Liability concerns for counties raised in sexual conduct package

Legislation to alter the statute of limitations on criminal sexual conduct and sexual misconduct — and which could lead to broad, unintended consequences for counties — was reviewed this week by the House Committee on Criminal Justice.

Legislation to alter the statute of limitations on criminal sexual conduct and sexual misconduct — and which could lead to broad, unintended consequences for counties — was reviewed this week by the House Committee on Criminal Justice.

House Bills 4482–4487 affect private employers, state government, local governments and educational institutions. HB 4486, by Rep. Karen Whitsett (D-Wayne), in particular, raises concerns, which is why MAC is opposing it.

HB 4486 holds government employers to a higher standard than that expected of private employers. The bill states an agency is liable and is not granted immunity if it “knew or should have known that the individual who committed the criminal sexual conduct had committed a prior act of criminal sexual conduct, and the governmental agency failed to act or intervene to prevent the subsequent criminal sexual conduct.”

Under HB 4486, county boards of commissioners would be held liable for the hiring decisions of other countywide elected officials, despite having no direct involvement in these hiring decisions. MAC also has concerns with the retroactive application of the potential statute of limitations and the vague, unintended consequences of HB 4486 that hold governmental agencies liable and to a higher standard than the private sector.

While there is need for reforms, MAC is working to create policy that focuses on prevention, intervention and appropriate accountability, with limited unintended consequences for the Michigan taxpayer.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Counties need voice on justice commission, MAC tells Legislature

As a funding unit and key administrative piece of local criminal justice, counties should have representation on a state commission to study criminal justice reform, a MAC staffer told a Senate committee this week.

As a funding unit and key administrative piece of local criminal justice, counties should have representation on a state commission to study criminal justice reform, a MAC staffer told a Senate committee this week.

Both the House and Senate held hearings on House Bills 4173 and 4384, by Reps. Abraham Aiyash (D-Wayne) and Luke Meerman (R-Ottawa) respectively, and Senate Bills 376 and 377, by Sens. Stephanie Chang (D-Wayne) and Ed McBroom (R-Dickinson) respectively.

The packages are identical, with the intent to create a Criminal Justice Policy Commission and detail who will serve on it. Under the original version of HB 4173, MAC was to submit a list of three names and one of the submitted names would be selected by the governor to serve on the commission. MAC had a member on the previous commission that operated from 2015 to 2019.

However, the current version of HB 4173, and the Senate package, do not include a MAC representative on the commission. Therefore, MAC is opposing HB 4173 and SB 376.

Given a county’s role as the funding unit, and its fiduciary responsibilities to jails, sheriff’s offices and prosecutor’s offices, it is imperative that counties have a voice, MAC Governmental Affairs Associate Samantha Gibson testified on Thursday.

In SB 377 and HB 4384, the commission would be tasked with submitting a prison and jail impact report relating to any modifications to sentencing guidelines, including any impact on state and local correctional facilities. There are also indirect costs associated with the bills, depending on decisions made by the commission. Costs could increase or decrease, depending on changes made to sentencing guidelines. The potential for financial burdens imposed by the state onto county jails is of great concern to MAC. A county voice is crucial on the commission.

The House panel advanced its version of the bills, while the Senate committee only took testimony.

MAC will continue to press for county representation.

For more information on this issue, please contact Samantha Gibson at gibson@micounties.org.

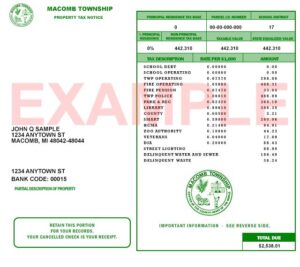

MAC seeks reimbursement in plan to expand veterans property tax exemption

Legislation to expand and streamline the state’s veterans property tax exemption were reviewed this week by the Senate Committee on Finance, Insurance and Consumer Protection.

Legislation to expand and streamline the state’s veterans property tax exemption were reviewed this week by the Senate Committee on Finance, Insurance and Consumer Protection.

Senate Bill 176, by Sen. Sylvia Santana (D-Wayne), SB 330, by Sen. Mary Cavanaugh (D-Wayne), and SB 364, by Sen. John Damoose (R-Emmet), are designed to grant the disabled veterans property tax exemption to surviving spouses, allow for a “one and done” application process for the exemption and provide for an audit process to determine continued eligibility and allow the local board of review, for 2023 only, to correct, upon appeal, the denial of an exemption based on “qualified errors.”

MAC has not yet taken a position on the bills but is working with the bills’ sponsors to include amendments to require the state to reimburse locals for their losses associated with the mandated exemptions.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC-backed water management bills get hearing

Bills designed to allow for water management districts and for the assessment of costs across watersheds in Michigan were discussed this week at a meeting of the House Committee on Local Government.

Bills designed to allow for water management districts and for the assessment of costs across watersheds in Michigan were discussed this week at a meeting of the House Committee on Local Government.

House Bills 4382-83, by Reps. Curt VanderWall (R-Mason) and Christine Morse (D-Kalamazoo) respectively, rewrite Chapter 22 of the Michigan Drain Code to allow local governments and residents to petition the drain commissioner for the establishment of the districts and, if found necessary, to create a plan to manage stormwater within the district in ways not currently allowed.

The plan would be unique to each district and could include actionable items like regional detention, buffer strips and the creation of wetlands, rain gardens and the like. The intent is to slow down and detain water during major storm events, instead of allowing it to flood roads, fields, businesses and homes on its way to a drain. The plan must include an estimate of the cost of each recommended activity.

The bills also require a public comment period and meeting to get feedback from residents and businesses. The local representation on the board would then vote on the plan and could choose one, multiple or none of the recommended activities. If the board votes to continue with implementation of the plan, bids would be taken for the work and assessments would be made based on benefits derived from the projects, just as it currently is for the drain code. This includes the Michigan Department of Transportation for benefits to state highways; counties for benefits to county roads; cities, villages and townships for benefit to roads and public health; and property owners based on their contribution. Impervious properties would be assessed at higher rates than agricultural land.

Proponents of the bills explained the stress on the aging infrastructure designed to drain the land for roads, developments and public health, stating the current infrastructure was primarily designed to handle stormwater in the early 1900s and cannot keep up with the intensity and frequency of major storm events in the 21st century.

Under the bills, water management districts would be allowed not mandated; locals would decide if they wanted to utilize these tools.

MAC and the Michigan Association of County Drain Commissioners support the legislation.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Early voting legislation discussed; funding not yet resolved

Legislation has been introduced to implement Proposal 2 of 2022, effectively overhauling Michigan’s election system. Last November, 60 percent of Michigan voters approved a new constitutional amendment to allow for nine days of early voting, among other provisions. Senate Bills 367-374 and House Bills 4695-4702 will codify Proposal 2 into law.

Legislation has been introduced to implement Proposal 2 of 2022, effectively overhauling Michigan’s election system. Last November, 60 percent of Michigan voters approved a new constitutional amendment to allow for nine days of early voting, among other provisions. Senate Bills 367-374 and House Bills 4695-4702 will codify Proposal 2 into law.

The Senate package, led by Sen. Jeremy Moss (D-Oakland), was brought before the Senate Elections and Ethics Committee on Wednesday, while Rep. Penelope Tsernoglou (D-Ingham) led the charge in the House Elections Committee on Thursday. Representatives from Promote the Vote, the Michigan Association of Municipal Clerks, the Michigan Association of County Clerks and the Secretary of State’s Office took turns commenting on each of the eight bills as the lead stakeholders. Aside from early voting, the package includes measures for being added to the permanent absent voter list, prepaid postage for absent voter ballots, expanding access to ballot drop boxes, and increasing precinct sizes.

Counties will be most directly affected by the early voting component and the cost of administering elections for additional days. Under SB 367, municipal clerks will have the option to jointly conduct elections with other municipalities or with their county clerk. Some clerks may find that pooling staff and other resources is beneficial given the new circumstances.

Unfortunately, the topic of funding was largely avoided by committee members and stakeholders. Chair Moss briefly noted budget negotiations are currently ongoing. In January, Secretary of State Joselyn Benson estimated the new constitutional amendment would cost locals between $30 million and $50 million annually. The final version of the state’s FY24 budget is expected to be approved later this month and will likely include some, if not all, of the funding necessary to implement these changes.

MAC has not taken a formal position on this legislation but will report on the funding allocation once it is finalized.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

MAC, NACo oppose amendment to federal broadband law

An amendment to preempt local control over telecommunication infrastructure projects has passed the U.S. House Committee on Energy and Commerce and will be presented to Congress for approval. The amendment is to the American Broadband Deployment Act of 2023, also known as H.R. 3557, and provisions include:

An amendment to preempt local control over telecommunication infrastructure projects has passed the U.S. House Committee on Energy and Commerce and will be presented to Congress for approval. The amendment is to the American Broadband Deployment Act of 2023, also known as H.R. 3557, and provisions include:

- Preemption of state and local zoning authority over the placement of wireless technologies, including towers, equipment, and small cells

- Elimination of state and local government authority to manage public rights-of-way (ROW) by collecting fair market compensation for their use and management, and limiting ROW fees to “actual, objectively reasonable costs”

- Enactment of shot clock rules and “deemed granted” provisions which place timelines for the review and approval of telecommunications projects

- Prohibition of state and local governments from revoking cable franchises.

Counties own much of the infrastructure necessary to build or expand telecommunication networks, including pole attachments and rights-of-way, and should be closely involved in the permitting and construction process. As the federal government prepares to distribute $42.45 billion to expand broadband through the BEAD program, with Michigan slated to receive roughly $1.6 billion, this legislation will damage the ability for local governments to serve as partners in the deployment process.

Furthermore, by enforcing a “shot clock” on the permitting process, counties will be unable to properly assess each application and the impact these projects will have on their communities.

The National Association of Counties (NACo) hosted a webinar late last week encouraging county officials to contact their federal legislators opposing this amendment.

Please utilize MAC’s Advocacy Center to send a prepared email of opposition to your member of Congress.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Podcast 83 dives into Michigan water issues in special episode

How Michigan’s local governments can mitigate the damage of flooding is the topic of a special episode of MAC’s Podcast 83.

How Michigan’s local governments can mitigate the damage of flooding is the topic of a special episode of MAC’s Podcast 83.

Stacy Hissong, partner at Fahey Schultz and legal adviser to the Michigan Association of County Drain Commissioners, is the featured guest on the episode, which is hosted by Deena Bosworth, MAC’s governmental affairs director.

The pair discuss:

- Excess flooding and how local governments can deal with it with tools they have now

- Legislation in Lansing to create more tools to aid residents in avoiding damage

- The history of how Michigan has dealt with groundwater and why the state has challenges now

View the full video of the episode, recorded on May 30, by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

Counties have until June 15 to file for pension grants

Applications for the Protecting MI Pension Grant Program must be submitted no later than June 15, 2023, using the electronic submission system (Michigan eSignature Solution), the state Department of Treasury advised.

Applications for the Protecting MI Pension Grant Program must be submitted no later than June 15, 2023, using the electronic submission system (Michigan eSignature Solution), the state Department of Treasury advised.

Qualified units are strongly encouraged to ensure the accuracy and completeness of of the application packet prior to submission. For detailed information regarding the Protecting MI Pension Grant application process or the Michigan eSignature Solution, please visit the Protecting MI Pension Grant Application website at www.michigan.gov/MIPensionGrant. On this page you can also access application forms, instructions, checklists, a sample governing body resolution, and frequently asked questions related to this grant application process.

As a reminder, in addition to the application submitted online through Michigan’s eSignature Solution, the following supporting documentation is required to be attached prior to submission.

- Protecting MI Pension Grant Affidavit (Form 5887): Must be signed by Chief Administrative Officer and Notarized.

- Copy of approved local government governing body resolution authorizing the chief administrative officer to file a claim for a grant payment for the Protecting MI Pension Grant Program.

- Copy of actuarial valuation(s) utilized in audited financial statements used to complete the most recent Form 5572 submitted as of 12/31/2021 for all qualified retirement systems that are requesting grant awards.

- Most recent actuarial valuation as of 12/31/2022 for all qualified retirement systems that are requesting grant awards.

- Copy of court ordered judgement levying a millage to cover local government pension costs (only required if applicable)

Additional information related to FAQs, program guidelines, and application materials are available at www.Michigan.gov/MIPensionGrant . Please be sure to sign up for Treasury – Local Government email alerts to be notified of additional updates to this grant program and other local government notifications.

The Michigan Department of Treasury (Treasury) reminds municipalities that, although not required, they can review and correct errors in Treasury’s calculation of each municipality’s millage rate eligible for the 2023 Personal Property Tax (PPT) reimbursement (MCL 123.1345(x)(ii)(B) and MCL 123.1353(5)).

Time to review millage rate calculations

The Local Community Stabilization Authority (LCSA) Act requires Treasury to make the eligible millage rate calculations available by May 1. The eligible millage rate calculations can be found on Treasury’s 2023 PPT Reimbursements website under the “Millage Rate Comparison Reports” heading. These 2023 Millage Rate Comparison Reports are intended to be used by municipalities to verify the accuracy of the eligible millage rates to be used in their 2023 PPT reimbursement calculations.

The Local Community Stabilization Authority (LCSA) Act requires Treasury to make the eligible millage rate calculations available by May 1. The eligible millage rate calculations can be found on Treasury’s 2023 PPT Reimbursements website under the “Millage Rate Comparison Reports” heading. These 2023 Millage Rate Comparison Reports are intended to be used by municipalities to verify the accuracy of the eligible millage rates to be used in their 2023 PPT reimbursement calculations.

How to review the 2023 Millage Rate Comparison Reports:

- Verify individual millage rate(s) levied in 2022

- Municipalities should compare the individual millage rate(s) levied in 2022 on the 2023 Millage Rate Comparison Reports with the millage rates reported on their 2022 Form 614 – Tax Rate Request (L-4029).

- Each millage rate reported on the 2022 Form 614 should be listed on the 2023 Millage Rate Comparison Reports (excluding special assessments).

- Verify calculated millage rate used in the computation

- The calculated millage rates to be used in the 2023 PPT reimbursement calculations should equal the lesser of the eligible millage cap and the 2022 millage rate.

- The Millage Rate Calculation tab of the Excel workbook provides information about how each eligible millage rate is calculated.

- NOTE: Calculated eligible millage rates may be prorated and thus may not reflect the actual millage rates levied by the municipality.

When NO millage rate errors are identified:

If a municipality does not identify an error in the 2023 Millage Rate Comparison Reports, the municipality does not need to file a form or take any further action to notify Treasury.

When errors ARE identified:

If a municipality does identify an error in the 2023 Millage Rate Comparison Reports, the municipality will need to complete the Form 5613 – Millage Rate Correction for the 2023 Personal Property Tax Reimbursement Calculations to notify Treasury of the error(s). In addition to the correction form, municipalities must provide substantiating documentation to support the millage correction.

The reporting forms related to the 2023 Millage Rate Comparison Reports (along with the associated deadlines) are available on Treasury’s Forms for Calculation of PPT Reimbursements website.

- Form 5608 – Portion of 2022 Essential Services Millage Rate Dedicated for the Cost of Essential Services

- Optional form to be used by counties, cities, villages, townships, and local authorities that levy an extra-voted millage rate that partially funds the cost of essential services (for example a Fire/Cemetery millage).

- NOTE: For extra-voted millage rates with a name that implies the millage was partially dedicated for the cost of essential services, Treasury has identified the millage type as “PARTIAL ESSENTIAL SERVICE” on the 2023 Millage Rate Comparison Reports.

- DUE DATE: Aug. 1, 2023

- Form 5613 – Millage Rate Correction for the 2023 Personal Property Tax Reimbursement Calculations

- Optional form to be used by municipalities that identify an error in the 2023 Millage Rate Comparison Reports.

- DUE DATE: Aug. 1, 2023

The corrections reported on Form 5613 and the essential services percentage reported on Form 5608 will be used in the calculation of the 2023 PPT reimbursements.

Form 5613 and Form 5608 submissions will not be accepted after Aug. 1, 2023.

Please direct any questions regarding the PPT reimbursement calculation or correction process to TreasORTAPPT@michigan.gov or 517-335-7484.

Additional information is available at www.michigan.gov/pptreimbursement.

State seeks infrastructure ‘champions’ for classes

The Michigan Infrastructure Council (MIC), Water Asset Management Council (WAMC), and Transportation Asset Management Council (TAMC) have been focusing efforts on creating a statewide culture of asset management through several initiatives. One of the MIC’s initiatives is the Champions training program, which will have a new class starting in August.

The Michigan Infrastructure Council (MIC), Water Asset Management Council (WAMC), and Transportation Asset Management Council (TAMC) have been focusing efforts on creating a statewide culture of asset management through several initiatives. One of the MIC’s initiatives is the Champions training program, which will have a new class starting in August.

The new class begins Aug. 1 and runs through Nov. 1, 2023.

To learn more about the program and apply, click here. The deadline to apply for this free training is July 26, 2023.

Since 2021, the MIC has trained more than 300 professionals from various backgrounds (engineering, finance, planning, elected officials) in key subject areas such as risk management, knowledge management, and strategic decision-making as they apply to infrastructure assets. Based on positive feedback and a growing list of graduate referrals, the MIC has committed to offering a second cohort of AM Champions in 2023.

For more information, contact Nathan Hamilton of the MIC at hamiltonn4@michigan.gov.

Staff picks

Staff picks

- FEMA requests feedback from counties on the BRIC Non-Financial Direct Technical Assistance Program (NACo News)

- Michigan counties provide services to human trafficking survivors (NACo News)

- Great Lakes Way Economic Impact Report (Community Foundation of Southeast Michigan)

- Boosting civics education in Indiana for democracy’s sake (Governing)