MAC applauds revenue sharing, infrastructure plans in governor’s budget

Gov. Gretchen Whitmer’s fiscal 2022 budget proposal makes important and much needed boosts to local governments dealing with the COVID-19 crisis and to public infrastructure, said MAC’s executive director on Thursday.

Gov. Gretchen Whitmer’s fiscal 2022 budget proposal makes important and much needed boosts to local governments dealing with the COVID-19 crisis and to public infrastructure, said MAC’s executive director on Thursday.

“We greatly appreciate the variety of recommendations for spending that recognize the ongoing demands on counties, demands increased by the pandemic,” said Stephan Currie.

See FY22 county-by-county revenue sharing estimates.

He added, however, that the short-term positive news will not reverse the long-term crisis in local government finance in Michigan. A recent analysis by the nonpartisan Lincoln Institute of Land Policy found that not only is Michigan “unique in the restrictiveness of the state’s property tax limits,” but “the property tax is particularly important for local governments’ fiscal health in Michigan because they have little access to other types of taxes to raise revenue.”

One such example of this dynamic is in state revenue sharing to counties. The governor is proposing a 2 percent increase in that annual amount, boosting it about $4 million to a total of $231 million. However, that increase has to stand against two decades of lagging payments. In 2000, counties received $214 million in revenue sharing. Adjusted for inflation, that would be $330 million this year, nearly $100 million below the governor’s recommendation.

“We need a full partnership with the state to address the funding crunch, similar to what started in 2019 on the Jail and Pre-trial Incarceration Task Force that led to significant improvements in state policy during the last Legislature,” Currie said.

Overall, though, the FY22 proposal has numerous benefits for local services and infrastructure, including:

- $300 million from the state General Fund to repair or replace about 120 local bridges that are in serious or critical condition.

- $15 million for the Dam Safety Emergency Fund for emergency response when private dam owners leave their structures in disrepair. The money for dams follows the devastating flooding in the Midland area last year after privately owned dams failed.

- $40 million to fund high water level and resilient infrastructure and planning grants to local governments to address high water issues such as flooding and erosion

- $5 million for first responder training

- $290 million in infrastructure grants for the MI Clean Water Plan to address sewer overflows and mitigate public health risks by removing sewage discharge to surface water and ground water and eliminate failing septic systems

- $148.9 million in grants from the Michigan Indigent Defense Commission to adhere to state mandates for defense services

- $262 million for the Child Care Fund

- $9 million for the Raise the Age Fund, to help cover costs resulting from the move of 17-year-old offenders to the juvenile justice system

- $12.9 million for Secondary Road Patrol services from sheriffs

- $4 million for the County Veteran Service Fund

- $14.8 million for the County Jail Reimbursement Program to compensate counties for housing state offenders in county jails

- $51.4 million for Essential Local Public Health Services

- $13 million for Community Corrections

For more information on MAC’s work on the state budget, contact Deena Bosworth at bosworth@micounties.org.

NACo: Federal aid could total $1.95 billion for Michigan counties

Counties across the United States stand to receive $65 billion in federal aid on COVID-19 under legislation now winding its way through Congress, the National Association of Counties (NACo) reported during a call on Wednesday.

Under the current provisions of the Fiscal Year (FY) 2021 Reconciliation Act bill, NACo calculates that Michigan’s 83 counties would receive about $1.95 billion.

See county-by-county estimates.

According to NACo Executive Director Matt Chase and NACo lobbyists, the aid would:

- Cover all counties of all sizes

- Be distributed based on population

- Cover COVID-related expenses and revenue lost due to COVID

- Be distributed directly from the U.S. Treasury Department to counties that fill out forms to certify they want to accept the funds

- Be eligible for sub-allocation to nonprofits doing COVID relief work

Counties that do certify for funds would receive them within 60 days.

The bill was expected to leave the U.S. House Oversight Committee today and advance to the House Budget Committee for review next week. The goal is to get the bill to President Biden for signature by mid-March.

For more information on this issue, click here.

MAC opposes bill on court records requirements

The Michigan Association of Counties and Michigan Association of County Clerks partnered in opposition this week to House Bill 4164. Rep. Ryan Berman (R-Oakland) introduced the legislation, which would require courts to allow an attorney to access, through a website, the register of documents and digital images of documents filed in that court.

The Michigan Association of Counties and Michigan Association of County Clerks partnered in opposition this week to House Bill 4164. Rep. Ryan Berman (R-Oakland) introduced the legislation, which would require courts to allow an attorney to access, through a website, the register of documents and digital images of documents filed in that court.

MAC opposes this bill because there is no funding attached to require a document management system to be implemented in all courts to adhere to this bill if it were enacted, which would create an unfunded mandate on counties.

Further, courts are currently implementing the MiFile system, as State Court Administrator Tom Boyd explained to the House Oversight Committee. The timing of this bill does not align with the current schedule for statewide rollout already occurring. Additionally, continued funding to move toward a unified court management system will need to be addressed with the goal of online court record accessibility.

MAC will continue to track this legislation, as well as the rollout of the MiFile system.

For questions, please contact Meghann Keit-Corrion at keit@micounties.org.

DHHS director will be guest on Feb. 16 podcast episode

Elizabeth Hertel, recently named by Gov. Gretchen Whitmer to lead the state’s mammoth Department of Health and Human Services, will be the guest on a special live episode of Podcast 83 on Tuesday, Feb. 16 at 4:30 p.m.

Elizabeth Hertel, recently named by Gov. Gretchen Whitmer to lead the state’s mammoth Department of Health and Human Services, will be the guest on a special live episode of Podcast 83 on Tuesday, Feb. 16 at 4:30 p.m.

The state’s response to COVID-19 will be the focus of the discussion with Hertel, of course, but the interview is sure to touch on other responsibilities of the department, which has 14,000 employees and operations in all 83 counties.

To pre-register for this live session, click here.

If you have specific questions, please send them to Meghann Keit-Corrion at keit@micounties.org by noon on Monday, Feb. 15.

Remember, state health orders still point to virtual public meetings

While the recent update to Michigan’s statewide health orders on COVID-19 focused on youth sports activities, the change still left in rules that make indoor public meetings, such as county board sessions, impractical, if not impossible.

While the recent update to Michigan’s statewide health orders on COVID-19 focused on youth sports activities, the change still left in rules that make indoor public meetings, such as county board sessions, impractical, if not impossible.

Indoor gatherings at non-residential venues are limited to 10 or fewer persons from two or fewer households. Public meetings may be held outdoors if there are fewer than 25 attendees or 20 attendees per 1,000 square feet, whichever is less. Attendees should be separated by at least six feet and wear a mask, the state orders.

County boards retain the legal ability to hold fully remote sessions for any reason through March 31, 2021.

For the latest COVID-19 news affecting Michigan counties, visit MAC’s Resources Page.

Broadband tax break bill clears Senate committee

A bill to give tax breaks to firms installing new broadband equipment in Michigan cleared the Senate Committee on Energy and Technology this week, despite ongoing MAC opposition.

A bill to give tax breaks to firms installing new broadband equipment in Michigan cleared the Senate Committee on Energy and Technology this week, despite ongoing MAC opposition.

“The good news is the committee made some changes that disentangled mobile equipment from the tax breaks some and increased the performance metrics (for qualifying firms)” said Deena Bosworth, MAC’s director of governmental affairs. “However, there’s still no reimbursement to local governments (for funds lost to the personal property tax), nor an option for locals to prioritize where those projects should go.

“MAC remains opposed,” she added, “but we are working on amendments for more local control and reimbursement for losses.”

Senate Bill 46, by Sen. Aric Nesbitt (R-Van Buren) is designed to give a 10-year personal property tax (PPT) exemption to businesses that provide broadband service of at least 10 megabits per second downstream.

The measure now moves to the full Senate for consideration.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Webinar focuses on board member conduct

Webinar focuses on board member conduct

“Codes of Conduct: Going Beyond the Minimum” is a new webinar from MSU Extension that will focus on an increasingly salient topic: proper behavior for members of public boards.

Codes of Conduct can be a useful tool for members of elected and appointed boards. They help underscore a person’s role and expected behavior and set clear expectations for how members will conduct themselves.

This webinar will use the planning commission as an example of how a code of conduct can be a valuable tool and discuss how other bodies can use them as well. The webinar comes with credit for MAC’s County Commissioner Academy.

The FREE webinar will start at 11 a.m. on Feb. 25 and run for one hour. To register, visit https://events.anr.msu.edu/ethics/.

Is your county ‘fiscally ready’? Webinar can help

The Michigan Department of Treasury and MSU Extension are excited to announce our next Fiscally Ready Communities training webinar titled, “Financial Best Practices.” This 90-minute webinar will take place at 10 a.m. on Thursday, March 25, 2021.

The Michigan Department of Treasury and MSU Extension are excited to announce our next Fiscally Ready Communities training webinar titled, “Financial Best Practices.” This 90-minute webinar will take place at 10 a.m. on Thursday, March 25, 2021.

This FREE training discusses the fundamental best practices for fiscal and operational planning and provides an overview of best practices in financial policies and good governance.

This webinar comes with credit for MAC’s County Commissioner Academy.

Training topics include: budgets; cash controls; debt; grants; internal controls; purchasing policies and receipting.

Please register for webinar at https://events.anr.msu.edu/fiscalbestpractice.

For more information about Fiscally Ready Communities, please check out the Treasury Fiscally Ready Communities webpage. This webpage includes Treasury’s 32-page Fiscally Ready Communities Best Practices document, which we encourage all local officials to review.

If you have any questions, please email TreasLocalGov@michigan.gov with the subject line “Fiscally Ready.”

Staf f picks

f picks

- The Flawed Juvenile Justice System that Sparked a National Outrage (video) (Detroit Free Press/Bridge/ProPublica)

- Michigan’s budget process (diagram) (House Fiscal Agency)

- Is bipartisanship the key to avoiding another annus horribilis? (Citizens Research Council of Michigan)

- Recruiting and retaining behavioral health workers in rural America (Center for Health and Research Transformation at the University of Michigan)

The House passed their $3.5B COVID relief funding plan on a largely party-line vote.

The House passed their $3.5B COVID relief funding plan on a largely party-line vote.  2021 Legislative Conference will be virtual in April

2021 Legislative Conference will be virtual in April The governor’s State of the State address and MAC’s 2021 legislative priorities were key topics discussed by MAC’s Podcast 83 team

The governor’s State of the State address and MAC’s 2021 legislative priorities were key topics discussed by MAC’s Podcast 83 team  The crisis in funding for Michigan’s local governments continues, MAC’s Deena Bosworth told the House Committee on Local Government and Municipal Finance

The crisis in funding for Michigan’s local governments continues, MAC’s Deena Bosworth told the House Committee on Local Government and Municipal Finance  FEMA now can pay 100 percent federal funding for the costs of activities that have previously been determined eligible, from the beginning of the pandemic in January 2020 to Sept. 30, 2021, under a

FEMA now can pay 100 percent federal funding for the costs of activities that have previously been determined eligible, from the beginning of the pandemic in January 2020 to Sept. 30, 2021, under a  A bill that would give a 10-year personal property tax (PPT) exemption to businesses that provide broadband service of at least 10 megabits per second downstream received a hearing this week before the Senate Committee on Energy and Technology.

A bill that would give a 10-year personal property tax (PPT) exemption to businesses that provide broadband service of at least 10 megabits per second downstream received a hearing this week before the Senate Committee on Energy and Technology. A MAC-supported bill to clarify state law so it reflects how the state and counties are handling veteran service funds was filed this week in the House.

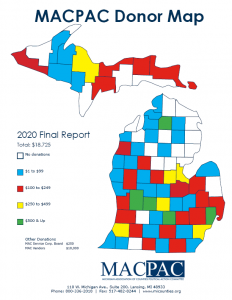

A MAC-supported bill to clarify state law so it reflects how the state and counties are handling veteran service funds was filed this week in the House. MACPAC exceeds $18,000 in 2020 fundraising

MACPAC exceeds $18,000 in 2020 fundraising The Michigan Association of Counties

The Michigan Association of Counties  In preparation for the 2021 dig season, MISS DIG 811 will be hosting regional virtual pre-construction meetings between Feb. 22 and March 1. See lists below for your county’s region.

In preparation for the 2021 dig season, MISS DIG 811 will be hosting regional virtual pre-construction meetings between Feb. 22 and March 1. See lists below for your county’s region. Gov. Gretchen Whitmer and Republicans who control the Michigan House of Representatives have a $2 billion difference of opinion on what to do next, spending wise, to address the COVID-19 pandemic.

Gov. Gretchen Whitmer and Republicans who control the Michigan House of Representatives have a $2 billion difference of opinion on what to do next, spending wise, to address the COVID-19 pandemic. Gov. Gretchen Whitmer’s inclusion of

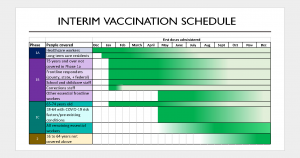

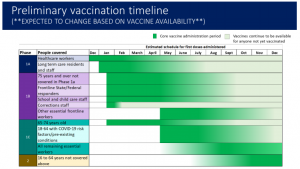

Gov. Gretchen Whitmer’s inclusion of  MAC Executive Director Stephan Currie was appointed this week by Gov. Gretchen Whitmer to serve on her Protect Michigan Commission and attended the body’s first meeting on Friday, when members were presented with updated information on Michigan’s

MAC Executive Director Stephan Currie was appointed this week by Gov. Gretchen Whitmer to serve on her Protect Michigan Commission and attended the body’s first meeting on Friday, when members were presented with updated information on Michigan’s  Local governments need money, Senate committee told

Local governments need money, Senate committee told It’s still January, but the first deadline for indigent defense plans in 2021 is not that far away. The first round of submissions for plans to the Michigan Indigent Defense Commission (MIDC), which are to include standard 5, are due by April 27. This year, MIDC also will be adopting a commonly used state grant program, EGRAMs. Training for EGRAMS will be available March 22-29.

It’s still January, but the first deadline for indigent defense plans in 2021 is not that far away. The first round of submissions for plans to the Michigan Indigent Defense Commission (MIDC), which are to include standard 5, are due by April 27. This year, MIDC also will be adopting a commonly used state grant program, EGRAMs. Training for EGRAMS will be available March 22-29. The Michigan Department of Resources (DNR) has released its

The Michigan Department of Resources (DNR) has released its  MAC partner gives advice on maximizing your internet

MAC partner gives advice on maximizing your internet February jails call to focus on rapid opioid screener tool

February jails call to focus on rapid opioid screener tool A state law authorizing four-year terms for county commissioners tops the

A state law authorizing four-year terms for county commissioners tops the  The Michigan Department of Health and Human Services (MDHHS) released its next epidemic order which will go into effect on Monday, Feb. 1 and will last three weeks, until Sunday, Feb. 21, which includes provisions for indoor dining.

The Michigan Department of Health and Human Services (MDHHS) released its next epidemic order which will go into effect on Monday, Feb. 1 and will last three weeks, until Sunday, Feb. 21, which includes provisions for indoor dining. MAC’s six policy committees will have members from at least 44 of Michigan’s 83 counties after MAC Board President Veronica Klinefelt of Macomb County approved appointments for 2021 this week.

MAC’s six policy committees will have members from at least 44 of Michigan’s 83 counties after MAC Board President Veronica Klinefelt of Macomb County approved appointments for 2021 this week.  Legislative committees were announced this week by the 101st Legislature.

Legislative committees were announced this week by the 101st Legislature. At a press conference held Tuesday afternoon, Gov. Gretchen Whitmer unveiled a

At a press conference held Tuesday afternoon, Gov. Gretchen Whitmer unveiled a  Registration is now open for the

Registration is now open for the  State leaders announced this week

State leaders announced this week  A huge legislative package of reforms suggested by a joint county-state task force on jail policies was signed into law recently by Gov. Gretchen Whitmer.

A huge legislative package of reforms suggested by a joint county-state task force on jail policies was signed into law recently by Gov. Gretchen Whitmer. Solar equipment tax bill rejected by governor

Solar equipment tax bill rejected by governor Legislative chambers release session calendars for 2021

Legislative chambers release session calendars for 2021 County officials are invited to attend a kickoff meeting led by the Federal Aviation Administration (FAA) on new rules governing the use of drones.

County officials are invited to attend a kickoff meeting led by the Federal Aviation Administration (FAA) on new rules governing the use of drones. Ottawa County Administrator Al Vanderberg was recently named a recipient of the

Ottawa County Administrator Al Vanderberg was recently named a recipient of the  The U.S. Treasury just released information for the new $25 billion emergency rental assistance program authorized under the

The U.S. Treasury just released information for the new $25 billion emergency rental assistance program authorized under the  A

A