Izzo charms, inspires during conference keynote

“All of us are role models,” Michigan State University basketball coach Tom Izzo told county leaders gathered for a special session Thursday of MAC’s 2020 Virtual Annual Conference. “You gotta give back some things. I look back and I see I have a responsibility, which is a privilege, not a burden.”

“All of us are role models,” Michigan State University basketball coach Tom Izzo told county leaders gathered for a special session Thursday of MAC’s 2020 Virtual Annual Conference. “You gotta give back some things. I look back and I see I have a responsibility, which is a privilege, not a burden.”

Izzo’s keynote remarks were the highlight of week 1 of the virtual conference, which resumes next Tuesday and concludes next Thursday.

The Hall of Fame coach and national championship winner (2000) expanded on the leadership theme by saying, “Greatest feeling – being a difference-maker in someone’s life.”

During a wide-ranging Q&A after his remarks, led by MAC Executive Director Stephan Currie, Izzo fielded queries on everything from the “side” of Iron Mountain he grew up on to how to bring cohesion to a group of wildly different people to the recent trend in changing team mascots. At one point, the coach seemed to be wistful as he related how, in his young adult days in the Upper Peninsula, his first big investments were trailers, culminating in a “double-wide” unit.

Izzo also engaged in some good-natured ribbing with Currie over the high expectations Spartan fans have for him and his team each year.

“Coach never fails to deliver,” Currie said after the session. “We at MAC are so appreciative of coach Izzo’s time and the kind words he had for the work of county leaders in Michigan.”

The keynote event was the final one of a week that began with a workshop on managing public facilities in a COVID-19 world and the first plenary session, which included the semi-annual “State of MAC” report from Currie and a “Legislative Update” from Governmental Affairs Director Deena Bosworth.

To keep track of conference events, visit the conferences page on the MAC website, where you can find a link to the conference program. Access to conference events is limited to registered attendees, but MAC will be posting slide decks from workshops and, in September, video files of the major sessions.

Treasury: Payroll reimbursement program requests exceed funding

The application deadline for counties to apply for public safety and public health payroll reimbursement for April and May of 2020 has passed. In conversations with the Michigan Treasury, MAC has learned the amount requested for reimbursement will exceed the supplemental budget appropriation of $200 million. This means Treasury will be prorating the reimbursements based on the amount each request bears to the total amount requested. And there will not be another a second round to apply for in August.

The application deadline for counties to apply for public safety and public health payroll reimbursement for April and May of 2020 has passed. In conversations with the Michigan Treasury, MAC has learned the amount requested for reimbursement will exceed the supplemental budget appropriation of $200 million. This means Treasury will be prorating the reimbursements based on the amount each request bears to the total amount requested. And there will not be another a second round to apply for in August.

On the bright side, the expenses that were not covered in the first round will be eligible for allocation to the CARES Act revenue sharing replacement fund. Again, these are the funds that should total approximately 1.5 times the amount of your August revenue sharing payment amount. Although the replacement is restricted to eligible expenses, public safety and public health payrolls are considered eligible.

As far as the hazard pay program goes, the appropriation of $100 million has not, as of yet, been exhausted. Applications for the program continue to come in, but the threshold is unlikely to be exceeded.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org

Report: Michigan spends more on roads, but trends aren’t promising

Michigan has devoted increasing sums to its road network in recent years, but road conditions are still projected to worsen, said a transportation funding analyst with the House Fiscal Agency (HFA) during a 2020 Annual Conference workshop on Thursday.

Michigan has devoted increasing sums to its road network in recent years, but road conditions are still projected to worsen, said a transportation funding analyst with the House Fiscal Agency (HFA) during a 2020 Annual Conference workshop on Thursday.

William Hamilton of the HFA led workshop participants through the funding mechanics for roads across the state – and the current and expected results of that work. On one slide, he noted that while about 85 percent of state “trunkline” roads were in good or fair shape five years ago, that share is projected to fall to below 50 percent by 2025.

After Thursday’s session, Hamilton followed up on a couple of questions posed by members during his talk:

Local road millages and funding levels

“There appear to be 32 county-wide road millages in 2018, with total county road millage revenue in 2018 = $69.4 million. And it looks like 554 townships have township road millages, most of which are used to support county road commission maintenance and improvement projects within the respective townships. Total township road millage revenue in 2018 = $86.6 million.

“So those two sources add up to $156 million of local funding for county road programs and projects.

“Also, some counties and townships simply provide direct General Fund (GF) support for county road commission projects, like Oakland County, which uses county GF as part of a match money program.

“And many townships use township GF as part of a match money program. And there are special assessment districts in many townships to recover the costs of certain road improvements.”

Federal COVID aid for transportation

“This document summarizes federal COVID assistance through June 8, 2020; transportation elements are on page 14.

“So far, the only transportation money is for transit and airport projects. And as we discussed, the COVID money is made available through existing federal aid programs.”

Property tax exemptions are growing problem for counties, lawyer says

The misapplication of a 2006 court decision has led to a growing number of businesses avoiding local property taxes, putting more stress on already-strained county revenues, a tax law expert told a Wednesday workshop during the 2020 Annual Conference.

The misapplication of a 2006 court decision has led to a growing number of businesses avoiding local property taxes, putting more stress on already-strained county revenues, a tax law expert told a Wednesday workshop during the 2020 Annual Conference.

Via a virtual session, Jessica Wood of the firm of Dickinson Wright showed county leaders how the 2006 Wexford has led Michigan awry. Pre-Wexford, Wood said, the state had a “common sense, relatively intuitive, straightforward test” for determining whether a business qualified as a charity and therefore received a tax break. But the Wexford decision, she said, “the truck that drove the hole through” state law.

Duo: Invest in tech to deal with COVID in facilities

In the conference’s first workshop on Tuesday, Gary Nauts of the city of Rochester Hills and Terry Van Doren of MMRMA discussed experiences and best practices on handling public facilities in the first few months of the coronavirus pandemic.

Among the points highlighted by the pair:

- Communication is key.

- Invest in technology.

- Facilities and maintenance leaders will lead the return to normal.

“We are off to a fast start with the amount of information in our workshops,” said MAC Executive Director Stephan Currie. “While we can’t meet in-person, the digital format still allows us to support continuing education for our members.”

MIDC continues plan reviews amid murky budget situation

The Michigan Indigent Defense Commission (MIDC) met this week to continue to review and approve county compliance plans and costs analysis, among other items.

The Michigan Indigent Defense Commission (MIDC) met this week to continue to review and approve county compliance plans and costs analysis, among other items.

The MIDC reviewed 98 staff recommendations for approvals and rejections of county and municipal plans. The entire list can be found on the agenda here.

Additionally, the commission approved a framework should the FY21 appropriation for compliance grants be less than the total of the approved compliance plans. In February, the governor recommended $117.5 million for plans, but as with all budgetary items, the compliance funding could be in jeopardy due to revenue effects of the COVID-19 pandemic. The latest estimates range from an FY21 shortfall of $1 billion to $1.5 billion in the General Fund. However, the final number will be approved on Aug. 24 at the Consensus Revenue Estimating Conference.

MAC supports full funding of MIDC grants and the $117.5 million proposed by the governor. Anything short of full funding would be a violation of the Headlee Amendment, and per statute, “A system’s duty of compliance with 1 or more standards within the plan under subsection (1) is contingent upon receipt of a grant in the amount sufficient to cover that particular standard or standards contained in the plan and cost analysis approved by the MIDC.”

The commission also received a letter from Orlene Hawks, director of the Department of Licensing and Regulatory Affairs (LARA), indicating Standard 5 (independence of the indigent defense system from the judiciary) is slated to be formally approved by LARA in October. Per statute, “No later than 180 days after a standard is approved by the department, each indigent criminal defense system shall submit a plan to the MIDC for the provision of indigent criminal defense services in a manner as determined by the MIDC and shall submit an annual plan for the following state fiscal year on or before Oct. 1 of each year.”

Lastly, a reminder that standards related to indigency and partial indigency determinations, required by the MIDC Act, are open for public comment until Sept. 14, 2020, and can be submitted to LARA-MIDC-Info@michigan.gov. Alternatively, comments can be sent by that date to the MIDC Office, 200 N. Washington Square, 3rd Floor, Lansing, MI 48913. All comments will be posted and available on the MIDC website.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

State to distribute $3.5M through Child Care Fund

The Michigan Department of Health and Human Services is slated to distribute the $3.5 million appropriated under the FY20 budget to cover Child Care Fund administrative costs relevant to the move of neglect/abuse payments to the “State Pays First” system in the next 30 days. As the state transitioned to the State Pays First model, the statute was not clear whether the 10 percent counties received for indirect costs must be applied to the abuse/neglect population.

The Michigan Department of Health and Human Services is slated to distribute the $3.5 million appropriated under the FY20 budget to cover Child Care Fund administrative costs relevant to the move of neglect/abuse payments to the “State Pays First” system in the next 30 days. As the state transitioned to the State Pays First model, the statute was not clear whether the 10 percent counties received for indirect costs must be applied to the abuse/neglect population.

The Legislature approved $3.5 million in FY20 to ensure counties did not see a shortfall, but due to so many unknowns during the FY20 budget process under COVID-19, payments were delayed. Since the recent completion of updates to the FY20 budget that included the $3.5 million, the state will be issuing payments as soon as possible. Per correspondence with the department, MAC expects payments within 30 days, and will stay in touch with members if that time frame changes.

A county-by-county breakdown of the $3.5 million can be found here.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Staff picks

Staff picks

- 2019 State of the Great Lakes Report (Office of the Great Lakes)

- North American cold-climate forests are already absorbing less carbon, study shows (University of Michigan)

- Police, Coast Guard searching for pilot who flew under Mackinac Bridge (WZZM)

- Michigan reaches $600M deal in Flint water crisis (Associated Press)

Virtual Annual Conference begins on Tuesday

The first events of MAC’s two-week Virtual Annual Conference are set for Tuesday, Aug. 18, including a Plenary Session of special reports from MAC personnel.

The first events of MAC’s two-week Virtual Annual Conference are set for Tuesday, Aug. 18, including a Plenary Session of special reports from MAC personnel.

Week one of the conference, which runs Aug. 18-27, also will include the President’s Gathering with conference keynoter Tom Izzo of the MSU Spartans (Aug. 20).

Registered attendees will be receiving emails today (Aug. 14) with their access credentials for all of the digital events, including the regional caucuses to elect Board members and the Annual Business Meeting to approve policy platforms. Just a reminder: Only county commissioners may participate in the regional caucuses and Annual Business Meeting.

The conference program will be posted to MAC’s conferences website page for reference during the event. Recordings of the conference workshops and special sessions will be posted to the website, too, but not until September.

Federal FAQ sheet has key details on FEMA matching rules

The U.S. Treasury has updated its Coronavirus Relief Fund (CRF) FAQ document. Main items they updated are:

The U.S. Treasury has updated its Coronavirus Relief Fund (CRF) FAQ document. Main items they updated are:

- Additional clarification on using CRF dollars for the non-federal FEMA matching requirement: Specifically, the guidance states that states and counties are fully permitted to use payments from the CRF to satisfy 100 percent of their cost share for lost wages assistance recently made available under the Stafford Act.

- Clarification on incurred costs and grant programs: The guidance states that a grant made to cover interest and principal costs of a loan, including interest and principal due after the period March 1, 2020, to Dec. 30, 2020, will be considered an “incurred cost” during the covered period.

For more resources from the federal and state governments on COVID response, visit MAC’s Resources Page.

Michigan Treasury holds sixth webinar on COVID-related funds

The hazard pay program, the payroll reimbursement program and the August revenue sharing payment were among topics addressed by officials with the Michigan Treasury during a webinar Wednesday co-sponsored by MAC and other local government groups.

The hazard pay program, the payroll reimbursement program and the August revenue sharing payment were among topics addressed by officials with the Michigan Treasury during a webinar Wednesday co-sponsored by MAC and other local government groups.

The session was the sixth in an ongoing series to brief local governments on pandemic-related expenses, programs and reimbursements.

Although Treasury does not anticipate utilizing all of the allocated $100 million for the hazard pay program, the department does anticipate expending the entire $200 million in the first round of the payroll reimbursement program that covers public safety and public health payroll expenses for April and May 2020.

To get CARES funds from the state to compensate for the terminated August revenue sharing payment, counties will have to certify to Treasury their desire to receive these funds and to allocate them to COVID-related expenses – including additional months of public safety and public health payroll expenses. Under the authorizing legislation, counties will get roughly 150 percent of their August revenue sharing in additional CARES funds. Those funds should go out in early September.

The Department also spent time this week going over the necessary accounting procedures in order to accurately and appropriately allocate the funding.

To watch the recording of the webinar, follow this link.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Whitmer vetoes health facility immunity provisions

An extension of legal immunity to certain health facilities, including Medical Care Facilities (MCFs) was vetoed by Gov. Gretchen Whitmer.

An extension of legal immunity to certain health facilities, including Medical Care Facilities (MCFs) was vetoed by Gov. Gretchen Whitmer.

The immunity would have applied to civil or criminal liability during a state of disaster or state of emergency declaration under Senate Bill 899, by Sen. Mike MacDonald (R-Macomb County).

Per the governor’s veto letter: “If this bill only attempted to restore the protections I offered under my orders, I would consider signing it. But the bill goes much further in ways that are directly counter to the interests of those receiving care. For example, this bill would give health care providers and the facilities that employ them broad immunity every time an emergency or disaster is declared, regardless of whether the circumstances demand this extreme measure.”

House Speaker Lee Chatfield (R-Emmet) said in a statement that the state’s “health care heroes” are working on the frontlines in difficult decisions and “deserve to know we all have their back.”

“It’s strange that the governor felt our frontline health care workers deserved this protection two months ago but not today, since she did not include any legitimate explanation of her veto,” he said. “But I know my commitment to doctors, nurses and hospitals has not changed. The House of Representatives will continue to look for ways to partner with them, support them, and help them combat this pandemic.”

Also this week, the governor extended the Executive Order titled “Enhanced protections for residents and staff of long-term care facilities during the COVID-19 pandemic,” through Sept. 7.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Commission accepting public input on indigency standard

The Michigan Indigent Defense Commission (MIDC) is accepting comments to a proposed standard for determining indigency and contribution, as required by statute. The MIDC Act requires the commission to “promulgate objective standards for indigent criminal defense systems to determine whether a defendant is indigent or partially indigent” and to “determine the amount a partially indigent defendant must contribute to his or her defense.”

The Michigan Indigent Defense Commission (MIDC) is accepting comments to a proposed standard for determining indigency and contribution, as required by statute. The MIDC Act requires the commission to “promulgate objective standards for indigent criminal defense systems to determine whether a defendant is indigent or partially indigent” and to “determine the amount a partially indigent defendant must contribute to his or her defense.”

Under 2018 statutory changes, the Legislature required systems to make “a preliminary inquiry regarding, and the determination of, the indigency of any defendant, including a determination regarding whether a defendant is partially indigent.” However, to ensure that systems do not vary dramatically in their determinations, the Legislature also tasked the commission with providing standards for systems to follow.

The proposed indigency standard can be found here.

“Written public comment for consideration by the Commission should be submitted before Sept. 14, 2020, to LARA-MIDC-Info@michigan.gov. Alternatively, comments can be sent by that date to the MIDC Office, 200 N. Washington Square, 3rd Floor, Lansing, MI 48913. All comments will be posted and available on the MIDC website.”

The MIDC will hold its next meeting on Aug. 18 at 9 a.m. via Zoom to continue review of FY21 compliance plans and costs analyses. Meeting agenda information and zoom links can be found here.

For more information on this issue, contact Meghann Keit at Keit@micounties.org.

Get state advice on pension/OPEB issues

The Michigan Treasury will brief local governments on the management and sustainability of their pension and retiree health care (OPEB) systems during a webinar on Tuesday, Aug. 18 at 2 p.m.

The Michigan Treasury will brief local governments on the management and sustainability of their pension and retiree health care (OPEB) systems during a webinar on Tuesday, Aug. 18 at 2 p.m.

Topics will include updates from the Municipal Employees Retirement System (MERS) and the Michigan Association of Public Employees Retirement Systems (MAPERS) on local pension and health care systems, problem solving and management of legacy debt from MSU Extension, University of Michigan, and the Citizens Research Council, and an update regarding reporting data, waiver applications, and the corrective action process for Public Act 202 of 2017 from the Department of Treasury.

Participants can register on the webinar’s registration page.

NACo analyzes executive actions taken by president

On Aug. 8, President Trump released a series of administrative actions — an executive order and three memorandums — to address the expiration of federal unemployment benefits and provide other assistance for U.S. residents hurt by the COVID-19 pandemic. The actions taken by the administration do not address NACo’s main priority for COVID relief, which is additional flexible fiscal aid for state and local governments of all sizes.

On Aug. 8, President Trump released a series of administrative actions — an executive order and three memorandums — to address the expiration of federal unemployment benefits and provide other assistance for U.S. residents hurt by the COVID-19 pandemic. The actions taken by the administration do not address NACo’s main priority for COVID relief, which is additional flexible fiscal aid for state and local governments of all sizes.

Here is a quick summary of two of the key areas for counties:

Unemployment Insurance (UI)

- Extra federal UI benefit on top of states’ regular UI benefit would be reduced from $600 to $400 per week

- Of the $400 total,

- WH proposes that $300 would be funded through FEMA’s existing Disaster Relief Funds (DRF)

- WH proposes to earmark up to $44 billion of $70 billion in existing DRF dollars – which would last for about 5 weeks at current UI levels

- States would be responsible for the 25% FEMA DRF state match, or $100 per UI recipient each week

- Governor must submit a federal request to FEMA to receive the extra federal UI payments; It is not automatic!

- WH notes that states may use their Treasury Coronavirus Relief Fund (CRF) dollars for the $100 state match; U.S. Dept of Labor issued a memo indicating that administration might also waive the $100 / 25% match for states

- However, the National Governors Association notes that states have already obligated more than 75% of CRF dollars so unlikely that states have enough money for the state match from Treasury CARES Act

Payroll taxes for Social Security and Medicare

- WH memo only applies to employee share that is normally collected and submitted by employers (and employee side of self employed)

- Earlier COVID19 supplemental law already allowed postponement for employer share of payroll taxes

- Explain that payroll taxes consist of:

- Social Security at 12.4% (6.2% by employee and 6.2% by employer) (NOTE – believe self employed pay the full 12.4%)

- Medicare at 2.9% (1.45% by employee and 1.45% by employer)

- WH action would only delay/postpone collection of employee share of payroll taxes, similar to earlier congressional action for employers. Money would still be owed to the federal government!

For additional detail, visit NACo’s blog.

Staff picks

Staff picks

- Shoreline-mapping EGLE drone sent to watery Lake Michigan grave by U.P. bald eagle (Department of Environment, Great Lakes and Energy)

- Michigan plans dedicated road lanes for autonomous vehicles (ClickonDetroit.com)

- Outline of the Michigan Tax System (Citizens Research Council of Michigan)

- There’s a shortage of Dr. Pepper during the coronavirus pandemic (Today.com)

Without federal dollars, FY21 state budget will be grim for counties

Without numbers scheduled to be derived from the next consensus revenue estimating conference slated for late August, we can only estimate the anticipated state budget deficit for fiscal year 21, which beings Oct. 1, 2020. However, all indications lean toward a General Fund shortfall of more than $3 billion.

Without numbers scheduled to be derived from the next consensus revenue estimating conference slated for late August, we can only estimate the anticipated state budget deficit for fiscal year 21, which beings Oct. 1, 2020. However, all indications lean toward a General Fund shortfall of more than $3 billion.

Should the federal government not provide additional, direct and flexible funding to states and local governments, the Michigan Legislature will be forced to make drastic cuts to roads, local governments, universities, community colleges, corrections and human services, all primary recipients of unrestricted General Fund dollars each year. The State Budget Office is anticipating a $3.1 billion deficit, while sources in the Legislature are expecting something closer to $3.5 billion for FY21.

Counties were spared drastic cuts in the FY20 budget due to the allocation of federal CARES dollars to help mitigate the impact of the eliminated August revenue sharing payment. But without additional federal dollars, it’s safe to say we can anticipate losing a large percentage of the more than $200 million in statutory revenue sharing for FY21, in addition to cuts to other areas of the state budget.

Again, all hinges on the August Consensus Revenue Estimating Conference and the actions at the federal level regarding continued COVIS-19 mitigation funding.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Legislative County Caucus expected to grow in 2021

The ranks of MAC’s County Caucus in the Legislature should grow in 2021 following the results of the Aug. 4 legislative primaries this week.

The ranks of MAC’s County Caucus in the Legislature should grow in 2021 following the results of the Aug. 4 legislative primaries this week.

Five current county commissioners won their party’s primary in House districts that solidly favor one party or the other, setting them up to be elected to the House of Representatives in November:

- Bob Bezotte of Livingston County won the Republican nomination in House District 47.

- Ken Borton of Otsego County won the Republican nomination in HD 105.

- Felicia Brabec of Washtenaw County won the Democratic nod in HD 55.

- Julie Rogers of Kalamazoo County won the Democratic nomination in HD 60.

- Amos O’Neal of Saginaw County claimed the Democratic nomination in HD 95.

All will be favorites to win in November and take office in January 2021.

Christine Morse of Kalamazoo County was unopposed for the Democratic nomination in HD 61, which will be highly competitive in the General Election.

In the current Legislature, 26 members are former county commissioners and thereby members of the County Caucus. Three of them, though, have reached their term limits. Still, based on current trends, the caucus should grow to more than 30 members in 2021.

County millages gain approval in record-breaking primary election

All but two county millage proposals gained voter approval in unofficial results in Tuesday’s primary election, which set a record for voter participation.

All but two county millage proposals gained voter approval in unofficial results in Tuesday’s primary election, which set a record for voter participation.

More than 2.5 million Michigan residents cast ballots on Tuesday, shattering the previous primary record of 2.2 million set in August 2018. The effects of the constitutional changes to voting that voters adopted in 2018 could be seen in this week’s results, as more than 2/3 of the ballots cast came through the option of “no reason” absentee (mail) balloting.

Of the 105 county-based millage requests on Tuesday monitored by the MIRS News Service, only 2 were rejected – one in Allegan County for its medical care facility and one in Iosco County for general operations. The majority of the requests were to renew or restore a millage, though several millage increases did gain voter support.

“Tuesday’s results represent an ongoing trend of Michigan county governments pushing extra-voted millages to fund services,” said Eric Scorsone, director of the Center for Local Government Finance and Policy. “Senior services, animal control, EMS and many others were funded.”

Michigan has 7,748,541 registered voters, of which the state deems 6,764,903 as active.

Last chance to register for the 2020 Virtual Annual Conference

Legendary Michigan State University coach Tom Izzo will address attendees of the 2020 Virtual Annual Conference LIVE on Aug. 20 at 11 a.m.. After his remarks on leadership and team building, the national championship coach will take questions.

Legendary Michigan State University coach Tom Izzo will address attendees of the 2020 Virtual Annual Conference LIVE on Aug. 20 at 11 a.m.. After his remarks on leadership and team building, the national championship coach will take questions.- Plenary sessions that will feature MAC’s Legislative Update, the semi-annual “State of MAC” report and an address by MAC Board President Veronica Klinefelt

- The Annual Business Meeting, during which members will vote on MAC’s policy platforms for the 2020-21 year

- Seven policy workshops that will focus heavily on the implications of COVID-19 for counties in the coming months

- A Virtual Exhibitor Show that will allow attendees to select up to five firms from which to hear 10-minute presentations

- The conference registration fee is only $50 for members, which includes all county officials

- Attendees must register by a new deadline prior to the event – Aug. 7

- MAC will not accept “walk-up” registrations during the conference (this is due to credentialing and election procedures adopted for the conference)

Treasury sets next COVID webinar for Aug. 12; register now

In partnership with the Michigan Municipal League, Michigan Townships Association and Michigan Association of Counties, the Michigan Department of Treasury is pleased to announce the joint webinar, “COVID-19 Updates and Resources for Local Governments,” at 2 p.m. on Aug. 12.

In partnership with the Michigan Municipal League, Michigan Townships Association and Michigan Association of Counties, the Michigan Department of Treasury is pleased to announce the joint webinar, “COVID-19 Updates and Resources for Local Governments,” at 2 p.m. on Aug. 12.

Topics will include updates on CARES Act funding for local governments including: first responder hazard pay premiums, public safety and public health payroll expenditures, August revenue sharing payments, and water utility assistance. Additional topics include opportunities for local government to support businesses and an update on FEMA grant dollars.

Participants can register and submit questions on the webinar’s registration page.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Governor vetoes bill on housing senior COVID patients

A bill to create regional facilities for COVID-19 patients that are separate from other nursing homes was vetoed this week by Gov. Gretchen Whitmer.

A bill to create regional facilities for COVID-19 patients that are separate from other nursing homes was vetoed this week by Gov. Gretchen Whitmer.

Senate Bill 956 would have created regional facilities for the housing of COVID-19 patients and required the Department of Health and Human Services (DHHS), in consultation with the Department of Licensing and Regulatory Affairs (LARA), to assess and report on the state’s response to COVID-19 in nursing homes and plan for any future response. It would also have prohibited admission or retention of coronavirus-positive individuals in nursing homes.

“Protecting the health and safety of nursing home residents and their staff continues to be a top priority for my administration,” said Whitmer. “Senate Bill 956 is nothing more than a political game that would relocate vulnerable seniors without any requirement for consent, doctor’s approval, or notification to patients and their families. It’s time for the Republican Legislature to get serious about protecting our most vulnerable and addressing the public health and economic crisis faced by our state. We look forward to continuing our work with stakeholders and legislators on the task force to develop real solutions that make sense for Michigan seniors and their families.”

“First, @GovWhitmer ignored experts who urged her not to expose nursing homes to COVID-19, with tragic consequences,” Senate Republicans wrote on Twitter in response to the governor’s actions. “Now, she has vetoed a bipartisan bill banning such a practice in the future. A slap in the face of Michigan families who have lost loved ones.”

Renee Beniak, executive director of the Michigan County Medical Care Facilities Council, serves on the Michigan Nursing Homes COVID-19 Preparedness Task Force created under Executive Order 135. The task force is tasked to adequately inform the state’s response to a potential second wave of COVID-19 and, by Aug. 31, 2020, produce a recommendation to the governor for an action plan on how to prepare nursing homes for any future wave of COVID-19 cases. Beniak said this week that the task force would be addressing the placement issue.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Compliance event to replace cancelled environmental conference

The Michigan Environmental Compliance Conference will not be held this year due to COVID-19 social distancing requirements. However, the Michigan Department of Environment, Great Lakes and Energy has created a Michigan Environmental Compliance Week, a week-long virtual event dedicated to helping local governments comply with environmental regulations that apply to them. This training will include webinars, livestream chats with directors, office hours with regulatory staff, case studies, best practices and more. It is free, and continuing education opportunities will be available.

The Michigan Environmental Compliance Conference will not be held this year due to COVID-19 social distancing requirements. However, the Michigan Department of Environment, Great Lakes and Energy has created a Michigan Environmental Compliance Week, a week-long virtual event dedicated to helping local governments comply with environmental regulations that apply to them. This training will include webinars, livestream chats with directors, office hours with regulatory staff, case studies, best practices and more. It is free, and continuing education opportunities will be available.

Municipal Stability Board seeks comment on Best Practices and Strategies document

Section 8 of Public Act 202 of 2017 requires the Municipal Stability Board to review and annually update a list of best practices and strategies that will assist underfunded local governments in developing their corrective action plans on pensions and retirement benefits. At its July 15 meeting, the board approved an updated best practices and strategies document, which can be viewed at the Board’s website along with other documents at Michigan.gov/MSB.

Section 8 of Public Act 202 of 2017 requires the Municipal Stability Board to review and annually update a list of best practices and strategies that will assist underfunded local governments in developing their corrective action plans on pensions and retirement benefits. At its July 15 meeting, the board approved an updated best practices and strategies document, which can be viewed at the Board’s website along with other documents at Michigan.gov/MSB.

The best practices and strategies document includes the following three best practice principles: Plan Funding, Modern Plan Design, and Effective Plan Administration. It also includes detailed corrective action plan approval criteria, including underfunded status, legality, and affordability.

The Board approved this document for public comment for a period of 30 days. Following the public comment period, the board will reconsider the document at their next scheduled meeting. Please send your comments to Treas-MunicipalStabilityBoard@michigan.gov by Aug. 19, 2020, with the subject line “Best Practices Comment: 2020”.

Staff picks

Staff picks

- Health professionals are the most trusted sources of information on COVID-19 (Center for Health and Research Transformation)

- Animated map: The history of U.S. counties (visualcapitalist.com)

- How debt collectors are transforming the business of state courts (Pew Trusts)

- Michigan Regulated Dams Map (Michigan Department of Environment, Great Lakes and Energy)

Whitmer tightens social, entertainment restrictions as caseloads climb

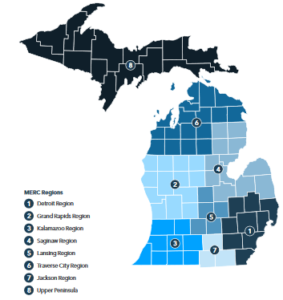

Gov. Gretchen Whitmer tightened restrictions on social and entertainment activity in Northern Michigan today in response to rising caseloads of COVID-19 in Michigan.

Gov. Gretchen Whitmer tightened restrictions on social and entertainment activity in Northern Michigan today in response to rising caseloads of COVID-19 in Michigan.

Beginning July 31, Executive Orders 160 and 161 direct that:

Bars that rely on alcohol sales for 70 percent or more of revenue are closed to indoor service.

Indoor gatherings are limited to no more than 10 people (in Regions 6 & 8, the limits are 25% of max capacity or 250 people, whichever is smaller).

These changes apply statewide, including to Regions 6 and 8 (the Upper Peninsula and 17 counties in the Northern Lower Peninsula), which have been operating with fewer restrictions for several weeks. The changes bring those regions into alignment with rules imposed on other regions in the southern parts of Michigan.

The executive orders consolidate and update a variety of existing executive orders, and it does expand activities in one area: the three casinos in the city of Detroit can reopen, but only to 15 percent of capacity.

Below is a summary of current executive orders on key county functions

Open Meeting Act

- Virtual sessions allowed (EO 154)

- Indoor gatherings limited to 10 people (EO 160, except for Regions 6 & 8)

- In Regions 6 & 8, 25% of max capacity or 250 people, whichever is smaller

Freedom of Information Act

- Normal operations resumed in June (EO 112)

Courts

- Normal filing deadlines resumed in June

Nonessential workers

- Any work capable of being performed remotely must be performed remotely; however, office work may be performed provided work done in conformance with COVID-19 protections provided in EO 161

DHHS: Opioid overdoses surge during COVID-19 pandemic

“Emergency Medical Services (EMS) and emergency departments (EDs) in Michigan have both seen substantial increases in opioid overdoses since the beginning of the COVID-19 epidemic,” the Michigan Department of Health and Human Services said in a release this week.

“Emergency Medical Services (EMS) and emergency departments (EDs) in Michigan have both seen substantial increases in opioid overdoses since the beginning of the COVID-19 epidemic,” the Michigan Department of Health and Human Services said in a release this week.

According to statistics gathered by MDHHS, EMS responses for opioid overdose increased by 33 percent from April to May of this year. Additionally, EMS responses for opioid overdoses from April through June 2020 were 26 percent higher than the same period in 2019. EMS responses for opioid overdoses increased for all regions and nearly all demographic groups.

The data provides other insights on how the pandemic has impacted the opioid crisis, DHHS noted. Patients were more likely to refuse transport to EDs in April to June compared to the same period in 2019. The percentage of opioid overdose EMS responses that resulted in the patient declining transport to EDs nearly doubled from 7.7 percent April to June 2019 to 14.3 percent April to June 2020.

After an initial drop in April, ED visits for opioid overdoses increased in May and June to pre-pandemic levels despite EDs seeing fewer visits overall in Michigan during the pandemic. The total number of ED visits April to June 2020 declined 38 percent compared with April to June 2019, while the number of opioid overdose ED visits increased by 2 percent. It is too early to determine if opioid overdose deaths have increased following the onset of the pandemic due to the length of time required to finalize death certificates.

Also this week, Judge Patricia Perez Fresard of the Wayne County Circuit Court heard arguments from the defendants’ motion to dismiss the state’s claims against drug distributors, including Cardinal Health Inc., McKesson Corp., AmerisourceBergen Drug Corp. and Walgreens.

“Among other defenses raised, defendants denied having a duty to prevent illegal diversion of opioids, and further claims d they are insulated from liability under Michigan’s Product Liability Act. Contrary to defendants claims, the State argued that defendants do have the duty and responsibility to ensure that these highly addictive medications are not diverted into illegal distribution and further that the Product Liability Act, which provides a defense to a defective product claim when a drug is FDA approved, does not protect defendants from responsibility for their illegal distribution and exacerbation of the opioids epidemic.”

For more information about overdoses and resources for prevention and treatment, visit Michigan.gov/Opioids.

One week left to register for the 2020 Virtual Annual Conference

Legendary Michigan State University coach Tom Izzo will address attendees of the 2020 Virtual Annual Conference LIVE on Aug. 20 at 11 a.m.. After his remarks on leadership and team building, the national championship coach will take questions.

Legendary Michigan State University coach Tom Izzo will address attendees of the 2020 Virtual Annual Conference LIVE on Aug. 20 at 11 a.m.. After his remarks on leadership and team building, the national championship coach will take questions.- Plenary sessions that will feature MAC’s Legislative Update, the semi-annual “State of MAC” report and an address by MAC Board President Veronica Klinefelt

- The Annual Business Meeting, during which members will vote on MAC’s policy platforms for the 2020-21 year

- Seven policy workshops that will focus heavily on the implications of COVID-19 for counties in the coming months

- A Virtual Exhibitor Show that will allow attendees to select up to five firms from which to hear 10-minute presentations

- The conference registration fee is only $50 for members, which includes all county officials

- Attendees must register by a new deadline prior to the event – Aug. 7

- MAC will not accept “walk-up” registrations during the conference (this is due to credentialing and election procedures adopted for the conference)

Treasury sets Aug. 18 webinar on pension, OPEB planning

On Aug. 18, the Michigan Department of Treasury will host a webinar event to assist local governments in the management and sustainability of their pension and retiree health care (OPEB) systems. This webinar, which will run from 2 p.m. to 3:15 p.m., provides additional resources in response to ever-changing economic conditions.

On Aug. 18, the Michigan Department of Treasury will host a webinar event to assist local governments in the management and sustainability of their pension and retiree health care (OPEB) systems. This webinar, which will run from 2 p.m. to 3:15 p.m., provides additional resources in response to ever-changing economic conditions.

Topics will include updates from the Municipal Employees Retirement System (MERS) and the Michigan Association of Public Employees Retirement Systems (MAPERS) on local pension and health care systems, problem solving and management of legacy debt from MSU Extension, University of Michigan, and the Citizens Research Council, and an update regarding reporting data, waiver applications, and the corrective action process for Public Act 202 of 2017 from the Department of Treasury.

Participants can register on the webinar’s registration page. Questions may be submitted during registration or sent to LocalRetirementReporting@michigan.gov by Friday, Aug. 14.

The event will be hosted using Microsoft Teams Live. A link to the webinar will be provided upon registration. Upon registration, instructions on how to use Microsoft Teams will also be provided. A recorded copy of this webinar and the PowerPoint will be made available after the webinar is completed on www.Michigan.gov/CEFD.

Additionally, the Michigan Department of Treasury has developed a webpage with numbered letters, memorandums, webinars, and resources regarding COVID-19 updates for local governments and school districts. This webpage was created to ensure that Michigan communities have access to the most up-to-date guidance and is updated frequently with information and resources as they become available.

Staff picks

Staff picks

- Opioid abuse surges in Michigan amid misery of coronavirus (Bridge Magazine)

- In Michigan, closing the digital divide can unite the red and the blue (Brookings Institution)

- Legislative Watch: Homelessness in the COVID era (Governing Magazine)

- Lockdowns could be the ‘biggest conservation action’ in a century (The Atlantic Magazine)

FY20 budget deal uses federal COVID aid to compensate counties for revenue sharing cuts

Legislative leaders and the Governor’s Office reached final agreement this week on a plan to balance the current FY20 state budget by making large cuts to state spending and backfilling them with federal COVID aid dollars.

Legislative leaders and the Governor’s Office reached final agreement this week on a plan to balance the current FY20 state budget by making large cuts to state spending and backfilling them with federal COVID aid dollars.

Of note for counties is a $97 million cut in revenue sharing from the state, backfilled with $150 million in federal aid that has some restrictions.

So, the August revenue sharing payment will not go out as a revenue sharing payment. Instead, the state will be sending out payments to local governments out of a new $150 million pot of CARES funding. The amount that will be sent to each unit eligible for the August revenue sharing payment will be based on their proportion of the total pot of the $97 million that was cut.

If your county, for example, was getting 2 percent of the $97 million, you will get 2 percent of the $150 million.

MAC has confirmed that this will be a disbursement, but it is assumed at this point that counties will have to issue a report back to the State certifying that the funds were allocated to COVID-19-related expenses. Eligible allocations would include non-reimbursed public health and public safety payroll expenditures, personal protection equipment and facility modifications.

In addition to the revenue sharing changes, the budget bill has also extended the July 17 deadline to apply for the payroll reimbursement program. The deadline to apply for that now will be one week from the time this supplemental budget is enacted. This was done to accommodate those entities that were not originally eligible to apply for the funds, included public safety authorities and district health departments.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC forming workgroup to study options on tax foreclosure

Following a Michigan Supreme Court ruling that gutted the system of tax foreclosures that counties have used for years, MAC will be forming a workgroup to study ways to address the consequences of the decision.

Following a Michigan Supreme Court ruling that gutted the system of tax foreclosures that counties have used for years, MAC will be forming a workgroup to study ways to address the consequences of the decision.

In Rafaeli v. Oakland County, the court ruled county treasurers cannot keep excess funds after a foreclosed property is sold and the overdue tax bill is satisfied. The court said such funds, minus the owed taxes, must be refunded to the former homeowner.

“We are disappointed in the decision,” said Stephan Currie, executive director of the Michigan Association of Counties. “We are still trying to determine the fiscal impact on our members. And we have concerns about the costs to our members of those properties that we end up selling at a loss, and concerns about the loss of funds used to remove blight from our communities.”

Oakland County had argued in the case that keeping the profits was constitutional because the tax foreclosure law gives delinquent homeowners a type of due process, reported Michigan Radio. Therefore, the county reasoned, counties aren’t taking the homeowners’ rightful property, because the homeowner had already forfeited it.

MAC continues its legal analysis of the ruling and will be reporting back to members when that analysis is complete.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Live talk with Tom Izzo confirmed for Annual Conference

Legendary Michigan State University coach Tom Izzo will address attendees of the 2020 Virtual Annual Conference LIVE on Aug. 20 at 11 a.m., MAC confirmed this week. After his remarks on leadership and team building, the national championship coach will take questions.

Legendary Michigan State University coach Tom Izzo will address attendees of the 2020 Virtual Annual Conference LIVE on Aug. 20 at 11 a.m., MAC confirmed this week. After his remarks on leadership and team building, the national championship coach will take questions.

The live chat will be one of the highlights of the 2020 MAC Virtual Annual Conference, which will include events on days between Aug. 18 and Aug. 27.

Other highlights include:

- Plenary sessions that will feature MAC’s Legislative Update, the semi-annual “State of MAC” report and an address by MAC Board President Veronica Klinefelt

- The Annual Business Meeting, during which members will vote on MAC’s policy platforms for the 2020-21 year

- Seven policy workshops that will focus heavily on the implications of COVID-19 for counties in the coming months

- A Virtual Exhibitor Show that will allow attendees to select up to five firms from which to hear 10-minute presentations

The unique nature of this event also brings changes to registration procedures:

- The conference registration fee is only $50 for members, which includes all county officials

- Attendees must register by a new deadline prior to the event – Aug. 7

- MAC will not accept “walk-up” registrations during the conference (this is due to credentialing and election procedures adopted for the conference)

Start your registration with our Attendee Packet.

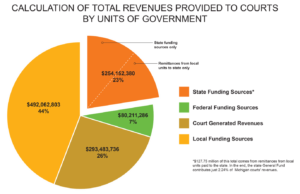

Senate committee approves trial court fee authority extension

Extension of the authority of trial courts to levy costs on defendants is one step closer to enactment this week, after the Senate Judiciary Committee approved House Bill 5488.

Extension of the authority of trial courts to levy costs on defendants is one step closer to enactment this week, after the Senate Judiciary Committee approved House Bill 5488.

The bill, by Rep. Sarah Lightner (R-Jackson), would extend statutory authority, and maintain the status quo, for Michigan’s trial courts to levy costs to defendants. Currently, that authority expires this October.

The state’s Trial Court Funding Commission said court costs “directly account for as high as $291 million annually in support (most of the 26.2 percent generated). Additionally, approximately $127 million of the annual funds transferred from the State originate from court assessments at sentencing. When totaled, Michigan trial courts are supported, in significant part, by over $418 million assessed to criminal defendants.”

The Commission also reported “findings from the survey of local funding units show that the total cost of Michigan’s court system (outside of the supreme court and court of appeals) amounts to between $1.14 billion and $1.44 billion.” Of the total amount, the percentage of local court operations expenses covered by state general fund is 2.24 percent. The report calls for a rebalancing of state and local funds and makes recommendations for the Legislature to consider for a stable court funding system.

Without completion of HB 5488, a longer-term stable funding solution cannot be worked out as an assurance that courts will not be in financial crisis is the utmost importance at this most difficult financial time for county governments.

Passage of the extension is a key priority for MAC this year. The Senate is expected to vote on the bill when it returns for session work in early August.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Legislative goals identified for jail reforms

This week, legislative leaders and bill sponsors teed up September priorities to include jail task force recommendations.

This week, legislative leaders and bill sponsors teed up September priorities to include jail task force recommendations.

The “Smarter on Crime, Better for Communities” campaign focuses on four principal objectives:

- Eliminate driver’s license suspension as a penalty for offenses unrelated to dangerous driving

- Expand the use of arrest alternatives at the system’s forefront, allowing policemen the discretion to issue citations for all misdemeanors and re-identifying some traffic misdemeanors as civil infractions

- Convert low-level offenses to jail alternatives and eliminate mandates for minimum jail sentences to serve

- Reduce jail admission for probation and parole violations, which is Michigan’s fifth-most-common reason for incarceration

Senate Bills 1046-51 and House Bills 5844 and 5846-5852 are before the judiciary committees in their respective chambers. MAC will be evaluating each one and partner with other key stakeholders in making policy decisions that conform with MAC platforms.

MAC policy platforms, before the membership this August, were amended to include “continued partnership with the Michigan Task Force on Jail and Pretrial Incarceration to support smart criminal justice reform and lessening burdens on county jails while maintaining public safety.”

For questions on this issue, contact Meghann Keit at keit@micounties.org.

Health worker immunity legislation has uncertain fate

Legislation to clarify legal immunity to health workers dealing with COVID-19 cases is headed to the governor after final approval this week by the House and Senate of two bills.

Legislation to clarify legal immunity to health workers dealing with COVID-19 cases is headed to the governor after final approval this week by the House and Senate of two bills.

Senate Bill 899 (H-2) clarifies when immunity applies and under specific circumstances.

The immunity will apply during the period from March 10, 2020, to Jan. 1, 2021 and “extend to any death or injury arising out of or resulting from any act or omission by a health care provider or health care facility, including a county medical care facility (MCF) while engaging in one or more of the following activities:

- Rendering COVID-19-related health care services to a person with presumed, suspected, or confirmed COVID-19

- Arranging, scheduling, rescheduling, canceling or postponing the rendering of health care services, including a decision to use telehealth or other remote services instead of an in-person encounter, in reliance on or in compliance with any administrative or governmental agency, division, or department policy, rule, or directive or any executive order or law regarding health care services provided by a health care provider or health care facility

- Acts, omissions, or decisions resulting from a shortage of necessary resources, including blood products, medical equipment, pharmaceuticals or staffing

However, it is uncertain if Gov. Gretchen Whitmer will sign the bill, as she and legislative Democrats have said they believe the protections go too far.

“The governor put in place liability protections for frontline workers when cases were spiking and she’s prepared to do so again if necessary,” said Whitmer aide Tiffany Brown in a MIRS News Service report. “The only obstacle frontline workers face is the legislative majority that refuses to recognize a state of emergency during this once-in-a-lifetime global pandemic, casting doubt on these protections.

“This bill attempts to paper over that failure. Moreover, it’s also just bad policy. Immunity should be available in very limited circumstances; it should not be a permanent feature of any emergency, which will only harm the people receiving care.

SB 956 (H-3) requires the Michigan Department of Health and Human Services (DHHS) to do the following:

- By Aug. 15, 2020, conduct an evaluation of the operation, efficacy, clinical outcomes and performance of each COVID-19 regional hub that was implemented and operating during the state response to coronavirus in nursing homes and provide a detailed report on that evaluation to the House and Senate Health Policy committees.

- By Sept. 1, 2020, in consultation with hospitals located in each of the state’s eight health care regions, develop a plan based on relevant and updated guidance from the federal Centers for Disease Control and Prevention (CDC), describing a process to ensure that there is at least one dedicated facility available for coronavirus-positive patients in each of the eight health care regions to provide care only for those ineligible for admission at a hospital, nursing home, or adult foster care facility. DHHS would have to submit the plan to the House and Senate Health Policy committees upon its completion.

- Beginning Sept. 1, 2020, if a hospital determined that a coronavirus-positive person was not eligible for hospital admission and the person was not a nursing home resident, the hospital would have to transfer him or her to a dedicated facility described above or a field hospital or other facility used as a surge capacity for the hospital.

- Beginning Sept. 1, 2020, a person who had tested positive for coronavirus and who was being moved from another health facility or agency could not be admitted or retained for care in a nursing home unless the person had since recovered from coronavirus.

- Beginning Sept. 1, 2020, unless a nursing home could provide care to a coronavirus-positive resident in a physically separate building, the nursing home would have to move the resident to a dedicated facility described above or a field hospital or other facility used as a surge capacity for a hospital.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

MDHHS rescheduling, changing format of opioid town halls

The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS) are rescheduling and changing the format of previously announced local town halls on opioids. These town halls will now be in a virtual format.

The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS) are rescheduling and changing the format of previously announced local town halls on opioids. These town halls will now be in a virtual format.

The following is the new town hall schedule:

- Northern Lower Michigan (previously the Gaylord town hall), Wednesday, Sept. 23.

- Flint and Thumb Region (previously the Flint town hall) Friday, Sept. 25.

- Upper Peninsula (previously the Escanaba town hall) Thursday, Oct. 8.

- West Michigan (previously the Grand Rapids town hall) Friday, Nov. 6.

- Macomb and Oakland counties (previously the Sterling Heights town hall) Thursday, Dec. 3

“During the events, state officials will seek to learn more about how the opioid epidemic has impacted different regions of the state. To ensure information gathered reflects the experience of the local communities, residents are asked to only participate in the virtual town hall for the area in which they reside,” the department said in a statement.

More details on how to participate will be provided at Michigan.gov/opioids closer to the events.

In 2018, Michigan recorded more than 2,000 opioid-related overdose deaths and more than 8,000 Michiganders have lost their lives to this epidemic in the last five years. At the town halls, MDHHS and the Michigan Opioids Task Force will share the 2020 strategy to turn the tide on the crisis, seek feedback from the public and host a Q& A about the crisis response.

A few key questions will guide the conversation:

- How has the opioid epidemic affected you, your family or your community?

- What services, programs or policies would you recommend to help address the crisis?

- How can the state help combat stigma and change the narrative around opioid use disorder?

For more information about the state’s opioids response and available resources, visit Michigan.gov/opioids.

Staff picks

Staff picks

- Coronavirus emptied Michigan’s jails without crime surge. Time for reform? (Bridge Magazine)

- Michigan’s standing dead trees (Michigan Arbor Day Alliance)

- Rural response to coronavirus could be hampered by years of population loss (Pew Trusts)

- Michigan Supreme Court ruling puts an end to county profits from foreclosure auctions (Michigan Radio)