MAC Board votes to shift Annual Conference to virtual sessions

The 2020 MAC Annual Conference will be a virtual event stretching across several days in late August, the MAC Board of Directors decided during a meeting on Friday.

The 2020 MAC Annual Conference will be a virtual event stretching across several days in late August, the MAC Board of Directors decided during a meeting on Friday.

“With counties and vendors alike still sorting through the budget problems caused by COVID, we had a real concern that attendance would drop, and the event would be costly for MAC,” said Board President Veronica Klinefelt of Macomb County. “Based on the success of the Virtual Legislative Conference and the continuing research of our MAC staff, the Board saw a virtual event as the better option.”

The virtual event will include workshops, plenary sessions, opportunities to interact with exhibiting vendors, board elections and the Annual Business Meeting on Aug. 18 to approve MAC’s policy platforms for the coming year.

The Board approved the draft platforms for the membership vote this week. Those drafts soon will be made available on MAC’s website and sent electronically to all counties for members’ review in advance of the Annual Business Meeting.

Since this year’s session will be done electronically, the Board also voted to require that all member amendments for the platforms be submitted in writing to MAC by 5 p.m. on Aug. 7. Amendments will not be accepted from “the floor” during the virtual meeting on Aug. 18.

Full details about the virtual conference, including exact dates, speakers and registration, will be released in early July.

The conference originally was scheduled for Aug. 16-19 at the Radisson Hotel in downtown Kalamazoo. MAC has arranged with the venue to reset that in-person event to 2023.

MAC’s conferences in 2021 are scheduled for April 27-29 in Lansing (Legislative) and Sept. 26-28 at the Grand Hotel on Mackinac Island (Annual).

For the latest conference-related news, visit MAC’s website.

Executive orders loosen economic restrictions due to COVID-19

Two executive orders on Friday will continue to ease economic restrictions imposed earlier due to the coronavirus crisis.

Two executive orders on Friday will continue to ease economic restrictions imposed earlier due to the coronavirus crisis.

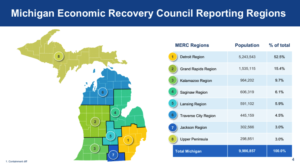

On June 10, Regions 6 and 8, which include much of Northern Michigan and the Upper Peninsula, will advance to Phase 5 of the governor’s MI Safe Start Plan. Phase 5 allows the reopening of salons, movie theaters, and gyms, subject to safety protocols and procedures designed to minimize the spread of COVID-19.

On June 15, personal services including hair, massages, and nails will reopen statewide. Though the remaining regions, 1 through 5 and 7, will remain in Phase 4 under the new executive orders. The governor said she expects the entire state will advance to Phase 5 in the coming weeks.

Normal FOIA requirements resume on June 11

Normal requirements under the state’s Freedom of Information Act resume on June 11, Gov. Gretchen Whitmer stated in a new Executive Order on June 3.

Normal requirements under the state’s Freedom of Information Act resume on June 11, Gov. Gretchen Whitmer stated in a new Executive Order on June 3.

FOIA requirements had been modified by Whitmer in Executive Order 38 during the height of the COVID-19 crisis and in response to the disrupt to local government operations.

That order was to expire on June 4, but Whitmer issued EO 112 to extend modifications, but only to June 11. Starting next week, counties are subject to all of the normal deadline and response requirements under the transparency law.

Hazard pay measure awaiting House floor action

A supplemental budget bill that includes hundreds of millions of dollars in payments for first responders and health workers awaits action on the Michigan House floor after its approval by the full Senate and the House Appropriations Committee.

Senate Bill 690, by Sen. Jim Stamas (R-Midland), is the subject of continuing negotiations between the Legislature and the governor. At issue is the $3.2 billion in Federal CARES Act dollars allocated for the state of Michigan. Guidance from the Federal Department of Treasury prohibits the use of these funds for revenue replacement and restricts the spending for COVID-19 related expenses.

While state and local governments are trying to balance budgets with significant revenue shortfalls, these funds can provide some relief under certain conditions. Included in current version of SB 690 is $100 million for hazard pay for public safety workers, $226.5 million for a pay differential for direct care workers and $200 million for grants to small businesses in the form of restart grants. The bill spends approximately $1.25 billion of the CARES money, but that amount is subject to change based on negotiations.

MAC has not taken a position on the bill yet.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Property tax bills advance despite MAC concerns

Legislation to provide relief for taxpayers struggling to pay their summer property tax bills on time advance out of its initial House review this week.

Legislation to provide relief for taxpayers struggling to pay their summer property tax bills on time advance out of its initial House review this week.

House Bills 5761 and 5810, by Rep. James Lower (R-Ionia), chair of the House Local Government and Municipal Finance Committee, will amend the General Property Tax act to do several things:

- Forgive interest and fees for property owners who qualify for the program due to financial hardship associated with the Covid-19 pandemic. Qualification will be based on an affidavit of hardship regardless and will apply to all types of property, not just residential.

- Require local units to submit unpaid summer taxes to the county treasurer by Oct. 1, 2020, instead of waiting until they become delinquent on March 1, 2021.

- Require county treasurers to advance the payment to local units in the amount of the summer taxes turned over to the county to assist with cash flow for taxing jurisdictions.

Language was added to the bill that indicates an intention of the Legislature to appropriate the money to cover the interest and costs associated with the advancement of money to local units from the Delinquent Tax Revolving Fund (DTRF).

It is unclear how many individuals and businesses would utilize the program, but many homeowners and businesses will be struggling to meet their financial obligations after such a long shutdown. If it is widely utilized, the advancement of payment from the DTRF could be in the billions of dollars, which in turn would require substantial borrowing by county treasurers in order to meet the obligations for cash set forth in the legislation. The critical components would be the ability for treasurers to borrow the funds and the guarantee by the state to pay for the additional expenditures and the lost interest used to repay the notes.

The bill sponsor has been working with MAC and other local units closely throughout this process to address our concerns, but MAC remains without a position on the legislation until solutions to the concerns can be found.

The bills have been referred to the House Committee on Appropriations for further consideration.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Major changes to solid waste management proposed

Legislation making substantial changes to how counties handle solid waste was introduced this week in Lansing.

House Bills 5812-5817 were discussed in the House Natural Resources and Outdoor Recreation Committee on Tuesday. Among the goals of bill sponsors are increasing Michigan’s overall recycling rate to 45 percent in the long term; increasing curbside recycling statewide; creating new recycling markets by increasing permitting fees for material management facilities; and funding counties to rewrite their waste management plans.

The most important bill for counties in the package is HB 5817, by Rep. Joe Tate (D-Wayne), which would replace county solid waste management plans with Materials Management Plans (MMP) and provide for funding to do the work. Counties would receive upfront funding through the Renew Michigan Fund at a rate of $60,000 plus 50 cents per resident in the county that will cover “100% of eligible costs” for three years, the timeline to finish the MMP. The bill would also permit counties to levy landfill surcharges, hauler licensing fees and other tools to finance adequate materials management practices.

Other bills in the package will eliminate the need to monitor imports and exports between counties, preserve local control in the siting of new material management facilities and increase financial assurance requirements for private landfills. A fiscal analysis of each of the bills can be found here.

The package is the result of findings from a 2016 task force created by Gov. Rick Snyder: the Solid Waste and Sustainability Advisory Panel. Recommendations from the report included empowering counties to plan for waste management practices other than landfilling, such as composting and recycling.

The bills are scheduled for further testimony in the House Natural Resources & Outdoor Recreation Committee on Tuesday, June 9.

MAC has not yet taken a position on the bills.

For more information on this issue, contact Michael Ruddock at ruddock@micounties.org.

Federal guidance: States need to send CARES Act money to locals

In comments released late last week, U.S. Treasury officials said that state governments need to be sharing CARES Act money with local governments that did not qualify for direct payments under the act due to their population. This guidance affirms what MAC has been saying in ongoing discussions with the State Budget Office on the need for state help to address COVID-19 financial effects.

In comments released late last week, U.S. Treasury officials said that state governments need to be sharing CARES Act money with local governments that did not qualify for direct payments under the act due to their population. This guidance affirms what MAC has been saying in ongoing discussions with the State Budget Office on the need for state help to address COVID-19 financial effects.

In Michigan, the federal guidance would apply to 79 of the 83 counties.

The guidance came via a May 28 FAQ document, which states:

“Should States receiving a payment transfer funds to local governments that did not receive payments directly from Treasury?

“Yes, provided that the transferred funds are used by the local government for eligible expenditures under the statute. To facilitate prompt distribution of Title V funds, the CARES Act authorized Treasury to make direct payments to local governments with populations in excess of 500,000, in amounts equal to 45% of the local government’s per capita share of the statewide allocation. This statutory structure was based on a recognition that it is more administratively feasible to rely on States, rather than the federal government, to manage the transfer of funds to smaller local governments. Consistent with the needs of all local governments for funding to address the public health emergency, States should transfer funds to local governments with populations of 500,000 or less, using as a benchmark the per capita allocation formula that governs payments to larger local governments. This approach will ensure equitable treatment among local governments of all sizes.

“For example, a State received the minimum $1.25 billion allocation and had one county with a population over 500,000 that received $250 million directly. The State should distribute 45 percent of the $1 billion it received, or $450 million, to local governments within the State with a population of 500,000 or less.”

MAC will continue to make the case for state help for counties as the budget process continues.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

![]() MAC has created a dedicated page of information related to 2020 Census efforts.

MAC has created a dedicated page of information related to 2020 Census efforts.

County leaders understand the importance of getting an accurate count of Michiganders to leverage maximum investment from the federal government. Visit the page at https://micounties.org/2020-census/ to find videos for local leaders, resources to maximize response rates and much more. The page will be updated frequently.

Next Treasury webinar is June 9

Next Treasury webinar is June 9

The latest in a series of webinars for local government officials who are dealing with COVID-19’s financial impacts will be at 2 p.m. on Tuesday, June 9. The event is co-sponsored by MAC and other local government groups.

To register, click here. Be advised that “seating” is limited, so registration as soon as possible.

State releases new tools on reopening

In an effort to help reopening businesses safely reengage in the economy, the MI Symptoms Web Application is a cost-free way for employers to comply with Executive Order 2020-97 and implement a COVID-19 symptoms screening questionnaire for employees.

In an effort to help reopening businesses safely reengage in the economy, the MI Symptoms Web Application is a cost-free way for employers to comply with Executive Order 2020-97 and implement a COVID-19 symptoms screening questionnaire for employees.

Designed primarily for employers and employees, the online tool is also available to all Michigan residents. Users enter information daily to help identify symptoms that might be caused by the virus and to make decisions about when to seek appropriate medical care. Local and state public health will also use the collective data to help identify the potential for new outbreaks of the disease.

Some employers may ask or require employees to use MI Symptoms as they return to work to help identify potential cases of COVID-19 before it can spread. Employees will have an objective tool to inform their employer that they should not be coming to work without having to share symptom-specific information.

If you choose to participate, employers can create a profile. After creation, a code will be generated that can be shared with employees to use on their profiles.

MI Symptoms and MI Safe Start Map support the state’s “Contain COVID” efforts by linking symptomatic individuals to resources and providing data to plan and evaluate the impact of target, testing and protection efforts as necessary to begin to safely reengage the economy.

SMART Fund bill would provide $500 billion to states and locals

A co-sponsor of federal legislation to funnel an additional $500 billion in corona aid to states and local governments released a detailed description of the measure this week.

Rep. Fred Upton (R-MI 6) is one of the original House co-sponsors of H.R. 6954, called the SMART Fund, which would “provide $500 billion in emergency funding to every state, county, and community in the country to help keep essential workers on the payroll and Michigan residents safe, while prioritizing state and local assistance based on population size, infection rates and revenue losses.”

Upton explained the funding would be allocated as follows:

- 33 percent based on population Size – “This tranche of funding will be allocated to all 50 states, D.C. and U.S. territories in proportion to each respective state or territory’s percentage of the U.S. population. Counties and municipalities will each get a share of one-sixth of their state’s respective allocation for a combined total of one-third of their state’s allocation from this tranche. Funding will be distributed to counties and municipalities based on each county or municipality’s proportion of the state’s population.”

- 33 percent based on infection rates – “This tranche of funding will be allocated based on each state’s relative share of the nation’s infection rate. … Counties and municipalities will each get a share of one-sixth of their state’s respective allocation for a combined total of one-third of their state’s allocation from this tranche. Funding will be distributed to counties and municipalities based on each county or municipality’s proportion of the state’s population.”

- 33 percent based on revenue losses – “This tranche of funding will be allocated based on each state’s revenue loss in proportion to the combined revenue loss of all the states from Jan. 1, 2020 through Dec. 31, 2020. … Counties and municipalities will each get a share of one-sixth of their state’s allocation for a combined total of one-third of their state’s allocation. Funding will be distributed to counties and municipalities based on each county or municipality’s revenue loss … in proportion to the combined revenue loss for all counties and municipalities in the state over this period.”

Upton is joined as a co-sponsor on the bill by Rep. Debbie Dingell (D-MI 12). For more information on the measure, visit www.upton.house.gov.

Staff picks

Staff picks

- Michigan’s vaccination rates drop, could lead to outbreaks (Associated Press)

- Michigan assures voting by mail won’t be riddled with fraud (Governing)

- The Employment Situation, May 2020 (Bureau of Labor Statistics)

- How much money do MLB players really make? (Fivethirtyeight.com)