New PPT bills would affect heavy equipment, solar

The House Committee on Tax Policy took testimony this week on House Bills 5778 and 5779, by Rep. Jim Ellison (D-Oakland), that would change the way rented heavy equipment is taxed in Michigan. Currently, heavy equipment is taxed as personal property (PPT) and credited to the taxing jurisdiction where it physically sits on Dec. 31 of each year.

Since this equipment is rented and movable, neither the companies paying the taxes are clear what their obligations will be on a year to year basis nor can the local tax collecting units forecast the revenue in an efficient manner. The bills seek to eliminate PPT on this equipment and instead replace it with a 2 percent tax on the rental of the equipment. This tax would be paid by the customer, collected by the company renting the equipment and submitted quarterly to the Michigan Department of Treasury.

By May 20 of each year, Treasury would be required to send 90 percent of this revenue to the local tax collecting unit where the rental transaction originated, and 10 percent of the revenue to the other counties, cities, villages and townships not receiving a share of the distribution. Within 35 days of receiving the revenue, the tax collecting unit would be required to disburse the revenue to the taxing units (counties, et al) in the same proportion as it distributes property taxes.

In addition to the equipment rental bills, bills affecting the PPT on solar energy facilities have been introduced. Senate Bill 1105, by Sen. Curt VanderWall (R-Mason) and SB 1101, by Sen. Kevin Daley (R-Tuscola), would exempt solar energy facilities and storage systems from the PPT and instead create a PILT (payment in lieu of taxes) system.

Proponents are seeking a standardized, statewide system that will provide predictability in the taxes owed, regardless of the jurisdiction; escape the variability in assessments and millage rates; and provide a flat stream of revenue for those communities that host this equipment. The legislation would create a PILT of $3,500 per megawatt maximum annual payment, as opposed to a tax based on an assessed value and depreciation schedule.

In order to qualify for PILT as opposed to a tax, the owner of the facility would be required to file for and receive an exemption certificate, which would not expire unless they permanently ceased production, received a judicial determination that they failed to make their payments, or upon the jointly agreed upon termination date. MAC is seeking clarification on the equitable amount per megawatt hour, the assumptions that brought them to that amount, the efforts of the Michigan Tax Tribunal to make recommendations on standardizing the assessment of the equipment and the overall financial impact to counties.

MAC has not yet taken a position on any of these bills. The legislation will be discussed at our September Finance and General Government Committee session.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

State launches Futures for Frontliners campaign

County frontline workers put their own health at risk during the worst of the pandemic. That’s why Michigan has created Futures for Frontliners – to offer essential workers like you the opportunity to attend school tuition-free full-time or part-time while you continue to work. MAC is pleased to partner with the state and others on this initiative.

County frontline workers put their own health at risk during the worst of the pandemic. That’s why Michigan has created Futures for Frontliners – to offer essential workers like you the opportunity to attend school tuition-free full-time or part-time while you continue to work. MAC is pleased to partner with the state and others on this initiative.

Who’s eligible? All essential workers in Michigan without college degrees or high school diplomas or equivalency who staffed our hospitals, nursing homes, and grocery stores, who cared for our children, provided critical police and fire services, delivered our food, picked up our trash, manufactured PPE, and other key jobs during the April-June period that kept our state running.

The application for seeking a college degree or certificate, attaining your high school diploma or equivalency, and additional program information are available now at Michigan.gov/Frontliners, with enrollment in classes available beginning January 2021.

Please share this information with your county employees.

NACo unveils toolkit for lobbying Congress

To help local leaders advocate for top county priorities between now and the end of the year, NACo has developed an online Advocacy Toolkit, which features in-depth information, talking points, sample advocacy emails, tweets and Facebook posts, federal legislation trackers and exclusive NACo materials to help tell the county story.

As members of Congress are in their home districts, this toolkit provides resources to communicate with them, demonstrate the impact of county programs and advocate for federal policies that support local priorities.

Water School webinars aimed at local officials

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from Michigan Sea Grant and Michigan State University Extension provides decision-makers with critical, relevant information needed to understand Michigan’s water resources in order to support sound water management decisions.

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from Michigan Sea Grant and Michigan State University Extension provides decision-makers with critical, relevant information needed to understand Michigan’s water resources in order to support sound water management decisions.

This year, Michigan Water School: Essential Resources for Local Officials will be offered for free in a series of Zoom webinars from 3 p.m. to 5 p.m. on four Thursday afternoons (Oct. 8 and 22, Nov. 5 and 19). The program will include sessions on water quantity; water quality; water finance and planning; and water policy issues. Topics to be covered include:

- The Blue Economy

- Fiscal benefits of water management

- Incorporating water into local planning and placemaking

- Resources to help address water problems

- Water policy at the federal, tribal, state, and local levels

Water School speakers will include educators and faculty from MSU and MSU Extension as well as other experts providing local perspectives.

Register to attend the free, policy-neutral, fact-based program at events.anr.msu.edu/WaterSchoolWebinarSeries2020. Not sure if you will be able to attend the live sessions? Each webinar will be recorded and all registrants will receive links to the recordings so you can watch them at a more convenient time, along with additional resources.

For more information, contact Michigan Sea Grant Extension Educator Mary Bohling at bohlingm@msu.edu. Follow on Twitter with #MIWaterSchool.

Staff picks

Staff picks

Almost 60 Michigan counties lacked the financial resources in 2017 to cover the public services they need to provide, even after accounting for state aid such as revenue sharing, says a new analysis from a Michigan State University professor.

Almost 60 Michigan counties lacked the financial resources in 2017 to cover the public services they need to provide, even after accounting for state aid such as revenue sharing, says a new analysis from a Michigan State University professor.

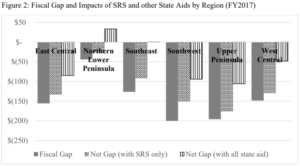

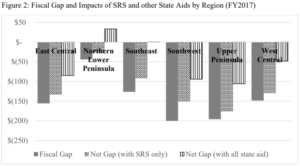

Shu Wang, an assistant professor at MSU who has presented at MAC on local government finance issues, compared a county’s revenue-raising capacity (RRC), its expenditure need and its state aid in the years 2011 and 2017 to assess the “fiscal gap.” While 24 counties did not show a gap in 2017, after adjusting for all county and state resources, 59 did, with the largest problems concentrated in the Upper Peninsula and Southwest Michigan. (See full county-by-county results here.)

The report states the “main drivers for counties’ needs are violent crime rate, population density and distribution, and employment in the manufacturing industry.”

MAC spoke with Dr. Wang this week to learn more about the report and what Michigan counties face fiscally:

What finding surprised you the most?

Shu Wang

Wang: “I don’t have preconceived assumptions so can’t say any result to be surprising. Rather, I’d share a few noteworthy points. One is the different equalizing effects of state revenue sharing (SRS) and other forms of state aid. Figure 2 (above) shows SRS does not close fiscal gap as much as other state aids. From a policy standpoint, SRS has some sort of formula, whereas other state aids are more difficult to track or to structure. Counties may want to further investigate the roles played by other aids from state in addition to SRS.

“A second point is variations of fiscal gap between regions and within regions. Again, figure 2 shows the northern Lower Peninsula has a small fiscal gap to begin with, and additional state support actually creates a fiscal surplus, whereas the Upper Peninsula still has a wide gap after all state support. In terms of within-region variation, Oakland and Wayne counties in the southeast can have quite different challenges. The fact that state support seems to close fiscal gap for that region shouldn’t mask their differences.”

What is the greatest misconception about county finances right now?

Wang: “It largely depends on who we talk to. I’d like to remind officials (or general public) not to overestimate the role of property taxes. I don’t mean to discount the fact that it is the most stable major revenue source; however, due to prop A the taxable values have remained stagnant. Counties levy a lower mill and raise millage less frequently than cities, and that further limits their revenue-raising capacity from properties.”

What’s the no. 1 thing that county leaders should be doing to drive reform in financing?

“I’d suggest not to be tempted into easy, oversimplified formula such as dollars per capita. It is important to understand the structural needs faced by each county, including structural deficits, unfunded mandates and underlying socioeconomic issues that are driving county spending. While doing so counties should also pay attention to how state policies contribute to addressing these needs and affecting their revenue-raising capacity. This is largely what motivated my study. Fiscal gap is a thought exercise for understanding these issues. Just like treating a disease, fiscal distress is a symptom and county leaders as doctors should focus on the cause for the symptom.”

County frontline workers put their own health at risk during the worst of the pandemic. That’s why Michigan has created Futures for Frontliners – to offer essential workers like you the opportunity to attend school tuition-free full-time or part-time while you continue to work. MAC is pleased to partner with the state and others on this initiative.

County frontline workers put their own health at risk during the worst of the pandemic. That’s why Michigan has created Futures for Frontliners – to offer essential workers like you the opportunity to attend school tuition-free full-time or part-time while you continue to work. MAC is pleased to partner with the state and others on this initiative.

Who’s eligible? All essential workers in Michigan without college degrees or high school diplomas or

equivalency who staffed our hospitals, nursing homes, and grocery stores, who cared for our children,

provided critical police and fire services, delivered our food, picked up our trash, manufactured PPE, and

other key jobs during the April-June period that kept our state running.

The application for seeking a college degree or certificate, attaining your high school diploma or

equivalency, and additional program information are available now at Michigan.gov/Frontliners, with

enrollment in classes available beginning January 2021.

Please share this information with your county employees.

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall.

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall.

Executive Director Stephan Currie will moderate the discussion that will include Deena Bosworth, governmental affairs director, and Meghann Keit, governmental affairs associate.

Click here to register for the free webinar, which will run from 1 p.m. to 2 p.m.

If the event doesn’t work with your schedule, don’t worry. A video recording will be made available on the Podcast 83 homepage on Sept. 22.

To ensure your question gets the full Podcast 83 treatment, send it in advance to Bosworth at bosworth@micounties.org.

At the request of Gov. Gretchen Whitmer, the Michigan Association of Counties (MAC) is supporting a new statewide public education campaign called “Spread Hope, Not COVID.” The goal of the campaign is to unite all in Michigan to take three simple actions that will contain the spread of the virus at levels that will enable the state to fully reopen — and stay open.

At the request of Gov. Gretchen Whitmer, the Michigan Association of Counties (MAC) is supporting a new statewide public education campaign called “Spread Hope, Not COVID.” The goal of the campaign is to unite all in Michigan to take three simple actions that will contain the spread of the virus at levels that will enable the state to fully reopen — and stay open.

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall.

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall. The latest webinar in a series co-sponsored by MAC, the Michigan Department of Treasury and others reviewed the latest guidance and tips involving COVID-19 aid for local governments on Sept. 8.

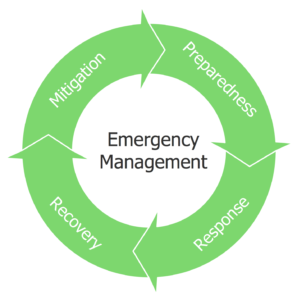

The latest webinar in a series co-sponsored by MAC, the Michigan Department of Treasury and others reviewed the latest guidance and tips involving COVID-19 aid for local governments on Sept. 8. A state Department of Emergency Management would be created under a bill filed last week.

A state Department of Emergency Management would be created under a bill filed last week.

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from Staff picks

Staff picks Almost 60 Michigan counties lacked the financial resources in 2017 to cover the public services they need to provide, even after accounting for state aid such as revenue sharing, says a

Almost 60 Michigan counties lacked the financial resources in 2017 to cover the public services they need to provide, even after accounting for state aid such as revenue sharing, says a