MAC-backed OMA bill clears Senate; quick House vote expected

A bill to change the Open Meetings Act (OMA) to allow remote attendance at local board meetings under certain circumstances was approved 36-2 by the Michigan Senate Thursday and now heads to the House for quick consideration.

A bill to change the Open Meetings Act (OMA) to allow remote attendance at local board meetings under certain circumstances was approved 36-2 by the Michigan Senate Thursday and now heads to the House for quick consideration.

Senate Bill 1108, by Sen. Lana Theis (R-Livingston), however, gained many changes during the Senate floor debate that did not exist in the bill approved by the Senate Local Government Committee.

The version now before the House will allow members of public bodies to meet remotely due to medical leave (current law), a medical condition or a state or local emergency, through Dec. 31, 2021.

MAC heard from numerous members concerned about board actions taken since April 30, when the governor’s authority to extend the State of Emergency unilaterally and implement further Executive Orders was deemed unconstitutional by a majority of the Michigan Supreme Count. (Reminder: MAC legal counsel advises that the EOs are still in place as the federal court has yet to rule in the challenge against them.)

To address this issue, the bill would apply retroactively to April 30, 2020, and provide that the remote meeting could take place under any circumstance. Since the governor’s state of emergency declaration has been called into question, and not all counties have declared a local emergency, this would ensure board actions since April 30 that took place over an electronic platform are covered by law.

In an unexpected turn of events, an additional amendment was added so remote capabilities revert to current law (remote participation only for a military absence) on Jan. 1, 2021. This caused much confusion, as it conflicted with allowing meetings through limited circumstances through December 2021. MAC staff has verified this was an error in drafting and the bill should revert to current law on Jan. 1, 2022, as consideration continues.

Despite this confusion, MAC is still supportive of the latest version, so long as the House addresses the date error.

MAC encourages members to speak to their representatives this weekend and remind them of the importance of this legislation. The House is expected to come back to session on Tuesday, Oct. 12 to act. Please remind them, as a county commissioner, interfacing directly with the public is preferable, but under the current COVID-19 situation, we need this bill to allow county officials to decide what is best for their community and provide safe measures for all residents, while continuing to govern and address county needs.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Formal legal analysis says governor’s EOs remain in effect for now

UPDATE – 10/12/20 – MAC COVID Update on Supreme Court orders

UPDATE – 10/12/20 –Michigan Supreme Court says Executive Orders are invalid immediately via new court orders (10/12)

MAC has received a formal legal analysis from the firm of Cohl, Stoker and Toskey on the situation regarding the Michigan Supreme Court announcement Friday and its effects on the governor’s Executive Orders, including the one governing virtual meetings under the Open Meetings Act.

The analysis says:

“As you are likely aware, the Michigan Supreme Court issued an opinion last Friday (October 2, 2020) in which the majority of the Justices agreed that the Governor’s Executive Orders issued after April 30, 2020 were invalid, as the law under which they were issued allowed an unconstitutional delegation of legislative authority to the Governor. The case presents a likely change in the near future, but as of now the Executive Orders appear to remain in effect. (emphasis added) …

“The Governor has asserted that this new decision should not take effect for 21 days, which is the normal practice for the effective date of Supreme Court decisions, unless the Supreme Court directs the Certification Opinion to have immediate effect. This would then generally allow time for a request for a motion to reconsider the Supreme Court’s decision. (MCR 7.315) However, it is not clear that there would be such a separate ‘order’ from the Supreme Court in this type of legal “Certification” interpretation opinion, as the actual litigation is in federal District Court. The Michigan Court Rules [MCR 7.308(A)(5)] do provide that such a ‘certified’ decision may be rendered by the Supreme Court ‘… in the ordinary form of an opinion to be published with other opinions of the Court.’ Although the Governor’s Attorneys filed a motion on October 5, 2020, seeking clarification that the Supreme Court’s Certification Opinion will not take effect until after the 21-day period has lapsed, it appears that as of now the Governor’s Executive Orders remain in effect.”

Click here to read the full analysis.

In a separate note, the firm of Dickinson Wright adds this caveat regarding the specific situation of issuing bonds:

“As a cautionary note, bond issues require a higher level of certainty as to the actions of a county. Therefore, counties should be aware that it may be necessary for resolutions relating to bond issues to be adopted at a meeting where there is at least a quorum of board members physically present. The failure to do so may prevent the County from being able to issue the bonds.”

For more information on this issue, call MAC at 517-372-5374.

Learn about water infrastructure funding options

An Oct. 14 webinar will discuss available funding to assist local governments in upgrading their drinking water and wastewater infrastructure.

An Oct. 14 webinar will discuss available funding to assist local governments in upgrading their drinking water and wastewater infrastructure.

Led by the Department of Environment, Great Lakes and Energy (EGLE), the webinar will run from 9 a.m. to 10 a.m. To register, click here.

Gov. Gretchen Whitmer and EGLE recently announced the MI Clean Water plan that includes $500 million worth of funding resources to help local communities upgrade drinking water and wastewater infrastructure. This webinar will help managers of community water supplies learn about the different funding categories and how to apply for assistance. It is geared toward drinking water system operators, wastewater managers, consultants, local officials and others who oversee or manage such systems.

A $207 million investment in drinking water quality, including: MI Clean Water will reduce barriers for communities and allow them to access needed funds for necessary and timely infrastructure upgrades.

Treasury sets Oct. 13 webinar on CARES Act relief reporting

A webinar on the Coronavirus Relief Local Government Grants (CRLGG) Program Quarterly Reporting System (OnCue) will be held Oct. 13 at 10 a.m., the Treasury Department announced this week.

A webinar on the Coronavirus Relief Local Government Grants (CRLGG) Program Quarterly Reporting System (OnCue) will be held Oct. 13 at 10 a.m., the Treasury Department announced this week.

This training is necessary for all CRLGG recipients.

Beginning this fall, local governments that received funding under the CRLGG program will be required to file quarterly financial status reports utilizing the OnCue reporting platform. The first of these reporting dates is Wednesday, Oct. 28 (updated from the original date of Oct. 7). In preparation for reporting, Treasury will be providing training on how to use the OnCue system, what information is required to be reported and key reporting dates.

To register for this event, please visit https://crfreporting.eventbrite.com.

If you have not completed the grant opening certification form, you must do so as soon as possible. This form was due Sept. 23, 2020.

Unable to attend? A recording of the webinar will be uploaded to Treasury’s COVID-19 Updates for Local Governments website by Oct. 19.

Questions about CARES Act-funded grant programs should be directed to the Treasury CARES Grant Programs Hotline at 517-335-0155 or Treas-CARES@michigan.gov.

Staff picks

Staff picks

MAC’s Podcast 83 team will host a special live edition on Wednesday at 3:30 p.m. They will discuss all of the details on how county boards can meet properly and safely now with special guest Matt Nordfjord of the firm of Cohl, Stoker and Toskey in Lansing.

MAC’s Podcast 83 team will host a special live edition on Wednesday at 3:30 p.m. They will discuss all of the details on how county boards can meet properly and safely now with special guest Matt Nordfjord of the firm of Cohl, Stoker and Toskey in Lansing.

A bill to change the Open Meetings Act (OMA) to allow remote attendance at local board meetings under certain circumstances was approved 36-2 by the Michigan Senate Thursday and now heads to the House for quick consideration.

A bill to change the Open Meetings Act (OMA) to allow remote attendance at local board meetings under certain circumstances was approved 36-2 by the Michigan Senate Thursday and now heads to the House for quick consideration.

An Oct. 14 webinar will discuss available funding to assist local governments in upgrading their drinking water and wastewater infrastructure.

An Oct. 14 webinar will discuss available funding to assist local governments in upgrading their drinking water and wastewater infrastructure. A webinar on the

A webinar on the  Staff picks

Staff picks A bill to create a new broadband grant program flew through the Senate this week, despite opposition from MAC, other local government groups and education groups.

A bill to create a new broadband grant program flew through the Senate this week, despite opposition from MAC, other local government groups and education groups.  Gov. Gretchen Whitmer announced this week a $500 million proposal to invest in water infrastructure across Michigan. Thanks to a recent federal amendment by Sen. Corey Booker (D-N.J.), states have a one-time window to transfer federal funds for clean water into their drinking water revolving fund for investment into the assessment and replacement of drinking water lines. Of the $500 million proposed by the governor, $207 million, which does not require legislative approval, will be allocated for:

Gov. Gretchen Whitmer announced this week a $500 million proposal to invest in water infrastructure across Michigan. Thanks to a recent federal amendment by Sen. Corey Booker (D-N.J.), states have a one-time window to transfer federal funds for clean water into their drinking water revolving fund for investment into the assessment and replacement of drinking water lines. Of the $500 million proposed by the governor, $207 million, which does not require legislative approval, will be allocated for:  Bills to adopt a new process for handling property tax foreclosures in the wake of the Rafaeli v Oakland County decision were passed out of the Senate Finance Committee this week.

Bills to adopt a new process for handling property tax foreclosures in the wake of the Rafaeli v Oakland County decision were passed out of the Senate Finance Committee this week. Bills to eliminate the Personal Property Tax (PPT) on solar energy facilities and energy storage systems were reviewed this week by the Senate Finance Committee, chaired by Sen. Jim Runestad (R-Oakland).

Bills to eliminate the Personal Property Tax (PPT) on solar energy facilities and energy storage systems were reviewed this week by the Senate Finance Committee, chaired by Sen. Jim Runestad (R-Oakland). Public Act 660 of 2018 requires each county in the state to have a Designated Assessor of Record on file with the State Tax Commission by Dec. 31, 2020.

Public Act 660 of 2018 requires each county in the state to have a Designated Assessor of Record on file with the State Tax Commission by Dec. 31, 2020.  The state Department of Health and Human Services

The state Department of Health and Human Services  The state will issue $80 million in federal State Opioid Response (SOR) funds to “support prevention, treatment and harm reduction services,” the Governor’s Office and the state’s Opioid Task Force announced this week. The funding includes $36.4 million from the new State Opioid Response II (SOR II) grant and $43.1 million from an extension of the current State Opioid Response I (SOR I) grant.

The state will issue $80 million in federal State Opioid Response (SOR) funds to “support prevention, treatment and harm reduction services,” the Governor’s Office and the state’s Opioid Task Force announced this week. The funding includes $36.4 million from the new State Opioid Response II (SOR II) grant and $43.1 million from an extension of the current State Opioid Response I (SOR I) grant. Ending a long period of behind-the-scenes work by key legislators and the Whitmer administration, the Legislature moved rapidly today to pass

Ending a long period of behind-the-scenes work by key legislators and the Whitmer administration, the Legislature moved rapidly today to pass

MSU Extension and the Michigan Department of Treasury will cover the fundamentals of budgeting during uncertain economic times, tracking long-term fiscal health and operational best practices in “Fiscally Ready Communities: Budgeting for Fiscal Sustainability.”

MSU Extension and the Michigan Department of Treasury will cover the fundamentals of budgeting during uncertain economic times, tracking long-term fiscal health and operational best practices in “Fiscally Ready Communities: Budgeting for Fiscal Sustainability.” To register,

To register,  Legislation to allow time pre-election to process mail-in ballots cleared the House this week on a 94-11 vote. The measure is supported by the Michigan Association of Municipal Clerks and the Council of Election Officials.

Legislation to allow time pre-election to process mail-in ballots cleared the House this week on a 94-11 vote. The measure is supported by the Michigan Association of Municipal Clerks and the Council of Election Officials. A legislative package spurred by recommendations from the

A legislative package spurred by recommendations from the  Michigan’s 34 county-owned skilled nursing facilities received good news in the fiscal 2021 state budget approved Wednesday, along with other parts of the state’s health field.

Michigan’s 34 county-owned skilled nursing facilities received good news in the fiscal 2021 state budget approved Wednesday, along with other parts of the state’s health field. Legislation allowing certain special assessment districts, filed in response to the Sanford Dam failure, cleared another legislative hurdle this week by advancing out of the House Committee on Natural Resources. MAC supports the legislation.

Legislation allowing certain special assessment districts, filed in response to the Sanford Dam failure, cleared another legislative hurdle this week by advancing out of the House Committee on Natural Resources. MAC supports the legislation. A new method to tax heavy construction and earth-moving equipment in Michigan cleared a House committee this week.

A new method to tax heavy construction and earth-moving equipment in Michigan cleared a House committee this week. A former member of the Michigan Tax Tribunal who served when the panel adopted the “Dark Stores” theory of property assessment will rejoin the tribunal after a Senate committee failed to reject her nomination by the Whitmer administration.

A former member of the Michigan Tax Tribunal who served when the panel adopted the “Dark Stores” theory of property assessment will rejoin the tribunal after a Senate committee failed to reject her nomination by the Whitmer administration. A webinar designed to provide participants, particularly law enforcement, with the knowledge and skills required to provide effective, equitable service to people with intellectual and/or developmental disabilities, including autism spectrum disorder, will be held Oct. 27 from 1 p.m. to 3 p.m.

A webinar designed to provide participants, particularly law enforcement, with the knowledge and skills required to provide effective, equitable service to people with intellectual and/or developmental disabilities, including autism spectrum disorder, will be held Oct. 27 from 1 p.m. to 3 p.m. Staff picks

Staff picks FY21 budget won’t cut revenue sharing

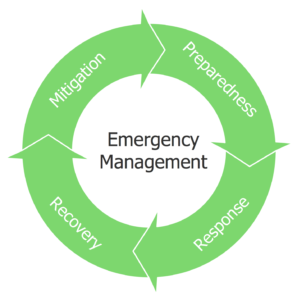

FY21 budget won’t cut revenue sharing The House committee on Military and Veterans Affairs took testimony this week from emergency managers (EM) in support of

The House committee on Military and Veterans Affairs took testimony this week from emergency managers (EM) in support of  2020 Annual Conference videos now available

2020 Annual Conference videos now available Michigan counties have weathered the initial fiscal crisis caused by the coronavirus pandemic, but dangers loom on the horizon, MAC Executive Director Stephan Currie said

Michigan counties have weathered the initial fiscal crisis caused by the coronavirus pandemic, but dangers loom on the horizon, MAC Executive Director Stephan Currie said  The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS)

The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS)