MAC continues push on Revenue Sharing Trust Fund legislation

“Revenue sharing is an unrestricted revenue source that local units of government use for the services that they need … What we’re trying to accomplish here is to have some growth entered into the formula.”

“Revenue sharing is an unrestricted revenue source that local units of government use for the services that they need … What we’re trying to accomplish here is to have some growth entered into the formula.”

So explained MAC’s Deena Bosworth to the House Committee on Local Government and Municipal Finance this week about bills that would create a dedicated source of dollars for local revenue sharing. Substitute versions of the original legislation were adopted in the committee prior to joint testimony given by MAC, the Michigan Municipal League and the Michigan Townships Association. (Click here to view Bosworth’s testimony, which begins at the 20:20 mark.)

House Bills 4274, by Rep. Amos O’Neal (D-Saginaw), and 4275, by Rep. Mark Tisdel (R-Oakland), would:

- Create a separate “Revenue Sharing Trust Fund” to receive and hold dollars solely for the purpose of fulfilling the state’s promise to local governments on revenue sharing;

- Require that 8 percent of the revenue generated by 4 percentage points of the state’s sales tax rate be directed into the fund; and

- Result in $601.1 million in statutory revenue sharing for all local governments across Michigan based on the May Consensus Revenue Estimate for sales tax.

Counties would receive 46.14 percent of this total in the first year, $277 million, which would be an increase of nearly $31 million from the current total.

MAC has long sought to create stability and fairness in the revenue sharing system by removing the statutory portion of it from the annual appropriations process and by designating a steady revenue source.

The bills did not receive a vote this week, and it is currently unclear if the Legislature will include these amounts and calculations in the state’s fiscal 2024 budget, which is expected to be completed early next week.

MAC has a digital advocacy campaign under way in support of these reforms and encourages all county commissioners to utilize this communication tool to notify your legislators of your support for the policy.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Lawmakers study Public Safety Trust Fund concept

Bills that would carve out 1.5 percent of the first 4 percentage points of the state sales tax and dedicate that revenue to public safety departments within municipalities with high crime rates were up for testimony this week in the House Committee on Local Government and Municipal Finance.

Bills that would carve out 1.5 percent of the first 4 percentage points of the state sales tax and dedicate that revenue to public safety departments within municipalities with high crime rates were up for testimony this week in the House Committee on Local Government and Municipal Finance.

House Bill 4605, by Rep. Nate Shannon (D-Macomb), and HB 4606, by Rep. Alabas Farhat (D-Wayne), would yield about $110 million for city and township police departments based on a three-year average of violent crime rates and be disbursed on a proportional basis based on a municipality’s average share of statewide reported crimes.

The bills would prevent eligible municipalities from supplanting existing public safety allocations with this funding unless there is a decline in total general fund from the previous year and a proportional decline in its existing reoccurring resources.

The bills do not include direct funding for county sheriff departments, though they do allow for a pass-through of the funds should a sheriff’s department have a contract with a local municipality to provide police services.

MAC does not have an official position on the bills at this time, but several inequities in the bills have been identified. First, numerous townships across the state rely on sheriff departments for police services but do not have a contract for that service and would, therefore, be ineligible for this funding. Second, increased policing will ultimately result in more incarcerations in county jails, thereby increasing costs at the county level without any corresponding financial assistance. Lastly, many counties in our state have law enforcement shortages and/or lack the tax base to handle the public safety needs brought on by increased tourism.

MAC will work with the bill sponsors and advocates to address our concerns while still supporting the overall effort of additional resources to address violent crime.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Broadband projects gearing up with new federal dollars

![]() Michigan is slated to receive nearly $300 million in federal funding to expand broadband access across the state, according to two separate announcements this week.

Michigan is slated to receive nearly $300 million in federal funding to expand broadband access across the state, according to two separate announcements this week.

About $238 million comes from the Realizing Opportunity with Broadband Infrastructure Networks (ROBIN) program to support 24 separate projects, while another $61 million comes from the National Telecommunications and Information Administration (NTIA) direct to Peninsula Fiber Network (PFN).

The Michigan High-Speed Internet Office (MIHI) announced Tuesday it had awarded 11 applicants a total of $238 million. Those applying for ROBIN dollars had to demonstrate public-private partnerships and an ability to match funds. This means the actual investment in broadband infrastructure through ROBIN will be $578 million. MIHI estimates these funds will help to connect more than 100,000 unserved homes, businesses, and institutions. There is a comment and objection period between now and July 31, 2023, so while these projects have been approved, they are not set in stone just yet.

As for the $61 million from NTIA, PFN has shared its plans to distribute the funds across three projects benefiting various regions of the state:

- An underwater fiber optic link will be installed to connect Benton Harbor and Chicago.

- The Upper Peninsula will be connected to Beaver Island and Charlevoix.

- A route will be installed between Flint and Port Huron.

MAC is thrilled to see such substantial investments in broadband infrastructure in Michigan, and there is more to come: Michigan expects to receive roughly $1.6 billion as part of the Broadband Equity, Access, and Deployment (BEAD) program in 2024. These funds will be prioritized for unserved and underserved locations and the application process will likely begin early next year.

For more information on MAC’s work on broadband, contact Madeline Fata at fata@micounties.org.

Justice commission bill passes Senate

A bill to establish the duties of a new Michigan Sentencing Commission passed out of the Senate on Thursday.

A bill to establish the duties of a new Michigan Sentencing Commission passed out of the Senate on Thursday.

Senate Bill 377, by Sen. Ed McBroom (R-Dickinson), advanced out of the chamber, though its companion measure, SB 376, by Sen. Stephanie Chang (D-Wayne), did not receive a vote. This is likely due to House Bills 4173 and 4384, by Reps. Abraham Aiyash (D-Wayne) and Luke Meerman (R-Ottawa) respectively, having passed out of the House last week and being referred to the Senate Judiciary Committee.

None of this legislation allows for a representative of county boards of commissioners on the state panel, despite a county’s role as a funding unit and key administrative piece of local criminal justice.

In light of this deficiency, MAC remains opposed to HB 4173 and SB 376.

Given a county’s role as the funding unit, and its fiduciary responsibilities to jails, sheriff’s offices and prosecutor’s offices, it is imperative that counties have a voice, MAC Governmental Affairs Associate Samantha Gibson testified previously.

In SB 377 and HB 4384, the commission would be tasked with submitting a prison and jail impact report relating to any modifications to sentencing guidelines, including any impact on state and local correctional facilities. There are also indirect costs associated with the bills, depending on decisions made by the commission. Costs could increase or decrease, depending on changes made to sentencing guidelines. The potential for financial burdens imposed by the state onto county jails is of great concern to MAC. A county voice is crucial on the commission.

Despite the current refusal from legislators to include county commissioners on the commission, MAC will continue to press for such representation.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Podcast delves into big changes for drain code

Bills designed to allow for water management districts and for the assessment of costs across watersheds in Michigan are the topic of a special episode of MAC’s Podcast 83 released on June 20.

Bills designed to allow for water management districts and for the assessment of costs across watersheds in Michigan are the topic of a special episode of MAC’s Podcast 83 released on June 20.

MAC’s Deena Bosworth hosted a session with Stacy Hissong, general counsel for the Michigan Association of County Drain Commissioners (MACDC) and member of the law firm of Fahey Schultz, on the proposed rewrite of Chapter 22 of the Michigan Drain Code.

House Bills 4382-83, by Reps. Curt VanderWall (R-Mason) and Christine Morse (D-Kalamazoo) respectively, would allow local governments and residents to petition the drain commissioner for the establishment of the districts and, if found necessary, to create a plan to manage stormwater within the district in ways not currently allowed.

The plan would be unique to each district and could include actionable items like regional detention, buffer strips and the creation of wetlands, rain gardens and the like. The intent is to slow down and detain water during major storm events, instead of allowing it to flood roads, fields, businesses and homes on its way to a drain. The plan must include an estimate of the cost of each recommended activity.

The legislation is backed by MAC and MACDC.

View the full video of the episode by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

MAC creates Opioid Settlement Learning Community to share best practices

County, city and township government officials are invited to participate in the Local Government Learning Community on Opioid Settlements hosted by MAC, the Michigan Municipal League and the Michigan Townships Association. This new network will bring together local subdivisions working to plan and spend their opioid settlement funds.

County, city and township government officials are invited to participate in the Local Government Learning Community on Opioid Settlements hosted by MAC, the Michigan Municipal League and the Michigan Townships Association. This new network will bring together local subdivisions working to plan and spend their opioid settlement funds.

The group is intended to foster peer-to-peer learning and will include presentations from local governments on practical solutions and examples to addressing the challenges of planning for use of the settlement funds.

The initial session will take place on Friday, July 14 at noon, and meetings will continue monthly on the second Friday from noon to 1 p.m.

To register, please see the flier.

For questions on this issue, contact Amy Dolinky at dolinky@micounties.org.

Juvenile Justice Reform Task Force members testify before House panel

A package of 20 bills to reform the state’s juvenile justice system, supported by MAC, received a hearing in the House Committee on Criminal Justice this week. This package, House Bills 4624–4643, would expand the County Child Care Fund (CCF), including an increase in reimbursement rates to counties from 50 percent to 75 percent for community-based services; expand eligibility for diversion; and require the use of risk and needs assessments.

A package of 20 bills to reform the state’s juvenile justice system, supported by MAC, received a hearing in the House Committee on Criminal Justice this week. This package, House Bills 4624–4643, would expand the County Child Care Fund (CCF), including an increase in reimbursement rates to counties from 50 percent to 75 percent for community-based services; expand eligibility for diversion; and require the use of risk and needs assessments.

(UPDATE: Please see clarification on CCF rate changes in the Aug. 25, 2023, Legislative Update.)

In addition to expanding the CCF, the Michigan Indigent Defense Commission would be expanded to implement youth defense standards in local county defense systems; the State Appellate Defender’s Office would be required to oversee a system of appellate defense for juveniles; and court fines and fees for juveniles would be waived.

The Task Force on Juvenile Justice Reform was established by Gov. Gretchen Whitmer in 2021. The bipartisan task force was chaired by Lt. Governor Gilchrist and included members from all three branches of government, as well as state and local level juvenile justice leaders and advocates. Two county commissioners served on the Task Force, each nominated by MAC. Alisha Bell of Wayne represented a county with a population over 100,000, and Marlene Webster of Shiawassee represented a county under 100,000 in population. Rep. Sarah Lightner, a former county commissioner, also served on the Task Force.

The Task Force discovered several challenges to strengthening public safety and improving outcomes for youth. Those challenges, however, led to the set of 32 recommendations last year. Six priority areas have been identified and translated into this 20-bill package.

HB 4624, by Rep. Christine Morse (D-Kalamazoo), enhances the Child Care Fund (CCF) by establishing a minimum framework of juvenile justice best practices statewide, including the use of risk screening and assessment tools. The best practices will be supported by an increase in the reimbursement rate for community-based services from 50 percent to 75 percent. These changes are essential to ensure counties have the resources to implement and utilize these approaches.

HBs 4625–4629 require the consistent use of validated screening and assessment tools to enable more objective decision-making and allow agencies to better match youth to appropriate supervision and services, reducing their likelihood to recidivate. The bills also expand the Diversion Act so that all offenses, with an exception for youth committing a specified juvenile violation, are eligible for pre-court diversion, based on the use of a risk-screening tool and other factors and limit the time that a youth can be placed on pre-court diversion, unless the court determines that a longer period is needed. While diversion eligibility would be expanded, judicial discretion remains.

HBs 4630 and 4631, by Rep. Lightner (R-Jackson), would expand the Michigan Indigent Defense Commission to include development, oversight, and compliance with youth defense standards in local county defense systems, and expands the State Appellate Defender Office to include appellate services for juveniles.

HBs 4634–4637 eliminate most non-restitution fees and costs associated with juvenile justice system involvement. The bills do not include the elimination of restitution or fees related to the Crime Victims Fund. For restitution and fees related to the Crime Victims Fund, the bills establish a standard procedure for ability to pay, determination of payment schedule, and total to be assessed.

HBs 4638–4642 would strengthen and expand the Office of the Children’s Ombudsman for handling, investigating, and reporting incidents in juvenile facilities.

Continued testimony is expected in the House over the coming weeks and throughout the summer.

MAC supports this package and has shared a letter of support with members of the House Criminal Justice Committee.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Michigan counties get $6 million in federal PILT funds

On June 15, the U.S. Department of the Interior (DOI) announced that $578.8 million will be distributed to counties in 2023 through the Payments in Lieu of Taxes (PILT) program.

On June 15, the U.S. Department of the Interior (DOI) announced that $578.8 million will be distributed to counties in 2023 through the Payments in Lieu of Taxes (PILT) program.

“Payments in Lieu of Taxes (PILT) are federal payments to local governments to help offset losses in property taxes due to the existence of nontaxable Federal lands within their boundaries. The original law is Public Law 94-565, dated October 20, 1976. This law was rewritten and amended by Public Law 97-258 on Sept. 13,1982, and codified at Chapter 69, Title 31 of the United States Code. The law recognizes the financial impact of the inability of local governments to collect property taxes on federally owned land.”

Thirty-one Michigan counties received $5.98 million covering 2.21 million acres of land, with payments ranging from $132 for Monroe to $709,500 for Gogebic.

Of states east of the Mississippi River, only Florida ($6.9 million) and Virginia ($6.5 million) receive more in federal PILT than Michigan.

To see the Michigan list, click here.

Solar PILT bills clear Michigan House

Legislation to create an optional structure for the taxes levied on solar facilities in Michigan has passed the House with bipartisan support.

Legislation to create an optional structure for the taxes levied on solar facilities in Michigan has passed the House with bipartisan support.

After years of participation in workgroups to ensure local options, a stable funding source, appropriate zoning considerations and adequate local reimbursements, MAC has taken a neutral position on the legislation.

House Bills 4317 and 4318, by Reps. Curt VanderWall (R-Mason) and Cynthia Neeley (D-Genesee) respectively, would allow for the creation of solar energy districts by local municipalities after a mandatory public hearing. Subsequently, solar energy developers could apply for an exemption from local property taxes and instead pay a flat rate of $7,000 per megawatt of nameplate capacity per year for the proposed solar energy facility, instead of ad valorem property taxes. The payment would be locked in for 20 years and distributed based on the proportions of normal taxes that would have been paid to each taxing unit.

An additional financial incentive would be offered for developers that choose to site their facilities on brownfield properties, in opportunity zones, as a secondary use on already improved real property (i.e., roof tops) or on state-owned property. In such cases, the reimbursement rate would be $2,000 per megawatt of nameplate capacity.

The impetus behind the legislation is twofold. First, this methodology for compensating locals for lost taxes will provide financial predictability for the developers and the locals, hopefully avoiding the same problems we have had with the challenges to the evaluation of wind turbines. Second, the rate and process should serve as incentives for developers to build more renewable energy facilities in the state.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

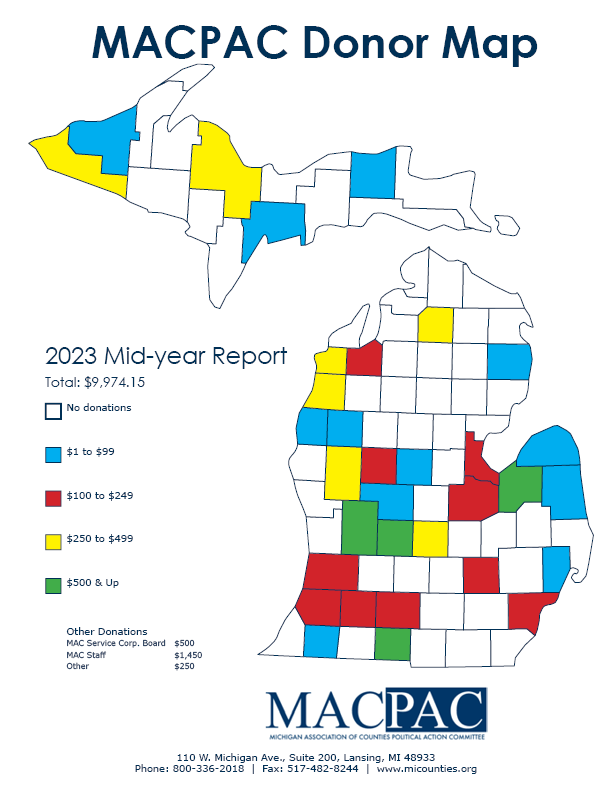

MACPAC reaches midyear point ahead of 2022 fundraising pace

MACPAC, the association’s political action committee, has raised nearly $10,000 since December 2022, nearly matching the total for 12 months prior to last December.

MACPAC, the association’s political action committee, has raised nearly $10,000 since December 2022, nearly matching the total for 12 months prior to last December.

MACPAC is the only PAC in Michigan devoted to supporting allies of county government in the Michigan Legislature.

As of June 13, MACPAC had received:

- $9,974.15 in donations

- Donations from 33 different counties

Allegan and Kent counties are tied at the midyear point for most commissioners donating with three each.

In the 2022 tracking year, MACPAC raised approximately $11,000.

To donate using MACPAC’s digital system, just click here.

For more information about MACPAC, visit its webpage.

icks

icks