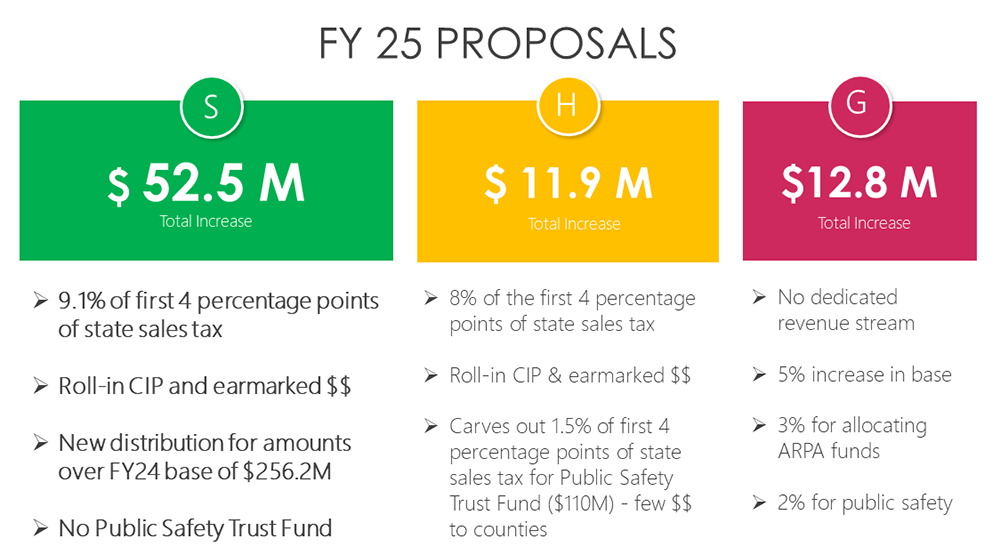

Comparing the FY25 revenue sharing proposals

As the state budget for fiscal 2025 heads to the Legislature’s Conference Committee, differing proposals for county revenue sharing from the governor and legislative chambers will be on the table. Each plan aims to address the fiscal needs of counties with varying methodologies and financial implications.

As the state budget for fiscal 2025 heads to the Legislature’s Conference Committee, differing proposals for county revenue sharing from the governor and legislative chambers will be on the table. Each plan aims to address the fiscal needs of counties with varying methodologies and financial implications.

As seen in the chart, the three proposals have significant differences.

The governor favors a traditional approach of ongoing and one-time increases still subject to the annual appropriations process.

The House wishes to follow the MAC-supported Revenue Sharing Trust Fund model built on a sales tax carve-out, thereby allowing for a steady increase in funding and ensuring a link between economic activity and county funding.

The Senate takes the Revenue Sharing Trust Fund model further with a larger chunk of the sales tax and an inverse relationship to taxable value, meaning counties with lower taxable values receive a larger share of the increase. This results in a $52.5 million increase, with the average county seeing a boost of approximately 20 percent.

The Senate’s proposal, which MAC favors, aims to provide more substantial financial support, particularly to counties with lower taxable values, thereby addressing disparities and promoting equitable distribution of resources.

To see how the different approaches affect your county, click here.

The challenge now before the Conference Committee, armed with final spending data from the Consensus Revenue Estimating Conference (see item below), lies in balancing the ambitious increases proposed by the Senate with the more conservative approaches of the governor and House, all while ensuring the final agreement meets the varied needs of counties.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

State has $14.26 billion to use for FY25 General Fund

Michigan’s legislators will have $236 million more available for the fiscal 2025 General Fund budget than was expected in January.

Michigan’s legislators will have $236 million more available for the fiscal 2025 General Fund budget than was expected in January.

In its final session before the Legislature completes its 2025 budget work, the Consensus Revenue Estimating Conference (CREC) concluded there will be a net amount of $14.26 billion to spend for the General Fund, state spending plan that covers many county-related functions.

This figure is up $235.6 million from the CREC projection from January 2024.

These conferences are required by statute to determine the state of Michigan’s financial resources as lawmakers draft annual budgets.

“With Michigan’s revenue outlook appearing to be stable if not growing slightly, we hope to see the manifestation of growth to continue to benefit not just the state, and infrastructure, but with counties as well through revenue sharing,” said MAC’s Deena Bosworth.

Notable information from the May 17 presentation on Michigan’s economy and budget:

- The state would enter FY25 with a “rainy day” reserve fund of $2.1 billion, after substantial growth in interest earnings. As recently as FY19, the reserve fund held only $1.15 billion.

- CREC continues to show the state falling further below the revenue limit imposed by the Headlee Amendment, which was adopted in the 1970s. For the next two fiscal years, the state could raise an additional $12 billion ― essentially a second state General Fund ― and still comply with Headlee’s restrictions.

- The housing affordability outlook is not good, but, conversely, that is positive news for businesses involved in home construction that are trying to fill unmet demand.

- Michigan employment is above pre-pandemic levels.

- Inflation in Michigan is “turning slowly,” with housing the major issue there.

For more information on MAC’s budget advocacy, contact Deena Bosworth at bosworth@micounties.org.

Policy Summit will focus on financial issues with opioids, roads, jails

The 2024 MAC Policy Summit on June 25 will feature briefings on Medicaid jail policies, the latest news on using opioid settlement dollars, a potentially massive shift in how Michigan funds its roads and an overview of counties’ long-term fiscal health.

The 2024 MAC Policy Summit on June 25 will feature briefings on Medicaid jail policies, the latest news on using opioid settlement dollars, a potentially massive shift in how Michigan funds its roads and an overview of counties’ long-term fiscal health.

Registration is now open for the session, with a $75 fee covering either the virtual option or attendance in-person at the AC Hotel Lansing just off U.S. 127 in the capital city.

The event is designed to allow county leaders to get to and from Lansing in a reasonable schedule. However, MAC has secured a room block at the AC Hotel (3160 E. Michigan Ave., Lansing) for $149 per night.

Agenda

9 a.m. – 9:40 a.m.: Registration and Continental Breakfast

9:40 a.m. – 10:40 a.m.: Medicaid Inmate Exclusion Policy and the Medicaid Section 1115 Waiver

- Presenters: Robert Sheehan, CEO, Community Mental Health Association of Michigan, and Samantha Gibson, governmental affairs associate, MAC

10:45 a.m. – 11:45 a.m.: Opioid Settlement Funds: Year in Review

- Presenter: Amy Dolinky, technical adviser, opioid settlement funds planning and capacity building, MAC

11:45 a.m. – 12:30 p.m.: Lunch

12:30 p.m. – 1:30 p.m.: Why and How to Conduct a Road Usage Charge Pilot in Michigan

- Presenter: Baruch Feigenbaum, senior managing director of transportation policy, Reason Foundation

1:30 p.m. – 2:30 p.m.: Beyond the Numbers: Assessing the Resilience of Michigan County Governments’ Finances

- Presenter: Stephanie Leiser, lead, Michigan Local Government Fiscal Health Project at the Center for Local, State, and Urban Policy

For more details on the presentations, the hotel and parking tips, visit MAC’s events page.

Participants in the summit will earn 1 credit hour toward certification in MAC’s County Commissioner Academy.

Legislator remarks, energy law featured in new MAC videos

The Legislative Panel was held on May 1 at the 2024 Legislative Conference. (Rod Sanford Photography)

MAC has added new videos to its YouTube playlist from the 2024 Michigan Counties Legislative Conference in Lansing, April 29-May 1:

- Energy Siting Law Workshop (April 30) led by Sarah Mills of the University of Michigan

- Basics of Public Act 233

- What’s a county to do under the act?

- Pros and cons of available options

- Legislative Panel held on May 1

- Senate Minority Leader Aric Nesbitt on indigent defense reform

- Comments on public safety funding

- Rep. John Fitzgerald on road funding

- Rep. Graham Filler on partisan dynamics in the House

Presentations and other documents from the conference can be found on MAC’s website.

Prospects for huge revenue sharing gain detailed in podcast

Legislators continue to grind on a fiscal 2025 state budget, a document that could yield a massive reform in county revenue sharing, a Podcast 83 team member detailed this week in a new episode.

Legislators continue to grind on a fiscal 2025 state budget, a document that could yield a massive reform in county revenue sharing, a Podcast 83 team member detailed this week in a new episode.

While the governor, the House and the Senate all have proposed increases in revenue sharing, it’s the Senate approach that is most attractive, said Governmental Affairs Director Deena Bosworth.

Like the House, the Senate is pursuing MAC’s trust fund proposal of carving out a portion of the state sales tax for use in dedicated fund for counties.

“(The Senate) wants to do 9.1 percent of the state sales tax for cities, villages, townships and counties. And they are not doing the public safety percentage (which the House is pursuing),” Bosworth said. “So, Sen. (John) Cherry made the recommendation that we’re going to take a bigger piece of the sales tax, which is a $52.5 million increase. He says whatever your county got in fiscal year 24 is absolutely the minimum. And then that additional $52.5 million that he is recommending for this year is going to get distributed out to counties based on an inverse relationship to their taxable value.”

In other Capitol news:

- Samantha Gibson explained MAC’s opposition to a bill on prisoners earning release credits that could disrupt the state’s “Truth in Sentencing” rules.

- Madeline Fata explained the huge burdens that could fall on county clerks and other local election officials if the current version of the so-called “Michigan Voting Rights Act” legislation were to be adopted.

View the full episode, recorded on May 13, by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

Register now for next ‘Chart Chat’ webinar from Michigan Treasury

Registration is open for Treasury’s next “Chart Chat” webinar on Thursday, May 30. The session will run from 2 p.m. to 3 p.m. Eastern.

Registration is open for Treasury’s next “Chart Chat” webinar on Thursday, May 30. The session will run from 2 p.m. to 3 p.m. Eastern.

The Chart Chat webinar series provides local governments with critical information related to accounting and auditing topics, measuring local government fiscal health, and other important updates from Treasury.

Topics covered in this session will include:

- Corrective Action Plans

- Numbered Letters Update

- Budget Projection Tool

- Uniform Actuarial Assumptions (PA 202 of 2017)

- Headlee Overview

Presentations and recordings from this webinar, along with previous webinars, can be found at TREASURY – BLGSS Learning Center. For support related to Treasury’s local government services, visit the TREASURY – Contact Information.

Staff picks

Staff picks

- Community ordinances are clashing with Michigan’s drug harm reduction strategy (Detroit Free Press)

- Michigan has plenty of jobs. Too bad workers find so many boring, study finds (Bridge Michigan)

- State backs collaborative approach to affordable housing project (Rural Innovation Exchange)

- Indiana judge opens door for new eatery, finding `tacos and burritos are Mexican-style sandwiches’ (Associated Press)