Massive federal aid plan wends way through Congress

Two versions of a massive federal response to the ongoing COVID crisis are now in play on Capitol Hill. Passage of either version would mean hundreds of millions of dollars for Michigan counties.

Two versions of a massive federal response to the ongoing COVID crisis are now in play on Capitol Hill. Passage of either version would mean hundreds of millions of dollars for Michigan counties.

The version passed by the U.S. House, the American Rescue Plan, has an overall price tag of $1.9 trillion and includes $65 billion in direct aid to U.S. counties. Of that amount, Michigan would receive about $1.95 billion. (Click here to see an estimated distribution under the House-backed plan.) Both MAC and the National Association of Counties (NACo) have backed this plan.

Later in the week, however, Senate Democrats released a slightly different version of the aid plan, which would lower the direct aid to all counties to $60 billion, of which $1.8 billion would come to Michigan. (Click here to see an estimated distribution under the Senate plan.)

In each case, the aid moves directly to counties (unlike in prior federal rescue plans), is distributed based on population and goes to all counties, regardless of size. The Senate plan would allocate half the funds upfront, with the other half to be released within one year. The Senate version requires counties to spend the aid by December 2024.

NACo is working to include language that would prevent the states from taking away county money because we will get federal money.

The Senate plan also includes an extra $10 billion for water, sewer and broadband, with each state getting a base of $100 million and the rest distributed based on population, poverty rates and how rural a state is.

The Senate is expected to spend all of Friday on amendments to the spending plan. If the Senate clears the plan, as expected tonight or tomorrow, it will head back to the House next week for final approval.

For more information on this issue, visit NACo’s advocacy center.

State loosens restrictions on public gatherings; MAC gets detailed response on effects for county board meetings

Gov. Gretchen Whitmer announced further loosening of state restrictions on public and economic activity due to the COVID pandemic during a Tuesday afternoon press conference.

Gov. Gretchen Whitmer announced further loosening of state restrictions on public and economic activity due to the COVID pandemic during a Tuesday afternoon press conference.

The orders come from the Michigan Department of Health and Human Services via its responsibilities under the Public Health Code.

“While we continue to have virus very present across the entire state, our improvements in case numbers, test positivity, and vaccinations mean we can move forward with reopening in an incremental way,” said Dr. Joneigh Khaldun, MDHHS chief medical executive and chief deputy for health. “I am glad we continue to make progress, but that progress is fragile. Everyone should continue to do important things like wearing a mask, washing hands, avoiding large gatherings and getting one of the three safe and effective vaccines when it becomes available to you.”

The changes, which take effect today and run through April 19, include:

- Indoor gatherings involving people from different households are allowed to have up to 25 people. (*See note below.)

- Restaurants and bars may have 50% indoor dining capacity, up to 100 people. Tables must still be six feet apart, with a max of six people at a table. A curfew on indoor dining is still in effect, but this order bumps it back from 10 p.m. to 11 p.m.

- Retail shops are allowed to operate at 50% indoor capacity, up from 30%.

- Indoor private residential gatherings are capped at 15 people from three separate households. Outdoor residential gatherings are allowed to have up to 50 people.

- Outdoor gatherings can resume with up to 300 people.

*MAC asked the Governor’s Office if public meetings or board meetings are permitted under this order?

MAC was told: “Yes, up to 25 board members may gather for a meeting. Under Public Act 254 of 2020, public meetings may be conducted virtually for any reason through March 31, 2021.

“The public may also attend the meeting in person subject to all applicable masking and distancing requirements. For public attendance to be permitted beyond 25 persons, the event must be designed to ensure that every person can avoid mingling or engaging in physical contact with persons from outside their household. For example, a reception larger than 25 persons would not be permitted indoors. All meetings covered by the Open Meetings Act – whether conducted virtually or in person – must also comply with Public Act 254 of 2020.”

With that in mind, MAC continues to advise counties to rely on virtual-only or hybrid virtual and in-person meetings to both comply with OMA and adhere to MDHHS orders and MIOSHA rules.

In related COVID news, Crain’s Detroit reported this week that MIOSHA, the state agency that oversees workplace safety and practices, is “very likely” to extend the ban on in-person office work beyond the current expiration date of April 14.

On the vaccination front, the state has updated its access calendar and announced that Michigan residents between the ages of 50 and 64 will be eligible for shots this month.

With all residents at skilled nursing homes having been offered their first dose of COVID-19 vaccine and a vast majority having had their second dose, the Residential Care Facilities Order goes into effect immediately. The order encourages communal dining and group activities for residents and allows indoor and outdoor visitation in all counties regardless of county risk level. Visitation is allowed as long as the facility has not had a new COVID-19 case in the last 14 days and all indoor visitors ages 13 and older are subject to rapid antigen testing.

As always, for the latest county-related news on COVID-19, visit MAC’s Resources Page.

Virtual Legislative Conference set for April 28-29

Dates are now set for the 2021 Michigan Counties Legislative Conference: April 28-29.

Dates are now set for the 2021 Michigan Counties Legislative Conference: April 28-29.

The event will be all virtual and include 12 workshops for MAC members and four for members of the Michigan County Medical Care Facilities Council. Among topics to be addressed are:

- The county apportionment process for drawing commissioner district lines

- Decoding legislative terminology to better understand the work at the State Capitol

- Options for local government finance reform

The conference also will have three plenary sessions for all attendees.

Registration information will be released in coming days. Please keep a watch on your email accounts for notices about the event. You also can check for updates on MAC’s conferences webpage.

Legislature adopts $2.3B COVID aid plan; governor’s response unclear

The Senate and House agreed this week on a plan to spend $2.3 billion to support businesses and help cover their costs incurred over the last year, including a property tax relief program. Additionally, the bill that now moves to Gov. Gretchen Whitmer supports an increase direct care worker hazard pay, vaccine distribution and continued COVID testing funds.

The Senate and House agreed this week on a plan to spend $2.3 billion to support businesses and help cover their costs incurred over the last year, including a property tax relief program. Additionally, the bill that now moves to Gov. Gretchen Whitmer supports an increase direct care worker hazard pay, vaccine distribution and continued COVID testing funds.

In fact, the direct care worker hazard pay adjustment would increase from the current $2 per hour to $2.25 per hour beginning March 1 and running through Sept. 30, 2021.

Another $347.3 million for epidemiology and laboratory capacity contingent funds cannot be spent or distributed unless the governor also signs Senate Bill 1, which limits the effectiveness of an emergency public health order issued by the director of the Department of Health and Human Services (DHHS) to 28 days, unless the Legislature approves an extension.

And the Legislature approved spending of $2 billion of federal education money under House Bill 4048. However, $800 million of that mount is tied to House Bill 4049, which passed 60-50 in the House. That bill stipulates local health departments could close schools for in-person instruction or halt school sports based on specific criteria in the bill. The bill passed without support from the state or local health departments.

It is unclear what the governor’s options are with the language in the legislation that ties funding to limits on the state’s pandemic powers. Gov. Whitmer has also been clear that she wants the full $5 billion of federal money from 2020 allocated, a result that is not reflected in the bills heading to her desk.

Reforms for veterans’ services advance in House

Legislation to improve state law on the delivery of services to Michigan’s more than 600,000 military veterans cleared a House committee this week.

Legislation to improve state law on the delivery of services to Michigan’s more than 600,000 military veterans cleared a House committee this week.

House Bill 4122, by Rep. Annette Glenn (R-Midland) reflects the work of MAC and the Michigan Veteran Affairs Agency (MVAA) to adapt state law to the realities of service delivery to Michigan veterans.

As with many new programs, statutory changes are needed as experience identifies what structures work and what do not. Among the MAC-supported changes in the bill are:

- Allowing grant funds to be expended for direct financial assistance for an emergent relief program (as counties continue to navigate through COVID-19 response, ensuring proper care and resources for our veteran community will remain a priority)

- A 60-day window for the MVAA to distribute the grant, once approved by the county

- A limited reduction in the county maintenance of effort (MOE) requirement to support hard-pressed counties (counties are not able to reduce the funding and supplant the reduction)

- An exemption for the 20 hours per week staffing requirement, if approved by MVAA

- A process for distribution if the state does not award enough for each county’s base amount (this is not expected, but will act as a protection in uncertain times dominated by COVID-19)

HB 4122 cleared the House Committee on Military, Veterans and Homeland Security on March 2 and now heads to the house floor. MAC appreciates the support of committee members in advancing this bill, but that’s just the first step in this process.

Please click on this link to use our P2A platform to send your personalized call to your House members to enact HB 4122 as quickly as possible.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Podcast 83 to discuss Capitol activity over previous week

Podcast 83 to discuss Capitol activity over previous week

The Podcast 83 team will continue its weekly reviews of legislative activity in Lansing and Washington, D.C., on Monday, March 8 at 3 p.m.

Click here to register for the live event, which will include a Q&A session on all of the hot legislative topics.

Members can view any previous episode of the Podcast, sponsored by DTE Energy, on the podcast webpage.

State to issue $5M to counties on marijuana

Counties will receive almost $5 million from revenue collected on marijuana businesses in fiscal year 2020. The state began distributions on Thursday.

Counties will receive almost $5 million from revenue collected on marijuana businesses in fiscal year 2020. The state began distributions on Thursday.

The FY20 amount available per each licensed marijuana retail store and microbusiness is $28,001.32. For FY20, the Michigan Department of Treasury is distributing $4,984,234.96 to counties , plus an additional $4,984,234.96 is to cities, villages and townships.

For more information on this program, click here.

A word of caution on this year’s distribution: The Department of Licensing and Regulatory Affairs did not fund the $20 million for research this year, but will be funding that for the next two years. Additionally, they expect more licenses in FY21 and similar consumption levels, while prices are down about 20 percent. As a result, the distributions on a per store basis may go down for FY21.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Webinar examines intersection of public safety and mental health

A new webinar will “explore interdisciplinary partnership and collaboration efforts from three innovative Michigan communities” in the intersection of public safety and mental health.

A new webinar will “explore interdisciplinary partnership and collaboration efforts from three innovative Michigan communities” in the intersection of public safety and mental health.

The webinar will be held March 26 from 10:30 a.m. to noon.

Amid a global pandemic, the related economic downturn and a renewed focus on racial justice, mental health, and public safety, the intersection of law enforcement and mental health have come to the fore in public discussion and debate. When placed on the shoulders of law enforcement, the list of community needs burdens them with an ever-growing list of expectations from the public – expectations beyond the core responsibilities and capacities of any law enforcement professional.

As we look forward to shared strategies that enhance the capacity to respond to a variety of crisis situations, Michigan communities have developed innovative and effective partnerships between local law enforcement agencies and community mental health systems.

To register for this free event, click here.

For information, contact J. Eric Waddell at jericwaddell@thecardinalgroup2.com.

Staff picks

Staff picks

- The benefits of local revenue diversification persist, even if income taxes cratered with COVID (Citizens Research Council)

- Pandemic reinforces Washington’s need for public health funding (Governing)

- With far fewer houses, Michigan’s real estate market is ‘absolutely crazy’ (Bridge Magazine)

- DNR seeks volunteers to listen for frogs, toads as part of annual survey (MLive)

MAC voiced concerns with sections of the manual used to guide indigent defense policies during a meeting this week of the Michigan Indigent Defense Commission (MIDC).

MAC voiced concerns with sections of the manual used to guide indigent defense policies during a meeting this week of the Michigan Indigent Defense Commission (MIDC). MAC’s 2021 Membership Directory will be mailed next week to all commissioners, administrators and county board offices across Michigan. The 2021 edition carries full listings of elected officials for all 83 counties and detailed information about MAC services and the Michigan Legislature in its 150 pages. MAC also will deliver copies to each legislative office, so lawmakers are reminded of the central role counties play in the delivery of local public services.

MAC’s 2021 Membership Directory will be mailed next week to all commissioners, administrators and county board offices across Michigan. The 2021 edition carries full listings of elected officials for all 83 counties and detailed information about MAC services and the Michigan Legislature in its 150 pages. MAC also will deliver copies to each legislative office, so lawmakers are reminded of the central role counties play in the delivery of local public services. Renee Beniak, executive director of the Michigan County Medical Care Facilities Council (MCMCFC), joined other health leaders on Wednesday to testify on nursing home visitation policies before the House Health Policy Committee at the invitation of Rep. Bronna Kahle (R-Lenawee), chair of the committee.

Renee Beniak, executive director of the Michigan County Medical Care Facilities Council (MCMCFC), joined other health leaders on Wednesday to testify on nursing home visitation policies before the House Health Policy Committee at the invitation of Rep. Bronna Kahle (R-Lenawee), chair of the committee. Members of Michigan’s new

Members of Michigan’s new  The deadline is March 5 to register for a series of live webinars on managing mental health crises during March.

The deadline is March 5 to register for a series of live webinars on managing mental health crises during March. Gov. Gretchen Whitmer’s fiscal 2022 budget proposal makes important and much needed boosts to local governments dealing with the COVID-19 crisis and to public infrastructure, said MAC’s executive director on Thursday.

Gov. Gretchen Whitmer’s fiscal 2022 budget proposal makes important and much needed boosts to local governments dealing with the COVID-19 crisis and to public infrastructure, said MAC’s executive director on Thursday.

The Michigan Association of Counties and Michigan Association of County Clerks

The Michigan Association of Counties and Michigan Association of County Clerks  Elizabeth Hertel, recently named by Gov. Gretchen Whitmer to lead the state’s mammoth Department of Health and Human Services, will be the guest on a special live episode of Podcast 83 on Tuesday, Feb. 16 at 4:30 p.m.

Elizabeth Hertel, recently named by Gov. Gretchen Whitmer to lead the state’s mammoth Department of Health and Human Services, will be the guest on a special live episode of Podcast 83 on Tuesday, Feb. 16 at 4:30 p.m. A bill to give tax breaks to firms installing new broadband equipment in Michigan cleared the Senate Committee on Energy and Technology this week, despite ongoing MAC opposition.

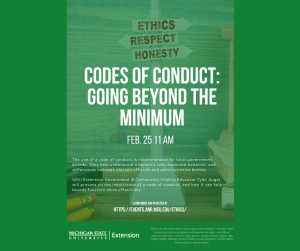

A bill to give tax breaks to firms installing new broadband equipment in Michigan cleared the Senate Committee on Energy and Technology this week, despite ongoing MAC opposition. Webinar focuses on board member conduct

Webinar focuses on board member conduct The Michigan Department of Treasury and MSU Extension are excited to announce our next Fiscally Ready Communities training webinar titled, “Financial Best Practices.” This 90-minute webinar will take place at 10 a.m. on Thursday, March 25, 2021.

The Michigan Department of Treasury and MSU Extension are excited to announce our next Fiscally Ready Communities training webinar titled, “Financial Best Practices.” This 90-minute webinar will take place at 10 a.m. on Thursday, March 25, 2021.