urgent COVID-19 response efforts to continue to decrease spread of the virus and bring the pandemic under control

- Replace lost revenue for eligible state, local, territorial, and Tribal governments to strengthen support for vital public services and help retain jobs

- Support immediate economic stabilization for households and businesses

- Address systemic public health and economic challenges that have contributed to the inequal impact of the pandemic

“The Coronavirus State and Local Fiscal Recovery Funds provide substantial flexibility for each government to meet local needs—including support for households, small businesses, impacted industries, essential workers, and the communities hardest hit by the crisis. These funds can also be used to make necessary investments in water, sewer, and broadband infrastructure,” Treasury stated.

Treasury has published an Interim Final Rule that implements the provisions of this program.

Also, please make sure to review a “quick reference” fact sheet from Treasury.