MAC makes case on trust fund to Senate committee

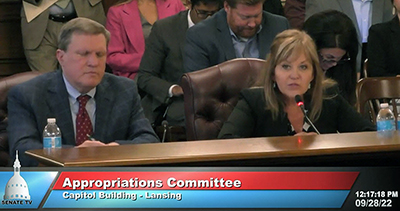

MAC’s Deena Bosworth testifies in support of revenue sharing legislation as sponsor Sen. Wayne Schmidt looks on during a Sept. 28 hearing at the State Capitol.

Legislation to earmark and increase county revenue sharing for the future was the topic of a hearing in the Senate Appropriations Committee this week.

Senate Bills 1160 and 1161, by Sen. Wayne Schmidt (R-Grand Traverse) and strongly supported by MAC, would establish a Revenue Sharing Trust Fund and fund it with a carveout from the state’s sales tax. The money deposited into the fund would stay in the fund for distribution to counties, cities, villages and townships and not lapse to the state’s General Fund at the end of the fiscal year.

The money in the fund would be split, with 50 percent going to county revenue sharing and 50 percent going to cities, villages and townships and could potentially increase county revenue sharing the first year by more than 40 percent.

Distribution to each county would be in the same proportion each was eligible to receive in the FY23 budget, except Emmet County, the last county to return to revenue sharing, would be treated as if they were receiving a full-year allocation going forward. Distribution to each city, village and township would be in the same proportion each was eligible to receive in the FY23 budget.

The legislation’s method of carving out a percentage of the sales tax for the fund is what revenue sharing was originally designed to do — share in the state’s revenue. If sales tax goes up, local allocations go up, if sales tax revenue falls, so do allocations, just like it does for Constitutional Revenue Sharing for cities, villages and townships.

MAC will continue to advocate for the movement and passage of SBs 1160-61 during the lame duck session this year, but county involvement in the advocacy is essential. MAC would like to thank those counties that have already begun the advocacy campaign with phone calls to senators, letters submitted to committee members and testimony provided at the hearing.

Expect to see an email from MAC next week about how to contact your senator in support of this legislation.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Senate approves extension for trial court funding

Michigan trial courts would continue to have the authority to impose fees, a critical funding element, until May 1, 2024, under House Bill 5956, a MAC-backed bill approved in the Senate on Wednesday.

Michigan trial courts would continue to have the authority to impose fees, a critical funding element, until May 1, 2024, under House Bill 5956, a MAC-backed bill approved in the Senate on Wednesday.

The bill now heads to Gov. Gretchen Whitmer and must be signed prior to Oct. 1 to avoid a disruption in fee authority.

HB 5956, by Rep. Sarah Lightner (R-Jackson), was designed to address the crisis caused by the looming expiration of fee authority on Oct. 1. Courts have long relied on fees to help fund operations. In 2014, the Michigan Supreme Court said, however, that courts could levy only fees specifically designated by the Legislature. MAC led a coalition to enact a legislative fix that was adopted in the fall. That legislation, to place “reasonably related” costs, has been extended twice already.

MAC thanks members who have reached out to their legislators, either directly or via MAC’s digital advocacy tool, in support of court funding.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Deal struck on ‘Zillow’ bill; MAC lends support

Legislation to require release of certain property tax records is now headed to the governor after an intense round of hearings and negotiations led to major revisions and an eventual compromise approved by MAC and other local government stakeholders.

Legislation to require release of certain property tax records is now headed to the governor after an intense round of hearings and negotiations led to major revisions and an eventual compromise approved by MAC and other local government stakeholders.

House Bill 4730, by Rep. Julie Calley (R–Ionia), passed the Senate unanimously on Wednesday. Commonly known as the “Zillow Bill,” HB 4730 was motivated by the online real estate giant wanting to share specific property tax information on their website. The initial draft of this legislation, however, required county treasurers to provide the public with a “qualified data file” upon request. Treasurers objected to this mandate due to the burden it would place on them, and MAC joined the treasurers in opposition to its original form.

Following an intense hearing in the House Commerce and Tourism Committee, amendments were agreed upon and stakeholders made concessions. The new language states a county treasurer must only provide pertinent information if they have it; they are no longer required to provide any information that is not routinely maintained. After these changes were made, county treasurers got on board and MAC submitted a card of support in the Senate Economic and Small Business Development Committee last week. The governor is expected to sign the bill.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Huge elections packages advance as MAC remains neutral

Two separate bill packages relating to consolidating the state’s election calendar passed the Senate Elections Committee on Wednesday, with MAC taking a neutral position.

Two separate bill packages relating to consolidating the state’s election calendar passed the Senate Elections Committee on Wednesday, with MAC taking a neutral position.

House Bills 4530-33 and Senate Bills 130-133 would change election dates in Michigan by eliminating the May election and pushing the traditional August primary election back to June. The intent is to provide clerks adequate time between the primary and general elections. Additionally, this measure would save counties money by having to conduct fewer elections.

It is typical for less than 15 percent of voters to show up to the polls for the May election, and school millages are traditionally the only item on most ballots. This election is a drain on county resources for such minimal turnout, but the school millage element poses a problem. School groups, including the Michigan Association of School Boards, fear that without the May election their millages are less likely to succeed. An amendment to SB 130 by Sen. Curt VanderWall (R-Mason) would introduce a third election in presidential election years only, on the second Tuesday in March. This compromise was not enough for many school groups, however, who ultimately opposed the legislation.

MAC remains neutral on the issue for several reasons. While the financial benefit of eliminating the May election is clear, as is reducing stress on our poll workers and county clerks, counties cannot ignore the situation this puts school boards in. MAC will continue to monitor the legislation should it advance this fall.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Senate approves county mental health transportation panels

County boards of commissioners would have the authority to establish a county mental health transportation panel under House Bill 4414, by Rep. Beau LaFave (R-Dickinson), which was approved by the Senate on Wednesday.

County boards of commissioners would have the authority to establish a county mental health transportation panel under House Bill 4414, by Rep. Beau LaFave (R-Dickinson), which was approved by the Senate on Wednesday.

MAC has backed HB 4414, which complements Senate Bill 101, by Sen. Ed McBroom (R-Dickinson), now PA 146 of 2022.

HB 4414 now awaits Gov. Gretchen Whitmer’s signature.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Visit Treasury portal on public land payments

Michigan counties with public lands are advised to visit a U.S. Treasury Department application portal on the Local Assistance and Tribal Consistency Fund (LATCF).

Michigan counties with public lands are advised to visit a U.S. Treasury Department application portal on the Local Assistance and Tribal Consistency Fund (LATCF).

The portal launched at 3 p.m. (Eastern) on Thursday. Click here to access it.

Treasury informed NACo that the formula focuses predominantly on federal acreage within each unit of local government, as defined by PILT and the Refuge Revenue Sharing program under the U.S. Fish and Wildlife Service. Population and various economic conditions (poverty levels, unemployment, etc.) also factor into the formula. The payments will for the most part look like “scaled PILT allocations,” according to Treasury.

Michigan LATCF Eligible Payments

Treasury will email all eligible recipient counties with more information on the LATCF application process. They will also host a webinar for counties on Oct. 4, so please keep an eye out for that invitation as well.

Mining taxes revamp gets hearing in House committee

Testimony was heard this week on a package of bills relating to mining operations during a session of the House Natural Resources and Outdoor Recreation Committee.

Testimony was heard this week on a package of bills relating to mining operations during a session of the House Natural Resources and Outdoor Recreation Committee.

House Bills 6218, 6220, 6254-55, and 6257-58, by Rep. Sara Cambensy (D-Marquette) seek to expand mining in Michigan by designating funds to research and development. The legislation would create the Metallic Mineral Mine Reclamation Fund and Ferrous Mining Research and Design Fund. The former would receive $250,000 and the latter would receive $200,000 each year from revenue generated by the minerals severance tax, which is currently allocated toward local governments and the School Aid Fund.

Cambensy expressed a willingness to work with stakeholders through October before advancing the legislation later this fall. MAC plans to engage on this issue and continue its work to protect revenue sources for counties.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Senate approves new judge slots for Allegan and Kalamazoo counties

A bill to add circuit court judgeships in Allegan Kalamazoo counties moved to the House this week after gaining Senate approval.

A bill to add circuit court judgeships in Allegan Kalamazoo counties moved to the House this week after gaining Senate approval.

Senate Bill 1047, by Sen. Sean McCann (D-Kalamazoo), would allow the 9th Judicial Circuit, which consists of Kalamazoo County, to add one additional judge, effective Jan. 1, 2025, increasing the number of judgeships from four to five, and specifies that the term of office for the judgeship would be eight years. The bill also allows the 48th Judicial Circuit, covering Allegan County, to have one additional judgeship beginning Jan. 1, 2025, increasing the number of judgeships from one to two.

SB 1047 is now in the House and has been referred to the Judiciary Committee.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Legislative Update takes fall break

MAC’s Legislative Update email will be taking a two-week break in October, resuming on Friday, Oct. 21.

MAC’s Legislative Update email will be taking a two-week break in October, resuming on Friday, Oct. 21.

If you have any legislative questions in the interim, please contact:

- Taxation/revenue sharing/finance – Deena Bosworth, bosworth@micounties.org

- Health/human services/judiciary/public safety – Samantha Gibson, gibson@micounties.org

- General government/environmental and regulatory affairs/infrastructure – Madeline Fata, fata@micounties.org

For questions regarding job postings, contact Derek Melot (melot@micounties.org) AFTER Oct. 16.

Webinar to review constitutional amendments on November ballot

On Nov. 8, 2022, Michigan voters will consider three proposed constitutional amendments:

On Nov. 8, 2022, Michigan voters will consider three proposed constitutional amendments:

- Proposal 1 would modify the implementation of legislative term limits and require certain financial disclosures for state elective offices.

- Proposal 2 would add several voting and elections provisions to the constitution.

- Proposal 3 would establish an explicit right to “reproductive freedom,” including all matters related to pregnancy.

Join the nonprofit, nonpartisan Citizens Research Council of Michigan (CRC) on Wednesday, Oct. 5 from 10 a.m. to 11:30 a.m. (Eastern) for a free webinar, in partnership with MIRS News, to hear summaries of CRC’s analyses of the proposals.

After registering, you will receive a confirmation email containing information about joining the webinar.

CRC does not take positions on ballot issues. In analyzing the questions on the November ballot, CRC hopes to provide more information so voters can make better informed decisions in formulating their votes.

Founded in 1916, the Citizens Research Council of Michigan works to improve government in Michigan. The organization provides factual, unbiased, independent information concerning significant issues of state and local government organization, policy and finance. For more information, visit www.crcmich.org.

Staff picks

Staff picks

- How Manchin’s permitting plan would restrict state power (RouteFifty)

- Kitten saves family of four from deadly carbon monoxide poisoning (MLive)

- Rethinking Revenue Initiative (Government Finance Officers Association)

- Confidence in election security high, according to Michigan local government officials, disinformation causes concerns (Center for Local, State and Urban Policy)