Michigan Supreme Court hears challenge to local judges’ ability to collect costs

The Michigan Supreme Court heard arguments this week in Lansing on People v. Johnson, which challenges the state statute allowing judges to impose court costs on convicted defendants.

The Michigan Supreme Court heard arguments this week in Lansing on People v. Johnson, which challenges the state statute allowing judges to impose court costs on convicted defendants.

Critics of state law say it’s unconstitutional for a judge to oversee a criminal case and also have the power to order someone to pay a share of their court’s operations. The attorney for Travis Johnson argued to the court the statute violates due process because it creates a perceived conflict of interest between a judge’s impartiality and the obligation to generate revenue for the court.

In a 2-1 decision in April 2021, the Michigan Court of Appeals affirmed the lower court’s order, holding the relevant statute was not unconstitutional.

In the hearing this week, Justice David Viviano questioned whether judges really feel they must “fundraise” to keep their courts in operation. He noted he did not while serving at the trial level and, because the Legislature is obligated to fund the courts, the judges should not feel pressure to do so. Chief Justice Bridget McCormack suggested whether a legislative fix imposing a specific fine per offense would remedy the problem, to which defense attorneys responded that while it may be better than status quo, their opinion is the main problem of courts generating revenue for their operations would remain in that scenario.

While the court case continues, the statute that allows these court costs is still on track to expire in October.

To deal with this legislative “sunset,” Rep. Sarah Lightner (R-Jackson) introduced House Bill 5956, which extends the sunset until 2025, and HB 5957, which authorizes the State Court Administrative Office to create a formula for local courts’ operational needs and requires the state to fund the amount needed to replace revenue loss due to a court ruling.

The Trial Court Funding Commission outlined this proposal in its recommendations under a scenario in which court costs are eliminated as a source of trial court funding prior to long-term solutions being implemented. The report specifically states, “Funds necessary to meet this shortfall must be appropriated by the Legislature.”

Lightner’s bills, which MAC supports, are before the House Appropriations Committee, chaired by Rep. Thomas Albert (R-Kent).

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

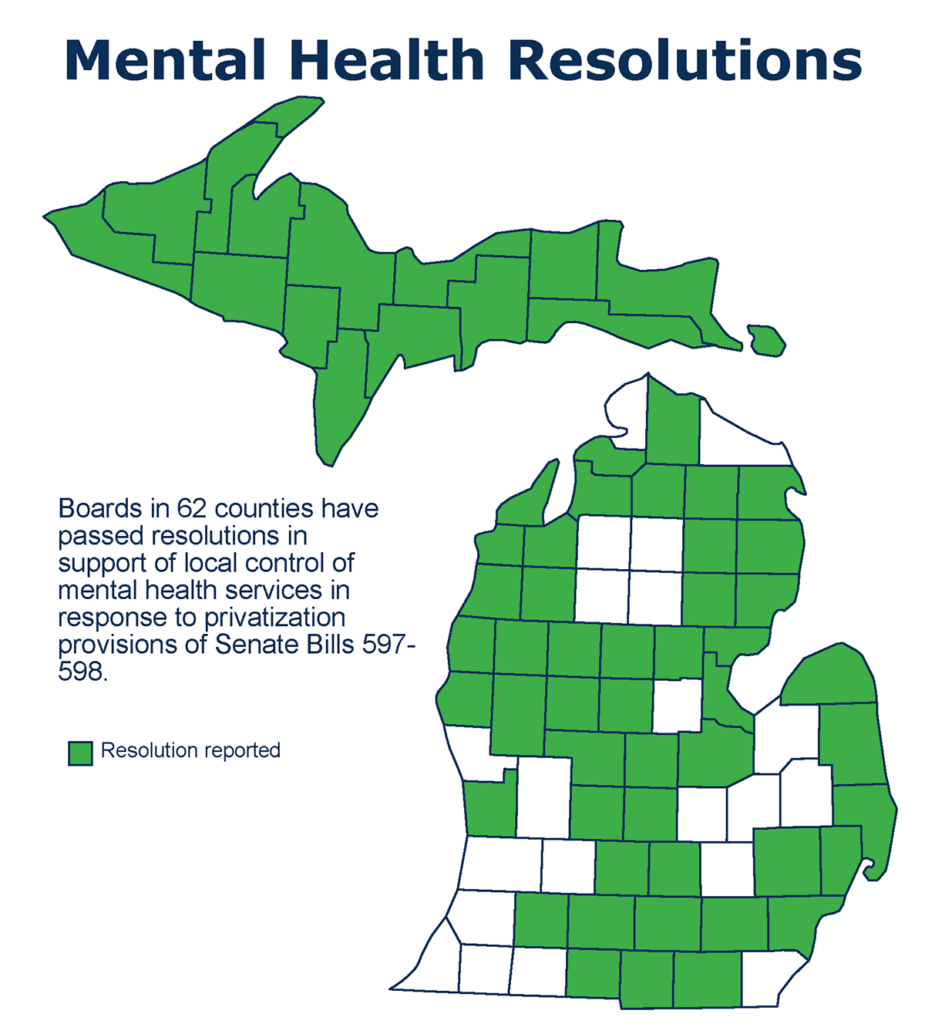

Counties continue to oppose mental health privatization bid

Legislation that eliminates local control and local decision-making in community mental health systems remains under consideration by the Michigan Senate.

Legislation that eliminates local control and local decision-making in community mental health systems remains under consideration by the Michigan Senate.

Senate Bills 597-98, by Senate Majority Leader Shirkey (R-Jackson) and Sen. John Bizon (R-Calhoun), would shift financial administration of Medicaid mental health services to private Medicaid health plans. These bills ultimately take away public accountability and local governance and turn control over to for-profit private insurance companies that do not have a good track record in treating patients with mental health needs.

MAC will continue to oppose any move to shift toward privatization of our local public mental health system. To use MAC’s digital advocacy tool to send a message of opposition to your senator, click here.

To date, the boards of 62 counties have passed resolutions in opposition to the legislation, covering 84.5 percent of House members and 92.2 percent of Senate members. (If your county is not listed below and passes a resolution in opposition, please send it to sweeney@micounties.org.)

- Poll on Mental Health Policies (CMHAM/EPIC-MRA)

- MAC Policy Brief on Senate Bills 597-598

- CMHAM Report Card on Senate Bills 597-598

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Join Podcast 83 team on April 11 for live update

MAC Executive Director Stephan Currie and the Podcast 83 team of Deena Bosworth and Meghann Keit-Corrion will be live on Monday, April 11 to discuss what issues will dominate in Lansing as legislators return from their spring break next week.

MAC Executive Director Stephan Currie and the Podcast 83 team of Deena Bosworth and Meghann Keit-Corrion will be live on Monday, April 11 to discuss what issues will dominate in Lansing as legislators return from their spring break next week.

The update will begin at a new time: 4 p.m. To join the session, just use this Zoom link: https://us02web.zoom.us/j/82867692853.

Viewers will be able to ask questions of the team as well.

If you can’t catch the episode live, a recording will be posted later next week to MAC’s YouTube channel.

And you always can find details about any Podcast 83 episode on the MAC website.

MAC provides option for members to download conference photos

In addition to the regular conference photo gallery for the 2022 Legislative Conference, MAC has created an even larger gallery of photos that can be downloaded in sizes suitable for printing.

In addition to the regular conference photo gallery for the 2022 Legislative Conference, MAC has created an even larger gallery of photos that can be downloaded in sizes suitable for printing.

Link to full photo gallery: https://www.dropbox.com/t/yq8A5pSwJRhrmgTv

Once you open the page, you may scroll down to find your photo and the option to download to your desktop or mobile device.

NACo issues alert about ARP auditing standards

The National Association of Counties issued the following alert regarding audit rules for American Rescue Plan funds:

The National Association of Counties issued the following alert regarding audit rules for American Rescue Plan funds:

“Today, the Office of Management and Budget posted a new alternative, titled Addendum 3, to Single Audit Act requirements for certain ARPA Recovery Fund recipients. Under current guidance, recipients and subrecipients that expend more than $750,000 in federal awards during their fiscal year will be subject to an audit under the Single Audit Act and its implementing regulation at 2 CFR Part 200, Subpart F regarding audit requirements. Addendum 3 changed this requirement for counties that received less than $10 million in Recovery Funds. This will help our rural counties significantly.

“Top 10 things you should know about Addendum 3 to the 2021 Single Audit Compliance Supplement:

- If a county is eligible, you should discuss this with your Auditor

- This is an addendum to the 2021 Single Audit Compliance Supplement and, specifically, the revision is Addendum 3

- Addendum 3 includes a simplified Single Audit process (an “Attestation”) for those direct recipients that are considered exempt from the Single Audit if it was not for the expenditures of SLFRF funds

- This alternative is intended to reduce the burden of a full Single Audit or Program-Specific Audit on eligible recipients and practitioners

- This alternative applies to fiscal year audits beginning after June 30, 2020

- Attestation would result in an auditor’s opinion on compliance which includes an assessment of two activities, specifically “activities allowed” and “unallowed/allowable cost”

- Attestation is optional – any SLFRF direct recipient can decide to perform a Single Audit instead even if they are eligible for attestation

- Eligibility is limited:

- Attestation (instead of SA) eligibility would only apply to direct recipients from Treasury receiving under $10M in total

- Attestation (instead of SA) eligibility would apply to direct recipients only if other Federal award funds the recipient expended are less than $750,000 during the recipient’s fiscal year – not including their SLFRF award funds

- Single Audit would still apply if the recipient spends over $750K in ANY OTHER federal funds

- Uniform Guidance (UG) still applies to ALL expended funds, whether the recipient performs an Attestation or a Single Audit”

For more information on this issue, contact MAC Executive Director Stephan Currie at scurrie@micounties.org.

Take the MGC Challenge by April 29

The Michigan Green Communities Challenge is open through April 29 and is open to all counties.

The Michigan Green Communities Challenge is open through April 29 and is open to all counties.

Participation involves two easy steps:

- Register for an account at: https://migreencommunities.com/register/

- Take the Challenge!

The annual Michigan Green Communities Challenge is a key part of the program and allows participants to track and benchmark their sustainability progress. Communities can log their sustainability actions using the MGC Challenge to achieve bronze, silver or gold recognition. The MGC Challenge should only take a few hours of staff time to complete.

Benefits of participating in the Challenge:

- Have access to peers across Michigan through the MGC Network

- Gain access to technical support, guidance, and examples

- Save money and municipal resources by taking steps to reduce energy and resource use

- Take steps to improve health outcomes for your residents

- Improve air and water quality

- Support your local economy

- Engage your residents in community planning and sustainable actions

If you have questions, you can reach the Michigan Green Communities coordinator, Danielle Beard, at dbeard@migreencommunities.com or MAC’s Hannah Sweeney at sweeney@micounties.org.

MAC is a supporting member of Michigan Green Communities.

Webinar focuses on new ways to think about budgets

The Government Finance Officers Association (GFOA) Rethinking Budgeting Initiative is helping local governments update budget practices to better meet the rapidly changing needs of communities. This initiative is raising new ideas and producing guidance for how local government budget systems can be adapted to changing needs. The initiative explores a wide range of topics related to the budget process including budget planning, fairness in budgeting and how behavioral science impacts budget decisions.

The Government Finance Officers Association (GFOA) Rethinking Budgeting Initiative is helping local governments update budget practices to better meet the rapidly changing needs of communities. This initiative is raising new ideas and producing guidance for how local government budget systems can be adapted to changing needs. The initiative explores a wide range of topics related to the budget process including budget planning, fairness in budgeting and how behavioral science impacts budget decisions.

In this webinar, participants will have a chance to learn more about the concept of fairness in budgeting and discuss how ideas of fairness impact their own budget process and decisions.

Join this free webinar on April 13 from 2 p.m. to 3 p.m. Click here to register.

The webinar link will be sent out following registration. The webinar will be recorded, and the recording will be sent out to everyone who registers.

Staff picks

Staff picks

- State Preemption of Local Authority in Michigan (webinar) (MSU Extension)

- Mojo vision brings new AR contact lenses prototype to the market. What does it do? (Tech Times)

- 1,300 miles of road will be driven in effort to bring broadband to all of Van Buren County (MLive)

- Successful Strategies for Attracting and Retaining Public Employees (RouteFifty)

National County Government Month (NCGM), held each April, is an annual celebration of county government. Since 1991, the National Association of Counties has encouraged counties to actively promote the services and programs they offer. Counties can schedule activities any time during the month. NCGM is an excellent opportunity for your county to highlight effective county programs and raise public awareness and understanding about the various services provided to the community.

National County Government Month (NCGM), held each April, is an annual celebration of county government. Since 1991, the National Association of Counties has encouraged counties to actively promote the services and programs they offer. Counties can schedule activities any time during the month. NCGM is an excellent opportunity for your county to highlight effective county programs and raise public awareness and understanding about the various services provided to the community.

The Michigan Department of Health and Human Services (MDHHS), in partnership with MAC, the Michigan Attorney General’s Office (AG) and others, will launch a webinar series on the Distributor/Janssen Opioid Settlements on Tuesday, April 5 from 3 p.m. to 4 p.m.

The Michigan Department of Health and Human Services (MDHHS), in partnership with MAC, the Michigan Attorney General’s Office (AG) and others, will launch a webinar series on the Distributor/Janssen Opioid Settlements on Tuesday, April 5 from 3 p.m. to 4 p.m. Helping county commissioners operate more effectively in public meetings is the focus of a three-session webinar series sponsored by MSU Extension in May.

Helping county commissioners operate more effectively in public meetings is the focus of a three-session webinar series sponsored by MSU Extension in May. In its blog on March 21, the National Association of Counties (NACo) urged county leaders to fully utilize federal aid for mental health services:

In its blog on March 21, the National Association of Counties (NACo) urged county leaders to fully utilize federal aid for mental health services: The National Association of Counties has announced a deadline extension for its Achievement Awards application process. The new application deadline is Friday, April 15 at 11:59 p.m. (Eastern Time).

The National Association of Counties has announced a deadline extension for its Achievement Awards application process. The new application deadline is Friday, April 15 at 11:59 p.m. (Eastern Time). After weeks of discussion and debate, the Legislature swiftly gave final passage this week to a spending bill that earmarks $4.7 billion for an array of infrastructure priorities and sectors.

After weeks of discussion and debate, the Legislature swiftly gave final passage this week to a spending bill that earmarks $4.7 billion for an array of infrastructure priorities and sectors.

The House Health Policy Committee, chaired by Rep. Bronna Kahle (R-Lenawee), unanimously approved a three-year extension to the county maintenance of effort (MOE) rate for county medical care facilities (MCFs), a key legislative priority for the Michigan County Medical Care Facilities Council (MCMCFC).

The House Health Policy Committee, chaired by Rep. Bronna Kahle (R-Lenawee), unanimously approved a three-year extension to the county maintenance of effort (MOE) rate for county medical care facilities (MCFs), a key legislative priority for the Michigan County Medical Care Facilities Council (MCMCFC). More than $21 million is being sent to 53 counties from fees paid by marijuana businesses in their jurisdictions, the Michigan Treasury announced this week.

More than $21 million is being sent to 53 counties from fees paid by marijuana businesses in their jurisdictions, the Michigan Treasury announced this week. The Michigan Treasury, in partnership with MAC and other local government groups, will hold the 16th joint webinar, “Updates and Resources for Local Governments,” on April 7, 2022.

The Michigan Treasury, in partnership with MAC and other local government groups, will hold the 16th joint webinar, “Updates and Resources for Local Governments,” on April 7, 2022. A MAC-supported legislative package to improve Secondary Road Patrol (SRP) funding via the state liquor tax passed out of the House Government Operations Committee this week.

A MAC-supported legislative package to improve Secondary Road Patrol (SRP) funding via the state liquor tax passed out of the House Government Operations Committee this week. MAC and MCMCFC are wrapping up preparations for the 2022 Michigan Counties Legislative Conference that starts Monday, March 21 in downtown Lansing.

MAC and MCMCFC are wrapping up preparations for the 2022 Michigan Counties Legislative Conference that starts Monday, March 21 in downtown Lansing. Michigan needs to extend the sunset on the current county maintenance of effort (MOE) rate for county medical care facilities (MCFs), so the rate remains capped and predictable, the executive director of the Michigan County Medical Care Facilities Council told legislators this week.

Michigan needs to extend the sunset on the current county maintenance of effort (MOE) rate for county medical care facilities (MCFs), so the rate remains capped and predictable, the executive director of the Michigan County Medical Care Facilities Council told legislators this week. In the latest live episode of Podcast 83 on Monday, March 14, host Deena Bosworth, subbing for Executive Director Stephan Currie, reviewed key county issues in play at the State Capitol with Meghann Keit-Corrion, governmental affairs associate.

In the latest live episode of Podcast 83 on Monday, March 14, host Deena Bosworth, subbing for Executive Director Stephan Currie, reviewed key county issues in play at the State Capitol with Meghann Keit-Corrion, governmental affairs associate. More state investment is vital for local public health, the head of the Michigan Association of Local Public Health (MALPH) told the House Appropriations Subcommittee for the Department of Health and Human Services this week.

More state investment is vital for local public health, the head of the Michigan Association of Local Public Health (MALPH) told the House Appropriations Subcommittee for the Department of Health and Human Services this week. Connect Michigan, a nonprofit working with the state to engage in a comprehensive broadband planning and technology initiative as part of a national effort to map and expand broadband, will host a

Connect Michigan, a nonprofit working with the state to engage in a comprehensive broadband planning and technology initiative as part of a national effort to map and expand broadband, will host a  Please join county elected and appointed officials from across the country in Adams County, Colo., for the National Association of Counties (NACo) 2022 Annual Conference & Exposition. The conference is the premier national opportunity for counties to exchange cutting-edge practices, elect the association’s leadership and shape NACo’s federal policy agenda for the year ahead.

Please join county elected and appointed officials from across the country in Adams County, Colo., for the National Association of Counties (NACo) 2022 Annual Conference & Exposition. The conference is the premier national opportunity for counties to exchange cutting-edge practices, elect the association’s leadership and shape NACo’s federal policy agenda for the year ahead. County officials have through March 15 to register for the 2022 Michigan Counties Legislative Conference in Lansing. While on-site registrations will be accepted starting on day 1 of the conference, March 21, the member fee will rise to $435, as compared to the early-bird rate of $395.

County officials have through March 15 to register for the 2022 Michigan Counties Legislative Conference in Lansing. While on-site registrations will be accepted starting on day 1 of the conference, March 21, the member fee will rise to $435, as compared to the early-bird rate of $395. Michigan ranks among the bottom half of states for broadband connectivity, an unfortunate fact that was all too apparent during the early months of the COVID-19 pandemic. The silver lining in this digital deficit, however, is that it now positions the state well in terms of federal funding assistance to connect homes and businesses.

Michigan ranks among the bottom half of states for broadband connectivity, an unfortunate fact that was all too apparent during the early months of the COVID-19 pandemic. The silver lining in this digital deficit, however, is that it now positions the state well in terms of federal funding assistance to connect homes and businesses. With Friday marking the 1-year anniversary of the passage of the American Rescue Plan Act (ARPA), Dan Gilmartin, Executive Director and CEO of the Michigan Municipal League, and Stephan Currie, Executive Director of the Michigan Association of Counties, issued the following statement on behalf of the

With Friday marking the 1-year anniversary of the passage of the American Rescue Plan Act (ARPA), Dan Gilmartin, Executive Director and CEO of the Michigan Municipal League, and Stephan Currie, Executive Director of the Michigan Association of Counties, issued the following statement on behalf of the  The Michigan Department of Health and Human Services (MDHHS) Office of Child Welfare Services and Support released new program instruction this week regarding substance abuse testing. The new instruction discontinues the use of Averhealth for substance use testing.

The Michigan Department of Health and Human Services (MDHHS) Office of Child Welfare Services and Support released new program instruction this week regarding substance abuse testing. The new instruction discontinues the use of Averhealth for substance use testing.