Juvenile justice package adopted as MAC scores win in 2023 priority

Nineteen pieces of a 20-bill package to make sweeping reforms to the juvenile justice system, long backed by MAC, was signed into law by Lt. Gov. Garlin Gilchrist this week.

Nineteen pieces of a 20-bill package to make sweeping reforms to the juvenile justice system, long backed by MAC, was signed into law by Lt. Gov. Garlin Gilchrist this week.

House Bills 4624-43 and Senate Bills 418-423, 424, 425, 426, 427, 428-429, 430-431 and 432-437 are a result of the Michigan Task Force on Juvenile Justice Reform’s recommendations provided in July 2022.

One bill, HB 4630, did not advance out of the Legislature.

The Task Force on Juvenile Justice Reform was established in 2021 and tasked with assessing Michigan’s juvenile justice data and identifying ways to improve the system. Two county commissioners served on the Task Force, each nominated by MAC. Alisha Bell of Wayne represented a county with a population over 100,000, and Marlene Webster of Shiawassee represented a county of under 100,000 in population. Rep. Sarah Lightner, R-Jackson and a former county commissioner, also served on the panel.

The task force discovered several challenges to strengthening public safety and improving outcomes for youth. This led to the set of 32 recommendations provided to the Legislature last year. The recommendations would improve community safety, reduce disparities and improve youth outcomes.

SB 418, by Sen. Sylvia Santana (D-Wayne), enhances the County Child Care Fund (CCF) by establishing a minimum framework of juvenile justice best practices statewide, including the use of risk screening and assessment tools. The best practices will be supported by an increase in the reimbursement rate for community-based services from 50 percent to 75 percent, including 17-year-olds. These changes are essential to ensuring counties have the resources to implement and utilize these approaches. The reimbursement rate for residential services will be 50 percent, including the 17-year-old population.

SBs 419–423 and HBs 4625-29 require the consistent use of validated screening and assessment tools to enable more objective decision-making and allow agencies to better match youth to appropriate supervision and services, reducing their likelihood to recidivate. The bills also expand the Diversion Act so that all offenses, with an exception for youth committing a specified juvenile violation, are eligible for pre-court diversion, based on the use of a risk-screening tool and other factors, and limit the time that a youth can be placed on pre-court diversion, unless the court determines that a longer period is needed. While diversion eligibility would be expanded, judicial discretion remains.

HB 4630, by Rep. Lightner, would have expanded the Michigan Indigent Defense Commission to include development, oversight and compliance with youth defense standards in local county defense systems. It never received a vote in the Senate. It remains to be seen if the Legislature will revisit this bill in 2024.

Enacted bills will take effect Oct. 1, 2024.

MAC supported this package as a 2023 priority.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Growing Michigan Council sets goals – but specifics lacking as to funding

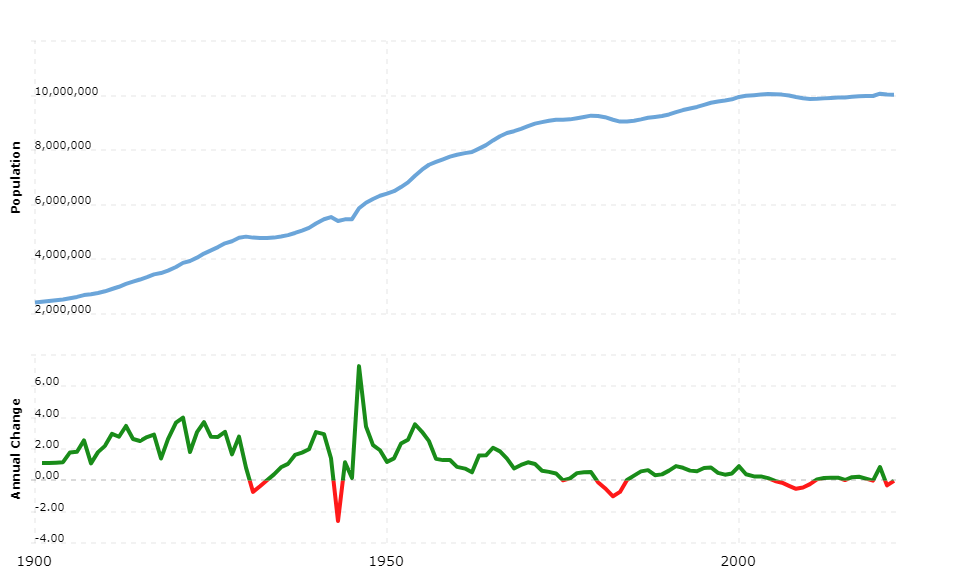

Michigan’s population has hovered around the 10 million mark for decades while other states have seen significant increases. (Source: Macrotrends.net)

The Growing Michigan Together Council, a special task force formed by Gov. Gretchen Whitmer that was notably lacking in local government representation, released a report this week for new state investments in human capital.

In its report, the council describes the hard truth facing Michigan, which is now ranked 49th out of 50 states in population growth, has seen its median income, fall, its population age and its infrastructure investments lag.

The report is light on blame for this decline but instead makes it a collective problem that we will have to face and change together:

- Full council report (86 pages)

- Executive summary (6 pages)

To counter these trends, the panel sets out three main components and subsequent recommendations, include establishing Michigan as an innovation hub, the creation of lifelong learning focused on future readiness skills and competencies and on creating thriving, resilient communities that are magnets for young talent.

Following the actionable items in the report are recommendations on ensuring momentum and taking a hard look at state policies and their funding models and an honest look at the return on investment for the state’s 10 million residents.

MAC’s Podcast 83 team will have its reactions to the council report in an episode scheduled for release on Wednesday, Dec. 20.

For more information or to provide thoughts and feedback on the report, contact Deena Bosworth at bosworth@micounties.org.

Presentations from 2023 Policy Summit

State launches online tool for FOIA requests

A new online tool for Freedom of Information Act (FOIA) searches was unveiled this week by Secretary of State Jocelyn Benson.

A new online tool for Freedom of Information Act (FOIA) searches was unveiled this week by Secretary of State Jocelyn Benson.

The new service will allow documents to be made publicly available online as part of a FOIA request. Rather than fulfilling multiple requests, the document will be accessible online to any interested party for one year.

Changes to the way the Department of State responds to FOIA requests come after an influx of requests for election materials in recent years. This system will make the process easier for both the requestor and the team fulfilling requests behind the scenes. Online payment will be accepted for the first time, adding another level of convenience.

It is possible other agencies will follow suit should this program prove successful.

For more information on MAC’s advocacy work on FOIA issues, contact Madeline Fata at fata@micounties.org.

Medication aide legislation signed into law

A package to create medication aide registration and permits, supported by the Michigan County Medical Care Facilities Council (MCMCFC), has been signed by Gov. Gretchen Whitmer.

A package to create medication aide registration and permits, supported by the Michigan County Medical Care Facilities Council (MCMCFC), has been signed by Gov. Gretchen Whitmer.

House Bills 4885 and 4923, by Reps. Donovan McKinney (D-Wayne) and Joseph Aragona (R-Macomb), respectively, allows for the training and registration of medication aides in a manner similar to registration and training for nurse aides, commonly referred to as certified nurse aides, or CNAs.

The changes will address staffing shortages within county medical care facilities; likely increase retention and recruitment for nurses, nurse aides and medication aides; and reduce overall errors by freeing up nurses within facilities.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Podcast 83 reviews MAC opioid settlement services

A special episode of Podcast 83 features MAC’s opioid settlement services to member counties.

A special episode of Podcast 83 features MAC’s opioid settlement services to member counties.

Host Stephan Currie interviews Amy Dolinky, MAC’s technical adviser for settlement services, about her work with dozens of Michigan counties and what questions and issues have arisen in her statewide travels.

“I’m engaged with 60 counties providing various levels of support,” explained Dolinky, who joined MAC about a year ago to work specifically with members on the complicated task of best deploying national opioid settlement dollars in their communities.

Dolinky explained she has been involved in everything from helping counties plan for creation of an advisory panel, all the way to helping folks think through what transparency looks like with their spending decisions.

“And (MAC has been) working with some counties on strategic planning efforts,” she noted.

During the discussion, Currie and Dolinky reviewed the payment timeline, with Dolinky noting that while each company has a set number of payments, they are not being issued on a standard fiscal year or annual basis — and amounts can differ from year to year.

County members with any questions about opioid settlements are encouraged to review MAC’s extensive resources on the web and/or contact Dolinky directly at dolinky@micounties.org.

View the full video of the episode, recorded in November 2023, by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

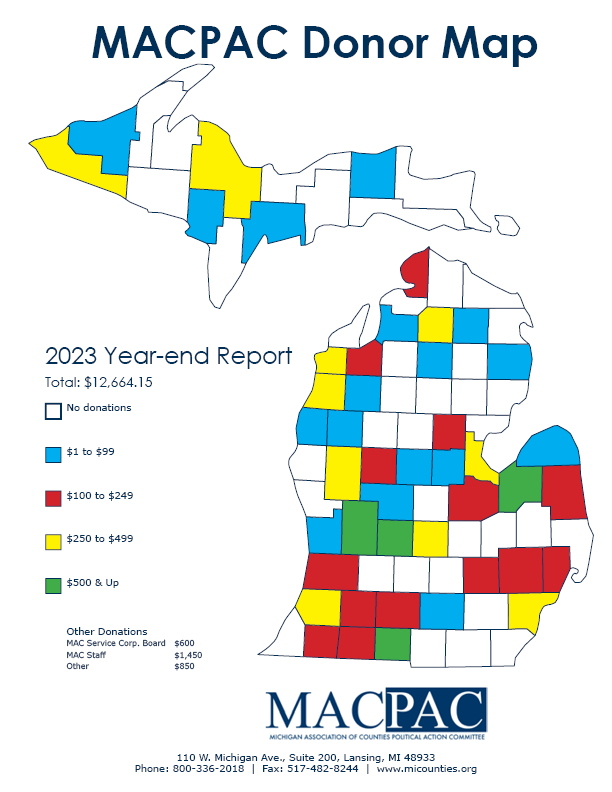

MACPAC nearly reaches $13,000 mark in 2023

Continuing its rebound from pandemic-year lows, the MAC Political Action Committee raised nearly $13,000 for a 12-month period ending on Dec. 4, 2023.

MACPAC, the only PAC in Michigan committed to supporting sitting legislators who have proven themselves to be allies of effective and efficient county government, received $12,664.15 for the year. It was backed by 80 individual donors, with donations coming from 45 of the 83 counties.

In his first months in office, Board President Jim Storey of Allegan County has spoken often about the important role MACPAC plays in MAC’s overall advocacy efforts, including at last week’s 2023 Policy Summit: “(W)hen you combine our PAC with our individual voice in our home communities, we are very strong, we are very effective.”

To learn more about MACPAC’s work or make a click online donation, click here.

Treasury seeks public comment on accounting documents

The Michigan Department of Treasury provides direction to local governments on accounting and auditing in the form of Numbered Letters and Michigan Committee on Governmental Accounting and Auditing (MCGAA) Statements. To ensure this information is up to date and useful for its trusted partners, Treasury has begun the process of removing and updating the Numbered Letters and MCGAA statements from 1993 to the present.

The Michigan Department of Treasury provides direction to local governments on accounting and auditing in the form of Numbered Letters and Michigan Committee on Governmental Accounting and Auditing (MCGAA) Statements. To ensure this information is up to date and useful for its trusted partners, Treasury has begun the process of removing and updating the Numbered Letters and MCGAA statements from 1993 to the present.

Its ongoing goal will be to update Numbered Letters and MCGAA Statements every five years to make sure they are maintained adequately, with a focus on updating 20 percent a year. Most of the updates made will be to bring all these publications to our most current format and ensure all weblinks within those resources are accurate. Many will need to be revised more substantially or even removed from being active.

In addition to the content updates, Treasury is changing the MCGAA Statements to Numbered Letters. For this release, there will be four MCGAA Statements that will be changed to Numbered Letters. The revisions include updating to our current format and ensuring all weblinks are accurate.

The Local Audit and Finance Division is currently soliciting public comment on selected Numbered Letters and MCGAA Statements (which have been changed to Numbered Letters). Any individual or organization that would like to submit comments should provide those comments in writing by Jan. 12, 2024.

You can find the selected Numbered Letters Exposure Drafts and Numbered Letters for Public Comment below:

Comments may be submitted by email to LAFD_Audits@michigan.gov with the subject line entitled, “Numbered Letters Exposure Draft.”

Alternatively, responses may also be submitted via U.S Postal Service to:

Michigan Department of Treasury

Local Audit and Finance Division

PO Box 30728

Lansing, MI 48909-8228

If you have any questions, contact Treasury at 517-335-7469.

Staff picks

Staff picks

- Meeting Michigan’s renewable energy targets will require regional coordination (Citizens Research Council of Michigan)

- Red regions, blue states and the urge to separate (Governing)

- 2024: 12 predictions for cities and counties – AI stars in all (American City and County)

- Italian officials secure 12th Century leaning tower in Bologna to prevent collapse (Associated Press)

Potential new funds for public safety and long-needed repairs to the state Open Meetings Act are two of several issues discussed in Part II of Podcast 83’s “

Potential new funds for public safety and long-needed repairs to the state Open Meetings Act are two of several issues discussed in Part II of Podcast 83’s “

The U.S. Department of Treasury released a new interim final rule to address questions regarding the definition of “obligation” and to provide guidance and clarification for Obligation Interim Final Rule (IFR).

The U.S. Department of Treasury released a new interim final rule to address questions regarding the definition of “obligation” and to provide guidance and clarification for Obligation Interim Final Rule (IFR). Legislative successes on juvenile justice reform, property tax reimbursements and revenue sharing highlight

Legislative successes on juvenile justice reform, property tax reimbursements and revenue sharing highlight  The Michigan State Court Administrative Office and the Michigan Department of Health and Human Services invite county officials to join an informational webinar to learn more about the recently passed Justice for Kids and Communities bill package. The bill package is the result of the work of the

The Michigan State Court Administrative Office and the Michigan Department of Health and Human Services invite county officials to join an informational webinar to learn more about the recently passed Justice for Kids and Communities bill package. The bill package is the result of the work of the

MAC congratulates the August 2023 NACo Leadership Academy graduates from Michigan. They join more than 10,000 graduates and current participants from across the country benefitting from the 12-week online program enabling existing and emerging county leaders to achieve their highest potential:

MAC congratulates the August 2023 NACo Leadership Academy graduates from Michigan. They join more than 10,000 graduates and current participants from across the country benefitting from the 12-week online program enabling existing and emerging county leaders to achieve their highest potential: A MAC-commissioned report on the services that counties provide to other local governments will be reviewed at the MAC Policy Summit set for Dec. 7, 2023.

A MAC-commissioned report on the services that counties provide to other local governments will be reviewed at the MAC Policy Summit set for Dec. 7, 2023. Before adjourning officially earlier this week, the Michigan Legislature pushed through a flurry of actions affecting counties in the months and years ahead, such as pre-empting local control on energy facilities and advancing much needed juvenile justice reforms.

Before adjourning officially earlier this week, the Michigan Legislature pushed through a flurry of actions affecting counties in the months and years ahead, such as pre-empting local control on energy facilities and advancing much needed juvenile justice reforms. On Thursday, December 7, The next webinar in the Opioid Settlement Technical Assistance Learning Series, “Evaluation Strategies for Projects Funded by Michigan’s Opioid Settlements,” will be held on Dec. 7 from 2 p.m. to 3 p.m.

On Thursday, December 7, The next webinar in the Opioid Settlement Technical Assistance Learning Series, “Evaluation Strategies for Projects Funded by Michigan’s Opioid Settlements,” will be held on Dec. 7 from 2 p.m. to 3 p.m. MAC’s Lansing offices will close at noon on Wednesday, Nov. 22 to observe the Thanksgiving holiday.

MAC’s Lansing offices will close at noon on Wednesday, Nov. 22 to observe the Thanksgiving holiday.