Legislative Update 5-15-20

Revenue meeting paints bleak outlook for Michigan into 2022

The state has a $3.2 billion hole in its current budgets, public finance experts testified today before the state’s Consensus Revenue Estimating Conference. The conference is used to set revenue targets for elected officials each year. Of that gap, $2 billion is in the state’s roughly $11 billion General Fund, which finances a wide variety of services that counties are mandated to provide.

The state has a $3.2 billion hole in its current budgets, public finance experts testified today before the state’s Consensus Revenue Estimating Conference. The conference is used to set revenue targets for elected officials each year. Of that gap, $2 billion is in the state’s roughly $11 billion General Fund, which finances a wide variety of services that counties are mandated to provide.

The outlook for FY21 is little better, with the experts seeing another $3 billion combined revenue drop for the General Fund and School Aid Fund. For FY22, which begins Oct. 1, 2021, the shortfall should be $2 billion.

Data and conclusions provided Friday by the University of Michigan, the Center for Automotive Research, the House and Senate Fiscal Agencies, the Michigan Department of Treasury and the State Budget Office included:

- 22% of the state’s population is unemployed; and that level will persist through the end of June 2020

- The state’s payroll tax revenue will be down 9% for FY20

- One in seven businesses across Michigan will close, resulting in the loss of about 4.9% of jobs in the state

- Light vehicle sales will be down 50% compared to last year, but should rebound to 2019 levels in 2021

With only four months left in the current fiscal year, serious decisions about cuts to the programs, services and departments supported by the state’s General Fund are imminent. Of the $3.2 billion FY20 shortfall, about $2 billion is in the General Fund. And the $1.2 billion gap in the School Aid Fund will put additional pressure on lawmakers to find more savings in the General Fund.

Restoring a balanced state budget, as required by law, can happen via a negative supplemental appropriations bill advanced by the Legislature or an executive order from the governor, which only would need approval by the House and Senate Appropriations committees, not the full chambers. The specifics of cuts, and the mechanism to enact them, are not yet apparent.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Supplemental could provide $1,000 per first responder

Public safety workers could get $1,000 payments under the terms of Senate Bill 690, sponsored by Appropriations Chairman Jim Stamas (R-Midland), which was unanimously approved by the Senate this week.

Public safety workers could get $1,000 payments under the terms of Senate Bill 690, sponsored by Appropriations Chairman Jim Stamas (R-Midland), which was unanimously approved by the Senate this week.

If the bill is also approved by the House and signed by Gov. Gretchen Whitmer in its current form, first responders could get the payments if their local employers agrees to it, thus qualifying for reimbursement via the state dollars.

The bill allocates more than $500 million of the $3.8 billion of federal COVID relief Funding. It includes large support for counties and their front-line workers, including:

- $100 million for up to $1,000 one-time, either lump sum or hourly, bonus payments for local public safety officers (police, fire, EMT, 911 etc.) under the following conditions –

- Requires bonuses be paid by September 30, 2020

- Allows local units until December 31, 2020, to apply for reimbursement through Treasury

- Requires that reimbursements be made on a first-come, first-served basis and that the payment be made no later than 45 days after all required information is submitted

- Sets a maximum award of $5 million to any city, township, village, or county

- $178M in temporary pay increase for direct care workers as follows –

- Those already receiving $2/hour under the governor’s order would receive $1 more for $3/hour total

- Nursing home workers added to receive $3/hour increase (this includes county medical care facilities)

- Eligibility would be until Sept. 30 and retroactive to April 1

- $62 million for PPE and testing needs for:

- Meat plants and other agricultural processing centers

- Nursing homes and other long-term care facilities

- Other entities included in DHHS prioritization guidance

- $125 million in financial help for childcare providers and impacted families

- $11 million in funding for UIA to hire 300 temporary workers to handle unemployment claims

- $2.5 million to the Replenish Hospitality Employee Fund to help restaurant workers adversely impacted by closures

House committee advances trial court funding bill

Statutory authority extending the ability for Michigan’s trial courts to levy fees, is one step closer to the governor’s desk. This week, the House Judiciary Committee unanimously approved House Bill 5488, by Rep. Sarah Lightner (R-Jackson), thereby keeping court funding stable until long-term reforms can be enacted.

Statutory authority extending the ability for Michigan’s trial courts to levy fees, is one step closer to the governor’s desk. This week, the House Judiciary Committee unanimously approved House Bill 5488, by Rep. Sarah Lightner (R-Jackson), thereby keeping court funding stable until long-term reforms can be enacted.

The bill originally extended the authority until October of 2023, but after some committee members expressed concerned with the three-year extension, the bill was amended for a two-year extension. MAC supports this change and encourages the Legislature to continue swift action to ensure a long-term funding solution for our courts.

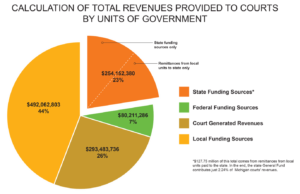

The state’s Trial Court Funding Commission said court costs “directly account for as high as $291 million annually in support (most of the 26.2 percent generated). Additionally, approximately $127 million of the annual funds transferred from the State originate from court assessments at sentencing. When totaled, Michigan trial courts are supported, in significant part, by over $418 million assessed to criminal defendants.”

The Commission also reported “findings from the survey of local funding units show that the total cost of Michigan’s court system (outside of the supreme court and court of appeals) amounts to between $1.14 billion and $1.44 billion.” Of the total amount, the percentage of local court operations expenses covered by state general fund is 2.24%. The report calls for a rebalancing of state and local funds and makes recommendations for the Legislature to consider for a stable court funding system.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Governor extends deadlines on property tax disputes

A Board of Review now has until July 21, 2020, to hear property tax disputes under a new order (Executive Order 87) issued by Gov. Gretchen Whitmer Thursday night.

The order also directs that Board of Review decisions are due by Sept. 1, 2020. Further, EO 87 pushes back the deadline for commercial and industrial real and personal property tax disputes from May 31, 2020, to July 31, 2020.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org

Skilled nursing facilities move into Lansing focus this week

Senate Bill 899, by Sen. Michael McDonald (R-Macomb), which would provide immunity for certain health care workers from civil or criminal liability during the declared COVID-19 state of emergency, or through Sept. 30, 2020, whichever is later, was debated before the House Judiciary Committee this week.

Senate Bill 899, by Sen. Michael McDonald (R-Macomb), which would provide immunity for certain health care workers from civil or criminal liability during the declared COVID-19 state of emergency, or through Sept. 30, 2020, whichever is later, was debated before the House Judiciary Committee this week.

The bill already has passed on party lines in the Senate and many Democratic members of the House committee questioned whether a bill to codify legal protections for hospitals treating new coronavirus patients would protect workers as much as it aimed to protect the hospitals themselves from potential lawsuits. The bill is supported by hospitals and doctors but is opposed by union groups representing hospital staff.

The bill is expected to come before the committee for a vote next week, but uncertain if there will be any changes at this point.

Also this week, the Senate Oversight Committee met regarding the governor’s executive order related to nursing homes (EO 50). Committee members focused on the operation of regional hubs created in the order and questioned Department of Health and Human Services Director Robert Gordon and other senior officials at DHHS. A full video of the committee hearing can be found here.

The governor did re-issue orders, rescinding EO 50 and 51, and extending “capacity for disaster relief child care services for essential workforce” and “protecting residents and staff in long-term care facilities.” The new versions are:

- EO 83 – child care – re-issued through June 10.

- EO 84 – long-term care facilities – re-issued through May 20

For more information on this issue, contact Meghann Keit at keit@micounties.org.

There’s still time to sign up for next Treasury webinar on May 18

In partnership with the Michigan Association of Counties, Michigan Municipal League and Michigan Townships Association, the Michigan Department of Treasury is pleased to announce the third joint webinar, “COVID-19 Updates and Resources for Local Governments,” at 2 p.m. on Monday, May 18.

In partnership with the Michigan Association of Counties, Michigan Municipal League and Michigan Townships Association, the Michigan Department of Treasury is pleased to announce the third joint webinar, “COVID-19 Updates and Resources for Local Governments,” at 2 p.m. on Monday, May 18.

Topics will include an update after the state of Michigan’s May Michigan Consensus Revenue Estimating Conference, an update from the Michigan Department of Transportation (MDOT) on project timelines and financing and best practices around local government cash and debt management.

Participants can register and submit questions on the webinar’s registration page.

Each webinar is limited to 1,000 attendees. With previous webinars reaching capacity limits, participants are strongly encouraged to register early.

A fourth webinar is tentatively scheduled for Monday, June 8. Additional information and registration details about this June webinar will be sent in the coming weeks.

The state Treasury Department has developed a website with numbered letters, communications and resources regarding COVID-19 information for local governments and school districts. This website was created to ensure that Michigan communities have access to the most up-to-date guidance and will be updated frequently with information and resources as they become available.

Prosecutors group: Governor’s orders valid unless court says otherwise

The Prosecuting Attorneys Association of Michigan (PAAM) – an association consisting of all 83 elected county prosecutors and affiliate member of MAC – issued a statement Wednesday that said Gov. Gretchen Whitmer’s Executive Orders remain in force.

The Prosecuting Attorneys Association of Michigan (PAAM) – an association consisting of all 83 elected county prosecutors and affiliate member of MAC – issued a statement Wednesday that said Gov. Gretchen Whitmer’s Executive Orders remain in force.

In the statement, PAAM acknowledged the legal challenge brought by the State Legislature against Governor Whitmer over her authority to issue Executive Orders but stated that, because no court has issued a ruling, “the Executive Orders are still in force.”

This statement comes after Attorney General Nessel issued similar guidance on May 5 to law enforcement across the state where she found the two orders – Stay Home, Stay Safe Order (2020-70) and Places of Public Accommodation Order (2020-69) – to be valid under the Emergency Powers of the Governor Act and asked local law enforcement agencies to continue their enforcement efforts.

Oral argument was heard today by Court of Claims Judge Cynthia Stephens in Michigan House of Representatives and Michigan Senate v Whitmer, (Case No. 20-000079).

No timeline was set for a decision in the case.

Jail Task Force issues memo on gaining COVID funds

Jail Task Force issues memo on gaining COVID funds

Michigan’s Jail and Pretrial Task Force has released a memo to county and city officials as they consider spending options from Coronavirus Emergency Supplemental Funding through the federal Bureau of Justice. Some counties were eligible for funding directly through the federal government, but the remainder will be funded through the state allocation. The Michigan State Police is the lead agency and will provide more information to MAC members when the application and information are available. Until then, county leaders can begin thinking about innovative ways to use funds, with this memo as a reference point.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Opioid summit information posted to web

Opioid summit information posted to web

The Center for Behavioral Health and Justice at Wayne State University thanks the 360 people who joined us for the first ever Opioid Treatment Ecosystem Community of Practice Summit on May 5, 2020. We have attached a copy of the presentation slides and responses to your questions from the Q&A portion of the event.

Watch the full recording of the event or navigate to a specific section here.

Staff picks

Staff picks

- DOT permits airlines to reduce Essential Air Service flights and still receive partial funding (NACo)

- Five ways to make your virtual meetings more effective (Governing)

- Black light experiment shows how quickly a virus like COVID-19 can spread at a restaurant (CNN)

- How llamas could help with antibody treatments for the coronavirus (BusinessInsider.com)