Registration opens for 2022 Annual Conference on Sunrise Side

Join us on the sunrise side of the state for the 2022 Michigan Counties Annual Conference, put on by the Michigan Association of Counties in coordination with the Michigan County Medical Care Facilities Council (MCMCFC).

Join us on the sunrise side of the state for the 2022 Michigan Counties Annual Conference, put on by the Michigan Association of Counties in coordination with the Michigan County Medical Care Facilities Council (MCMCFC).

This year, we are in Port Huron in St. Clair County. The venue is the Bluewater Convention Center, located along the St. Clair River, with views of freighter traffic entering and exiting Lake Huron and the Blue Water Bridge to Canada.

Running from the afternoon of Sept. 18 through the morning of Sept. 21, the 2022 Annual Conference will feature:

- Four plenary sessions featuring key issues now before Michigan and a MAC Legislative Update (Speakers will be announced soon.)

- 12 breakout sessions for MAC members and 6 workshops for MCMCFC members (Speakers will be announced soon.)

- A Welcome Reception and Strolling Dinner on the evening of Sunday, Sept. 18.

- A lavish President’s Banquet on the night of Tuesday, Sept. 20.

- Plenty of free time in the afternoons for attendees to enjoy sights and sounds of Port Huron, including the St. Clair River.

Members of MCMCFC will enjoy specialized breakouts designed for its members to earn Nursing and NAB Continuing Education credits.

MAC members attending the conference will receive credits in MAC’s County Commissioner Academy.

Conference Rates

The conference fee provides you access to all conference activities. (The spouse fee also provides access to any conference event, including the President’s Banquet on the evening of Sept 20.) This fee includes two dinners, two receptions, two breakfasts and two lunches.

|

|

|

Early bird |

Full rate |

|

Member |

Full conference |

$395 |

$425 |

|

|

Single day |

$275 |

$325 |

|

|

Spouse/guest |

$150 |

$175 |

|

Non-Member |

Full conference |

$525 |

$575 |

NOTE: The member rate is open to all county commissioners, administrators, countywide elected officials and county employees of MAC member counties, plus employees and board members of MCMCFC facilities.

Hotel Information

The DoubleTree by Hilton Hotel is attached to the Blue Water Convention Center (conference headquarters). You can expect a DoubleTree famous chocolate chip/oatmeal cookie, served warm upon arrival. After you’ve settled in, take a stroll along the St. Clair River, view watercraft/freighter traffic on the river or see the big Blue Water Bridge to Canada!

To make your reservations, you can call the DoubleTree Hotel directly at 810/984.8000 or go online at www.porthuron.doubletree.com.

As always, MAC and MCMCFC have secured highly competitive room rates that begin at $149 per night for single/double occupancy. Breakfast is not included with your hotel pricing. Join us in the conference center instead! GROUP CODE: MIA

The room block deadline is Aug. 17, 2022.

In anticipation of another popular conference, we have also reserved a block of rooms at the Comfort Inn at $129 per night. The Comfort Inn is located at 1720 Hancock St., Port Huron, MI 48060. To book your room reservations, contact 810-987-5999. Group Name: Michigan Association of Counties.

We expect a large gathering this year, so members are strongly encouraged to book their rooms immediately to ensure access to the conference room block and best room rates.

Getting around: For those staying at the Comfort Inn, we will provide complimentary shuttle service via Blue Water Transit during the conference schedule. There also is plenty of free parking at the convention center.

Please direct any conference registration questions or issues to conference@micounties.org.

MAC will be releasing information on plenary sessions, speakers and breakout descriptions in coming weeks.

MAC working to improve bill on remote participation in meetings

A bill to allow remote participation during an open meeting, with a quorum present, was introduced last week by Rep. Julie Calley (R-Ionia).

A bill to allow remote participation during an open meeting, with a quorum present, was introduced last week by Rep. Julie Calley (R-Ionia).

House Bill 6283 would require written notice to all board members of an impending remote participation at least 18 hours before the meeting begins. However, remote participation could be denied if a member of the public body motions for a vote and a majority disapproves. In addition, remote participation would be limited to the lesser of 10 percent of the public body’s meetings per year or three in total.

Although this bill is a step in the right direction, according to MAC’s platforms, much work still needs to be done to ensure that the restrictions are not too onerous, and that gamesmanship can be avoided. Rep. Calley has assured MAC that she is open to changes to the bill.

MAC anticipates House committee action on the bill in the fall.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Solar PILT bills designed to eliminate uncertainty on taxation

After years of workgroups, Sen. Curt VanderWall (R-Mason) and Sen. Kevin Daley (R-Lapeer) have introduced legislation to create a process for establishing solar energy districts, allowing for a personal property tax exemption for solar energy equipment and replacing it with a payment in lieu of taxes (PILT) system.

After years of workgroups, Sen. Curt VanderWall (R-Mason) and Sen. Kevin Daley (R-Lapeer) have introduced legislation to create a process for establishing solar energy districts, allowing for a personal property tax exemption for solar energy equipment and replacing it with a payment in lieu of taxes (PILT) system.

Senate Bill 1106, by VanderWall, and SB 1107, by Daley (R-Lapeer), would establish the PILT payment at a rate of $7,000 per megawatt (MW) of capacity for 20 years. These bills were developed to give local governments a stable funding source for the equipment and to avoid litigation on the assessed value of the equipment.

For context, many counties are still fighting in court over the disputed assessment amounts for wind turbines in their jurisdiction. These bills will provide a financial incentive to the solar developers to move toward more green energy, while at the same time eliminating the uncertainty of the value of the property.

Senate action on the bills is anticipated in the fall. MAC is neutral on the bills at this time (and opposed similar legislation last session that pegged payments at $4,000 per MW).

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

County input sought on project to streamline financial reporting

A pilot project involving MAC, the University of Michigan and others is exploring whether a new fiscal reporting mechanism for governmental entities can help create transparency — and prevent future financial crises.

A pilot project involving MAC, the University of Michigan and others is exploring whether a new fiscal reporting mechanism for governmental entities can help create transparency — and prevent future financial crises.

The Center for Local, State, and Urban Policy (CLOSUP), in partnership with the nonprofit standards setting organization XBRL US, seeks input from county leaders about its proposed digital financial data standards for local governments.

Ogemaw County volunteered to serve as the county pilot for the effort. “I am convinced this project will result in an affordable tool that will categorically improve efficiency and accuracy of municipal financial reporting,” said Timothy Dolehanty, Ogemaw County administrator. “Elimination of multiple, redundant keystrokes will certainly save time. But public administrators will also gain the ability to compare and contrast financial trends in real time, which provides an early opportunity to take necessary corrective actions.”

The most important and reliable information for understanding local fiscal health is found in audited Annual Comprehensive Financial Reports (ACFRs). ACFRs are currently provided as PDF documents, which severely limits their accessibility, comparability, and usefulness for many stakeholders. The proposed open standards, based on XBRL (eXtensible Business Reporting Language), create a fully digital human- and machine-readable version of ACFRs in order to better share the information with the public, state and others.

The digital standards, called a taxonomy, also incorporate all concepts needed for the Michigan Form F-65 (Local Unit Fiscal Report), Form 5572 (Retirement System Annual Report), and the Uniform Chart of Accounts. Digitizing this information will allow these reports to be generated automatically from the underlying data rather than manually entered into separate forms.

During the 60-day public review period set to end on Aug. 15, participants are encouraged to review and provide feedback on the proposed taxonomy, which is available online in a downloadable Excel format or in an online viewer. Detailed instructions, FAQs, and examples of XBRL-formatted financial statements are also available on the website.

To learn more about the project, please visit https://closup.umich.edu/research-projects/modernizing-michigan-local-government-fiscal-transparency.

Legislative Update takes brief mid-summer hiatus

Legislative Update takes brief mid-summer hiatus

MAC’s weekly Legislative Update will take a one-week break for the week of July 11-15.

The email will resume its regular schedule on Friday, July 22.

Staff picks

Staff picks

- 4 proven strategies for attracting and retaining state and local government workers (RouteFifty)

- USDOT releases $573 million in FY2022 through new railroad crossing elimination program (NACo)

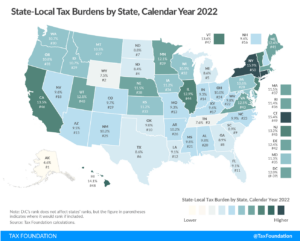

- State and Local Tax Burdens, Calendar Year 2022 (Tax Foundation)

- Sleeping Bear Dunes star parties return for 5 dates in 2022 (MLive)

FY23 state budget includes 6% boost for county revenue sharing

In the wee hours on Friday, the Legislature finished the FY 2023 budget, which is set to begin on Oct. 1 of this year. Below are the major highlights, including a 6 percent (5% in the base and 1% one-time) increase in County Revenue Sharing. In addition, they passed a supplemental budget for FY22, included in which are items of importance to counties.

In the wee hours on Friday, the Legislature finished the FY 2023 budget, which is set to begin on Oct. 1 of this year. Below are the major highlights, including a 6 percent (5% in the base and 1% one-time) increase in County Revenue Sharing. In addition, they passed a supplemental budget for FY22, included in which are items of importance to counties.

FY22 Supplemental

- ARP – community policing grants for Wayne ($3M), Saginaw ($1M) and Genesee ($500,000) counties

- ARP – community policing competitive grants – $11 million

- Communication Radios and Tower – $1 million for radios in Midland County, $3 million for towers in Barry County and $4.8 million for towers in Isabella County

- Requires that grants be used for the construction of new towers or the augmentation of existing towers and associated equipment to support the integration of the county into the Michigan Public Safety Communication System (MPSCS) or to expand the interoperability of all local public safety entities within the county

- EMS scholarship and grant program – $30 million

- Raise the Age Fund Increase – $4 million

- Broadband equity, access and deployment – $5 million

FY23 Budget (by state department)

Agriculture

- Local conservation districts – $3 million

- Office of Rural Development Grants – $3 million for grants to rural communities, related to economic development, workforce development, affordable housing, infrastructure, education and high-speed internet access

- County fairs – $500,000 for fair capital grant program (a reduction of almost $2 million from current year)

- Economic development for food and agriculture industries – $50 million, of which $12 million is set aside for improvements to the Eastern Market in Detroit

Corrections

- Jail reimbursement – $1 million to reimburse counties who housed felons in their jails due to the department’s closed intake of prisoners during COVID. (rate is $80 per offender per day; inmates paid for through the county jail reimbursement program are not eligible for this payment)

Energy, Great Lakes and Environment

- Contaminated site cleanups – $10 million

- Watershed Council grants – $600,000

- Environmental health – $7.9 million for water supply oversight and support for local health departments in monitoring and testing drinking water

- Municipal Assistance for FTEs to increase loan processing staff and access to federal water infrastructure loans for local communities – $5.1 million

- Water State Revolving Funds – $120 million gross to continue funding the state’s water state revolving fund program

- Private well testing – $5 million in one-time funding for grants to local health departments to provide free or low-cost water testing to private well owners

Labor and Economic Development

- Michigan Infrastructure Grants – $212,800 for grants for infrastructure

- Economic Development and Workforce Grants – $251.5 million

- Blight Elimination Program – $75 million to address blighted properties across the State

- Going Pro – $15 million

- Pure Michigan – $40 million

- Nonprofit Relief Grants to nonprofit community service organizations – $50 million

Treasury (General Government)

- Revenue Sharing to Counties – $245.8 million, which is a 6 percent increase (1% is one-time increase, while 5 percent is designated as ongoing)

- Pensions – $750 million for grants for local retirement systems that are less than 60 percent funded

- ARP relief grants – $50 million

Health and Human Services

- Medicaid primary care rates – $56.1 million to increase them

- Behavioral health capacity and access initiatives – $47.3 million

- Medicaid reimbursement for Community Health Workers – $28.3 million

- Child and adolescent health centers – $25 million to increase funding

- Child care – $10.5 million to provide a 5 percent reimbursement increase for residential child caring institutions and a 12 percent increase to private residential juvenile justice providers

- Guardian and conservator reimbursement rates – $5 million to increase them

- Medicaid Mental Health Local Match – $5.1 million to replace a like amount of local funding used for Medicaid mental health supports and services (amount would reflect the third year of phasing out the local match portion over a 5-year period)

- Behavioral Health Inpatient Capacity and Operations – $41 million and authorizes 87 FTE positions to increase capacity at Hawthorn and to reimburse private providers of intensive psychiatric treatments

- Jail Diversion Fund – $10 million

- Student loan repayment for behavioral health professionals – $10 million

- Non-State Behavioral Health Facility Capacity – $178.6 million

- Clinical and CMHSP Integration Readiness Initiatives – $50 million for grants to facilities and providers that wish to clinically integrate physical and behavioral health services and providers and to CMHSPs for system, IT, staffing, and administrative improvements for integration readiness (funds are not available for expenditure until legislatively transferred)

- State Nursing Home Surveyors – $1.6 million and 10 FTEs for education and consultation activities to improve care at skilled nursing facilities

Judiciary

- Statewide Judicial Case Management System – $150 million for the cost of developing a single, statewide judicial case management system (Currently, there are 242 trial courts using and funding more than 16 case management systems and 150 computer systems. The Trial Court Funding Commission recommended that the state provide all court technology needs for trial courts, including case and document management services, and the Supreme Court recently ordered that local trial courts submit all case data in a uniform manner. Funding would support data management efforts and consistent implementation of newer technologies among trial courts; prohibits funds from being used to supplant the current user fee system and administrative purposes unrelated to the system; requires the system to comply with all security measures and restrictions and to be hosted in a secure cloud by an experienced vendor; requires implementation status report.)

Veterans Affairs

- Grand Rapids Home for Veterans – $6.5 million

- Veterans Suicide Prevention Outreach – $1.2 million for an outreach campaign targeting current and former servicemembers and their families on reducing suicide incidents

Natural Resources

- Off-road Vehicle Trail Improvement Grants – $6.4 million to increase funding for the off-road vehicle trail improvements initiative

State Police

- Secondary Road Patrol Grant Program – $15 million

Transportation

- County Road Commissions Restricted Fund – $56.3 million

- Airport Safety Improvement Program – $33.9 million

- Local Federal Aid Road and Bridge Construction – $15.2 million

- IIJA Airport Infrastructure Grants – $2.2 million

- Technical Assistance, Planning, and IIJA Match Grants – $25 million to help local units to plan and match resources for IIJA grants

- Electric Vehicle Study – requires the department to study the impact on revenue resulting from the integration of electric vehicles on Michigan roadways

For more information on the state budget, contact Deena Bosworth at bosworth@micounties.org.

Governor signs another investment in water infrastructure

A second water infrastructure bill package using federal infrastructure dollars was signed by Gov. Gretchen Whitmer this week.

A second water infrastructure bill package using federal infrastructure dollars was signed by Gov. Gretchen Whitmer this week.

House Bill 5890, by Rep. Beth Griffin (R-Van Buren), HB 5891, by Rep. David Martin (R-Genesee), and HB 5892 by Rep. Sara Cambensy (D-Marquette), will update Michigan’s State Revolving Fund to ensure dollars go to modern infrastructure needs of communities. Specifically, the legislation will ensure financing is equally distributed and communities will be able to easily access state financing for water infrastructure projects.

MAC applauds the bill sponsors and the governor for their continued investments in water infrastructure.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Flurry of county-related bills filed in hectic legislative week

Several pieces of legislation impacting local government were introduced this week during the Legislature’s marathon work days this week.

Several pieces of legislation impacting local government were introduced this week during the Legislature’s marathon work days this week.

Senate Bill 1106, by Sen. Curt VanderWall (R-Mason), and SB 1107, by Sen. Kevin Daley (R-Lapeer), are solar payment in lieu of taxes (PILT) measures that would establish solar energy districts in local units of government and provide for an exemption of certain taxes.

House Bill 6283, by Rep. Julie Calley (R-Ionia), would bring changes to the current Open Meetings Act rules. The legislation will create procedures for conducting electronic meetings.

House Bill 6296, by Rep. Jeff Yaroch (R-Macomb), is legislation to create an early warning system for local units of government that are at risk for fiscal stress.

MAC has been working with lawmakers and staffers on these issues. A more in-depth analysis of these bills will appear in the July 8 Legislative Update.

For more information, contact Deena Bosworth at bosworth@micounties.org

Brush up on key county issues at July 27 Policy Summit

County leaders are cordially invited to attend, in person or via Zoom, the 2022 MAC Policy Summit on July 27 in downtown Lansing.

County leaders are cordially invited to attend, in person or via Zoom, the 2022 MAC Policy Summit on July 27 in downtown Lansing.

The Policy Summit replaces MAC’s Regional Summits, which were held at locations across Michigan in June, July and August.

Follow the link below to register. The fee is $50 for either in-person or digital registration.

The summit will include presentations on such issues as:

- Addressing the workforce housing challenge

- Understanding Michigan’s political landscape in 2022

- The value of expanding Michigan’s trail network

- Maximizing your infrastructure dollars

The day will begin at 8:30 a.m. with check-in and a continental breakfast. Policy presentations will continue until 3 p.m., with lunch provided and compliments of Enbridge. MAC also has arranged a discount rate of $139 at the Courtyard for members who wish to arrive on the evening of July 26. (To get this rate, make your reservation by July 19.)

Those who register to attend digitally will be provided a link and access codes on the day prior to the summit. In-person attendees will be provided parking information in the week prior to the event.

Feds announce $1B pilot program on transportation

The U.S. Department of Transportation is now accepting applications for the first-of-its-kind Reconnecting Communities pilot program. The $1 billion program will help reconnect communities that were previously cut off from economic opportunities by transportation infrastructure.

The U.S. Department of Transportation is now accepting applications for the first-of-its-kind Reconnecting Communities pilot program. The $1 billion program will help reconnect communities that were previously cut off from economic opportunities by transportation infrastructure.

Reconnecting a community could mean adapting existing infrastructure — such as building a pedestrian walkway over or under an existing highway — to better connect neighborhoods to opportunities or better means of access such as crosswalks and redesigned intersections.

Eligible applicants for the Reconnecting Communities competitive grant pilot program include:

- States

- Local and Tribal governments

- Metropolitan planning organizations

- Nonprofit organizations

- Other transportation facility owners

Preference will be given to applications from economically disadvantaged communities, especially those with projects that are focused on equity and environmental justice, have strong community engagement and stewardship, and a commitment to shared prosperity and equitable development. Of the $195 million available from the grant program this year, $50 million is dedicated to planning activities for communities that may be earlier in the process.

The Reconnecting Communities Notice of Funding Opportunity can be found here. Information on Reconnecting Communities technical assistance and other resources can be found here. Applications are due Oct. 13, 2022. Awards are expected to be announced in early 2023. The new DOT Navigator can be accessed here and information on the Thriving Communities program can be found here.

The department will convene a series of stakeholder webinars to help potential applicants learn about the RCP grant program and what they need to know to prepare an application. The first one will be held Thursday, July 14 at noon EST.

Draft policy platforms now available for review prior to September vote

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 20 at 2 p.m. in the Blue Water Convention Center during the 2022 Michigan Counties Annual Conference.

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 20 at 2 p.m. in the Blue Water Convention Center during the 2022 Michigan Counties Annual Conference.

County commissioners who are registered for the conference may participate as voting members in the business meeting, which includes review and approval of MAC’s 2022-2023 policy platforms.

The platform process begins with MAC’s policy committees, which meet during the year to address key issues. Their drafts are then submitted to the MAC Board of Directors for review. The MAC Board then advances the drafts to the membership for final approval.

Those Board-vetted drafts are now available on the MAC website here. (Please note that this is a password-protected page. Each member county has a set of access credentials, which are shared each year with your county administrator. If you do not have your credentials, contact Hannah Sweeney at sweeney@micounties.org for them.)

According to MAC’s By-laws (Article III, Section 6):

“A member wishing to submit an amendment to the MAC Platform shall submit the amendment to MAC at least five (5) days prior to the opening day of the MAC Annual Conference. Such amendment will require a majority vote at the annual meeting to be adopted.

“An amendment to the MAC Platform may be presented from the floor during the annual meeting. Such amendment will require a 2/3 majority vote of the members at the meeting at which a quorum is initially established to be adopted.”

To submit a platform amendment in advance, draft your preferred language and email to sweeney@micounties.org no later than Sept. 13, 2022.

MAC offices closed on July 4

MAC’s Lansing offices will be closed on Monday, July 4 to observe the Independence Day holiday.

MAC’s Lansing offices will be closed on Monday, July 4 to observe the Independence Day holiday.

Normal office hours will resume on Tuesday, July 5 at 8 a.m.

See a full transcription of the Declaration of Independence, issued on July 4, 1776, by clicking here.

Staff picks

State and Local Workforce Report 2022 (MissionSquare Research Institute)

State and Local Workforce Report 2022 (MissionSquare Research Institute)

- Trees are critical infrastructure (Citizens Research Council of Michigan)

- Great Lakes water levels could increase on average from 19 to 44 centimeters in the next few decades, study says (Great Lakes Now)

- Michigan pot sales skyrocket to all-time high as prices keep dropping (Bridge magazine)

Debate continues on legislation to weaken local control on gravel sites

A rigorous debate on aggregate mining legislation occurred this week in the House Local Government and Municipal Finance Committee.

The set of bills would change the oversight and permitting responsibilities of aggregate mining. Testimony was heard from several stakeholder groups and the Department of Environment, Great Lakes, and Energy (EGLE) on whether the permitting process should be in the hands of locals or the department.

House Bill 4875, by Rep. Julie Alexander (R-Jackson), aims to create a clear process of mining regulations all the while keeping control in the hands of local government. This is the preferred approach supported by MAC.

Senate Bill 429, Senate Bill 430 and Senate Bill 431, by Sen. Jim Ananich (D-Genesee), would place all oversight and responsibilities in the hands of EGLE. The set of bills were introduced last year and had passed the through the Senate. MAC remains opposed to this approach.

MAC will continue to monitor the legislation as it moves through the legislative process.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org

Senate OKs Personal Property Tax exemption reimbursement

Bills to fully reimburse local units for their losses associated with the Legislature’s 2021 Personal Property Tax exemption that is estimated will hit locals with a $75 million loss annually has passed unanimously out of the Senate. The bill package now moves to the House for consideration.

Senate Bill 1060, by Sen. Mark Huizenga (R- Kent), Senate Bill 1061, by Sen. Kimberly LaSata (R-Berrien), and Senate Bill 1062, by Sen. Michael McDonald (R-Macomb), would create a Local Government Reimbursement Fund into which the state would deposit $75 million annually.

The reimbursement package is a result of the House Bill 5351, by Rep. Steve Johnson (R-Kent), passed in December 2021. The bill lifted of the PPT exemption threshold for small taxpayers from $80,000 to $180,000 in true cash value. Lawmakers did also vote for a $75 million reimbursement for the first year of this exemption scheme (which starts in 2023), but they did not provide for the years beyond.

Deena Bosworth, MAC’s director of governmental affairs, previously testified in support of the package in the Senate Finance Committee. MAC helped develop the process in SB 1060-1062 alongside other local government groups.

MAC will continue to support the bill package and monitor its progress through the legislative process.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

Draft policy platforms now available for review prior to September vote

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 20 at 2 p.m. in the Blue Water Convention Center during the 2022 Michigan Counties Annual Conference.

County commissioners who are registered for the conference may participate as voting members in the business meeting, which includes review and approval of MAC’s 2022-2023 policy platforms.

The platform process begins with MAC’s policy committees, which meet during the year to address key issues. Their drafts are then submitted to the MAC Board of Directors for review. The MAC Board then advances the drafts to the membership for final approval.

Those Board-vetted drafts are now available on the MAC website here. (Please note that this is a password-protected page. Each member county has a set of access credentials, which are shared each year with your county administrator. If you do not have your credentials, contact Hannah Sweeney at sweeney@micounties.org for them.)

According to MAC’s By-laws (Article III, Section 6):

“A member wishing to submit an amendment to the MAC Platform shall submit the amendment to MAC at least five (5) days prior to the opening day of the MAC Annual Conference. Such amendment will require a majority vote at the annual meeting to be adopted.

“An amendment to the MAC Platform may be presented from the floor during the annual meeting. Such amendment will require a 2/3 majority vote of the members at the meeting at which a quorum is initially established to be adopted.”

To submit a platform amendment in advance, draft your preferred language and email to sweeney@micounties.org no later than Sept. 13, 2022.

Webinar to focus on rail grants on June 28

A webinar on June 28 will provide county leaders a review of the numerous grant opportunities involving railroads.

There are more than a dozen grant programs with rail funding availability offered through the U.S. Department of Transportation. In particular, the new Grade Crossing Elimination Program offers $3 billion in appropriated funding for grade crossing projects that improve the safety and mobility of people and goods.

GoRail is hosting the webinar so local officials can learn more about USDOT’s grant process and how best to approach their own applications.

William Thompson, chief engineer at the Association of American Railroads, has worked closely with the CREATE program in Chicago and will offer lessons learned from his experience, including building connections between public and private partners and project organization as well as CREATE’s approach to grant writing. We hope this will help officials begin to approach and navigate their own grant proposals.

The webinar runs from 2 p.m. to 2:45 p.m. on June 28.

To register or for more information, click here.

Staff picks

Analysis on Motor Fuel Taxation in Michigan (Senate Fiscal Agency)

Local governments search for answers to hiring challenges (Governing)

Distribution of Michigan PILT by County (Senate Fiscal Agency)

Cambodian catches world’s largest recorded freshwater fish (Associated Press)

Senate passes big supplemental bill tied to mental health privatization

The Senate passed a mental health supplemental budget this week, but tie-barred a portion of the funding to the passage of Senate Majority Leader Mike Shirkey’s mental health integration package.

The Senate passed a mental health supplemental budget this week, but tie-barred a portion of the funding to the passage of Senate Majority Leader Mike Shirkey’s mental health integration package.

Senate Bill 714, by Sen. Shirkey (R-Jackson), provides $565.5 million in funding for the current fiscal year to the behavioral health system. $548.7 million would come from what the state received from the American Rescue Plan Act and $17.5 million would be directed from the state’s General Fund.

However, the following line-item appropriations are conditional upon the passage of Senate Bill 597 and Senate Bill 598, two bills that MAC and others strenuously oppose due to the loss of local control they would create:

- Requires Medicaid Mental Health Services be used to replace local match with GF/GP.

- Requires the Clinical Integration Fund be used to provide grants to facilities and providers that integrate their setting with physical and behavioral health services and providers.

- Requires the funding for Community Mental Health Services Program (CMHSP) Integration Readiness be used to support CMHSP efforts to make information technology, staff, and administrative improvements for integration.

- Requires the funding for DHHS integration readiness be used to make one-time investments to support implementation of SBs 597-98.

- Directs the Department of Health and Human Services to appropriate $15 million of part 1 funding for Integrated Care Center to the Detroit Wayne Integrated Health Network to implement a centrally located integrated service center to provide physical and mental health services.

- Directs the funding for Jail Diversion Fund be allocated to the Jail Diversion Fund, which would be administered by the Mental Health Diversion Council. Directs the Council to distribute grants to local entities to establish or expand jail diversion programs, with 50.0% going to community-based mobile crisis intervention services that include full integration with 911 dispatch centers, include both co-responder clinicians and peers, have access to residential treatment facilities, include telehealth response and follow-up services, and employ mental health professionals independent of law enforcement. Directs that the other 50.0% go to pre-arrest or post-arrest diversion programs for individuals with behavioral health needs, with priority given to nonurbanized areas.

MAC will continue to oppose any move to shift toward privatization of our local public mental health system. A total of 62 counties have voiced their opposition by passing resolutions in opposition to the mental health integration plan. We also encourage commissioners to use our Advocacy Tool to voice your opposition to your senator.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Treasury releases new guidance on P&E reports for July deadline

The National Association of Counties reported this week that, “Treasury released updated reporting guidance for the Project and Expenditure (P&E) Reports and a new template for the Recovery Plan Performance Report (Recovery Plan) ahead of the July 31, 2022, reporting deadline. The new requirements outlined below will impact all counties regardless of population size and award amount.

The National Association of Counties reported this week that, “Treasury released updated reporting guidance for the Project and Expenditure (P&E) Reports and a new template for the Recovery Plan Performance Report (Recovery Plan) ahead of the July 31, 2022, reporting deadline. The new requirements outlined below will impact all counties regardless of population size and award amount.

“Key updates to the compliance and reporting guidance outlined by Treasury include:

- Additional programmatic data for capital expenditures: When using Recovery Funds for capital expenditures projects, counties need to report the type of expenditure based on a list of enumerated uses. Examples of enumerated uses are COVID-19 vaccination sites, job and workforce training centers, and public health data systems. A full list of enumerated uses is available on pages 27 to 28 of the updated guidance.

- Written justification for capital expenditures: Counties are required to provide a written justification for capital projects of any category that cost at least $10 million and for projects in the “other” (i.e., project not explicitly enumerated by Treasury) category that cost at least $1 million. Previously, counties needed to create a written justification for these projects but were not required to submit them as part of regular reporting.

- Description of labor requirements for capital expenditures: Counties are required to provide additional labor reporting. For projects that cost at least $10 million, counties will need to report on the strength of the project’s labor standards, including information on the presence of a project labor agreement, community benefits agreement, prevailing wage requirement, or local hiring. This new required information is outlined under Infrastructure Project on pages 30-31 of the updated guidance.

- Project information for broadband projects: The updated guidance requires counties to provide detailed project information for broadband infrastructure investments. Counties need to report what kind of technology is involved in the project (i.e., fiber optic cables, coaxial cables, etc.), the total miles of fiber deployed over the project, and the total number of funded locations served broken out by both speed of connection and type of location (i.e., residential, business, or community). This new required information is outlined under Broadband Projects on pages 32-33 of the updated guidance.

- Moving of Recovery Plan Performance Report data into P&E Report: Under the updated guidance, some of the data that was previously only required for the Recovery Plan Performance Report (Recovery Plan) is now required for large counties (i.e., populations above 250,000 and/or above $10 million in awards) on their quarterly P&E Report. For example, large counties investing in housing security programs must now report the number of households receiving eviction prevention services. A full list of changes to programmatic data requirements for large counties is available on page 33 of the compliance and reporting guidance.

- Updated template for Recovery Plan: The updated guidance also provides a template for the Recovery Plan due for large counties on July 31, 2022, reflecting the expenditure categories and other changes made by the Final Rule.”

For questions regarding COVID funds reporting, visit NACo’s information hub at https://www.naco.org/resources/featured/arpa-fiscal-recovery-fund.

PPT reimbursement plan moves to full Senate

Bills to fully reimburse local units for their losses associated with the Legislature’s massive Personal Property Tax exemption that was estimated to have hit locals with $75 million loss annually passed out of the Senate Finance Committee this week. The MAC-backed bill package now awaits a vote from the full Senate.

Bills to fully reimburse local units for their losses associated with the Legislature’s massive Personal Property Tax exemption that was estimated to have hit locals with $75 million loss annually passed out of the Senate Finance Committee this week. The MAC-backed bill package now awaits a vote from the full Senate.

Senate Bill 1060, by Sen. Mark Huizenga (R- Kent), SB 1061, by Sen. Kimberly LaSata (R-Berrien), and SB 1062, by Sen. Michael McDonald (R-Macomb), would create the Local Government Reimbursement Fund, to which the state would deposit $75 million annually.

The reimbursement package is a result of the House Bill 5351, by Rep. Steve Johnson (R-Kent), passed in December 2021. The bill lifted the PPT exemption threshold for small taxpayers from $80,000 to $180,000 in true cash value. Lawmakers did also vote for a $75 million reimbursement for the first year of this exemption scheme (which starts in 2023), but they did not provide for the years beyond.

MAC’s Deena Bosworth, director of governmental affairs, previously testified in support of the package before the committee. MAC had helped develop the process in SBs 1060-62 alongside other local government groups.

MAC will continue to support the bill package and monitor its progress through the legislative process.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

Road agency liability measures get hearing in House

Bills to apply immunity to county road agencies from liability for failure to maintain highways in their jurisdiction received a hearing in the House Transportation and Infrastructure Committee this week. The bills previously passed the Senate.

Bills to apply immunity to county road agencies from liability for failure to maintain highways in their jurisdiction received a hearing in the House Transportation and Infrastructure Committee this week. The bills previously passed the Senate.

Senate Bill 39 and SB 43, by Sen. Roger Victory (R-Ottawa), clarifies language in county road law regarding the liability of counties for failure to maintain highways to ensure provisions of the governmental immunity law apply to county road commissions.

MAC supports the bills and will continue to monitor the legislation.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Resolution opposing wilderness expansion clears Senate committee

A resolution to oppose the designation of 65,000 acres of additional national wilderness areas in Michigan’s Upper Peninsula passed out of Senate Natural Resources Committee this week.

A resolution to oppose the designation of 65,000 acres of additional national wilderness areas in Michigan’s Upper Peninsula passed out of Senate Natural Resources Committee this week.

Senate Resolution 150, by Sen. Ed McBroom (R-Dickinson), expresses concern over the effort to designate new wilderness areas in the Ottawa National Forest. The designation would significantly limit access to recreational areas, thereby decreasing tourism and economic returns to the community and local government.

The resolution urges the Michigan Legislature to recommend Congress not to designate more national wilderness areas. MAC supports the resolution, which is now on the Senate floor.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC-backed measures on mental health transportation advance

A MAC-supported bill to allow county mental health transportation panels passed out of the House Health Policy Committee this week. The bill now awaits a vote on the House floor.

A MAC-supported bill to allow county mental health transportation panels passed out of the House Health Policy Committee this week. The bill now awaits a vote on the House floor.

Senate Bill 101, by Sen. Ed McBroom (R-Dickinson), would allow the panels for the purpose of alternative transportation services for individuals needing involuntary psychiatric hospitalization.

The bill would set forth a description and responsibilities of the panel, should a county choose to establish one, and outline contract and liability requirements. Any private security company considered to provide the transport services must meet certain requirements in order to enter into contract, including maintaining certain insurance coverage and providing to security transport officers a specialized training program for best practices when working with an individual with severe mental illness.

The bill also creates the Mental Health Transportation Fund, which, if funded by the Legislature, could help counties carry out functions of these mental health transportation services.

House Bill 4414, by Rep. Beau LaFave (R-Dickinson), is identical to SB 101 and passed out of the House Health Policy Committee and now awaits a full vote from the House.

MAC supports both bills as an important tool for counties to secure alternative transportation services, so county law enforcement staff and resources are not tied up in long transport times.

For any questions on this issue, contact Deena Bosworth at bosworth@micounties.org.

House approves set of bills to bolster crime victims’ rights

Bills to better protect victims in the criminal justice system passed out of the House this week and has been referred to the Senate Judiciary and Public Safety Committee.

Bills to better protect victims in the criminal justice system passed out of the House this week and has been referred to the Senate Judiciary and Public Safety Committee.

House Bill 5679, by Rep. Graham Filler (R-Clinton), HB 5680, by Rep. Ken Borton (R-Otsego), HB 5681, by Rep. Greg Wan VanWoerkom (R-Muskegon), and HB 5560, by Rep. Julie Rogers (D- Kalamazoo), would require the expansion of offenses that would count as a serious misdemeanor, allow public video recordings of court proceedings to blur victims faces and allow victim impact statements to be made remotely.

MAC supports these bills to modernize and strengthen the rights of victims. MAC will continue to monitor the legislation as it moves through the legislative process.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

MAC-backed bill on opioid treatments gets Senate hearing

A bill to create a standing order on the distribution of opioid treatment medication received a hearing in the Senate Health Policy and Human Services Committee the week of June 6. The bill previously passed the House.

A bill to create a standing order on the distribution of opioid treatment medication received a hearing in the Senate Health Policy and Human Services Committee the week of June 6. The bill previously passed the House.

House Bill 5166, by Rep. Mary Whiteford (R-Allegan), allows the state’s chief medical executive to expand the ability of community organizations to dispense FDA-approved medication for the treatment of a drug overdose to an individual. Any community organization providing substance use disorder prevention, treatment, recovery, or harm reduction services would be allowed.

MAC supports HB 5166 and will continue to push for its passage in the Senate.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

Justice Department conducting ADA reviews of courthouses in Pennsylvania

The association of counties in Pennsylvania has advised MAC that the U.S. Department of Justice has been visiting courthouses in the Keystone State to conduct assessments of Americans with Disabilities Act compliance.

The association of counties in Pennsylvania has advised MAC that the U.S. Department of Justice has been visiting courthouses in the Keystone State to conduct assessments of Americans with Disabilities Act compliance.

According to the Pennsylvania report, one of these incidents involved “DOJ (sending) in an ADA expert who literally took a tape measure to check how far the sinks were off the floor, elevator buttons and much more.”

MAC is working to gather more information on the scope of this federal inquiry, but members are advised to be ready to respond promptly to such inspections.

For questions on this issue, contact Stephan Currie at scurrie@micounties.org.

MAC offices closed on Monday, June 20

MAC’s Lansing offices will be closed on Monday, June 20 to observe the federal Juneteenth holiday.

MAC’s Lansing offices will be closed on Monday, June 20 to observe the federal Juneteenth holiday.

Juneteenth “has its significance in 1865 when Major General Gordon Granger arrived in Galveston and issued the Order Number 3, which stated the freedom of all slaves by the issue of Emancipation Proclamation, by Abe Lincoln on Jan. 1, 1863. The people of Galveston did not know they were free and found out after the order was issued by Gordon Granger on June 19, 1865, two years after the original date of proclamation. Texas was the last state to recognize the proclamation and hence June 19th or ‘Juneteenth’ became the official day. The law was ratified after all the states agreed to free all forms of slavery within the Union of America which was completed on June 19, 1865.”

MAC’s normal office hours will resume on Tuesday, June 21 at 8 a.m.

Staff picks

Staff picks

- Where’s that $1B in state, local cybersecurity grants? (Govtech.com)

- What state leaders must do to access billions of dollars in broadband funding for rural communities (Connected Nation)

- The ‘impossible’ federal standard states can’t meet as they work to assist low-income families (RouteFifty)

- Michigan lifts poultry show ban imposed to control bird flu (WXYZ)

Important conversations held during the Mackinac Policy Conference

The Detroit Regional Chamber hosted its annual Mackinac Policy Conference this week on Mackinac Island. The event brings together business, community, and policy leaders in Michigan to have conversations on the biggest issues facing the state.

Steve Currie, MAC’s Executive Director and Deena Bosworth, MAC’s Director of Government Affairs, were also on the island having meetings with key legislators and county commissioners to ensure the interests of all Michigan’s 83 counties were a part of the conversation.

The legislature did not hold any committee meetings or votes this week because of the Mackinac Policy Conference. MAC is gearing up for a busy few weeks as the Legislature reconvenes to reach a consensus on the state budget before the deadline on July 1.

For more information contact Deena Bosworth at bosworth@micounties.org

Michigan Treasury releases 2022 PPT millage rates

Counties are encouraged to review 2022 millage rates just released by the Michigan Treasury as part of the Personal Property Tax (PPT) reimbursement system.

Counties are encouraged to review 2022 millage rates just released by the Michigan Treasury as part of the Personal Property Tax (PPT) reimbursement system.

The 2022 Millage Rate Comparison reports are available on Treasury’s PPT reimbursement website: www.michigan.gov/pptreimbursement.

Under state law, Treasury (Treasury) must issue these reports so municipalities can verify the eligible millage rates to be used in the 2022 PPT reimbursement calculations.

The eligible millage rates to be used in the 2022 PPT reimbursement calculations are calculated based on the eligible millage cap and 2021 millage rates and may be prorated as required by the Local Community Stabilization Authority Act (LCSA Act. Therefore, the calculated eligible millage rates to be used in the 2022 PPT reimbursement calculations may not reflect the actual 2021 millage rates levied by the municipality.

Municipalities should review the 2022 Millage Rate Comparison reports for accuracy.

- If the millage rate data is correct, the municipality does not need to take any further action.

- If there are any errors in the millage rate data, the municipality is required by the LCSA Act to notify Treasury of the error(s) by submitting Form 5613 – Millage Rate Correction for the 2022 Personal Property Tax Reimbursement Calculations no later than Aug. 1, 2022 (MCL 123.1358(4)).

Below is a list of the reporting forms related to millages that are available on Treasury’s PPT Reimbursement website under Forms for Calculation of PPT Reimbursements.

- Form 5451 – 2022 School District and Intermediate School District (ISD) Debt Millage Rate for the 2022 Personal Property Tax Reimbursement Calculation

- Optional form to be used by eligible school districts and ISDs to report the debt millage rate levied in the current year specifically for the payment of debt obligations approved by voters or incurred before 2015.

- DUE DATE: Aug. 1, 2022

- Form 5608 – Portion of 2021 Essential Services Millage Rate Dedicated for the Cost of Essential Services

- Optional form to be used by counties, cities, villages, townships, and local authorities that levy an extra-voted millage rate that partially funds the cost of essential services (for example a Fire/Cemetery millage). For extra-voted millage rates where the name of the millage would imply that the millage was partially dedicated for the cost of essential services, Treasury has identified the millage type as “PARTIAL ESSENTIAL SERVICE” on the 2022 Millage Rate Comparison reports.

- DUE DATE: Aug. 1, 2022

- Form 5609 – 2022 Hold Harmless Millage Rate for the 2022 Personal Property Tax Reimbursement Calculation

- Required form to be used by the 24 school districts that levy a supplemental hold harmless millage rate in 2022.

- DUE DATE: Aug. 1, 2022

- Form 5613 – Millage Rate Correction for the 2022 Personal Property Tax Reimbursement Calculations

- Optional form to be used by municipalities that identify an error in the 2022 Millage Rate Comparison reports.

- DUE DATE: Aug. 1, 2022

Direct any questions regarding the PPT reimbursement calculation or correction process to TreasORTAPPT@michigan.gov or 517-335-7484.

June conference to focus on environmental emergencies

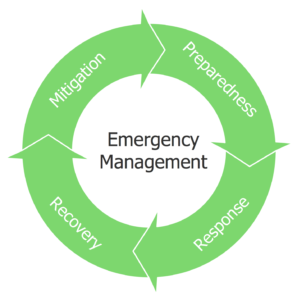

Is your community prepared to handle environmental emergencies such as fires, floods, oil spills, etc.? The Michigan Department of Environment, Great Lakes, and Energy (EGLE) is hosting the Environmental Emergency Management Conference at the Lansing Center in Lansing June 29-30, 2022. to help communities with preparedness and mitigation, response, and recovery related to incidents impacting the environment and public health. Participants may include federal, state and local emergency response personnel, public health officials, facility emergency managers, contractors, consultants, academia or anyone within the emergency response community.

Is your community prepared to handle environmental emergencies such as fires, floods, oil spills, etc.? The Michigan Department of Environment, Great Lakes, and Energy (EGLE) is hosting the Environmental Emergency Management Conference at the Lansing Center in Lansing June 29-30, 2022. to help communities with preparedness and mitigation, response, and recovery related to incidents impacting the environment and public health. Participants may include federal, state and local emergency response personnel, public health officials, facility emergency managers, contractors, consultants, academia or anyone within the emergency response community.

Conference highlights will include:

- Plenary presentation on the Coast Guard Great Lakes Center of Expertise for Oil Spill Response

- Special breakout session on Natural Disaster Debris to Increase Community Resiliency

- Additional breakout sessions on themes of Preparedness and Mitigation, Initial Response and Response and Recovery

- Networking Reception with exhibitors and hundreds of emergency response professionals

View the agenda and session descriptions.

General admission fee: $125 for both days.

Registration deadline: June 17, 2022.

Lodging block deadline: June 7, 2022.

For registration questions, contact Joel Roseberry, RoseberryJ@Michigan.gov, or Alana Berthold, BertholdA@Michigan.gov.

Staff picks

Staff picks

- Internet presence among Michigan local governments: websites, online services and experience with virtual meetings (Center for Local, State and Urban Policy)

- The unintended consequences of safety messaging on digital highway signs (Citizens Research Council of Michigan)

- Long COVID’s impact on Michiganders and the Michigan economy (Center for Health Research and Transformation)

- Pure Michigan ad: “Wish you were here” (State of Michigan)