Counties skirt fiscal danger in FY21 budget deal

Ending a long period of behind-the-scenes work by key legislators and the Whitmer administration, the Legislature moved rapidly today to pass budget bills for the state fiscal year that starts Oct. 1.

Ending a long period of behind-the-scenes work by key legislators and the Whitmer administration, the Legislature moved rapidly today to pass budget bills for the state fiscal year that starts Oct. 1.

In all major program areas, counties avoided cuts in funding that were once feared, and would have badly hampered members’ ability to provide key local services:

- Counties will receive their revenue sharing at levels established in fiscal year 2020, which totals more than $226 million.

- The deadline to pay hazard pay to first responders is extended to Oct. 31 (from the previous Sept. 30).

- Indigent Defense grants are funded for $117.5 million.

- About $4.2 million is provided for behavioral health training and crime victim support, as recommended by the Joint Task Force on Jail and Pretrial Incarceration.

- The County Jail Reimbursement Program will receive $14.8 million.

- The Secondary Road Patrol program will receive $13.1 million.

- The Community Corrections program will receive $13.2 million.

- Counties will have access to $4 million for Veteran Service Fund grants.

- Local road agencies will receive a $35 million increase from FY20 levels from the Michigan Transportation Fund.

- About $13 million is cut, however, from General Fund appropriations for the local bridge program.

- An increase of $27 million in federal funds is included for local public airports.

- Local public health funding was kept at FY20 levels: $51.4 million.

- The Child Care Fund will receive $254.3 million.

- Includes $3.5 million in Child Care Fund indirect cost payments.

- Match requirements for non-Medicaid community mental health (CMH) services will continue in a way that saves counties $5 million.

For more information, contact Deena Bosworth at bosworth@micounties.org.

Expungement bill gets final legislative approval

Legislation that expands expungement of convictions and creates an automatic process for such actions is on its way to the governor after the Senate approved House Bill 4980 by a vote of 29-8. Under the bill, and beginning in two years (subject to an appropriation), certain offenses will be set aside without the filing of an application.

The bill directs the Department of Technology, Management and Budget to develop a computer-based program for setting aside of records. The Department of State Police must also have an accessible record of each conviction and ensure it is accessible to each court in the state. The governor is given authority under the bill to postpone implementation by 180 days if it determined there are technological limitations.

Additionally, a fund will be created for implementation costs, necessary systems upgrades and any staffing needs that may be required as the automatic process is developed.

MAC advises county commissioners to work with court administration and clerks, as systems vary among courts. System changes that the state implements over the next two years may affect local systems in different ways and should be covered by the state as to avoid a Headlee Amendment violation.

For more information, contact Meghann Keit at keit@micounties.org.

Webinar offers budget expertise, certification credit to county commissioners

MSU Extension and the Michigan Department of Treasury will cover the fundamentals of budgeting during uncertain economic times, tracking long-term fiscal health and operational best practices in “Fiscally Ready Communities: Budgeting for Fiscal Sustainability.”

MSU Extension and the Michigan Department of Treasury will cover the fundamentals of budgeting during uncertain economic times, tracking long-term fiscal health and operational best practices in “Fiscally Ready Communities: Budgeting for Fiscal Sustainability.”

Commissioners who participate in this session would earn 3 credit hours in MAC’s County Commissioner Academy. As of Sept. 1, nearly 40 commissioners were 3 hours or fewer short of their qualification as “certified” under the CCA program. So, this is an excellent opportunity for members to earn either their certification or build up hours toward it. The first “graduates” of CCA will be honored at MAC’s Legislative Conference in Lansing in April 2021.

MSU Extension encourages all elected and appointed officials in local government, administrators and staff to attend one of the three sessions, which will occur on:

- Oct. 27, 2 p.m. to 3:30 p.m.

- Nov. 19, 2 p.m. to 3:30 p.m.

- Dec. 3, 9 a.m. to 10:30 a.m.

To register, click here.

To register, click here.

The webinar will provide best practices for local government fiscal health, including budgeting, long-term planning, dealing with uncertainty, and financial policies and procedures. Participants will learn about key financial variables, such as the “rainy day fund; understanding how the tax base provides revenue; understanding volatile revenue; forecasting revenue and expenditures; and how to track your budget performance, including reviewing and amending your budget.

There is no cost to attend a session, but each session is limited to 50 attendees. (If necessary, additional dates and times will be added.)

For questions on the webinar, contact MSUE’s Eric Walcott at walcott3@msu.edu. For questions on County Commissioner Academy, contact MAC’s Derek Melot at melot@micounties.org.

Ballot pre-processing measure headed to governor

Legislation to allow time pre-election to process mail-in ballots cleared the House this week on a 94-11 vote. The measure is supported by the Michigan Association of Municipal Clerks and the Council of Election Officials.

Legislation to allow time pre-election to process mail-in ballots cleared the House this week on a 94-11 vote. The measure is supported by the Michigan Association of Municipal Clerks and the Council of Election Officials.

Senate Bill 757, by Sen. Ruth Johnson (R-Oakland), allows clerks in cities or townships with a population of at least 25,000 to perform certain absent voter (AV) ballot pre-processing activities prior to Election Day, as long as they give notice of that action to the Secretary of State (SOS) at least 20 days before Election Day. This provision would apply only for the Nov. 3, 2020, general election.

The bill would also allow election inspectors on AV counting boards in cities or townships to work in shifts. Additionally, it would provide requirements for AV ballot drop boxes and notification requirements for AV ballot applications and ballots that were rejected for missing a signature or having one that did not match the signature on file.

The bill now goes to Gov. Gretchen Whitmer, who is expected to sign it.

Criminal justice reforms pass House, get Senate hearings

A legislative package spurred by recommendations from the Joint Task Force on Jail and Pretrial Incarceration were approved by the House this week, while the Senate began its own deliberations related to task force ideas.

A legislative package spurred by recommendations from the Joint Task Force on Jail and Pretrial Incarceration were approved by the House this week, while the Senate began its own deliberations related to task force ideas.

House Bills 5844 and 5854-57 remove mandatory minimum jail sentences for certain offenses. Removal of mandatory minimum sentences would mean a court could impose any term of imprisonment, up to the statutory maximum specified for an offense. For certain driving while intoxicated offenses, it prohibits a judge from waiving the minimum, unless the offender successfully completes a specialty court program, such as a drug treatment or sobriety court.

Additionally, bills removing driver’s licenses sanctions for non-related driving offenses were also passed by the House. HBs 5846-5852 would eliminate various license suspensions unrelated to dangerous driving, such as failure to appear for court or failing to pay child support.

MAC, along with the Michigan Sheriffs Association and the Prosecuting Attorneys Association of Michigan, supported the bills as passed the House.

The Senate, meanwhile, began hearings on bills recommended by the task force that address alternatives to arrest, such as issuance of appearance tickets and allowing resolutions to low-level warrants without being arrested. Review of Senate Bills 1046-51 will continue before the Senate Judiciary Committee in upcoming weeks.

While a full fiscal analysis is not done projecting county savings, it is assumed that these changes will save counties money by ensuring funds are not spent on housing those in county jails for reasons that are not a threat to public safety. MAC’s policy platforms support the task force, in which MAC members were represented, and smart criminal justice reforms, while maintaining public safety.

The task force appointments expire, under the current Executive Order, on Sept. 30. MAC expects the governor to extend the group’s make-up through the end of the year.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Legislative burst brings good news for skilled nursing facilities

Michigan’s 34 county-owned skilled nursing facilities received good news in the fiscal 2021 state budget approved Wednesday, along with other parts of the state’s health field.

Michigan’s 34 county-owned skilled nursing facilities received good news in the fiscal 2021 state budget approved Wednesday, along with other parts of the state’s health field.

In the budget now awaiting Gov. Gretchen Whitmer’s signature:

- The nursing facility rate escaped a $85 million reduction that had been sought by Whitmer.

- Section 1775 maintains the status quo: (1) Requires the Department to report on the progress in implementing the MI Health Link Waiver on March 1. (2) Requires the existence of an independent ombudsman to help assist with complaint and dispute resolution mechanisms.

- Section 1857 “requires the Department to explore the implementation of a managed care long-term support service by July 1.”

- A new line was included for $20 million to Nursing Home PPE grants that is funded through federal CARES Act funds. The new section reads, “(1) Appropriates $20.0 million of Federal Coronavirus Relief Fund revenue to nursing homes to help cover the cost of PPE during the COVID-19 pandemic. (2) Directs that funds under this section be allocated on a per licensed skilled nursing facility bed basis, with each nursing home receiving a fixed amount per licensed skilled nursing facility bed equal to $20 million divided by the total number of the licensed skilled nursing facility beds in the state. (3) The funds under this section must be allocated by Oct. 31.”

- CARES Act funding of $150 million is included to continue the $2 per hour direct care worker wage increase, as provided in the previous fiscal year originally approved under SB 690 in July. MCMCFC understands this will continue through the end of December and, according to budget sources, the eligibility remains the same for direct care workers, including those at skilled nursing facilities, that were eligible under SB 690.

In other legislative news related to medical care facilities, House Bills 4098 and 6159 were passed by the full House this week and now await action in the Senate Health Policy and Human Services Committee.

HB 4098, by Rep. Ben Frederick (R-Shiawassee), would allow the training and permitting of medication aides. MCMCFC supports the bill as a way to relieve the strained nursing profession by allowing specially trained CNAs to administering routine medication Under supervision of a nurse.

HB 6159, by Rep. Roger Hauck (R-Isabella), creates the Pandemic Health Care Immunity Act to provide protection from liability to health care facilities, including MCFs, that provided health care services related to the COVID-19 from March 9 to July 15 this year. MCMCFC supports this bill.

For more information on MCMCFC-related legislation, contact Meghann Keit at keit@micounties.org.

Flawed broadband measure gets House approval

A bill that creates the “Connecting Michigan Communities Act” to establish a statewide grant program to expand broadband in underserved areas passed the House this week. House Bill 4288, by Rep. Michele Hoitenga (R-Wexford), however, leaves locals out of the running to apply for the grant funds, leaving MAC no option but to oppose this legislation in current form.

A bill that creates the “Connecting Michigan Communities Act” to establish a statewide grant program to expand broadband in underserved areas passed the House this week. House Bill 4288, by Rep. Michele Hoitenga (R-Wexford), however, leaves locals out of the running to apply for the grant funds, leaving MAC no option but to oppose this legislation in current form.

While MAC supports the concept of greater access to broadband, this bill excludes local governments or educational institution from accessing these grants, which in some cases, may be the only viable entity to provide services. This could result in leaving some residents unserved in areas where a private provider has no plans to expand but could otherwise be served by a local unit.

Local partners such as the Michigan Municipal League and Michigan Townships Association were also in opposition as the bill passed the House. The bill now moves to the Senate Energy and Technology committee, chaired by Sen. Dan Lauwers (R-St. Clair), and is expected to receive a vote next week.

For more information, contact Meghann Keit at keit@micounties.org.

Bill on lake level bonds advances in House

Legislation allowing certain special assessment districts, filed in response to the Sanford Dam failure, cleared another legislative hurdle this week by advancing out of the House Committee on Natural Resources. MAC supports the legislation.

Legislation allowing certain special assessment districts, filed in response to the Sanford Dam failure, cleared another legislative hurdle this week by advancing out of the House Committee on Natural Resources. MAC supports the legislation.

Senate Bill 1080, by Sen. Rick Outman (R-Montcalm) already has Senate approval and would allow a special assessment district, with the approval of the County Board of Commissioners, to issue notes or bonds for up to 40 years to finance lake level projects. While a direct response to the Sanford Dam failure, the bill also provides greater financing options for the multitude of other lake level projects across the state in dire need of repair.

The bill would extend time a district could issue bonds from 10 years to 40 years, allowing the property assessments that pay for the work to be spread out over a much longer period and thereby make the payments more affordable for property owners. The bill now awaits action in the House Ways and Means Committee.

For more information on this issue, contact Deena Bosworth at bosowrth@micounties.org.

Tax shift for heavy equipment clears House committee

A new method to tax heavy construction and earth-moving equipment in Michigan cleared a House committee this week.

A new method to tax heavy construction and earth-moving equipment in Michigan cleared a House committee this week.

House Bill 5779, by Rep. Jim Ellison (D-Oakland) and voted out of House Tax Policy Committee, would end the current system for taxing rented heavy equipment, which is assessed in the jurisdiction where the property is physically located on Dec. 31 each year, regardless of where the property originated from or where it was for the rest of the year. This system has created difficulties for assessors, who have to track down the equipment within their jurisdictions on one day out of the year; creates uncertainty for the business owners who will have to pay multiple jurisdictions each year based on where the equipment is on that one day; and it can create unpredictable revenue issues for tax collecting units year to year.

Ellison’s bill, instead, would establish a 2 percent levy on the rental price of the heavy equipment. The levy would be collected by the Department of Treasury on a quarterly basis. Late penalties, audits of submissions and additional disqualifications penalties would also apply. Of the money collected by Treasury, up to $250,000 per year would go to the department for administering the program; the remaining funds would be distributed to the taxing jurisdictions.

Ninety percent of the funds would be sent to the tax collecting units where the businesses are located, who would then have 35 days to distribute the funds to the other taxing jurisdictions in the same proportion as it distributes property taxes. The remaining 10 percent would go to those local units of government not receiving any of the 90 percent distribution in the same proportion as distributions of the personal property tax reimbursement funds under the Local Community Stabilization Authority.

This bill is tie-bared to one that would exempt this equipment from personal property taxes under the General Property Tax Act. MAC is neutral on the legislation.

For more information, contact Deena Bosworth at bosworth@micounties.org.

Controversial ‘Dark Stores’ advocate regains Tax Tribunal seat

A former member of the Michigan Tax Tribunal who served when the panel adopted the “Dark Stores” theory of property assessment will rejoin the tribunal after a Senate committee failed to reject her nomination by the Whitmer administration.

A former member of the Michigan Tax Tribunal who served when the panel adopted the “Dark Stores” theory of property assessment will rejoin the tribunal after a Senate committee failed to reject her nomination by the Whitmer administration.

Victoria Enyart will be seated after the Senate Advice and Consent Committee turned aside a move by Sen. Ed McBroom (R-Dickinson) to reject her reappointment. MAC and others had opposed Enyart’s reappointment due to her role in the adoption of the “Dark Stores” assessment ideology, which has stripped local governments statewide of more than $100 million in revenue, thereby increasing the local tax burden on homeowners and small businesses.

The day before, a different Senate committee, Finance, took testimony on legislation, Senate Bill 39, by McBroom, which ban one of the Dark Stores techniques – the use of deed-restricted parcels as comparable properties for assessment purposes. MAC supports the bill, which did not receive a committee vote but is gaining traction in the Legislature.

For more information, contact Deena Bosworth at Bosworth@micounties.org.

Webinar to aid law enforcement with autism, DD communities

A webinar designed to provide participants, particularly law enforcement, with the knowledge and skills required to provide effective, equitable service to people with intellectual and/or developmental disabilities, including autism spectrum disorder, will be held Oct. 27 from 1 p.m. to 3 p.m.

A webinar designed to provide participants, particularly law enforcement, with the knowledge and skills required to provide effective, equitable service to people with intellectual and/or developmental disabilities, including autism spectrum disorder, will be held Oct. 27 from 1 p.m. to 3 p.m.

The content presented in this course is a culmination of information from a partnership of mental health and law enforcement professionals. The webinar is co-sponsored ty the state Department of Health and Human Services and the Michigan Municipal Risk Management Authority (MMRMA).

County commissioners may wish to encourage colleagues and partners in law enforcement to attend this free training session, which is MCOLES-approved and meets with MCOLES recommended annual officer trainings.

To register, click here. The class is limited to 50 slots. Deadline to register is Oct. 25.

To register groups or for additional course information, contact J. Eric Waddell at jericwaddell@thecardinalgroup2.com.

Staff picks

Staff picks

- County airports get federal funding (Federal Aviation Administration)

- Helping America’s distressed communities recover from the COVID-19 recession (Brookings Institution)

- Michigan earnings shot up 54 percent in the spring. Thank the stimulus funds. (Bridge Michigan)

- Giant rat wins animal hero award for sniffing out landmines (WZZM)

FY21 budget won’t cut revenue sharing

FY21 budget won’t cut revenue sharing MAC-supported legislation that would allow remote participation in board meetings after the pandemic Executive Orders expire has been introduced in the Legislature. Rep. Luke Meerman (R-Ottawa) introduced

MAC-supported legislation that would allow remote participation in board meetings after the pandemic Executive Orders expire has been introduced in the Legislature. Rep. Luke Meerman (R-Ottawa) introduced  The authority for trial courts to impose costs on defendants is extended to 2022 under a state law

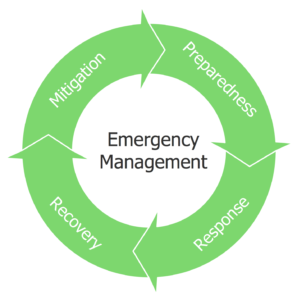

The authority for trial courts to impose costs on defendants is extended to 2022 under a state law  The House committee on Military and Veterans Affairs took testimony this week from emergency managers (EM) in support of

The House committee on Military and Veterans Affairs took testimony this week from emergency managers (EM) in support of  2020 Annual Conference videos now available

2020 Annual Conference videos now available Michigan counties have weathered the initial fiscal crisis caused by the coronavirus pandemic, but dangers loom on the horizon, MAC Executive Director Stephan Currie said

Michigan counties have weathered the initial fiscal crisis caused by the coronavirus pandemic, but dangers loom on the horizon, MAC Executive Director Stephan Currie said  The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS)

The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS)  Staff picks

Staff picks

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall.

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall. The latest webinar in a series co-sponsored by MAC, the Michigan Department of Treasury and others reviewed the latest guidance and tips involving COVID-19 aid for local governments on Sept. 8.

The latest webinar in a series co-sponsored by MAC, the Michigan Department of Treasury and others reviewed the latest guidance and tips involving COVID-19 aid for local governments on Sept. 8.

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from

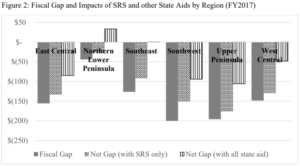

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from Almost 60 Michigan counties lacked the financial resources in 2017 to cover the public services they need to provide, even after accounting for state aid such as revenue sharing, says a

Almost 60 Michigan counties lacked the financial resources in 2017 to cover the public services they need to provide, even after accounting for state aid such as revenue sharing, says a