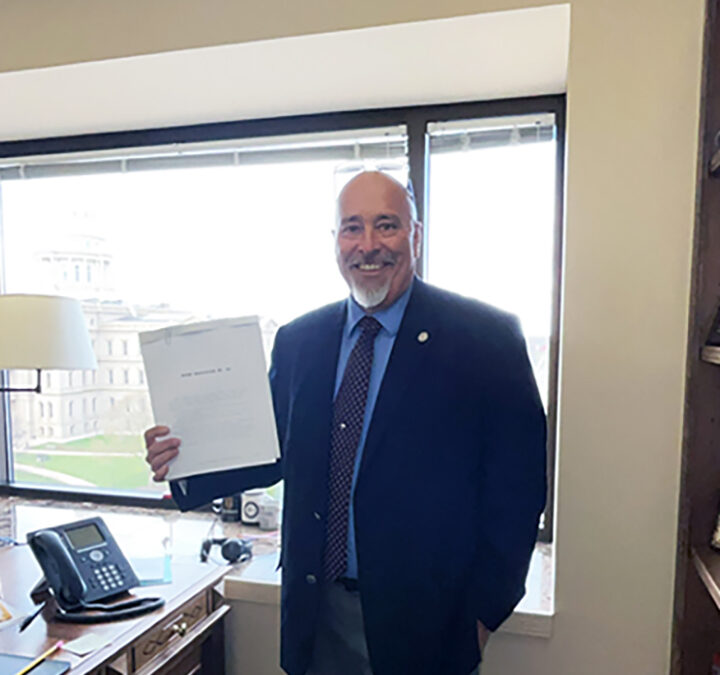

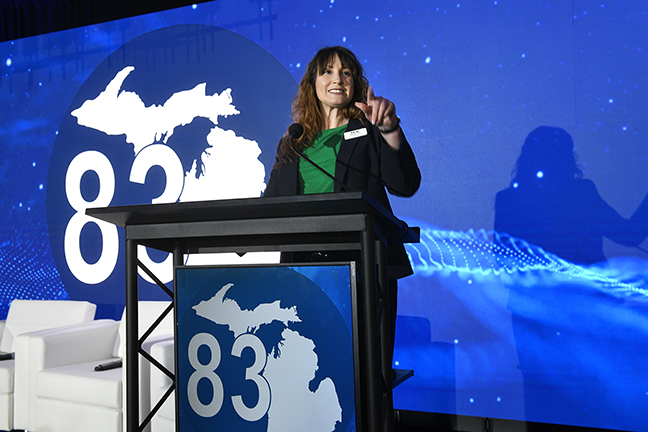

MAC testifies on county use of opioid settlement funds MAC’s work with counties on utilizing opioid settlement funds was the subject of a legislative hearing on Tuesday, May 20 in Lansing. MAC’s Jimmy Johnson and Amy Dolinky testified before the Michigan House...