Security threats on local officials will be focus of MAC conference session

Statewide headline this week: As election nears, Michigan, other states confront intimidation of clerks.

Statewide headline this week: As election nears, Michigan, other states confront intimidation of clerks.

As your association, MAC is committed to policy and educational briefings that tackle emerging issues. To that end, the 2024 Annual Conference will feature a plenary session on security concerns led by experts from the Federal Bureau of Investigation (FBI) and the Michigan State Police (MSP).

FBI Special Agent Kaylee Barker and Intelligence Analyst Nishawn Spiller will discuss the bureau’s Election Crimes Coordinator Program, then Ryan Rich of the MSP will present on the “Current Threat Environment for Elected Officials.”

To see this briefing, though, you must attend the conference, for which online registration will continue for only one more week.

The three-day event also will feature:

- The 2024 President’s Banquet on Sept. 25

- The Welcome Reception on Sept. 24

- An optional new session called “Women of MAC” on Sept. 24

- MAC’s Annual Business Meeting on Sept. 26

- Elections for five MAC board seats via regional caucuses on Sept. 25

For registration questions, first review MAC’s website, then contact Tammi Connell at connell@micounties.org.

Counties now can see projected revenue sharing amounts for FY25

Michigan counties now can see estimates for their fiscal year 2025 revenue sharing payments via projections recently released by the Michigan Department of Treasury.

Michigan counties now can see estimates for their fiscal year 2025 revenue sharing payments via projections recently released by the Michigan Department of Treasury.

These projections offer an insight into how the new distribution model of the $291 million in county revenue sharing will affect each county.

The changes to the distribution methodology are the result of the changes made to the state’s FY25 enacted budget. For years, county revenue sharing was based on an outdated model that was rooted in values from, among other things, a 1975 inventory tax, inflationary increases for those counties still drawing down from a reserve fund and random percentage increases and decreases decided on by the legislature and the administration. The old methodology also required counties to earn a portion of their revenue sharing with reports at the local level and state level.

The new methodology has its roots in previous distributions, but the unprecedented $30 million increase for county revenue sharing this year will be distributed based on a county’s taxable value, as compared with the rest of the state. To be clear, all counties will see an increase in revenue sharing for FY25, compared to previous years. However, the actual impact on each county’s budget from the $30 million increase will vary depending on the final 2024 taxable values.

The new projections are based on the taxable values from 2023, which have been used as the foundation for estimating the amount each county will receive. However, it’s important to note that the actual payments to counties will be calculated based on the 2024 taxable values, which are expected to be released later in September. This means that the figures currently provided are preliminary and subject to change once the updated taxable values are available.

The FY25 projections provide a valuable early look at the funding counties can expect in the coming fiscal year. While the final amounts will depend on the forthcoming 2024 taxable values, these projections serve as an early indication on what counties can expect to receive.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

|

|

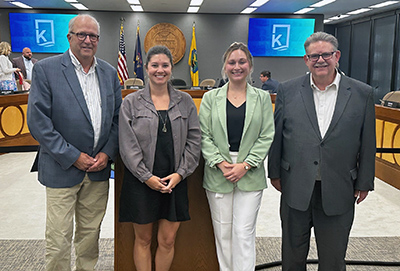

MAC’s Governmental Affairs Team continued its travel to members this week, stopping in Iosco County for the Board session on Sept. 4. After the meeting, MAC’s Samantha Gibson and Madeline Fata met with (l-r): Commissioners Charles Finley, Brian Loeffler, Jay O’Farrell and Terry Dutcher.

Treasury webinar will focus on fundamentals, best practices

The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) want to make you aware of our next Fiscally Ready Communities training opportunity. This FREE training is a 90-minute webinar that’s designed to assist appointed and elected officials.

The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) want to make you aware of our next Fiscally Ready Communities training opportunity. This FREE training is a 90-minute webinar that’s designed to assist appointed and elected officials.

The upcoming webinar training will be Sept. 16, 2024, from 2 p.m. to 3:30 p.m., with additional sessions available on Oct. 21, 2024, and Dec. 12, 2024.

“From Fundamentals to Best Practices”

This program focuses on implementing financial best practices, measuring fiscal health, and local government financial management fundamentals. It will include material on reconciling a bank account, how to read and interpret governmental financial statements, audit prep umbrella, how to complete and file an F65 Report, remitting taxes timely, and how to craft an appropriate and effective audit finding Corrective Action Plan. Participants will also receive resources to support best practice implementation and assess their local unit fiscal health.

For more information about Fiscally Ready Communities, please check out Fiscally Ready Communities webpage. This webpage includes Treasury’s 32-page Fiscally Ready Communities Best Practices document, which we encourage all local officials to review.

If you have any questions, email TreasLocalGov@michigan.gov with the subject line “Fiscally Ready.”

Opioid experts to provide issue briefing in advance of elections

Opioid experts to provide issue briefing in advance of elections

The Bipartisan Policy Center and the Foundation for Opioid Response Efforts (FORE) on Sept. 26 will offer an in-depth discussion on the opioid epidemic ahead of the election.

Experts will share insights from a recent national survey on Americans’ views of the opioid epidemic and evaluate the government’s response to the crisis.

Registration for virtual attendance is available by clicking here.

State sets regional briefings on renewable energy siting rules

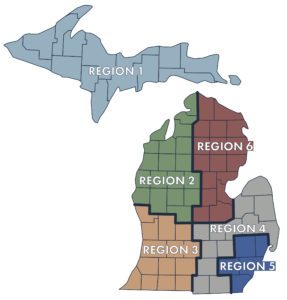

Local officials can learn more about the upcoming changes to siting for large-scale renewable energy projects at regional learning sessions in October. The Department of Environment, Great Lakes and Energy (EGLE) will be hosting Renewable Energy Academy workshops in conjunction with several councils of government to provide those interested with “neutral guidance” on the new law.

Local officials can learn more about the upcoming changes to siting for large-scale renewable energy projects at regional learning sessions in October. The Department of Environment, Great Lakes and Energy (EGLE) will be hosting Renewable Energy Academy workshops in conjunction with several councils of government to provide those interested with “neutral guidance” on the new law.

- The West Michigan Shoreline Regional Development Commission event will be held on Oct. 8 at Muskegon Community College.

- The Southcentral Michigan Planning Council event will be Oct. 28 at Delta Hotels by Marriott Kalamazoo Conference Center.

- The Region II Planning Commission event will be scheduled at a later date.

Workshop activities include discussions on planning and zoning, “workable” ordinances, and presentations by the University of Michigan Center for EmPowering Communities. No more than four individuals may attend per community. Registration is only available to each municipality located within the planning regions listed above.

How to register: Municipalities from the planning regions mentioned above will receive email notice directly from the council of government with more detailed information of the time and location, as well as instructions on how to register to attend this workshop.

Staff pi cks

cks

- A peek at the post-Chevron world (Council of State Governments)

- How the Kent County hotel tax increase will fund projects (WOOD-TV)

- How local election officials can prepare for the risks of AI (Governing)

- Michigan 2024 ‘I Voted’ sticker design contest winners announced (9&10 News)

The field is set for this year’s elections for the MAC Board of Directors.

The field is set for this year’s elections for the MAC Board of Directors. The Michigan Department of Treasury has recently posted the Fiscal Year (FY) 2025 County Revenue Sharing projections, providing an essential preview of the expected funds that will be distributed to counties across the state. These projections offer a insight into how the new distribution model will affect each county.

The Michigan Department of Treasury has recently posted the Fiscal Year (FY) 2025 County Revenue Sharing projections, providing an essential preview of the expected funds that will be distributed to counties across the state. These projections offer a insight into how the new distribution model will affect each county.

County leaders feeling hesitant about artificial intelligence (AI) entering their workplaces need to realize the technology is already there – and will be a boon to them and their staffs, said a National Association of Counties (NACo) expert in the

County leaders feeling hesitant about artificial intelligence (AI) entering their workplaces need to realize the technology is already there – and will be a boon to them and their staffs, said a National Association of Counties (NACo) expert in the  John Malnar, Delta County, Region 1 candidate

John Malnar, Delta County, Region 1 candidate I have put in my name for the open Board seat in Region 1. For those who may not be familiar with me, I have been a commissioner for 12 years, six of which I served as Board chair.

I have put in my name for the open Board seat in Region 1. For those who may not be familiar with me, I have been a commissioner for 12 years, six of which I served as Board chair.  I feel that I will be a particularly good candidate for the Region 2 seat because of my extensive history with MAC and county government.

I feel that I will be a particularly good candidate for the Region 2 seat because of my extensive history with MAC and county government. Rick Shaffer is a 40-year resident of St. Joseph County and is widely known for his active service in health care and county government activities.

Rick Shaffer is a 40-year resident of St. Joseph County and is widely known for his active service in health care and county government activities. I am running for re-election to the MAC Board (Region 5, Seat B) because I want to continue to be an advocate for the vital work that we all do for our counties. I believe in promoting local control. I have learned so much since joining the Board about the issues that are affecting counties statewide. I know the importance of empowering counties to address these issues in ways that make sense for their residents, rather than settling for one size fits all policy making in Lansing.

I am running for re-election to the MAC Board (Region 5, Seat B) because I want to continue to be an advocate for the vital work that we all do for our counties. I believe in promoting local control. I have learned so much since joining the Board about the issues that are affecting counties statewide. I know the importance of empowering counties to address these issues in ways that make sense for their residents, rather than settling for one size fits all policy making in Lansing. I am a graduate of Plymouth-Canton High School and hold a bachelor’s degree from Eastern Michigan University. I live in Canton with my son and my senior rescue dog, Toby. Prior to serving on the Wayne County Commission, I worked in the accounting field, with extensive experience in both leadership and individual contributor positions.

I am a graduate of Plymouth-Canton High School and hold a bachelor’s degree from Eastern Michigan University. I live in Canton with my son and my senior rescue dog, Toby. Prior to serving on the Wayne County Commission, I worked in the accounting field, with extensive experience in both leadership and individual contributor positions. August and September highlight a time to recognize the lives lost to drug overdose and celebrate recovery from substance use disorders.

August and September highlight a time to recognize the lives lost to drug overdose and celebrate recovery from substance use disorders. The Federal Communications Commission (FCC) imposed a ruling last month lowering the cost of jail and prison communications by capping the call rates for inmates to 6 to 12 cents per minute.

The Federal Communications Commission (FCC) imposed a ruling last month lowering the cost of jail and prison communications by capping the call rates for inmates to 6 to 12 cents per minute.

The Michigan Department of Treasury will hold its next “Chart Chat” webinar at 2 p.m. on Thursday, Sept. 5.

The Michigan Department of Treasury will hold its next “Chart Chat” webinar at 2 p.m. on Thursday, Sept. 5.

A review of the major changes in county mental health responsibilities in recent decades and the challenges now confronting counties in the mental health space are the focus of a new

A review of the major changes in county mental health responsibilities in recent decades and the challenges now confronting counties in the mental health space are the focus of a new  Voters across Michigan gave broad approval to millage requests from county governments in the August 2024 primary election.

Voters across Michigan gave broad approval to millage requests from county governments in the August 2024 primary election. The public

The public  The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) want to make you aware of our next Fiscally Ready Communities training opportunity. This FREE training is a 90-minute webinar that’s designed to assist appointed and elected officials.

The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) want to make you aware of our next Fiscally Ready Communities training opportunity. This FREE training is a 90-minute webinar that’s designed to assist appointed and elected officials.

America is more polarized than ever before. Tensions exist in all sectors, and especially across government and between county governments and communities. Public meetings are sometimes veering out of control, highlighting the urgency for county leaders to develop strategies and skills to bridge divides and collaborate across differences. County leaders are uniquely trusted by the American people to solve local problems.

America is more polarized than ever before. Tensions exist in all sectors, and especially across government and between county governments and communities. Public meetings are sometimes veering out of control, highlighting the urgency for county leaders to develop strategies and skills to bridge divides and collaborate across differences. County leaders are uniquely trusted by the American people to solve local problems.