Extension for court fee authority heads to governor

Legislation to secure key trial court funding now awaits the governor’s signature after a vote in the Senate this week.

House Bill 5392, by Rep. Sarah Lightner (R-Jackson), extends a quickly approaching May 1, 2024, expiration (“sunset”) of the authority of trial courts to levy fees that constitute a key part of their operational funding.

HB 5392 was previously “tie-barred” to House Bill 5534, by Rep. Kelly Breen (D-Oakland), which outlines a plan for the State Court Administrative Office to conduct data collection on certain trial court costs and revenue sources and provide a report to the Legislature with proposals to implement the Trial Court Funding Commission’s recommendations from 2019. See more details in this MAC Issue Brief.

On Wednesday, the Senate broke the tie bar, meaning the bills no longer must advance together. With this amendment to the bills, they were sent back to the House for a concurrence vote. The House passed HB 5392 with broad support and HB 5534 failed along party lines. It is expected that the Democrats will regain majority in the House on Tuesday next week and will pass HB 5534 at that time.

With HB 5392 headed to the governor this week, MAC expects the sunset to be extended prior to its expiration on May 1.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

After hiatus, legislators accelerate FY25 budget work

Budget proceedings ramped up in the Legislature this week with a remarkable increase proposed for county revenue sharing.

Budget proceedings ramped up in the Legislature this week with a remarkable increase proposed for county revenue sharing.

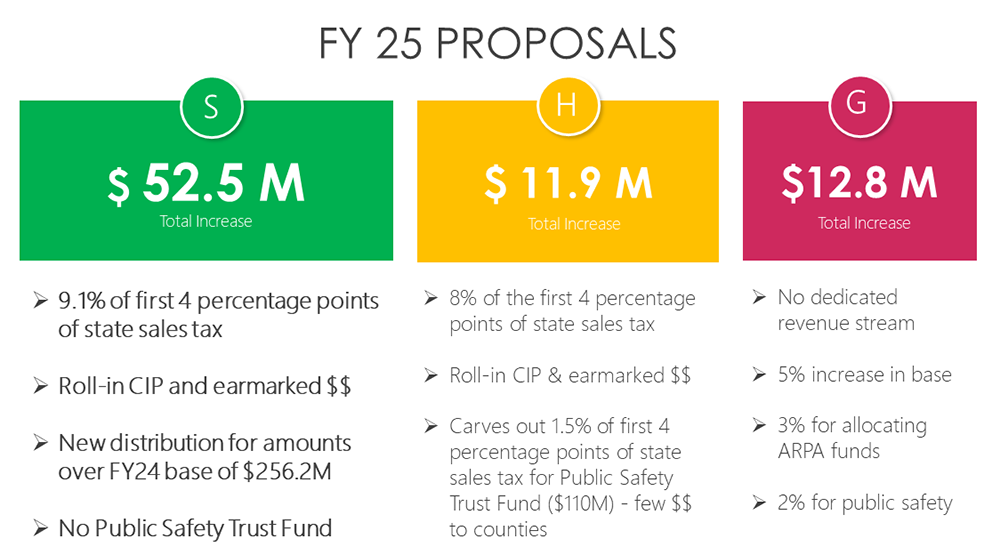

Both the House and Senate General Government subcommittees used the Revenue Sharing Trust Fund model proposed by MAC as guidance when making their recommendations. The Senate subcommittee was most generous by dedicating 9.1 percent of the first 4 percentage points of the state sales tax for local revenue sharing. This would mean a $52.5 million increase from last year. The House subcommittee recommended 8 percent of the first 4 percentage points of the state sales tax with an increase of $11.9 million.

The House’s proposal reflects the provisions outlined in House Bills 4274-75, which MAC has been advocating for since March 2023. The bills would establish the Revenue Sharing Trust Fund in statute and dedicate a portion of the state’s sales tax to locals, allowing for a true sharing in the state’s revenue. The bills passed the House in November 106-4.

The governor’s FY25 budget did not follow the trust fund model; it calls for a 5 percent increase in base funding and 3 percent for locals that hit ARPA funding allocation requirements.

More details on these proposals will be presented on Tuesday at MAC’s Legislative Conference in Lansing.

Courts

In other great news, funding panels in both chambers recommended more dollars for local prosecutors. These grants would serve to “bring staffing closer to optimal levels to reduce the average caseload per attorney.” The House General Government Subcommittee included $3 million, while the Senate subcommittee included $35 million. There is a caveat to the Senate funds, however: they would only go toward the 15 counties with the most violent crime.

Transportation

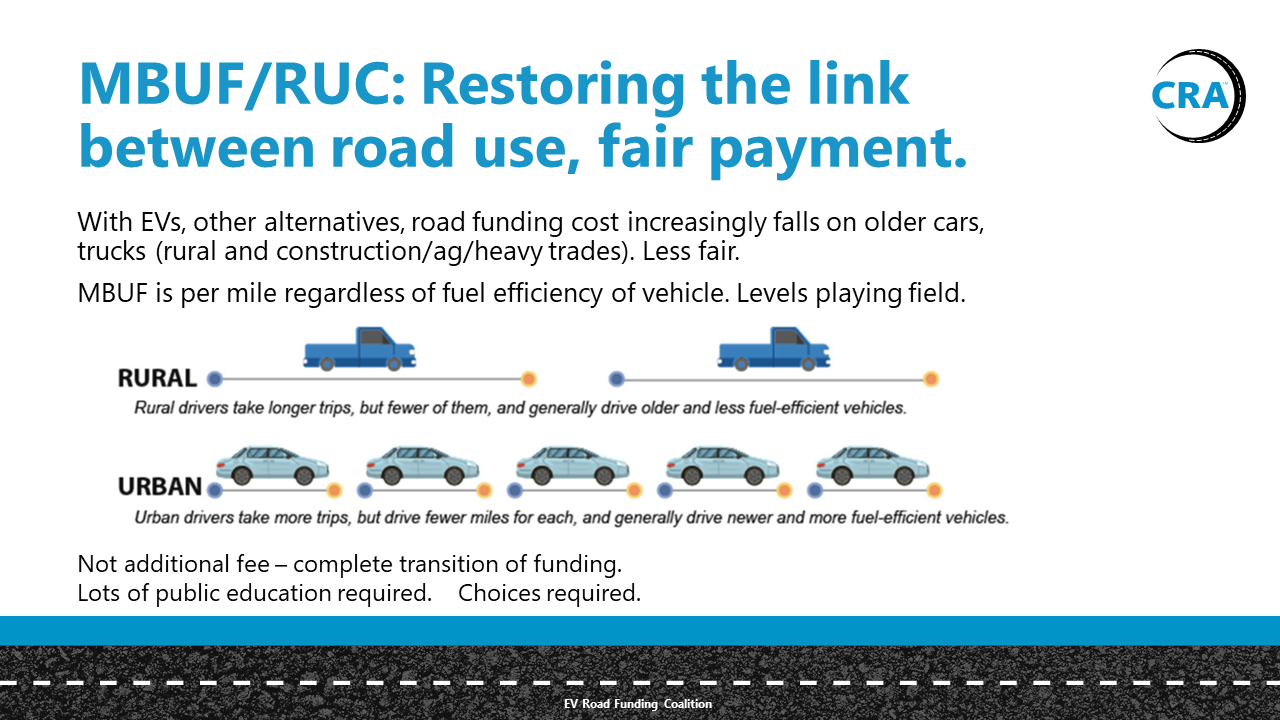

Both the House and Senate Transportation subcommittees expressed interest in a mileage-based user fee via a pilot project by allocating $5 million in their budget plans for FY25. The concept of a milage-based user fee is to charge people for the miles they drive rather than how much gas they consume.

While the specifics of the pilot project have not yet been solidified, participation will be voluntary, and participants will be reimbursed for what they pay in gas tax while the study is active. While Michigan is already billions of dollars short on road funding, electric vehicles and high-efficiency vehicles are exacerbating the issue by contributing much less to motor fuel tax revenue.

While the specifics of the pilot project have not yet been solidified, participation will be voluntary, and participants will be reimbursed for what they pay in gas tax while the study is active. While Michigan is already billions of dollars short on road funding, electric vehicles and high-efficiency vehicles are exacerbating the issue by contributing much less to motor fuel tax revenue.

Nineteen other states are administering similar pilots and at least one state has fully implemented a mandatory mileage-based user fee program. With both chambers in agreement, MAC anticipates the program will be included in the final version of the budget.

Environment

In departmental budgets on environmental programs, neither the House nor Senate included the governor’s proposed raise on the “trash tax.” Commonly referred to as landfill tipping fees, the governor sought to increase them more than 1,000 percent from 36 cents per ton to $5 per ton. The increase was meant to generate $80 million for environmental remediation and brownfield redevelopment. Following the governor’s initial recommendation, industry leaders voiced strong opposition and the Legislature has shown little indication it wants to pursue the increase.

Since neither chamber included the recommendation in their budgets it seems unlikely that it will be included in the final budget.

The next step in the budget process is for the chambers to pass their budgets on the floor. In mid-May, the second Consensus Revenue Estimating Conference of the year will be held to provide an update on the state’s revenue. The official budget targets will then be negotiated between the governor and the Legislature. Conference committees will then meet to agree on the final budget (this is where the House and Senate subcommittees come together to compromise on each chamber’s proposed budgets). The final budget must be presented to the governor before July 1 for her signature.

For more information on MAC’s budget advocacy, contact Deena Bosworth at bosworth@micounties.org.

MAC seeks fair treatment for counties on short-term rentals

MAC urged a House panel to treat counties fairly by amending a 10-bill package designed to restrict ― but not eliminate ― local governments’ power to regulate short term-rentals in testimony this week.

MAC urged a House panel to treat counties fairly by amending a 10-bill package designed to restrict ― but not eliminate ― local governments’ power to regulate short term-rentals in testimony this week.

Speaking before the House Local Government Committee meeting this week (start at 9:58 mark), Governmental Affairs Director Deena Bosworth focused on the failure in the original bill drafts to include counties in revenue to be derived from a 6 percent excise tax: “Let me be clear, MAC supports tourism and the promotion of all Michigan has to offer. However, counties and municipalities across the state are struggling with having enough resources to invest in our facilities, infrastructure and emergency response personnel.

“We want our residents to enjoy the resources and services they pay for,” she added, “and we want them to have access to public safety and emergency response personnel even when there is a large influx of tourists demanding services.”

The primary bill in the package is HB 5438, by Rep. Joey Andrews (D-Berrien), which would require short-term rentals to be registered with the state; carry $1 million in liability insurance; have carbon monoxide detectors, smoke detectors and fire extinguishers; and have an emergency contact for renters within 30 miles of the rental. The bill would not allow a local government to ban short-term rentals but would allow communities to restrict their number.

Bosworth summarized MAC’s views in four points:

- All counties across the state would like to have access to funds for economic development;

- Counties across the state play a critical role in the planning and zoning of communities;

- Counties across the state have significant infrastructure responsibilities; and

- Counties across the state play a critical role in providing services to residents and tourists alike.

House Bills 5437-5446 did not receive a vote in committee this week.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

House adopts resolution on County Government Month

“Have you ever needed to call 911 for an emergency? interfaced with our courts enjoyed a county park? How about eaten with your family at a local restaurant and enjoyed your meal without getting ill …” said Rep. Julie Rogers (D-Kalamazoo) in remarks in support of a House resolution naming April as County Government Month in Michigan.

MAC thanks Rogers, a former commissioner and MAC Board director, for advancing the resolution. Click here for a video of her full remarks.

Learn about advantages of digital payment systems

Join NACo on April 30 for the webinar “Modernizing County Finance with Digital Disbursements” to discover how incorporating digital payments can increase constituents’ satisfaction and improve government efficiency. In this session, representatives from Knox County, Ill., the National Association of Counties (NACo) and Visa will share how they delivered fast and secure payments to county election judges and jurors.

Join NACo on April 30 for the webinar “Modernizing County Finance with Digital Disbursements” to discover how incorporating digital payments can increase constituents’ satisfaction and improve government efficiency. In this session, representatives from Knox County, Ill., the National Association of Counties (NACo) and Visa will share how they delivered fast and secure payments to county election judges and jurors.

To register for the session, which runs from 2 p.m. to 3 p.m. Eastern, click here.

You will learn:

- The importance of cross-sector partnerships for driving digital transformation.

- The benefits of transitioning to digital payment systems.

- The unique challenges and solutions for implementing a digital payment system involving the public sector.

- The role of stakeholder involvement and effective communication in successful digital payments projects.

NACo webinar to review legal requirements for online materials

On April 8, the U.S. Department of Justice (DOJ) announced the release of a final rule which seeks implementation of Title II of the Americans with Disabilities Act (ADA) on web-based government services provided by state and local governments.

On April 8, the U.S. Department of Justice (DOJ) announced the release of a final rule which seeks implementation of Title II of the Americans with Disabilities Act (ADA) on web-based government services provided by state and local governments.

The final rule lays out the details for web accessibility requirements and compliance, and standards will adhere to the Web Content Accessibility Guidelines (WCAG) 2.1 Standard, Level AA. The WCAG is a set of guidelines that outlines the parameters around web accessibility, and is developed by the World Wide Web Consortium.

Like the proposed rule released last August, the final rule includes exceptions for the following categories of web content:

- Archived web content

- Preexisting conventional electronic documents

- Web content posted by third parties on a county’s website

- Third-party web content linked from a county’s website

- Course content for specific students in public postsecondary institutions

- Class or course content for specific students in public elementary or secondary schools

- Conventional electronic documents related to specific individuals, their property, or their accounts, and are password-protected or secured

If a county’s web content falls under these exceptions without limitations, they do not need to conform to the WCAG 2.1 Level AA standard. However, if a limitation applies, compliance with the proposed rule’s accessibility requirements becomes necessary.

Counties with a total population of 50,000 or more need to comply within two years of the final rule’s publication. Counties with a total population of less than 50,000 need to comply within three years of publication.

The rule also creates a provision which states that compliance with WCAG 2.1 Level AA is not mandated if it results in undue financial and administrative burdens or fundamentally alters the services, programs, or activities of the county.

The final rule projects a cost of up to $1 billion in total to counties, which may prove onerous for under-resourced counties. The cost figure for compliance accounts for initial rule familiarization, necessary remediation, and ongoing compliance with the accessibility requirements going forward.

To help counties familiarize with the rule and to answer questions, NACo will host an informational webinar on the final rule on May 6, 2024, from 2: p.m. to 3 p.m. Eastern. NACo members can register for the webinar here.

May 2 webinar will focus on infrastructure requirements, resources

County leaders are advised to participate in the newest edition of a webinar series co-sponsored by MAC. The May 2 edition of “Updates and Resources for Local Governments” will focus on infrastructure requirements and resources available to local governments.

County leaders are advised to participate in the newest edition of a webinar series co-sponsored by MAC. The May 2 edition of “Updates and Resources for Local Governments” will focus on infrastructure requirements and resources available to local governments.

To register for the session, which will run from 2 p.m. to 3 p.m. Eastern, click here.

The Updates and Resources for Local Governments webinar series is designed to provide local governments with the information, tools, and resources necessary to make important decisions at the local level.

Specific topics to be covered will include:

- Lead Service Line Replacement

- Infrastructure Financing – State Revolving Funds

- Michigan Infrastructure Council – Asset Management Champions Program

- Michigan Infrastructure Office Technical Support

- State and Local Cybersecurity Grant Program (SLCGP)

Presentations and recordings from this webinar, along with previous webinars, can be found at TREASURY – BLGSS Learning Center. Utilize TREASURY – Contact Information for support related to Treasury’s local government services.

Staff picks

Staff picks

- Limited access to health care contributes to higher rural death rates (Capital News Service)

- U.S. Supreme Court ruling may increase counties’ legal liability when transferring employees (NACo News)

- Keeping food scraps out of landfills is a bigger problem than you think (Governing)

- Up North ‘nature megaphone’ amplifies sweet sounds of the forest (MLive)