Revenue Sharing Trust Fund bills clear committee with unanimous support

By a unanimous vote this week, the House Committee on Local Government and Municipal Finance voted out legislation to create a Revenue Sharing Trust Fund, a key MAC priority in 2023.

By a unanimous vote this week, the House Committee on Local Government and Municipal Finance voted out legislation to create a Revenue Sharing Trust Fund, a key MAC priority in 2023.

House Bill 4274, by Rep. Amos O’Neal (D-Saginaw), and HB 4275, by Rep. Mark Tisdel (R-Oakland), would:

- Create a separate “Revenue Sharing Trust Fund” to receive and hold dollars solely for the purpose of fulfilling the state’s promise to local governments on revenue sharing; and

- Require that 8 percent of the revenue generated by 4 percentage points of the state’s sales tax rate be sent to that fund.

The result would be $601.1 million in statutory revenue sharing for all local governments across Michigan based on the May Consensus Revenue Estimate for sales tax.

Counties would receive 46.14 percent of this total in the first year, or $277 million, which would be an increase of nearly $31 million from the current revenue sharing amounts.

“We are thrilled by the unanimous support for the bills today,” MAC’s Deena Bosworth said in a statement to a Capitol news outlet. “The support of the bills’ sponsors and the committee shows a strong commitment by this Legislature to go back to what revenue sharing was always intended to be: the sharing of the state’s revenue with local governments. These bills, if enacted, will provide predictability and certainty for counties so they can better allocate funding to the services they provide.”

MAC has long sought to create stability and fairness in the revenue sharing system by removing the statutory portion of it from the annual appropriations process.

A vote by the full House is expected by the end of September. The bills would then move to the Senate. Similar bills were introduced in the Senate this session as well, so a favorable outcome in the Senate is anticipated.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Public Safety Trust Fund bills advance to House floor

Legislation to create a Public Safety Trust Fund, setting aside dollars for cities and townships that may contract with counties for law enforcement services, gained narrow approval in a House committee this week.

Legislation to create a Public Safety Trust Fund, setting aside dollars for cities and townships that may contract with counties for law enforcement services, gained narrow approval in a House committee this week.

House Bill 4605, by Rep. Nate Shannon (D-Macomb) and HB 4606, by Rep. Alabas Farhat (D-Wayne), would carve out 1.5 percent of the first 4 percentage points of the state sales tax and dedicate those dollars for the Public Safety and Violence Prevention Fund.

This carve-out is estimated to yield $110 million for city and township police departments that have violent crimes to contend with. The allocation to each municipality will be based on a three-year average of violent crimes and be disbursed on a proportional basis based on that municipality’s average share of reported crimes statewide.

While the bills do not directly allocate funding to a county or county sheriff, they do allow for pass-through funds if a county contracts with a municipality to provide policing services. According to preliminary survey results, many counties do not have contracts in place for these services, so MAC is seeking 5 percent of the money scheduled to be allocated to municipalities within the county to be re-allocated to the county sheriff’s office for our support and jail services.

MAC will work with the bill sponsors and advocates to address our concerns, while still supporting the overall effort of creating additional resources to address violent crime.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC-backed PPT reimbursement plans get committee approval

A statutory mechanism to reimburse local governments for funds diverted by an expansion of the Personal Property Tax (PPT) exemption is moving to the House floor after the House Committee on Tax Policy voted out House Bills 4553-54, by Rep. John Fitzgerald (D-Kent) and Rep. Denise Mentzer (D-Macomb) respectively.

A statutory mechanism to reimburse local governments for funds diverted by an expansion of the Personal Property Tax (PPT) exemption is moving to the House floor after the House Committee on Tax Policy voted out House Bills 4553-54, by Rep. John Fitzgerald (D-Kent) and Rep. Denise Mentzer (D-Macomb) respectively.

Expansion of the small business PPT exemption expansion from $80,000 in true cash value to $180,000 in true cash value is expected to cost local governments up to $75 million per year.

The legislation provides a methodology and reimbursement mechanism to reimburse locals, plus make changes to the Michigan Trust Fund Act to create the Local Government Reimbursement Fund in the state Treasury. The state treasurer would then be required to deposit money and assets received under the amendments to the Use Tax Act proposed by HB 4554 or from any other source. The investment of the fund would be directed by the state treasurer, and interest and earnings from those investments would be credited to the fund. Changes to the Use Tax Act would be made to require $75 million in use tax revenue to be deposited into the Local Government Reimbursement Fund each fiscal year, beginning with FY24.

MAC supports these bills and expects them to be enacted prior to the end of 2023.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Joint committee hears testimony on Child Care Fund changes

A special joint session of House and Senate committees was held this week to take on House Bills 4624-4629, which change the Child Care Fund (CCF) reimbursement rates and outline mandated risk, mental health and detention screening tools.

A special joint session of House and Senate committees was held this week to take on House Bills 4624-4629, which change the Child Care Fund (CCF) reimbursement rates and outline mandated risk, mental health and detention screening tools.

MAC supports the reform legislation.

House Bill 4624, by Rep. Christine Morse (D-Kalamazoo), would codify the increase to 75 percent reimbursement for community-based services via the Child Care Fund, along with requiring the use of evidence-based practices, risk and assessment screening tools and more.

The FY24 state budget includes $31.5 million to implement a recommendation from the Task Force on Juvenile Justice Reform to statutorily increase the state CCF reimbursement rate to 75 percent from 50 percent for community-based juvenile justice services.

Currently, the reimbursement rate for residential placements and community-based services is at 50 percent. Beginning in FY24, community-based services will be reimbursed at 75 percent, while residential services will remain at a 50 percent reimbursement rate.

As one of the recommendations from the Task Force on Juvenile Justice Reform, the intent of a 75 percent reimbursement rate for community-based services is to incentivize jurisdictions to utilize community-based services in lieu of incarceration.

The requirements outlined in HB 4624 will NOT be mandated until the bill is signed by the governor — implementation is likely in FY25. The changes to the Child Care Fund requiring the use of research-based practices and risk and needs assessments can increase system consistency, improve equity, and in other states, has led to reduced use of incarceration and cost saving.

To recap: The 75 percent reimbursement rate applies ONLY to community-based services. Residential placement expenses will continue to be reimbursed at 50 percent.

Additional testimony on these bills will take place next week.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Detroit-backed ‘land value’ tax plan begins legislative journey

Legislation to allow local governments to create a “land value tax,” a concept backed by Detroit Mayor Mike Duggan, was filed and reviewed by a House committee this week.

Legislation to allow local governments to create a “land value tax,” a concept backed by Detroit Mayor Mike Duggan, was filed and reviewed by a House committee this week.

House Bills 4966 and 4969–70, by Rep. Stephanie Young (D-Detroit), HB 4967, by Rep. Karen Whitsett (D-Eaton), and HB 4968, by Rep. Alabas Farhat (D-Wayne), would create the Land Tax Equity Act and make complementary changes to the General Property Tax Act, the Neighborhood Enterprise Zone Act, the Income Tax Act and the Tax Reverted Clean Title Act.

The bills were introduced the same day they were heard in the House Committee on Tax Policy.

The concept was pitched by Detroit Mayor Duggan at the Mackinac Policy Conference back in May. The bills would allow cities and local units of government to authorize a land value tax (LVT). The LVT would allow cities and local units of government to put on the ballot a measure to allow for an equivalent land tax rate to be levied on all parcels of land not specifically exempted by the bill. The intent is to reduce the property tax burden on occupied residential properties and increase the tax liability for undeveloped and blighted properties that are bringing down the area and value of the properties around them.

It is anticipated that action will be taken on the bills before the end of the year. MAC has not yet taken a position on the bills and will be working with our internal policy committee and the Legislature in coming months.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC testifies on reimbursement for veterans exemption

In yest another attempt to secure reimbursement for counties for their losses associated with the 100 percent exemption on property taxes for disabled veterans, MAC testified this week in support of House Bill 4894, by Rep. Nate Shannon (D-Macomb), HB 4895, by Rep. John Roth (R-Grand Traverse), and HB 4896, by Rep. John Fitzgerald (D-Kent).

In yest another attempt to secure reimbursement for counties for their losses associated with the 100 percent exemption on property taxes for disabled veterans, MAC testified this week in support of House Bill 4894, by Rep. Nate Shannon (D-Macomb), HB 4895, by Rep. John Roth (R-Grand Traverse), and HB 4896, by Rep. John Fitzgerald (D-Kent).

In short, the bills would create a refundable income tax credit for the veterans payable to the local unit of government as the mechanism for reimbursement.

A vote was not taken on the bills this week due to some language changes necessary to bring the veterans organization fully on board. MAC anticipates movement on the bills in the next several weeks.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

County-opposed staffing bill gets House committee hearing

A bill to require minimum staffing levels as a mandatory subject of collective bargaining between a public employer and the representative of its employees received a House haring this week.

A bill to require minimum staffing levels as a mandatory subject of collective bargaining between a public employer and the representative of its employees received a House haring this week.

The House Labor Committee took testimony on House Bill 4688, by Rep. Jim Haadsma (D-Calhoun), which is opposed by MAC and the Michigan County Medical Care Facilities Council, an affiliate of MAC.

The bill would amend the Public Employment Relations Act (PERA) and specifies that “other terms and conditions of employment” would include minimum staffing levels within the bargaining unit and consider minimum staffing levels a condition of employment with respect to a bargaining representative’s collective bargaining responsibilities.

Making minimum staffing levels a mandatory topic of collective bargaining could increase staffing costs to counties. In addition to the potential for increased costs, many counties are facing staffing shortages. Implementing minimum staffing requirements when local governments are struggling to maintain fully staffed facilities will add to the difficulties counties already face when recruiting and retaining employees.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

State budget provides dollars for Michigan Appellate Assigned Counsel System fees

The FY24 state budget includes changes to the Michigan Appellate Assigned Counsel System (MAACS) attorney fee policy for indigent felony appeals, effective Oct.1, 2023. Moving forward, the MAACS attorney fee vouchers will match Michigan Indigent Defense System hourly rates of $130 to $1142, with local costs offset by a 1:1 state reimbursement. The local obligation, under this cost share, will be $64 to $71 per hour, similar to existing MAACS fees of $50 to $75 per hour in nearly all circuit courts. Any future inflationary increases would also be offset by a 1:1 state reimbursement. For cases still pending on the October 1 effective date, attorney fee vouchers will include new rates.

The FY24 state budget includes changes to the Michigan Appellate Assigned Counsel System (MAACS) attorney fee policy for indigent felony appeals, effective Oct.1, 2023. Moving forward, the MAACS attorney fee vouchers will match Michigan Indigent Defense System hourly rates of $130 to $1142, with local costs offset by a 1:1 state reimbursement. The local obligation, under this cost share, will be $64 to $71 per hour, similar to existing MAACS fees of $50 to $75 per hour in nearly all circuit courts. Any future inflationary increases would also be offset by a 1:1 state reimbursement. For cases still pending on the October 1 effective date, attorney fee vouchers will include new rates.

State funding for private appellate representation for felony and juvenile appeals will allow for quality representation without relying entirely on local budgets. The 1:1 state match will keep local costs consistent for nearly all circuit courts, however, its success depends on participation from circuit courts and their funding units.

MAACS has requested that every circuit court contact maacsvouchers@sado.org with any questions or concerns regarding the new rates or voucher process. Brad Hall, MAACS administrator, can be reached at bhall@sado.org.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

State offers learning sessions on new Materials Management Planning

Michigan’s Department of Environment, Great Lakes, and Energy (EGLE) has several opportunities to learn more about Materials Management Planning this fall. As you know, counties have been given the opportunity to draft new plans for managing solid waste and recyclables. Please consider participating in one of the following events to ensure your county is well prepared for the upcoming changes.

Michigan’s Department of Environment, Great Lakes, and Energy (EGLE) has several opportunities to learn more about Materials Management Planning this fall. As you know, counties have been given the opportunity to draft new plans for managing solid waste and recyclables. Please consider participating in one of the following events to ensure your county is well prepared for the upcoming changes.

Oct. 5, 11 a.m.-12 p.m.

Understanding and Preparing for Changes to Part 115: Materials Management Planning

In March 2023, amendments to Part 115 of Michigan’s Solid Waste Law went into effect. These amendments have provided a broader approach to handling end-of-life materials including a new Materials Management Plan (Plan). This webinar will describe how the Plan will consider management of solid waste, recyclables, organics, and other related activities. Learn about new requirements, timelines, resources, and technical assistance opportunities that pertain to the Part 115 updates.

Nov. 14, 11 a.m.-12 p.m.

Tools and Resources to Help Communities Navigate Materials Management

With amendments to Part 115 of Michigan’s Solid Waste Law going into effect earlier this year, now is a great time to learn what tools and resources EGLE offers to communities to assist them with their materials management programs. In this webinar, recycling specialists from EGLE will explain how they are helping Michigan communities navigate the complexities of these program changes. They will also elaborate on available technical assistance and educational services, as well as highlight grant opportunities communities can apply to for help funding successful materials management programs.

The Michigan Recycling Coalition will be hosting in-person meetings at eight different locations to connect regional stakeholders and provide up-to-date recycling program information. These events will run through September and October:

MRC Regional Meetings – Michigan Recycling Coalition (michiganrecycles.org)

Last, but certainly not least, Christina Miller, Materials Management Planning Specialist from EGLE, will be presenting at the Michigan Counties Annual Conference on Oct. 2 Her session will cover new requirements, timelines, roles, and responsibilities, walk through scenarios, tools and resources, technical assistance opportunities and offer a better understanding of planning and its importance overall.

Field set for Board elections at 2023 Annual Conference

Four seats on the MAC Board of Directors will be filled on Oct. 2 at the 2023 Annual Conference.

Four seats on the MAC Board of Directors will be filled on Oct. 2 at the 2023 Annual Conference.

The commissioners who filed for seats in this cycle are:

- Region I, Seat B – Joe Bonovetz, Gogebic County (seeking 3rd term)

- Region II, Seat B – Richard Schmidt, Manistee County (seeking 3rd term)

- Region III, Seat B – Jim Storey, Allegan County (seeking 3rd term)

- At-large, Seat B – Stan Ponstein, Kent County (seeking 3rd term)

Although only one candidate filed for each of the four available seats, regional caucuses must be held, per MAC By-laws, to elect the candidate.

The 16-member Board of Directors governs MAC and sets policies for the association. Board terms are three years long and a commissioner may serve a total of three full terms (or 9 years).

Election procedures

- Only commissioners who register for the Annual Conference may participate in the regional caucuses that fill these seats.

- Regional Board seats are filled by elections in which each COUNTY gets ONE vote. At-large seats are filled with each attending commissioner casting one vote in each caucus; the winning at-large candidate must have majorities in at least four of the six caucuses.

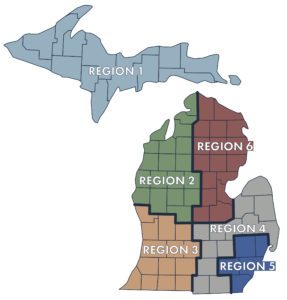

(If you are not sure which Region your county is in, please consult this list.)

To see statements from the candidates, click here.

Staff picks

Staff picks

- The link between housing affordability and transportation (Citizens Research Council)

- Fiscal Brief: Comprehensive Transportation Fund and State Support for Local Public Transportation (House Fiscal Agency)

- Palisades plant secures purchase agreement with Wolverine (The Herald-Palladium)

- China authorities arrest 2 for smashing shortcut through Great Wall with excavator (Associated Press)