Legislative Update 12-18-20

Legislature approves ‘no reason’ virtual sessions until March 31, 2021

The Legislature voted to extend the ability for local boards to meet remotely, under any circumstance, through March 31, 2021. Senate Bill 1246, by Sen. Lana Theis (R-Livingston), would maintain the ability for a board to meet remotely past March 31 if a local emergency is declared pursuant to the Emergency Management Act or by a local ordinance. The ability for local declarations to serve as a means for remote meetings still expires Dec. 31, 2021. (Please see the local emergency declaration template provided by Cohl, Stoker and Toskey.)

The Legislature voted to extend the ability for local boards to meet remotely, under any circumstance, through March 31, 2021. Senate Bill 1246, by Sen. Lana Theis (R-Livingston), would maintain the ability for a board to meet remotely past March 31 if a local emergency is declared pursuant to the Emergency Management Act or by a local ordinance. The ability for local declarations to serve as a means for remote meetings still expires Dec. 31, 2021. (Please see the local emergency declaration template provided by Cohl, Stoker and Toskey.)

The bill also clarifies that if a public body meets in person before April 1, 2021, the body must, to the extent feasible, abide by social distancing and mitigation measures recommended by the Centers for Disease Control and Prevention. Any public body that meets in person must have adopted cleaning standards to limit any exposure to COVID-19.

MAC has received questions about announcing locations of local board meetings. That is still required under the law. Each board member that is meeting remotely must announce the county, city, village or township and state from which you are attending.

The bill now goes to the governor, who is expected to sign it into law before the end of the year.

For questions, contact Meghann Keit at keit@micounties.org.

State extends health orders to Jan. 15, 2021

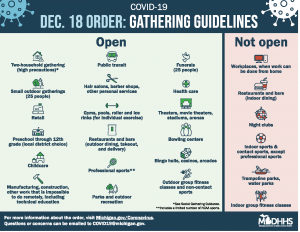

Revised public health orders announced Friday loosen some restrictions on public activity while extending the state’s COVID-19 response to Jan. 15, 2021.

Revised public health orders announced Friday loosen some restrictions on public activity while extending the state’s COVID-19 response to Jan. 15, 2021.

The new orders go into effect Dec. 21 and replace the ones instituted on Dec. 7.

Everything from high schools to casinos could offer in-person services under the revisions but indoor dining, nightclubs and indoor sports are still banned by order of the Michigan Department of Health and Human Services.

The state’s chief medical executive, Dr. Joneigh Khaldun, said cases in Michigan are still six times higher than they were at the start of September, but the figures are trending in the right direction.

- Dec. 18 – Gatherings and Face Mask Order

- Dec. 18 Epidemic Order Key Metrics

- Dec. 18 Epidemic Order Infographic

- Dec. 18 Epidemic Capacity Limits Fact Sheet

- Dec. 18 Epidemic Outdoor Seating Enclosures

For the latest coronavirus news affecting counties, visit MAC’s Resources Page.

Legislature fails to act on 4-year terms for commissioners

Among items that officially died in the lame duck session was the MAC-led legislation to increase county commissioner terms to four years from the current two. Despite numerous last-ditch efforts to get Senate Bills 504-505, by Sen. Ed McBroom (R- Dickinson), moved out of the Senate Local Government Committee to give it a chance this month, the bills were never taken up by Chairman Dale Zorn (R-Monroe).

Among items that officially died in the lame duck session was the MAC-led legislation to increase county commissioner terms to four years from the current two. Despite numerous last-ditch efforts to get Senate Bills 504-505, by Sen. Ed McBroom (R- Dickinson), moved out of the Senate Local Government Committee to give it a chance this month, the bills were never taken up by Chairman Dale Zorn (R-Monroe).

The House versions of the legislation never made it past the House Ways and Means Committee after union opposition led to debate over which election cycle the term would fall on: presidential or gubernatorial. As this issue got lost in politics, MAC tried to overcome the arguments, but, in the end, it was not enough to get it done before the close of the 2019-20 session.

MAC greatly appreciates all efforts by our members to reach out to legislators, respond to action alerts and stress the importance of this legislation. We certainly expect to bring this back up early in 2021. With a growing number of former county commissioners represented in the Legislature, and on both sides of the aisle, MAC is hopeful for progress next year.

Bills spurred by county-state jail task force about to become law

Executive Director Steve Currie discusses county participation in a partnership with the state and Pew at an event in Lansing on April 17, 2019, as (left to right) Gov. Gretchen Whitmer, Lt. Gov. Garlin Gilchrist, Chief Justice Bridget Mary McCormack and Attorney General Dana Nessel look on.

After months of input from around the state and legislative work from the Joint Task Force on Jail and Pretrial Incarceration, a huge package of bills stemming from the task force recommendations goes to the governor’s desk for final approval.

In the late days of lame duck session, Senate Bills 1046-51 were approved, with last minute changes to safeguard victim protections and address the concerns of the Michigan Coalition to End Domestic and Sexual Violence.

House Bills 5844 and 5854-57 also garnered unanimous support from both chambers, to eliminate mandatory minimum jail sentences for certain offenses.

The various bills eliminating license suspension for violations of the law unrelated to dangerous driving were also overwhelmingly approved.

MAC largely supported all these measures but was neutral on SBs 1046 and 1048. All the bills will go before the governor, who is expected to sign them.

While several task force recommendations will become law, MAC still supports further legislative efforts to act on recommendations pertaining to behavioral health in our jails. State support for mental health diversion, screening tools and increased financial resources is greatly needed to serve this jail population.

For more information on this issue, contact Meghann Keit at keit@micounities.org.

Tax foreclosure bills sent to the governor

MAC-supported bills to address a court decision that upended the tax foreclosure system on property in Michigan were approved by the Legislature this week.

MAC-supported bills to address a court decision that upended the tax foreclosure system on property in Michigan were approved by the Legislature this week.

In July, the Michigan Supreme Court, in Rafaeli, LLC v Oakland County, ruled the surplus proceeds from the sale of foreclosed property lawfully belong to the former property owner, not to the foreclosing governmental unit.

In response, Sens. Jim Runestad (R-Oakland) and Pete Lucido (R-Macomb) have been working on Senate Bills 1137 and 676 to create a statutory process by which county treasurers can comply with the decision. The two bills, supported by MAC, the Michigan Association of County Treasurers and other local government groups, establish a new process of notification, allowable expenses, fair disposition of property and the method by which former owners may claim surplus proceeds. Such proceeds are subject to reimbursement first to the foreclosing governmental unit for deposit into the delinquent tax revolving fund and for reimbursement of costs associated with the foreclosure process. Claims by a former owner would have to be evaluated by a circuit court before proceeds would be disbursed to them.

Unfortunately, there are situations when the property will sell for less than the taxes owed. In such a case, counties can charge back those losses to other local units with interest. But there could be losses that exceed the amount counties can charge back. Where that money will come from is unclear since the bills provide no provision for financial relief in those cases.

Tracking these chargebacks and losses was included in the final version of the bills, however, so future evaluations of the financial harm to local governments can be ascertained.

The bills now head to the governor, who is expected to sign them.

Next year, MAC will pursue legislation granting counties the ability to relinquish their foreclosing governmental unit responsibilities to the state, should they so choose. At present, the state acts as the foreclosing governmental unit in seven Michigan counties.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Commission rejects Wayne’s request for construction costs

At its last meeting of 2020 this week, the Michigan Indigent Defense Commission (MIDC) approved a final set of local proposals for spending plans to defend indigent residents accused of crimes.

At its last meeting of 2020 this week, the Michigan Indigent Defense Commission (MIDC) approved a final set of local proposals for spending plans to defend indigent residents accused of crimes.

Prior to the session, the commission had approved plans for 110 of 120 systems, many of which have already received their initial grant distribution. MAC worked diligently with the MIDC to ensure grant contracts and funds were distributed as quickly and efficiently as possible.

At this week’s session, counties that gained full approval included Alger, Kalamazoo and Roscommon.

But the largest system in the state, Wayne County, generated a great deal of debate. Wayne County General Counsel James Heath urged the commission to give full support for the plan, arguing the request for MIDC grant money cover about $5 million for new construction at the criminal justice complex helps Wayne comply with standards requiring confidential meeting space.

MIDC staff, however, recommended a conditional approval with everything except the $5 million. Commissioner Jim Fisher moved to adopt the staff recommendation, while Commissioner Andrew DeLeeuw (Washtenaw County) offered an amendment to also approve the new construction. DeLeeuw, supported by Commissioner Margaret McAvoy (Isabella County), argued the spending was easily justifiable per statute and standard 2 and the state is responsible for funding compliance with the standards beyond the local share. Commissioner Tom McMillan asked if the approval of the $5 million would put the MIDC over its budget for FY21, necessitating a request for a supplemental outlay from the Legislature. Executive Director Loren Khogali assured the commission there would be enough in their current budget and they would not need to seek additional funds.

The amendment by DeLeeuw was rejected. The staff recommendation to conditionally approve Wayne’s plan without the new construction costs was approved. The commission meets again on Feb. 23, 2021. (See the agenda.)

For questions, please contact Meghann Keit at keit@micounties.com

Solar energy PILT bills headed to governor

Legislation to exempt solar equipment f rom ad valorem property taxes and replace the levy with a payment in lieu of taxes (PILT) system cleared the Legislature this week. Although a PILT system, as opposed to a valuation and depreciation model, has its merits, MAC is opposed to the bills and has urged the governor to reject the legislation so the policy discussion can resume in 2021 on a system that addresses some key points.

rom ad valorem property taxes and replace the levy with a payment in lieu of taxes (PILT) system cleared the Legislature this week. Although a PILT system, as opposed to a valuation and depreciation model, has its merits, MAC is opposed to the bills and has urged the governor to reject the legislation so the policy discussion can resume in 2021 on a system that addresses some key points.

The legislation before Gov. Gretchen Whitmer would cap the reimbursements to local governments at $4,000 per megawatt of nameplate alternating current capacity (what they are capable of generating, not what they actually generate). This statutorily mandated payment level has not been fully vetted and evaluated by the State Tax Commission or the Department of Treasury to determine whether this is a fair value and reimbursement rate for each taxing jurisdiction. Also, MAC favors legislation that ensures local governments will not be forced to accept solar developments; that ensures the PILT payments will be collectable throughout the duration of the agreement; that ensures the equipment will be removed from the site once operations cease; and that includes language to clarify the real property on which the solar development is located is still subject to real property tax.

The bills now go to the governor for her consideration.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Extension of poverty-based tax exemptions on homes passes

Senate Bill 1234, a measure by Sen. Jim Runestad (R-Oakland) to allow local assessing units to extend a poverty-based tax exemption for a primary residence that was originally granted in 2019 or 2020 for three years, cleared the Legislature this week with unanimous support. The bill now goes to the governor for her signature.

Full and partial exemptions may be granted and continued. The bill also allows, for three years, poverty-based exemptions granted in 2021, 2022 and 2023 to be granted for three years if the owner of the principal residence is on a fixed income such as Social Security or a pension. Again, the local assessing unit can grant full or partial exemptions based on stated criteria.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Bill for property tax penalties and interest waiver gets legislative OK

For the better part of 2020, the House and the Senate have been working on a bill to forgive the penalties and interest for those who could not afford to make their summer property tax payments.

For the better part of 2020, the House and the Senate have been working on a bill to forgive the penalties and interest for those who could not afford to make their summer property tax payments.

Senate Bill 943, by Sen. Peter MacGregor (R-Kent), was thought dead for the better half of 2020, however, due to the inability of stakeholders to reach a consensus on how to pay for the anticipated costs of forgiving taxes, penalties and interest. But the Senate scaled back the proposal to qualifying businesses in the restaurant, bar, gym and entertainment industries and the bill moved through the Legislature.

If signed by the governor, forgiveness of the penalties and interest for unpaid summer property taxes will be on a first come, first served basis, based on the level of appropriation dedicated to the program. It will be up to the Department of Treasury to take applications, grant deferments of summer taxes through Feb. 15, 2021, and to reimburse local governments for their losses in penalties and interest. The bill does not provide exemption from the taxes, nor does it provide any relief for residential customers or those businesses who have already paid their summer taxes.

MAC is supportive of the revised version of SB 943.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Legislature backs tax exemption for automation tech

Final legislative approval was given this week to Senate Bills 1149-1150 and 1153, which would give sales, use and Personal Property Tax (PPT) exemptions to large retailers who are installing and utilizing automation equipment to assist with their distribution systems.

Final legislative approval was given this week to Senate Bills 1149-1150 and 1153, which would give sales, use and Personal Property Tax (PPT) exemptions to large retailers who are installing and utilizing automation equipment to assist with their distribution systems.

Advocates argue the property they are seeking to exempt is industrial in nature and the same types of exemptions enjoyed by those same types of companies located in renaissance zones. They also claim the automation equipment does not reduce jobs because these employees are redeployed into other areas of their company or they retire.

MAC disagrees with those claims and opposes the bills.

The sales and use tax exemptions are one-time hits to the state’s General Fund and School Aid Fund, but the PPT exemptions are annual losses of revenue to local units of government. The bills do not provide any replacement revenue for local governments. This is a yet another example of the Legislature passing bills that affect local government without any attempt to reimburse locals for the lost revenue.

The bills now head to the governor. MAC has urged her to reject them and is optimistic she will do so.

For more information on this issue, please contact Deena Bosworth at bosworth@micounties.org.

State creates Vaccine Dashboard to track access

The Michigan Department of Health and Human Services (MDHHS) has updated information in its priority groups for vaccination administration document and launched a COVID-19 Vaccine Dashboard to help Michiganders track information about the vaccine across the state, the department announced in a statement.

The Michigan Department of Health and Human Services (MDHHS) has updated information in its priority groups for vaccination administration document and launched a COVID-19 Vaccine Dashboard to help Michiganders track information about the vaccine across the state, the department announced in a statement.

“MDHHS expanded its guidance to allow Michiganders 16 years of age and older to receive the vaccine and also provided updated information on pregnant women and the vaccine. While there is not currently data on the safety and efficacy of Pfizer’s COVID-19 vaccine in pregnant women, the Centers for Disease Control and Prevention has recommended that pregnant women may be offered the vaccine within the priority groups upon consultation with their medical provider.

“The COVID-19 Vaccine Dashboard includes data from the Michigan Care Improvement Registry on the number of providers enrolled to provide the vaccine, the amount of vaccine received and doses administered. The dashboard will be expanded over the coming weeks to include vaccination coverage rates by age and race.

“MDHHS is following the Centers for Disease Control and Prevention recommendations for prioritization of distribution and administration of COVID-19 vaccines. CDC recommendations are based on input from the Advisory Committee on Immunization Practices (ACIP). ACIP is a federal advisory committee made up of medical and public health experts who develop recommendations on the use of vaccines in the United States. MDHHS has also obtained input from a stakeholder group of Michigan public health and health care leaders and reviewed correspondence from the public.

- Phase 1A includes paid and unpaid persons serving in health care settings who have direct or indirect exposure to patients or infectious materials and are unable to work from home, as well as residents of long-term care facilities.

- Phase 1B includes some workers in essential and critical industries, including workers with unique skill sets such as non-hospital or non-public health laboratories and mortuary services.

- Phase 1C includes individuals age 16 years or older who are at high risk for severe COVID-19 illness due to underlying medical conditions, and people 65 years and older.

- Phase 2 is a mass vaccination campaign for all individuals aged 16 years or older.

“MDHHS has provided additional prioritization guidance within these categories. It is important to note that vaccination in one phase may not be complete before vaccination in another phase begins. Vaccination in these phases will likely overlap. The timing of the start of vaccination in a phase is dependent on guidance from CDC and ACIP, the supply of vaccine from the manufacturer, how vaccine is allocated from the federal level to Michigan and the capacity to administer the vaccine to populations.

“Vaccine distribution will roll out over a series of weeks, and current estimates are that by late spring 2021 enough vaccine will be available for everyone who is recommended to receive it. There will be no out-of-pocket costs to individuals for the vaccine, however, healthcare providers may bill insurance for administrative costs. The COVID-19 vaccine will require two doses, separated by three or four weeks depending on the manufacturer. Michiganders should receive both doses in order to have full protection from the virus. Individuals who receive the vaccine may experience mild side effects such as low-grade fever, sore arm and fatigue, which indicate that the vaccine is working. There is a robust state and national process for tracking vaccines and reporting side effects.

“MDHHS stresses Michiganders should continue to wear masks, social distance from those not in their household and wash their hands often, even after receiving the vaccine.”

Legislature advances variety of nursing regulatory measures

Bills that the Michigan County Medical Care Facilities Council (MMCFC) has been tracking for many months cleared the Legislature this week. Senate Bill 77, by Sen. Jim Runestad (R-Oakland) would require a nursing home to allow a resident or their representative to monitor the resident using an electronic monitoring device. Under the bill, the Department of Licensing and Regulatory Affairs (LARA) could promulgate rules, in consultation with the long-term care ombudsman program, to establish procedures for residents to request a camera and requirements for when the camera must be turned off or blocked to protect residents’ privacy.

Bills that the Michigan County Medical Care Facilities Council (MMCFC) has been tracking for many months cleared the Legislature this week. Senate Bill 77, by Sen. Jim Runestad (R-Oakland) would require a nursing home to allow a resident or their representative to monitor the resident using an electronic monitoring device. Under the bill, the Department of Licensing and Regulatory Affairs (LARA) could promulgate rules, in consultation with the long-term care ombudsman program, to establish procedures for residents to request a camera and requirements for when the camera must be turned off or blocked to protect residents’ privacy.

The House amended the bill on the floor, however, so that audio recordings are disallowed. After the Senate agreed to the new version, the bill heads to the governor’s desk for review.

House Bill 4098, by Rep. Ben Frederick (R-Shiawassee), passed the Legislature this week as well and now goes to the governor. It would create a medication aide training and permit program that will undoubtedly enhance resident safety and help address the workforce issues all facilities are facing. The legislation closely mirrors the statutory framework in place for a certified nurse aide (CNA), and would allow a CNA to complete additional education and testing to become a medication aide. Responsibilities of medication aides are limited in scope and the aide would not be allowed to administer controlled substances, medications in injectable forms or the initial administration of medications. This additional support to nursing staff would help with routine care.

Union groups have opposed this, leading to a partisan divide. It is not certain if the governor will approve or reject this bill. MCMCFC sent an alert to MCF administrators to urge enactment of this bill.

Lastly, extending health provider immunity was passed to ensure protections from March 29 through July 13, 2020, and from Oct. 30, 2020, through Feb. 13, 2021. Similar to the recently passed “Pandemic Health Care Immunity Act,” Senate Bill 1185, by Sen. Curt VanderWall (R-Mason), would extend COVID-19 liability protections for most health care facilities, including MCFs, to psychiatric hospitals, psychiatric units, and nursing home care and recovery centers. The bill now heads to the governor’s desk.

Barry County’s Parker passes

Barry County Commissioner Dan Parker died Dec. 11 after contracting COVID-19

Barry County Commissioner Dan Parker died Dec. 11 after contracting COVID-19

According to a report from WOODTV in Grand Rapids, “Fellow Commissioner Ben Geiger said Parker had just been elected Thornapple Township Supervisor. Geiger said Parker owned a publishing business and held public service positions in Thornapple Kellogg Schools and the village of Middleville.

‘Our hearts are broken in losing Dan Parker,’ Geiger said in a Monday statement. ‘But he wouldn’t want us to be sad. He would want us to find peace.’”

Heather Wing, chair of the Barry County Board of Commissioners, said, “It was such an honor to have been able to work with Dan Parker. He was perpetually looking for the compromise to settle uncomfortable situations for a win for both sides. He was passionate about Barry County and promoted every aspect of our great resources. Dan was one of a kind and his legacy will be difficult to duplicate.”

Parker first served on the Barry board from Jan. 1, 2011, to Dec. 31, 2012. He rejoined the board on Jan. 1, 2017.

Double-check your PPT reimbursement calculations

Counties now can contest state calculations on FY20 Personal Property Tax reimbursements until March 31, 2021.

Counties now can contest state calculations on FY20 Personal Property Tax reimbursements until March 31, 2021.

In a memo sent to County Equalization Directors, the department instructs counties to double-check their reimbursement amounts and the calculations used to determine those amounts. If any errors are found, counties are to fill out form 5651 and submit to the department by March 31, 2021.

For questions, contact the revenue sharing and grants division of the Michigan Department of Treasury at TreasORTAPPT@michigan.gov or 517-335-7484.

Mental health trainings resume in early January

A new set of free “Managing Mental Health Crisis” sessions will begin in early January. County officials have until Jan. 5, 2021, to register for:

A new set of free “Managing Mental Health Crisis” sessions will begin in early January. County officials have until Jan. 5, 2021, to register for:

- Jan. 6, 2021 – Mental Health Stigma, Mental Health Illness & Violence, Mental Illness and Disorders

- Jan. 7, 2021 – Michigan Mental Health Code, De-Escalation, Mood Disorders

- Jan. 13, 2021 – Trauma, Psychotic Disorders, Personality Disorders and Youth Interactions

- Jan. 14, 2021 – Substance Use Disorder, Medications, Alzheimer’s, Neurodevelopmental Disorders, Excited Delirium, Recovery

Managing Mental Health Crisis is designed specifically for Michigan law enforcement, public safety and community mental health responders. Funded by the Michigan Department of Health and Human Services, it is endorsed by the state’s Diversion Council, is approved by MCOLES and meets with MCOLES recommended annual officer trainings

For questions, contact J. Eric Waddell at jericwaddell@thecardinalgroup2.com.