Give locals a ‘true sharing’ of revenue, MAC tells Senate panel

MAC and other local government groups explained the key to restoring the full meaning of state revenue sharing is creating a dedicated revenue stream and trust fund to exist outside the annual appropriations process to a Senate appropriations panel this week.

MAC and other local government groups explained the key to restoring the full meaning of state revenue sharing is creating a dedicated revenue stream and trust fund to exist outside the annual appropriations process to a Senate appropriations panel this week.

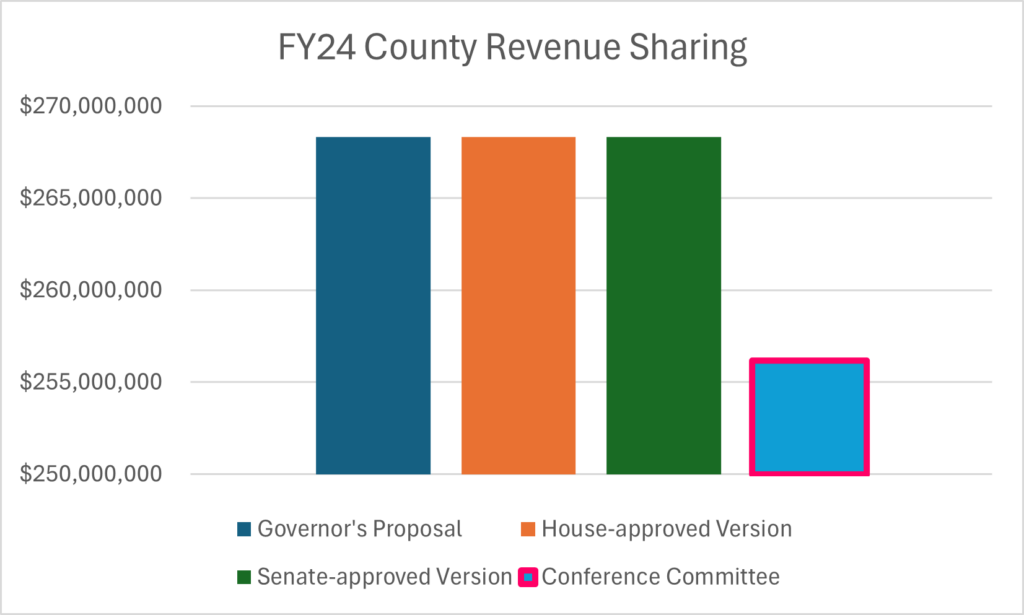

“Last year shows that the money that goes to revenue sharing for local units of government is just based on whatever money the state has available. It’s not really based on a true sharing of the state revenue,” said MAC Governmental Affairs Director Deena Bosworth. “When we got to conference committee, local units of government were devalued, and the money was pushed elsewhere.”

Bosworth was referring to this chart (see at right) in her presentation before the General Government Subcommittee that showed how, in FY24, lawmakers backed higher revenue sharing until the waning hours of the budget process. (View her testimony, starting at 33:14 mark.)

To avoid such situations, MAC and others developed a Revenue Sharing Trust Fund plan embodied in House Bill 4274, by Rep. Amos O’Neal (D-Saginaw), and HB 4275, by Rep. Mark Tisdel (R-Oakland). The bills would require that 8 percent of the revenue generated by 4 percentage points of the state’s sales tax rate go into the fund.

Counties would receive 46.14 percent of this total, which would be $273 million in the first year, an increase of nearly $16 million from the current total.

The bills cleared the House last fall with a huge, bipartisan majority.

“All of the things that counties do at the local level are mandated either in the (Michigan) Constitution or by statute,” Bosworth advised the committee in urging adoption of the fund. “There are very few things that counties governments do for their residents that they have the discretion to do. Most of them are mandated.”

This week’s hearing was informational, as the bills are before the Senate Finance Committee. MAC is aiming for Senate action on them once the Legislature returns to sessions on Tuesday, April 8.

To send a ready-made message of support for these bills, just visit MAC’s Advocacy Center.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Renewable energy industry gives its take on controversial siting law

Solar and wind developers shared a much different interpretation than locals on the new renewable energy siting law in the second in a series of public meetings hosted by the Michigan Public Service Commission (MPSC) this week.

Solar and wind developers shared a much different interpretation than locals on the new renewable energy siting law in the second in a series of public meetings hosted by the Michigan Public Service Commission (MPSC) this week.

MPSC staff heard from developers and their attorneys about their concerns for implementing Public Act 233, which takes effect this November. MAC vigorously opposed the legislation in 2023 that became PA 233.

The law references “each affected local unit of government” numerous times throughout, and while locals have interpreted that to mean the city, village or township, in addition to the county a project lies in, developers say it only applies to the local unit handling the zoning.

During the meeting, they argued that only the primary local unit should receive the $2,000 per megawatt payment and the maximum $75,000 in intervenor funds. A legal representative for the developers strongly cautioned the MPSC that while they may grant a local unit up to $75,000 to contest the MPSC over a permitting decision, they should allocate much less.

Local governments and planning experts spoke during the first session and shared different concerns.

The MPSC must now determine how to proceed through the rule-making process. It is likely these disputes will be elevated, and a court of law may ultimately have to decide how to interpret the legislation. Much of the language in the law was drafted without proper consultation from stakeholders.

The next session is set for April 5 and is open to the public, though the time has not yet been announced. In the meantime, the MPSC is seeking feedback from the public. It has shared a list of questions and have asked that responses be submitted by March 31:

- What guidance or information are local units of government and communities seeking from the MPSC about implementing the new siting law (Public Act 233)?

- What lessons learned, resources, or expertise do local units of government and communities have to share with the MPSC?

- What types of consultant specialties were needed and who are the consultants you worked with in your evaluation of past developer applications?

- How can the MPSC incorporate local considerations into the process when a developer files an application at the MPSC?

- How should the MPSC determine the amount of the 1-time grant (up to $75,000 per affected local government and not more than $150,000 in total) for local intervenor compensation?

Responses can be sent to lara-mpsc-commissioners2@michigan.gov or

Michigan Public Service Commission

Attn: Cathy Cole

PO Box 30221

Lansing, MI 48909

MAC encourages members to stay tuned for more information.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Could ‘perfect user fee’ dig Michigan out of $3 billion hole in county road resources?

Michigan has a nearly $3 billion a year funding gap to maintain its county road network, an expert in the field told MAC’s Podcast 83 in a new special episode.

Michigan has a nearly $3 billion a year funding gap to maintain its county road network, an expert in the field told MAC’s Podcast 83 in a new special episode.

“We’re short about $2.8 billion a year for county road agencies,” said Ed Noyola, chief deputy and legislative director for the County Road Association of Michigan. “So that is really a number that boggles the mind, and I’m sure it’s going to boggle the minds of our legislators and the governor’s office to include on top of what MDOT needs and what the cities and villages need.”

As daunting as the need is, finding a solution may be more of a challenge, Noyola warned.

“There is no way that the amount of money that we have is going to maintain (the roads) that we all have to maintain and make improvements to, period,” Noyola said.

“We’ve tried not to tell the Legislature what’s the best choice or how much they need to invest in the infrastructure. I don’t think we can play that anymore. I think we have to be direct and honest with them as to how much we need. They can decide whether they can meet that figure or not, but at least we have to tell them how much we need to increase it in the short term,” he explained.

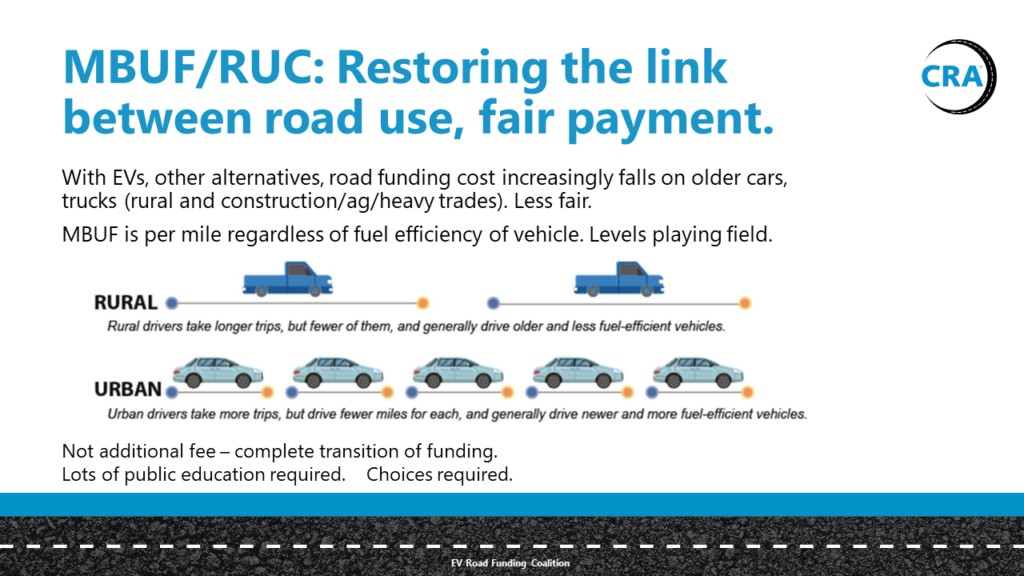

What is a “mileage-based user fee” and how would it work?

A promising new solution, Noyola says is the “mileage-based user fee.”

“It is a perfect user fee. If you drive 10,000 miles, you’re going to pay for 10,000 miles; if you drive 50,000 miles, you’re going to pay for 50,000 miles of road driving.”

Hear more about what the County Road Association thinks needs to be done ASAP on this issue by viewing the full session, recorded on March 5.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

Deadline approaching for 1% of revenue sharing payment

Deadline approaching for 1% of revenue sharing payment

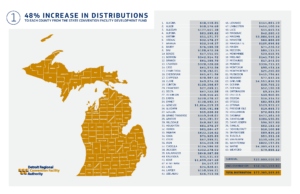

Counties are required, as part of the FY2024 budget, to certify that they have fully obligated or expended all their ARP funds by Dec. 31, 2023.

The Michigan Department of Treasury Form 6056 must be completed and submitted to Treasury by March 30.

As of 8 a.m. on March 18, 40 counties had yet to comply with the reporting to receive the additional 1 percent of their revenue sharing payments.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Report offers suggestions on spending opioid dollars

Recommendations on how counties could deploy their opioid settlement funds are included in a new report paid for by the Michigan Opioid Partnership.

Recommendations on how counties could deploy their opioid settlement funds are included in a new report paid for by the Michigan Opioid Partnership.

The partnership, a public-private collaborative including representatives from Michigan state government and key philanthropic organizations and the Center for Health and Research Transformation (CHRT) at the University of Michigan, worked to understand the needs and challenges of community-based recovery organizations in supporting recovery for individuals and families.

CHRT researched gaps and identified opportunities to address those gaps with relation to opioid settlement funding and to develop potential recommendations for state government and local governments. The report outlines areas for investment with opioid settlement funds in the areas of recovery and harm reduction, highlighting specific practices and pointing to Michigan-specific examples of these activities. Primary strategies presented in the report include recovery housing, peer support, recovery community organizations, engagement centers and jail services.

Read the full report here.

For additional information, contact Amy Dolinky at dolinky@micounties.org.

Interested in national policy? Apply for a NACo committee seat

A meeting of one of NACo’s many policy committees.

NACo members have the opportunity to serve on 31 committees, caucuses, task forces and advisory boards to inform national policy-making and help solve problems impacting counties, boroughs and parishes.

If you want to serve as a member of one of NACo’s 10 policy steering committees, you simply need to email MAC Executive Director Stephan Currie at scurrie@micounties.org. MAC is responsible for these appointments. You do not need to complete any forms. Just list your first and second choices for committees. It is NACo practice to reappoint all members each year, so if you currently serve on a committee as a regular member, you will be renewed automatically. Please note that you can only serve on one Policy Steering Committee.

Leadership (chair/vice chair): All chairs and vice chairs of all committees and subcommittees are appointed by the NACo president each spring, with appointments announced at the NACo Annual Conference in July. Appointments are made through an application process. The Presidential application portal for incoming President Supervisor Jame Gore is currently open through April 26, 2024. You can access the site to apply here. Detailed application instructions are outlined below. Please note that you can only serve on one Policy Steering Committee, so if you are appointed to leadership for a committee, you can’t serve as a member on another Policy Steering Committee. …

Forum will focus on mass shootings and local responses

A forum to brief county and other local leaders on resources to prevent and respond to mass shootings will be held on April 17 in Lansing.

A forum to brief county and other local leaders on resources to prevent and respond to mass shootings will be held on April 17 in Lansing.

“School Mass Shooting & Critical Incident Preparedness Forum: The Role of Local Leaders” which run from 9 a.m. to 1 p.m. at Crowne Plaza Lansing, 925 S. Creyts Rd.

“The MSU and Oxford Village shootings have taught us that a school shooting can happen anywhere at any time. We owe it to our children to be prepared. Give the importance of this issue, former Dayton, Ohio, Mayor Nan Whaley (who responded to a mass shooting in Dayton) and Lansing Mayor Andy Schor will be keynote speakers. They will be joined by subject matter experts who will brief us on crisis communications, victim services, law enforcement training needs, school safety and available resources for county and other local leaders,” explained event organizer Sarah Peck of the Public Health Advocacy Institute at Northeastern University’s School of Law.

Registration link: https://www.chds.us/in/registration/?event=3355

Contact Peck at s.peck@phai.org for questions.

Cycling infrastructure for rural areas is topic of MDOT class

Planning and designing approaches for cycling facilities in a “rural context” will be the focus of a three-hour webinar to be offered twice in April by the Michigan Department of Transportation. Each session will run from 1 p.m. to 4 p.m. Eastern.

Planning and designing approaches for cycling facilities in a “rural context” will be the focus of a three-hour webinar to be offered twice in April by the Michigan Department of Transportation. Each session will run from 1 p.m. to 4 p.m. Eastern.

Click here to register for the April 10 session.

Click here to register for the April 30 session.

The program will look deeper into the challenges and solutions for establishing safe and connected bicycle networks within and between rural communities. These concepts will be illustrated using national best practices, case studies and actual projects in rural communities.

This free course is for village, city, township and county managers, engineers, planners and officials.

RSVP by April 5 for the April 10 class or by April 26 for the April 30 class.

The class link will be provided by a separate email prior to the day of the class.

Staff picks

Staff picks

- Even $23B might not be enough to upgrade Midwest’s power lines (Governing)

- Wayne County signs off on contract to erase medical debt for up to 300K (Bridge Detroit)

- Opioid needs assessment to be administered by (Lake) County (Ludington Daily News)

- Spring is very early. That’s not good. (Vox.com)

Time-sensitive legislation to secure key trial court funding took its first step toward passage this week.

Time-sensitive legislation to secure key trial court funding took its first step toward passage this week. The MAC Board of Directors has voted to join the

The MAC Board of Directors has voted to join the  MAC encourages county leaders to support the coalition’s work in several ways:

MAC encourages county leaders to support the coalition’s work in several ways: Action could occur in coming weeks on a so-called “polluter pay” package that MAC opposes due to the burdens it would impose on county agencies.

Action could occur in coming weeks on a so-called “polluter pay” package that MAC opposes due to the burdens it would impose on county agencies. What should have been a simple extension on state authority for local courts to levy fees for their operations has turned into a complicated bout of legislative gamesmanship, the Podcast 83 team reported in

What should have been a simple extension on state authority for local courts to levy fees for their operations has turned into a complicated bout of legislative gamesmanship, the Podcast 83 team reported in  Legislation aimed at addressing staffing shortages in sheriff offices cleared the Michigan House this week in a broad, bipartisan vote.

Legislation aimed at addressing staffing shortages in sheriff offices cleared the Michigan House this week in a broad, bipartisan vote.

Two different packages of bills that create a state Revenue Sharing Trust Fund and direct the expenditures of such a fund have been introduced in the Legislature.

Two different packages of bills that create a state Revenue Sharing Trust Fund and direct the expenditures of such a fund have been introduced in the Legislature. Members of the Michigan Task Force on Juvenile Justice Reform testified before the Senate Committee on Civil Rights, Judiciary and Public Safety this week on the 32 recommendations

Members of the Michigan Task Force on Juvenile Justice Reform testified before the Senate Committee on Civil Rights, Judiciary and Public Safety this week on the 32 recommendations  On March 29, new state legal provisions kick in requiring counties to update their Materials Management Plans (MMP) and increase recycling rates in Michigan.

On March 29, new state legal provisions kick in requiring counties to update their Materials Management Plans (MMP) and increase recycling rates in Michigan. Major changes are looming for three significant areas of county responsibility, MAC’s Podcast 83 team said this week.

Major changes are looming for three significant areas of county responsibility, MAC’s Podcast 83 team said this week. The Michigan Opioid Advisory Commission released its

The Michigan Opioid Advisory Commission released its

Legislation to privatize control of local mental health services, opposed by MAC and others, was defeated last week after it came up in a surprise vote in the Senate.

Legislation to privatize control of local mental health services, opposed by MAC and others, was defeated last week after it came up in a surprise vote in the Senate. Changes to local reimbursements for property taxes exempted for disabled veterans appear dead for 2022. In a last-minute decision, the House took up Senate Bills

Changes to local reimbursements for property taxes exempted for disabled veterans appear dead for 2022. In a last-minute decision, the House took up Senate Bills  A bill to change the distribution structure of the County Veteran Service Fund gained broad approval from the Legislature this week and is headed to the governor.

A bill to change the distribution structure of the County Veteran Service Fund gained broad approval from the Legislature this week and is headed to the governor. A package of bills that will place new reporting and coordination burdens on counties was approved by the Legislature on the last day of the lame duck session. The legislation modifies Part 115 of the Natural Resources and Environmental Protection Act, which deals with solid waste management.

A package of bills that will place new reporting and coordination burdens on counties was approved by the Legislature on the last day of the lame duck session. The legislation modifies Part 115 of the Natural Resources and Environmental Protection Act, which deals with solid waste management. A bill to add circuit court judgeships in Allegan and Kalamazoo counties passed in the House this week, its final step before a signature by the governor.

A bill to add circuit court judgeships in Allegan and Kalamazoo counties passed in the House this week, its final step before a signature by the governor. A bill to alter how emergency orders can limit visits to patients in health care facilities gained final legislative approval this week.

A bill to alter how emergency orders can limit visits to patients in health care facilities gained final legislative approval this week.