This year would be a great time for Michigan to tackle reform of local government finance, says the nonpartisan Citizens Research Council of Michigan in a new study.

This year would be a great time for Michigan to tackle reform of local government finance, says the nonpartisan Citizens Research Council of Michigan in a new study.

The report, “It’s an Opportune Time to Tackle Local Government Finance Reform,” says, “During the upcoming Fiscal Year (FY)2025-26 budgetary debate about the amount of discretionary state revenues that will be shared with local governments, state policymakers should review the objectives of revenue sharing program, especially how its distribution formulas meet those objectives, in context of the state’s overall municipal finance system.”

This parallels MAC’s long efforts to reform county revenue sharing at the Capitol, funding that has lagged significantly against the effects of inflation in the 21st century.

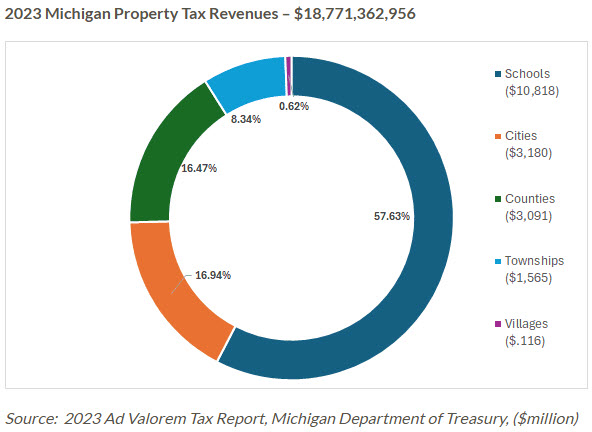

The report also states, “Michigan law restricts the taxes available to local governments to essentially the property tax. A city income tax and several minor taxes for counties are options, but not available to all local units. With the property assessment cap restricting growth in the property tax base, and the inability to levy non-property taxes, local governments have little option than to raise property tax rates or fees to sustain revenues over time.”

Finally, the authors recognize, “The fiscal stability of local governments is critical to Michigan’s economic well-being. Without alternative ways to raise revenues and lower their community’s property tax burden, local governments face significant challenges in maintaining their operations, offering the public services they are expected to provide and growing their local economies.”

For more information about MAC’s advocacy efforts in 2025, contact Director of Governmental Affairs Deena Bosworth at bosworth@micounties.org.