A rigorous debate on aggregate mining legislation occurred this week in the House Local Government and Municipal Finance Committee.

The set of bills would change the oversight and permitting responsibilities of aggregate mining. Testimony was heard from several stakeholder groups and the Department of Environment, Great Lakes, and Energy (EGLE) on whether the permitting process should be in the hands of locals or the department.

MAC will continue to monitor the legislation as it moves through the legislative process.

Bills to fully reimburse local units for their losses associated with the Legislature’s 2021 Personal Property Tax exemption that is estimated will hit locals with a $75 million loss annually has passed unanimously out of the Senate. The bill package now moves to the House for consideration.

Senate Bill 1060, by Sen. Mark Huizenga (R- Kent), Senate Bill 1061, by Sen. Kimberly LaSata (R-Berrien), and Senate Bill 1062, by Sen. Michael McDonald (R-Macomb), would create a Local Government Reimbursement Fund into which the state would deposit $75 million annually.

The reimbursement package is a result of the House Bill 5351, by Rep. Steve Johnson (R-Kent), passed in December 2021. The bill lifted of the PPT exemption threshold for small taxpayers from $80,000 to $180,000 in true cash value. Lawmakers did also vote for a $75 million reimbursement for the first year of this exemption scheme (which starts in 2023), but they did not provide for the years beyond.

Deena Bosworth, MAC’s director of governmental affairs, previously testified in support of the package in the Senate Finance Committee. MAC helped develop the process in SB 1060-1062 alongside other local government groups.

MAC will continue to support the bill package and monitor its progress through the legislative process.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

Draft policy platforms now available for review prior to September vote

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 20 at 2 p.m. in the Blue Water Convention Center during the 2022 Michigan Counties Annual Conference.

County commissioners who are registered for the conference may participate as voting members in the business meeting, which includes review and approval of MAC’s 2022-2023 policy platforms.

The platform process begins with MAC’s policy committees, which meet during the year to address key issues. Their drafts are then submitted to the MAC Board of Directors for review. The MAC Board then advances the drafts to the membership for final approval.

Those Board-vetted drafts are now available on the MAC website here. (Please note that this is a password-protected page. Each member county has a set of access credentials, which are shared each year with your county administrator. If you do not have your credentials, contact Hannah Sweeney at sweeney@micounties.org for them.)

According to MAC’s By-laws (Article III, Section 6):

“A member wishing to submit an amendment to the MAC Platform shall submit the amendment to MAC at least five (5) days prior to the opening day of the MAC Annual Conference. Such amendment will require a majority vote at the annual meeting to be adopted.

“An amendment to the MAC Platform may be presented from the floor during the annual meeting. Such amendment will require a 2/3 majority vote of the members at the meeting at which a quorum is initially established to be adopted.”

To submit a platform amendment in advance, draft your preferred language and email to sweeney@micounties.org no later than Sept. 13, 2022.

Webinar to focus on rail grants on June 28

A webinar on June 28 will provide county leaders a review of the numerous grant opportunities involving railroads.

There are more than a dozen grant programs with rail funding availability offered through the U.S. Department of Transportation. In particular, the new Grade Crossing Elimination Program offers $3 billion in appropriated funding for grade crossing projects that improve the safety and mobility of people and goods.

GoRail is hosting the webinar so local officials can learn more about USDOT’s grant process and how best to approach their own applications.

William Thompson, chief engineer at the Association of American Railroads, has worked closely with the CREATE program in Chicago and will offer lessons learned from his experience, including building connections between public and private partners and project organization as well as CREATE’s approach to grant writing. We hope this will help officials begin to approach and navigate their own grant proposals.

The webinar runs from 2 p.m. to 2:45 p.m. on June 28.

To register or for more information, click here.

Staff picks

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 20 at 2 p.m. in the Blue Water Convention Center during the 2022 Michigan Counties Annual Conference.

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 20 at 2 p.m. in the Blue Water Convention Center during the 2022 Michigan Counties Annual Conference.

The Senate passed a mental health supplemental budget this week, but tie-barred a portion of the funding to the passage of Senate Majority Leader Mike Shirkey’s mental health integration package.

The Senate passed a mental health supplemental budget this week, but tie-barred a portion of the funding to the passage of Senate Majority Leader Mike Shirkey’s mental health integration package. The National Association of Counties reported this week that, “Treasury released

The National Association of Counties reported this week that, “Treasury released  Bills to apply immunity to county road agencies from liability for failure to maintain highways in their jurisdiction received a hearing in the House Transportation and Infrastructure Committee this week. The bills previously passed the Senate.

Bills to apply immunity to county road agencies from liability for failure to maintain highways in their jurisdiction received a hearing in the House Transportation and Infrastructure Committee this week. The bills previously passed the Senate. A resolution to oppose the designation of 65,000 acres of additional national wilderness areas in Michigan’s Upper Peninsula passed out of Senate Natural Resources Committee this week.

A resolution to oppose the designation of 65,000 acres of additional national wilderness areas in Michigan’s Upper Peninsula passed out of Senate Natural Resources Committee this week. A MAC-supported bill to allow county mental health transportation panels passed out of the House Health Policy Committee this week. The bill now awaits a vote on the House floor.

A MAC-supported bill to allow county mental health transportation panels passed out of the House Health Policy Committee this week. The bill now awaits a vote on the House floor. Bills to better protect victims in the criminal justice system passed out of the House this week and has been referred to the Senate Judiciary and Public Safety Committee.

Bills to better protect victims in the criminal justice system passed out of the House this week and has been referred to the Senate Judiciary and Public Safety Committee. A bill to create a standing order on the distribution of opioid treatment medication received a hearing in the Senate Health Policy and Human Services Committee the week of June 6. The bill previously passed the House.

A bill to create a standing order on the distribution of opioid treatment medication received a hearing in the Senate Health Policy and Human Services Committee the week of June 6. The bill previously passed the House. The association of counties in Pennsylvania has advised MAC that the U.S. Department of Justice has been visiting courthouses in the Keystone State to conduct assessments of Americans with Disabilities Act compliance.

The association of counties in Pennsylvania has advised MAC that the U.S. Department of Justice has been visiting courthouses in the Keystone State to conduct assessments of Americans with Disabilities Act compliance. MAC’s Lansing offices will be closed on Monday, June 20 to observe the federal Juneteenth holiday.

MAC’s Lansing offices will be closed on Monday, June 20 to observe the federal Juneteenth holiday.

Legislation that alters the Freedom of Information Act (FOIA) in ways detrimental to county government passed out of the House Oversight Committee this week. MAC needs your voice to urge the House to set aside this ill-advised package.

Legislation that alters the Freedom of Information Act (FOIA) in ways detrimental to county government passed out of the House Oversight Committee this week. MAC needs your voice to urge the House to set aside this ill-advised package. A MAC-supported bill to modernize state law on public notices passed out of House Oversight Committee this week. The legislation will save counties time and money and create more avenues for our citizens to receive public notices.

A MAC-supported bill to modernize state law on public notices passed out of House Oversight Committee this week. The legislation will save counties time and money and create more avenues for our citizens to receive public notices.  Changes to the financial liability guidelines for mental health services are on their way after Gov. Gretchen Whitmer recently signed reform legislation.

Changes to the financial liability guidelines for mental health services are on their way after Gov. Gretchen Whitmer recently signed reform legislation. Following the announcement by the Michigan Supreme Court that the judicial branch of Michigan would observe the Juneteenth holiday on June 20, 2022, MAC has received numerous inquiries from members about what that means for county government offices.

Following the announcement by the Michigan Supreme Court that the judicial branch of Michigan would observe the Juneteenth holiday on June 20, 2022, MAC has received numerous inquiries from members about what that means for county government offices. A legislative package to to improve Secondary Road Patrol (SRP) funding via the state liquor tax advanced out of the Senate Appropriations Committee this week.

A legislative package to to improve Secondary Road Patrol (SRP) funding via the state liquor tax advanced out of the Senate Appropriations Committee this week. Legislation supported by the Michigan County Medical Care Facilities Council (MCMCFC) to ease the regulatory burden of certifications, surveys and evaluations of nursing homes received a hearing in the Senate Health Policy and Human Services Committee this week. The bill previously passed the House.

Legislation supported by the Michigan County Medical Care Facilities Council (MCMCFC) to ease the regulatory burden of certifications, surveys and evaluations of nursing homes received a hearing in the Senate Health Policy and Human Services Committee this week. The bill previously passed the House. The next free webinar in the “Fiscally Ready Communities” series put on by the Michigan Department of Treasury and Michigan State University Extension will be held on June 14. The session is designed to assist appointed and elected officials and will focus on “Capital Asset Management and Planning.”

The next free webinar in the “Fiscally Ready Communities” series put on by the Michigan Department of Treasury and Michigan State University Extension will be held on June 14. The session is designed to assist appointed and elected officials and will focus on “Capital Asset Management and Planning.”

Counties are encouraged to review 2022 millage rates just released by the Michigan Treasury as part of the Personal Property Tax (PPT) reimbursement system.

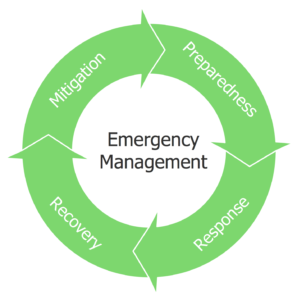

Counties are encouraged to review 2022 millage rates just released by the Michigan Treasury as part of the Personal Property Tax (PPT) reimbursement system. Is your community prepared to handle environmental emergencies such as fires, floods, oil spills, etc.? The Michigan Department of Environment, Great Lakes, and Energy (EGLE) is hosting the

Is your community prepared to handle environmental emergencies such as fires, floods, oil spills, etc.? The Michigan Department of Environment, Great Lakes, and Energy (EGLE) is hosting the