MAC speaks in favor of Open Meetings Act rewrite

MAC testified in the Michigan House this week in support of legislation to update the state’s Open Meetings Act.

MAC testified in the Michigan House this week in support of legislation to update the state’s Open Meetings Act.

House Bill 6423, by Rep. Julie Calley (R-Ionia), contains few substantive policy changes but is a full, linguistic and stylistic rewrite of the act. Calley has told MAC and others that her goal was to remove the overly complicated legalese in the act, making it easier to interpret and prevent any inadvertent violations.

The House Committee on Rules and Competitiveness is reviewing the measure, which has prompted feedback from MAC, the Michigan Townships Association, the Michigan Municipal League and the Michigan Association of School Boards. MAC continues to work with Calley on the bill.

MAC will post updates on this issue when the Legislature returns to Lansing after the General Election.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

State puts out call for nonpartisan poll workers

Michigan is still in critical need of poll workers for the Nov. 8 General Election, the Michigan Department of State tells MAC.

Michigan is still in critical need of poll workers for the Nov. 8 General Election, the Michigan Department of State tells MAC.

County leaders are encouraged to promote the state’s nonpartisan MVP poll worker recruitment program. Election clerks are staffing and training now, so it’s the perfect time to share this opportunity. Looking forward to hearing from you on this.

The MVP stakeholder toolkit is available online at the link above, just look under “Stakeholder Resources.”

For questions on this program, contact Sarah Reinhardt of the Department of State at reinhardts@michigan.gov.

County leaders sought for NACo group studying opioid crisis

As the opioid epidemic continues to ravage communities large and small, the National Association of Counties is increasing its response to the crisis with the Opioid Solutions Leadership Network.

As the opioid epidemic continues to ravage communities large and small, the National Association of Counties is increasing its response to the crisis with the Opioid Solutions Leadership Network.

The Leadership Network will be formed from up to 26 county officials selected by NACo to attend virtual and in-person convenings (travel reimbursed) to explore members’ opioid response efforts and share strategies for scaling and replicating these strategies in members’ home jurisdictions.

Applications will be taken from interested county leaders until Nov. 9. To download the application form, click here.

For latest updates and news on the opioid national settlement and related matters, visit MAC’s Opioid Settlement Resource Center. For questions on opioid issues, contact Samantha Gibson at gibson@micounties.org.

Shine a light for America’s veterans on Nov. 11

This coming Veterans Day, the National Association of Counties (NACo) and the National Association of County Veteran Service Officers (NACVSO) invite the nation’s 3,069 counties, parishes and boroughs to join Operation Green Light and show support for veterans by lighting our buildings green Nov. 7-13. By shining a green light, county governments and our residents will let veterans know that they are seen, appreciated and supported.

This coming Veterans Day, the National Association of Counties (NACo) and the National Association of County Veteran Service Officers (NACVSO) invite the nation’s 3,069 counties, parishes and boroughs to join Operation Green Light and show support for veterans by lighting our buildings green Nov. 7-13. By shining a green light, county governments and our residents will let veterans know that they are seen, appreciated and supported.

To show support, counties can use this template to pass a resolution declaring your county’s participation in Operation Green Light.

NACo is offering a toolkit online for counties to get the word out. The toolkit includes a blueprint for declaring a resolution in your county; sending out press releases; writing a letter to the editor to your local newspaper; writing a letter to Congress; and posting information on social media.

The Michigan Veterans Affairs Agency offers an online search tool to aid veterans and others in finding their nearest veteran service officer.

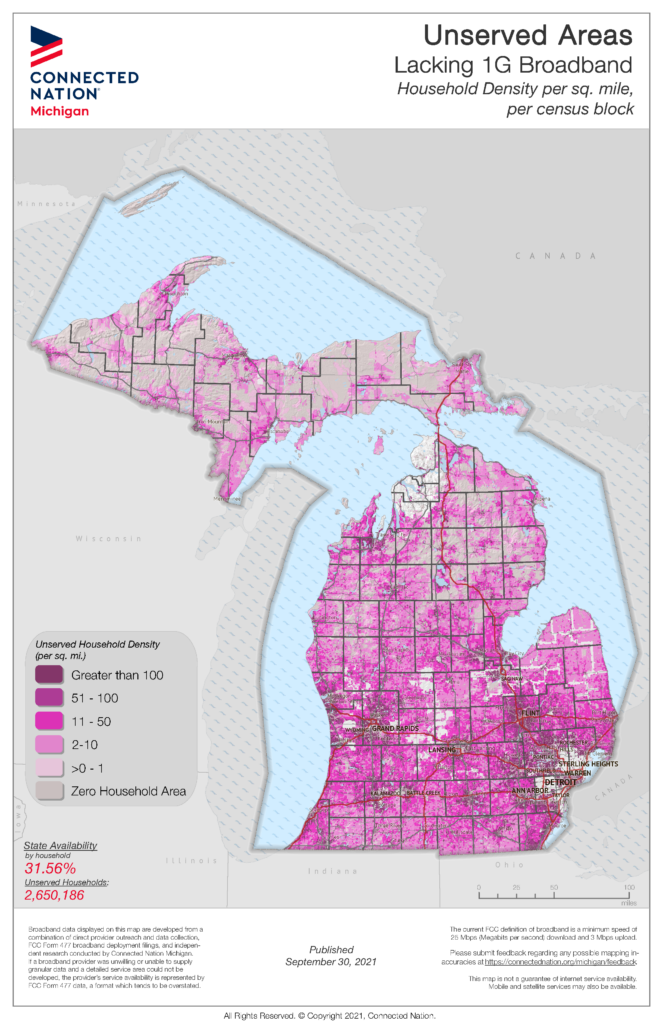

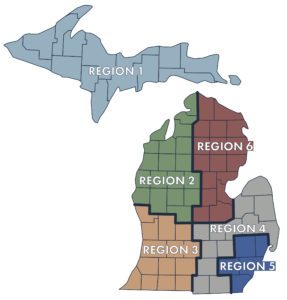

Dec. 1 deadline looms for counties to challenge broadband maps

Counties will have until Dec. 1 to challenge broadband maps developed by the Federal Communication Commission (FCC) as part of the Broadband Data Collection (BDC) process, which will guide the distribution of billions of infrastructure dollars.

Counties will have until Dec. 1 to challenge broadband maps developed by the Federal Communication Commission (FCC) as part of the Broadband Data Collection (BDC) process, which will guide the distribution of billions of infrastructure dollars.

The latest map of availability, commonly called the “Fabric,” will be made available in November 2022, the FCC says. To learn more about how your county can gather and submit data, visit https://www.fcc.gov/BroadbandData/governments.

More than $42 billion has been allocated from the Bipartisan Infrastructure Law (BIL) to expand broadband access across the country through the BEAD program, of which Michigan would receive $1.5 billion. These funds will be prioritized for unserved and underserved communities, so the FCC and Michigan High-Speed Internet Office (MIHI) must have a clearer picture of broadband service coverage and gaps.

For more information on this issue, contact Madeline Fata at fata@micounties.org.

Trial court funding approved by Gov. Whitmer

Michigan trial courts will continue to have the authority to impose fees, a critical funding element, until May 1, 2024, under House Bill 5956, a MAC-backed bill signed by Gov. Whitmer on October 7.

Michigan trial courts will continue to have the authority to impose fees, a critical funding element, until May 1, 2024, under House Bill 5956, a MAC-backed bill signed by Gov. Whitmer on October 7.

HB 5956, by Rep. Sarah Lightner (R-Jackson), was designed to address the crisis caused by the looming expiration of fee authority on Oct. 1. Courts have long relied on fees to help fund operations. In 2014, the Michigan Supreme Court said, however, that courts could levy only fees specifically designated by the Legislature. MAC led a coalition to enact a legislative fix that was adopted in the fall. That legislation, to place “reasonably related” costs, has been extended twice already.

For cases between Oct 1 (the original sunset date). and Oct. 7 (the governor’s signature date), the State Court Administrator’s Office released a memo advising that a court’s ability to assess court costs must be resolved by the judge assigned to the case in question.

MAC thanks members who have reached out to their legislators, either directly or via MAC’s digital advocacy tool, in support of court funding.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Governor approves county mental health transportation panels

County boards of commissioners now have the authority to establish a county mental health transportation panel under House Bill 4414, by Rep. Beau LaFave (R-Dickinson), which was approved by Gov. Gretchen Whitmer on Oct. 14.

County boards of commissioners now have the authority to establish a county mental health transportation panel under House Bill 4414, by Rep. Beau LaFave (R-Dickinson), which was approved by Gov. Gretchen Whitmer on Oct. 14.

MAC backed HB 4414, which complements Senate Bill 101, by Sen. Ed McBroom (R-Dickinson), now PA 146 of 2022.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Marquette County receives national award

Marquette County has recently honored with the Rural Justice Advisory Council Community Innovation Award by The National Rural Justice Collaborative (RJC). The award is given to county courts and health care providers “who have worked to improve access to behavioral health, reducing victimization, facilitating education and employment opportunities for justice involved individuals, eliminating barriers to accessing justice, reducing incarceration and recidivism and facilitating reentry.”

Marquette County has recently honored with the Rural Justice Advisory Council Community Innovation Award by The National Rural Justice Collaborative (RJC). The award is given to county courts and health care providers “who have worked to improve access to behavioral health, reducing victimization, facilitating education and employment opportunities for justice involved individuals, eliminating barriers to accessing justice, reducing incarceration and recidivism and facilitating reentry.”

Marquette County’s recognition is well-deserved. They have created a Jobs Court, established a program to divert mentally ill individuals from incarceration with the help of a Crisis Intervention Team and provided behavioral health services to all defendants. Their efforts have reduced incarceration and recidivism rates, helped defendants convicted of low-level and nonviolent offenses find employment and given defendants access to social workers and mental health care.

MAC congratulates Marquette County for its diligent work to improve the mental and behavioral health programs within their justice system.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Staff picks

Staff picks

- The Upper Peninsula’s food price premium (Rural Insights)

- What the housing market slowdown will mean for property taxes (RouteFifty)

- Analysis of Ballot Proposal 22-1 (term limits/financial disclosure) (Michigan Senate Fiscal Agency)

- Say what? Hearing aids available over the counter for as low as $199, and without a prescription (Kaiser Health News)

Legislation to require release of certain property tax records is now headed to the governor after an intense round of hearings and negotiations led to major revisions and an eventual compromise approved by MAC and other local government stakeholders.

Legislation to require release of certain property tax records is now headed to the governor after an intense round of hearings and negotiations led to major revisions and an eventual compromise approved by MAC and other local government stakeholders. County boards of commissioners would have the authority to establish a county mental health transportation panel under

County boards of commissioners would have the authority to establish a county mental health transportation panel under  Michigan counties with public lands are advised to visit a U.S. Treasury Department application portal on the Local Assistance and Tribal Consistency Fund (LATCF).

Michigan counties with public lands are advised to visit a U.S. Treasury Department application portal on the Local Assistance and Tribal Consistency Fund (LATCF).  Testimony was heard this week on a package of bills relating to mining operations during a session of the House Natural Resources and Outdoor Recreation Committee.

Testimony was heard this week on a package of bills relating to mining operations during a session of the House Natural Resources and Outdoor Recreation Committee. A bill to add circuit court judgeships in Allegan Kalamazoo counties moved to the House this week after gaining Senate approval.

A bill to add circuit court judgeships in Allegan Kalamazoo counties moved to the House this week after gaining Senate approval. MAC’s Legislative Update email will be taking a two-week break in October, resuming on Friday, Oct. 21.

MAC’s Legislative Update email will be taking a two-week break in October, resuming on Friday, Oct. 21. On Nov. 8, 2022, Michigan voters will consider three proposed constitutional amendments:

On Nov. 8, 2022, Michigan voters will consider three proposed constitutional amendments: A permanent funding source for Secondary Road Patrol needs only the governor’s signature to become reality after the Senate approved enabling legislation this week.

A permanent funding source for Secondary Road Patrol needs only the governor’s signature to become reality after the Senate approved enabling legislation this week.

Join NACo on Sept. 23 for broadband mapping update

Join NACo on Sept. 23 for broadband mapping update

Legislation to create an optional structure for the taxes levied on solar facilities in Michigan received a hearing this week before the Senate Committee on Energy and Technology.

Legislation to create an optional structure for the taxes levied on solar facilities in Michigan received a hearing this week before the Senate Committee on Energy and Technology. Commissioners attending the 2022 Michigan Counties Annual Conference (Sept. 18-21 in Port Huron) will vote in caucuses to fill five seats on the MAC Board of Directors after the candidate filing period closed on Thursday.

Commissioners attending the 2022 Michigan Counties Annual Conference (Sept. 18-21 in Port Huron) will vote in caucuses to fill five seats on the MAC Board of Directors after the candidate filing period closed on Thursday.

The state is encouraging Michiganders working in public service to review the Public Service Loan Forgiveness (PSLF) program to see if they qualify for federal student loan relief no later than October 31, 2022. Thousands have already utilized the program to pay off their debt, and over 148,000 more Michiganders may be eligible due to the recent PSLF waiver, says Gov. Gretchen Whitmer.

The state is encouraging Michiganders working in public service to review the Public Service Loan Forgiveness (PSLF) program to see if they qualify for federal student loan relief no later than October 31, 2022. Thousands have already utilized the program to pay off their debt, and over 148,000 more Michiganders may be eligible due to the recent PSLF waiver, says Gov. Gretchen Whitmer.