Legislative Update 9-9-22

Massive reform of county revenue sharing introduced

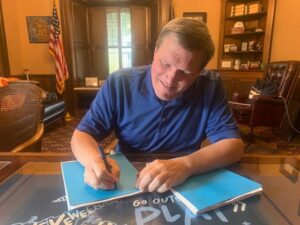

Sen. Wayne Schmidt finalizes paperwork to file legislation for a massive reform of county revenue sharing in Michigan.

Legislation to increase county revenue sharing and protect it from the annual appropriations process is now before the Michigan Legislature.

Introduced by Sen. Wayne Schmidt (R-Grand Traverse), Senate Bills 1160 and 1161 earmark 10 percent of the state’s sales tax for deposit each year into a new “Revenue Sharing Trust Fund.” Money in the fund has to be sent out each year, so the state can’t divert the dollars into its General Fund for other uses.

In addition, the bills require that 50 percent of that 10 percent be distributed to counties, with the other half going to cities, villages and townships in accordance with the distribution methodology in the FY23 budget (except for Emmet County, the last county back in the state revenue sharing formula, which would be treated as if it was a full year).

If enacted, counties could see an increase of at least 43 percent on their current revenue sharing dollars in the first year. Additional increases would be based on the growth of the state’s sales tax.

The bills, developed by MAC in consultation with Schmidt and others, have been referred to the Senate Appropriations Committee.

In the coming weeks, MAC will be sending out a digital advocacy campaign link and additional talking points for counties to use when reaching out to their legislators in support of these bills.

For more information on this issue, contact Deena Bosworth at bosworth@micoounties.org.

Opioids payment notice is out; review your document carefully

Counties will soon receive their first payment from the national Opioid Distributor Settlement. On Sept. 7, the notice regarding Payment 1 of the Opioid Distributor settlement was sent to local governments.

Counties will soon receive their first payment from the national Opioid Distributor Settlement. On Sept. 7, the notice regarding Payment 1 of the Opioid Distributor settlement was sent to local governments.

Please note, however, that this notice reflects only Payment 1 of the Opioid Distributor Settlement and does not include any funds from the Janssen Distributor Settlement. A separate notice will be sent regarding the Janssen funds.

Once counties have received the notice for Payment 1, they must take action as provided in the notice to receive payment as soon as possible.

BrownGreer, the national settlement administrator for both settlements, is responsible for providing notice to counties for settlement payments. This notice is crucial to receiving payment and outlines the Michigan State-Subdivision Agreement, how to receive payment, how to reallocate payment and information regarding the Special Circumstance Fund.

The Special Circumstance Fund provides additional opioid abatement funding to address a special circumstance of the opioid epidemic that was not addressed by the original calculations for local government’s allocation percentage. Counties are eligible to apply to the Special Circumstance Fund by Oct. 28. In addition to applying to the Special Circumstance Fund, counties have the right to dispute the calculation of the payment they will receive within 21 calendar days of receiving their settlement payment notice.

For more information on this issue, contact Samantha Gibson at Gibson@micounties.org.

Solar PILT bills receive Senate hearing

Legislation to create an optional structure for the taxes levied on solar facilities in Michigan received a hearing this week before the Senate Committee on Energy and Technology.

Legislation to create an optional structure for the taxes levied on solar facilities in Michigan received a hearing this week before the Senate Committee on Energy and Technology.

After years of participation on workgroups to ensure local options, a stable funding source, appropriate zoning considerations and adequate local reimbursements, MAC has taken a neutral position on the legislation.

Senate Bills 1106 and 1107, by Sens. Curt VanderWall (R-Mason) and Kevin Daley (R-Lapeer), would allow for the creation of solar energy districts by local municipalities after a mandatory public hearing. Subsequently, solar energy developers could apply for an exemption from local property taxes and instead pay a flat rate of $7,000 per megawatt of nameplate capacity for the proposed solar energy facility, instead of ad valorem property taxes. The payment would be locked in for 20 years and distributed based on the proportions of normal taxes that would have been paid to each taxing unit.

An additional financial incentive would be offered for developers that choose to site their facilities on brownfield properties, in opportunity zones, as a secondary use on already improved real property (i.e., roof tops) or on state-owned property. In such cases, the reimbursement rate would be $2,000 per megawatt of nameplate capacity.

The impetus behind the legislation is twofold. First, this methodology for compensating locals for lost taxes will provide financial predictability for the developers and the locals, hopefully avoiding the same problems we have had with the challenges to the evaluation of wind turbines. Second, the rate and process should serve as incentives for developers to build more renewable energy facilities in the state.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Counties can again apply for rural broadband funds

Applications are now open for another round of funding for rural broadband through U.S. Department of Agriculture’s Rural Utility Service program, ReConnect.

Applications are now open for another round of funding for rural broadband through U.S. Department of Agriculture’s Rural Utility Service program, ReConnect.

Eligible applicants can apply through the Rural Utilities Service portal by clicking here. The application deadline is Nov. 2.

The ReConnect Loan and Grant Program furnishes loans and grants to provide funds for the costs of construction, improvement or acquisition of facilities and equipment needed to provide broadband service in eligible rural areas.

Award funds may be used to pay for the following costs:

- To fund the construction or improvement of facilities required to provide fixed terrestrial broadband service.

- To fund reasonable pre-application expenses.

- To fund the acquisition of an existing system that does not currently provide sufficient access to broadband (eligible for 100 percent loan requests only).

Only projects that USDA determines to be financially feasible and sustainable will be eligible for an award. An eligible project must demonstrate a positive ending cash balance as reflected in the cash flow statement for each year of the forecast period and demonstrate positive cash flow from operations by the end of the forecast period. Eligible projects must also meet at least two of the following requirements: a minimum Times Interest Earned Ratio (TIER) requirement of 1.2, a minimum Debt Service Coverage Ratio (DSCR) requirement of 1.2, and a minimum Current Ratio of 1.2.

For more details on the program, visit www.usda.gov/reconnect.

Staff picks

Staff picks

- State offers webinar series Sept. 12-17 for Wetlands Protection Week (Department of Environment, Great Lakes and Energy)

- Reimagining the government technology workforce (Governing)

- Deciding how to spend billions in opioid settlement payments (RouteFifty)

- Chinese man trapped aloft in hydrogen balloon for 2 days (Associated Press)