Important conversations held during the Mackinac Policy Conference

The Detroit Regional Chamber hosted its annual Mackinac Policy Conference this week on Mackinac Island. The event brings together business, community, and policy leaders in Michigan to have conversations on the biggest issues facing the state.

Steve Currie, MAC’s Executive Director and Deena Bosworth, MAC’s Director of Government Affairs, were also on the island having meetings with key legislators and county commissioners to ensure the interests of all Michigan’s 83 counties were a part of the conversation.

The legislature did not hold any committee meetings or votes this week because of the Mackinac Policy Conference. MAC is gearing up for a busy few weeks as the Legislature reconvenes to reach a consensus on the state budget before the deadline on July 1.

For more information contact Deena Bosworth at bosworth@micounties.org

Michigan Treasury releases 2022 PPT millage rates

Counties are encouraged to review 2022 millage rates just released by the Michigan Treasury as part of the Personal Property Tax (PPT) reimbursement system.

Counties are encouraged to review 2022 millage rates just released by the Michigan Treasury as part of the Personal Property Tax (PPT) reimbursement system.

The 2022 Millage Rate Comparison reports are available on Treasury’s PPT reimbursement website: www.michigan.gov/pptreimbursement.

Under state law, Treasury (Treasury) must issue these reports so municipalities can verify the eligible millage rates to be used in the 2022 PPT reimbursement calculations.

The eligible millage rates to be used in the 2022 PPT reimbursement calculations are calculated based on the eligible millage cap and 2021 millage rates and may be prorated as required by the Local Community Stabilization Authority Act (LCSA Act. Therefore, the calculated eligible millage rates to be used in the 2022 PPT reimbursement calculations may not reflect the actual 2021 millage rates levied by the municipality.

Municipalities should review the 2022 Millage Rate Comparison reports for accuracy.

- If the millage rate data is correct, the municipality does not need to take any further action.

- If there are any errors in the millage rate data, the municipality is required by the LCSA Act to notify Treasury of the error(s) by submitting Form 5613 – Millage Rate Correction for the 2022 Personal Property Tax Reimbursement Calculations no later than Aug. 1, 2022 (MCL 123.1358(4)).

Below is a list of the reporting forms related to millages that are available on Treasury’s PPT Reimbursement website under Forms for Calculation of PPT Reimbursements.

- Form 5451 – 2022 School District and Intermediate School District (ISD) Debt Millage Rate for the 2022 Personal Property Tax Reimbursement Calculation

- Optional form to be used by eligible school districts and ISDs to report the debt millage rate levied in the current year specifically for the payment of debt obligations approved by voters or incurred before 2015.

- DUE DATE: Aug. 1, 2022

- Form 5608 – Portion of 2021 Essential Services Millage Rate Dedicated for the Cost of Essential Services

- Optional form to be used by counties, cities, villages, townships, and local authorities that levy an extra-voted millage rate that partially funds the cost of essential services (for example a Fire/Cemetery millage). For extra-voted millage rates where the name of the millage would imply that the millage was partially dedicated for the cost of essential services, Treasury has identified the millage type as “PARTIAL ESSENTIAL SERVICE” on the 2022 Millage Rate Comparison reports.

- DUE DATE: Aug. 1, 2022

- Form 5609 – 2022 Hold Harmless Millage Rate for the 2022 Personal Property Tax Reimbursement Calculation

- Required form to be used by the 24 school districts that levy a supplemental hold harmless millage rate in 2022.

- DUE DATE: Aug. 1, 2022

- Form 5613 – Millage Rate Correction for the 2022 Personal Property Tax Reimbursement Calculations

- Optional form to be used by municipalities that identify an error in the 2022 Millage Rate Comparison reports.

- DUE DATE: Aug. 1, 2022

Direct any questions regarding the PPT reimbursement calculation or correction process to TreasORTAPPT@michigan.gov or 517-335-7484.

June conference to focus on environmental emergencies

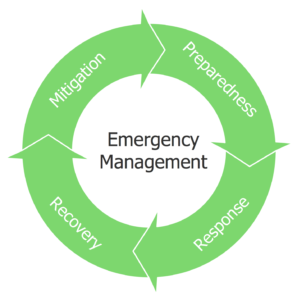

Is your community prepared to handle environmental emergencies such as fires, floods, oil spills, etc.? The Michigan Department of Environment, Great Lakes, and Energy (EGLE) is hosting the Environmental Emergency Management Conference at the Lansing Center in Lansing June 29-30, 2022. to help communities with preparedness and mitigation, response, and recovery related to incidents impacting the environment and public health. Participants may include federal, state and local emergency response personnel, public health officials, facility emergency managers, contractors, consultants, academia or anyone within the emergency response community.

Is your community prepared to handle environmental emergencies such as fires, floods, oil spills, etc.? The Michigan Department of Environment, Great Lakes, and Energy (EGLE) is hosting the Environmental Emergency Management Conference at the Lansing Center in Lansing June 29-30, 2022. to help communities with preparedness and mitigation, response, and recovery related to incidents impacting the environment and public health. Participants may include federal, state and local emergency response personnel, public health officials, facility emergency managers, contractors, consultants, academia or anyone within the emergency response community.

Conference highlights will include:

- Plenary presentation on the Coast Guard Great Lakes Center of Expertise for Oil Spill Response

- Special breakout session on Natural Disaster Debris to Increase Community Resiliency

- Additional breakout sessions on themes of Preparedness and Mitigation, Initial Response and Response and Recovery

- Networking Reception with exhibitors and hundreds of emergency response professionals

View the agenda and session descriptions.

General admission fee: $125 for both days.

Registration deadline: June 17, 2022.

Lodging block deadline: June 7, 2022.

For registration questions, contact Joel Roseberry, RoseberryJ@Michigan.gov, or Alana Berthold, BertholdA@Michigan.gov.

Staff picks

Staff picks

- Internet presence among Michigan local governments: websites, online services and experience with virtual meetings (Center for Local, State and Urban Policy)

- The unintended consequences of safety messaging on digital highway signs (Citizens Research Council of Michigan)

- Long COVID’s impact on Michiganders and the Michigan economy (Center for Health Research and Transformation)

- Pure Michigan ad: “Wish you were here” (State of Michigan)