Extension for court fee authority heads to governor

Legislation to secure key trial court funding now awaits the governor’s signature after a vote in the Senate this week.

House Bill 5392, by Rep. Sarah Lightner (R-Jackson), extends a quickly approaching May 1, 2024, expiration (“sunset”) of the authority of trial courts to levy fees that constitute a key part of their operational funding.

HB 5392 was previously “tie-barred” to House Bill 5534, by Rep. Kelly Breen (D-Oakland), which outlines a plan for the State Court Administrative Office to conduct data collection on certain trial court costs and revenue sources and provide a report to the Legislature with proposals to implement the Trial Court Funding Commission’s recommendations from 2019. See more details in this MAC Issue Brief.

On Wednesday, the Senate broke the tie bar, meaning the bills no longer must advance together. With this amendment to the bills, they were sent back to the House for a concurrence vote. The House passed HB 5392 with broad support and HB 5534 failed along party lines. It is expected that the Democrats will regain majority in the House on Tuesday next week and will pass HB 5534 at that time.

With HB 5392 headed to the governor this week, MAC expects the sunset to be extended prior to its expiration on May 1.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

After hiatus, legislators accelerate FY25 budget work

Budget proceedings ramped up in the Legislature this week with a remarkable increase proposed for county revenue sharing.

Budget proceedings ramped up in the Legislature this week with a remarkable increase proposed for county revenue sharing.

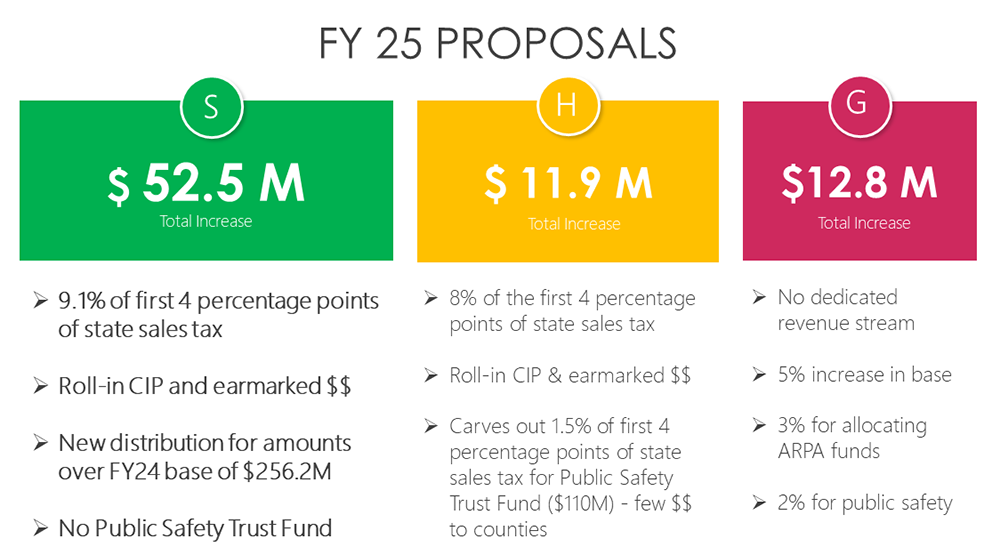

Both the House and Senate General Government subcommittees used the Revenue Sharing Trust Fund model proposed by MAC as guidance when making their recommendations. The Senate subcommittee was most generous by dedicating 9.1 percent of the first 4 percentage points of the state sales tax for local revenue sharing. This would mean a $52.5 million increase from last year. The House subcommittee recommended 8 percent of the first 4 percentage points of the state sales tax with an increase of $11.9 million.

The House’s proposal reflects the provisions outlined in House Bills 4274-75, which MAC has been advocating for since March 2023. The bills would establish the Revenue Sharing Trust Fund in statute and dedicate a portion of the state’s sales tax to locals, allowing for a true sharing in the state’s revenue. The bills passed the House in November 106-4.

The governor’s FY25 budget did not follow the trust fund model; it calls for a 5 percent increase in base funding and 3 percent for locals that hit ARPA funding allocation requirements.

More details on these proposals will be presented on Tuesday at MAC’s Legislative Conference in Lansing.

Courts

In other great news, funding panels in both chambers recommended more dollars for local prosecutors. These grants would serve to “bring staffing closer to optimal levels to reduce the average caseload per attorney.” The House General Government Subcommittee included $3 million, while the Senate subcommittee included $35 million. There is a caveat to the Senate funds, however: they would only go toward the 15 counties with the most violent crime.

Transportation

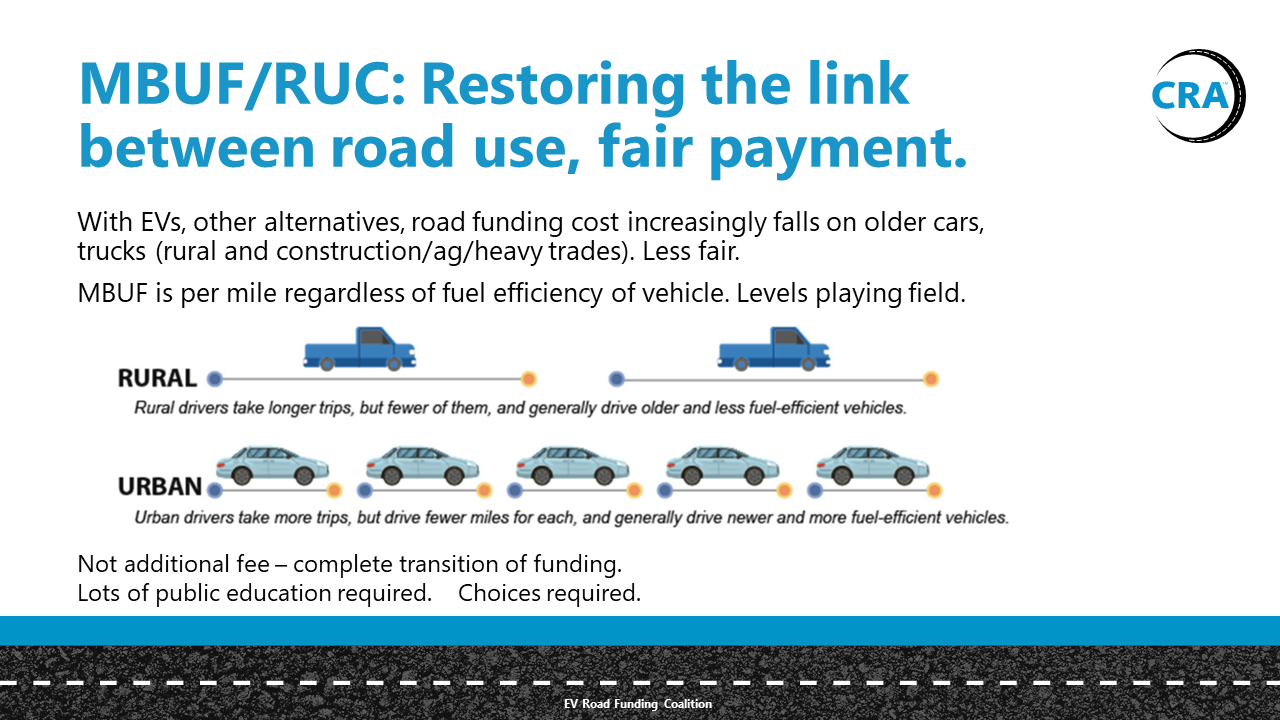

Both the House and Senate Transportation subcommittees expressed interest in a mileage-based user fee via a pilot project by allocating $5 million in their budget plans for FY25. The concept of a milage-based user fee is to charge people for the miles they drive rather than how much gas they consume.

While the specifics of the pilot project have not yet been solidified, participation will be voluntary, and participants will be reimbursed for what they pay in gas tax while the study is active. While Michigan is already billions of dollars short on road funding, electric vehicles and high-efficiency vehicles are exacerbating the issue by contributing much less to motor fuel tax revenue.

While the specifics of the pilot project have not yet been solidified, participation will be voluntary, and participants will be reimbursed for what they pay in gas tax while the study is active. While Michigan is already billions of dollars short on road funding, electric vehicles and high-efficiency vehicles are exacerbating the issue by contributing much less to motor fuel tax revenue.

Nineteen other states are administering similar pilots and at least one state has fully implemented a mandatory mileage-based user fee program. With both chambers in agreement, MAC anticipates the program will be included in the final version of the budget.

Environment

In departmental budgets on environmental programs, neither the House nor Senate included the governor’s proposed raise on the “trash tax.” Commonly referred to as landfill tipping fees, the governor sought to increase them more than 1,000 percent from 36 cents per ton to $5 per ton. The increase was meant to generate $80 million for environmental remediation and brownfield redevelopment. Following the governor’s initial recommendation, industry leaders voiced strong opposition and the Legislature has shown little indication it wants to pursue the increase.

Since neither chamber included the recommendation in their budgets it seems unlikely that it will be included in the final budget.

The next step in the budget process is for the chambers to pass their budgets on the floor. In mid-May, the second Consensus Revenue Estimating Conference of the year will be held to provide an update on the state’s revenue. The official budget targets will then be negotiated between the governor and the Legislature. Conference committees will then meet to agree on the final budget (this is where the House and Senate subcommittees come together to compromise on each chamber’s proposed budgets). The final budget must be presented to the governor before July 1 for her signature.

For more information on MAC’s budget advocacy, contact Deena Bosworth at bosworth@micounties.org.

MAC seeks fair treatment for counties on short-term rentals

MAC urged a House panel to treat counties fairly by amending a 10-bill package designed to restrict ― but not eliminate ― local governments’ power to regulate short term-rentals in testimony this week.

MAC urged a House panel to treat counties fairly by amending a 10-bill package designed to restrict ― but not eliminate ― local governments’ power to regulate short term-rentals in testimony this week.

Speaking before the House Local Government Committee meeting this week (start at 9:58 mark), Governmental Affairs Director Deena Bosworth focused on the failure in the original bill drafts to include counties in revenue to be derived from a 6 percent excise tax: “Let me be clear, MAC supports tourism and the promotion of all Michigan has to offer. However, counties and municipalities across the state are struggling with having enough resources to invest in our facilities, infrastructure and emergency response personnel.

“We want our residents to enjoy the resources and services they pay for,” she added, “and we want them to have access to public safety and emergency response personnel even when there is a large influx of tourists demanding services.”

The primary bill in the package is HB 5438, by Rep. Joey Andrews (D-Berrien), which would require short-term rentals to be registered with the state; carry $1 million in liability insurance; have carbon monoxide detectors, smoke detectors and fire extinguishers; and have an emergency contact for renters within 30 miles of the rental. The bill would not allow a local government to ban short-term rentals but would allow communities to restrict their number.

Bosworth summarized MAC’s views in four points:

- All counties across the state would like to have access to funds for economic development;

- Counties across the state play a critical role in the planning and zoning of communities;

- Counties across the state have significant infrastructure responsibilities; and

- Counties across the state play a critical role in providing services to residents and tourists alike.

House Bills 5437-5446 did not receive a vote in committee this week.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

House adopts resolution on County Government Month

“Have you ever needed to call 911 for an emergency? interfaced with our courts enjoyed a county park? How about eaten with your family at a local restaurant and enjoyed your meal without getting ill …” said Rep. Julie Rogers (D-Kalamazoo) in remarks in support of a House resolution naming April as County Government Month in Michigan.

MAC thanks Rogers, a former commissioner and MAC Board director, for advancing the resolution. Click here for a video of her full remarks.

Learn about advantages of digital payment systems

Join NACo on April 30 for the webinar “Modernizing County Finance with Digital Disbursements” to discover how incorporating digital payments can increase constituents’ satisfaction and improve government efficiency. In this session, representatives from Knox County, Ill., the National Association of Counties (NACo) and Visa will share how they delivered fast and secure payments to county election judges and jurors.

Join NACo on April 30 for the webinar “Modernizing County Finance with Digital Disbursements” to discover how incorporating digital payments can increase constituents’ satisfaction and improve government efficiency. In this session, representatives from Knox County, Ill., the National Association of Counties (NACo) and Visa will share how they delivered fast and secure payments to county election judges and jurors.

To register for the session, which runs from 2 p.m. to 3 p.m. Eastern, click here.

You will learn:

- The importance of cross-sector partnerships for driving digital transformation.

- The benefits of transitioning to digital payment systems.

- The unique challenges and solutions for implementing a digital payment system involving the public sector.

- The role of stakeholder involvement and effective communication in successful digital payments projects.

NACo webinar to review legal requirements for online materials

On April 8, the U.S. Department of Justice (DOJ) announced the release of a final rule which seeks implementation of Title II of the Americans with Disabilities Act (ADA) on web-based government services provided by state and local governments.

On April 8, the U.S. Department of Justice (DOJ) announced the release of a final rule which seeks implementation of Title II of the Americans with Disabilities Act (ADA) on web-based government services provided by state and local governments.

The final rule lays out the details for web accessibility requirements and compliance, and standards will adhere to the Web Content Accessibility Guidelines (WCAG) 2.1 Standard, Level AA. The WCAG is a set of guidelines that outlines the parameters around web accessibility, and is developed by the World Wide Web Consortium.

Like the proposed rule released last August, the final rule includes exceptions for the following categories of web content:

- Archived web content

- Preexisting conventional electronic documents

- Web content posted by third parties on a county’s website

- Third-party web content linked from a county’s website

- Course content for specific students in public postsecondary institutions

- Class or course content for specific students in public elementary or secondary schools

- Conventional electronic documents related to specific individuals, their property, or their accounts, and are password-protected or secured

If a county’s web content falls under these exceptions without limitations, they do not need to conform to the WCAG 2.1 Level AA standard. However, if a limitation applies, compliance with the proposed rule’s accessibility requirements becomes necessary.

Counties with a total population of 50,000 or more need to comply within two years of the final rule’s publication. Counties with a total population of less than 50,000 need to comply within three years of publication.

The rule also creates a provision which states that compliance with WCAG 2.1 Level AA is not mandated if it results in undue financial and administrative burdens or fundamentally alters the services, programs, or activities of the county.

The final rule projects a cost of up to $1 billion in total to counties, which may prove onerous for under-resourced counties. The cost figure for compliance accounts for initial rule familiarization, necessary remediation, and ongoing compliance with the accessibility requirements going forward.

To help counties familiarize with the rule and to answer questions, NACo will host an informational webinar on the final rule on May 6, 2024, from 2: p.m. to 3 p.m. Eastern. NACo members can register for the webinar here.

May 2 webinar will focus on infrastructure requirements, resources

County leaders are advised to participate in the newest edition of a webinar series co-sponsored by MAC. The May 2 edition of “Updates and Resources for Local Governments” will focus on infrastructure requirements and resources available to local governments.

County leaders are advised to participate in the newest edition of a webinar series co-sponsored by MAC. The May 2 edition of “Updates and Resources for Local Governments” will focus on infrastructure requirements and resources available to local governments.

To register for the session, which will run from 2 p.m. to 3 p.m. Eastern, click here.

The Updates and Resources for Local Governments webinar series is designed to provide local governments with the information, tools, and resources necessary to make important decisions at the local level.

Specific topics to be covered will include:

- Lead Service Line Replacement

- Infrastructure Financing – State Revolving Funds

- Michigan Infrastructure Council – Asset Management Champions Program

- Michigan Infrastructure Office Technical Support

- State and Local Cybersecurity Grant Program (SLCGP)

Presentations and recordings from this webinar, along with previous webinars, can be found at TREASURY – BLGSS Learning Center. Utilize TREASURY – Contact Information for support related to Treasury’s local government services.

Staff picks

Staff picks

- Limited access to health care contributes to higher rural death rates (Capital News Service)

- U.S. Supreme Court ruling may increase counties’ legal liability when transferring employees (NACo News)

- Keeping food scraps out of landfills is a bigger problem than you think (Governing)

- Up North ‘nature megaphone’ amplifies sweet sounds of the forest (MLive)

Legislation to secure key trial court funding has passed out of the House, and recently introduced Senate bills on the subject received a hearing in the Senate Judiciary Committee this week.

Legislation to secure key trial court funding has passed out of the House, and recently introduced Senate bills on the subject received a hearing in the Senate Judiciary Committee this week. Democrats again will hold a 56-54 edge in the Michigan House of Representatives after two special elections held Tuesday.

Democrats again will hold a 56-54 edge in the Michigan House of Representatives after two special elections held Tuesday.

Learn your options about social media posting in April 22 webinar

Hosted by the Local Government Legal Center (LGLC), legal experts will lead a discussion of the Lindke v. Freed decision in which the Supreme Court set forth the test for when local government officials are considered “state actors” for the purposes of the First Amendment when they post on social media.

Click here to register. The webinar begins at 2 p.m. Eastern.

The LGLC is a coalition of national local government organizations formed in 2023 by the National Association of Counties (NACo), National League of Cities (NLC), International Municipal Lawyers Association (IMLA) and Government Finance Officers Association (GFOA) to provide education to local governments regarding the Supreme Court and its impact on local governments and local officials and to advocate for local government positions at the Supreme Court in appropriate cases.

Capital improvements are subject of April 22 ‘Fiscally Ready’ session

Recurring annual expenses are simple to budget, but repair and replacement of big-ticket items can be much more difficult. A Capital Improvement Program (CIP) will help your local government organize those major projects and forecast the expenses to make long-term planning simpler. This session will cover the basics of a CIP, best practices, and give participants a chance to share techniques that have worked for their community, as well as policies, procedures, and accounting for capital asset management and planning.

Click here to register for the event, which runs from 3 p.m. to 4:30 p.m. Eastern.

For more information about Fiscally Ready Communities, please check out the Treasury Fiscally Ready Communities webpage. This webpage includes Treasury’s 32-page Fiscally Ready Communities Best Practices document, which we encourage all local officials to review.

If you have any questions, email TreasLocalGov@michigan.gov with the subject line “Fiscally Ready.”

Legislative Update 4-12-24

MAC news, Blog, Events, Legislative, MACSC, Marketing, NACo

Fee authority for courts likely to expire without legislative intervention

House Bill 5392, by Rep. Sarah Lightner (R-Jackson), extends a quickly approaching May 1, 2024, expiration (“sunset”) of the authority of trial courts to levy fees that constitute a key part of their operational funding.

However, HB 5392 is “tie-barred” to a separate measure through actions of the House Judiciary Committee. The companion bill, HB 5534, by Rep. Kelly Breen (D-Oakland), outlines a plan for the State Court Administrative Office to conduct data collection on certain trial court costs and revenue sources and provide a report to the Legislature with proposals to implement the Trial Court Funding Commission’s recommendations from 2019. A “tie-bar” means both bills must advance together.

MAC sees broad support for the sunset extension, but the prospects for the companion bill are much less clear. If, for political reasons, the legislation is delayed and not signed before May 1, a funding gap will result.

As we approach May 1, and the bills have yet to receive a vote, it is increasing likely fee authority for courts will expire. Courts stand to lose nearly $50 million in operational funding annually if HB 5392 does not pass. This loss of revenue, if not covered by the state, will fall on the counties to cover.

With the likelihood for the fee authority to expire, the State Court Administrative Office sent a memo to courts last week, encouraging them to work with counties to establish a back-up funding plan.

While we are expecting the authority to expire on May 1, MAC anticipates the bills will still be signed in May. MAC is advocating for state funding to be appropriated to counties in the event a funding gap is created, to the tune of $1 million per week.

MAC supports both HB 5392 and 5534, with our priority to move HB 5392 and extend the funding authority prior to May 1.

MAC is asking members to take immediate action to urge quick legislative passage. Please visit MAC’s advocacy center to share your support for HBs 5392 and 5534 with your elected officials. The legislative window is closing, as there are limited days for the Legislature to advance the bills to the governor prior to May 1.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

Executive Director Stephan Currie with official County Government Month resolution.

Legislative resolution recognizes ‘County Government Month’

April has been designated National County Government Month in Michigan after the Senate approved a resolution this week.

Resolution 105, by Sens. Jeff Irwin (D-Washtenaw) and Sylvia Santana (D-Wayne), was requested by MAC as part of National County Government Month festivities led by the National Association of Counties. Irwin is a former Washtenaw County commissioner and a member of MAC’s County Caucus.

This recognition is an opportunity to highlight the hard work of county officials and the multitude of services county governments provide. Since 1991, the National Association of Counties has pushed for all states to celebrate counties throughout the month of April.

Impact on counties of federal PFAS rule as yet unclear

The federal government has issued new drinking water standards pertaining to Per- and Polyfluoroalkyl Substances (PFAS). The U.S. Environmental Protection Agency (EPA) announced this week the “first-ever national, legally enforceable drinking water standard.”

There are 66,000 public drinking water systems in the U.S. and the EPA estimates that between 6 percent and 10 percent of those systems will need to take action to meet the new standards. The federal government has made available $1 billion in funding to test and treat both private and public water supplies for PFAS.

Michigan has been a national leader in PFAS testing and treatment since at least 2017 with the creation of the Michigan PFAS Action Response Team (MPART). While MPART has already sampled every public drinking water system in the state, it is not yet publicly known how many, if any, will be impacted by the new standards.

For more information on MAC’s environmental policy work, contact Madeline Fata at fata@micounties.org.

Trial court legislation still stuck in Lansing calendar, Podcast 83 reports

“So, at this time, unfortunately, we’re still held up on trial court funding legislation in the House,” Gibson said. “What’s becoming increasingly likely, and what I think will end up happening, is once the two vacant house seats are filled after those special elections, April 16, maybe. So, let’s say April 23 or 24, maybe the House will vote the bills out, then the Senate is going to have a hearing on some Senate versions of those bills on the 18th. So, whenever the House bills get over there, they can just get sent right to the Senate floor. … We probably will be looking at a week or so after May 1 for implementation of the new sunset.”

In that case, MAC will be pressing the state to reimburse counties for the approximately $1 million per week that will be lost in operating revenue, as it did the last time the fee authority expired in the fall of 2022.

Also reviewed in this week’s episode are:

The potential effects of legislation just signed by Gov. Gretchen Whitmer on hotel/motel tax authority for Kent and seven other counties.

The timing for the passage of the state’s FY25 budget this spring with the statewide election calendar looming.

View the full episode, recorded on April 8, by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

April 16 webinar set on harm reduction and opioid treatment meds

Many people have negative reactions when they hear “methadone” or “needle exchange,” but these are two of several science-backed ways to improve health and prevent deaths among people who use drugs. This presentation provides a broad overview of two kinds of interventions that science shows can help people who use drugs: medications for opioid use disorder (MOUD), sch as methadone, and harm reduction, which includes services like needle and syringe programs. We will explain how these interventions work, show evidence of their effectiveness, and address common misconceptions about them.

Register to attend here.

The series is hosted by the Michigan Department of Health and Human Services, in partnership with Michigan State University, University of Michigan and Wayne State University as part of their Technical Assistance Collaborative.

For more information on opioid settlements are technical assistance, contact Amy Dolinky at dolinky@micounties.org.

New tool provides ‘one-stop shop’ for your grant searches

The MI Funding Hub is a new effort led by the Michigan Municipal League and state Department of Labor and Economic Opportunity to develop one-stop shop for grants. The hub provides open access to a searchable database of federal and state funding sources as well as philanthropic foundations that can be queried based on type of applicant and funding category as funding becomes available.

The hub provides a monthly newsletter announcing new grants, webinars and grant readiness training.

Local officials also have free access to hands-on technical assistance from a team of experts across many fields through the MI Funding Hub helpdesk. After receiving your helpdesk request form, the team will schedule a meeting to discuss funding needs, answer funding questions, direct applicants to appropriate funding sources and coach you on developing application strategies.

Services provided through the MI Funding Hub do not include writing grant applications, but MAC’s CoProPlus subsidiary does have a pre-negotiated grant writing contract available.

Get started by watching a recorded introductory webinar.

Use cyber courses to bolster your county’s defenses

In early April, Grand Traverse County was hit with a “spear phishing” attack through its email system. The county’s IT team was able to ward off the assault, but this is yet another reminder that digital security is a fundamental duty for any county government in the 21st century.

The NACo Cyberattack Simulation is a reality-based simulation that prepares county risk leaders for cyberattacks by assessing counties’ current state of readiness and identifying gaps. This simulation will help attendees evaluate their incident response procedures and tools and guide them in developing a detailed cyberattack response strategy.

Upcoming sessions will focus on:

The NACo Cyberattack Simulation is designed for cybersecurity managers, their teams and those responsible for risk defense, protection, and recovery, including HR, policy management, finance, public safety and emergency services. It requires 30-60 minutes per day for one week. Activities can be completed on the participants’ schedule and accessed online anywhere.

The retail price of the one week Cyberattack Simulation is $795 per enrollee; however, the simulations are fully sponsored for all counties, bringing your price down to ZERO.

To learn more or enroll, email moderator@pdaleadership.com.

Electronic options now offered on payments from state

The LCSA issues thousands of checks each year to local governments and a number of these remain uncashed. Issuing physical checks means there’s a greater chance of those funds being lost.

While we do work with the local units to try to locate checks and/or reissue them, if necessary, this process can take months.

As a result, we are commencing an electronic payment outreach program with the goal of ensuring local governments receive payments required under state statute(s). Our partners at Plante Moran are launching an outreach effort to contact local units of government directly to set up electronic payment.

LCSA offers two options for electronic deposit: through an ACH or through a Michigan Class participant-to-participant transfer.

If you would like to begin the simple process of converting to electronic payment, email us at electronicpayment@lcsami.gov. For questions, please contact Samantha Harkins, ceo@michiganmsa.org.

Opioid settlement metrics tool released

OSPRI was developed by a working group from Vital Strategies and Johns Hopkins Bloomberg School of Public Health with additional contributions from the Pew Charitable Trusts, Shatterproof, the CDC Foundation, and the National Association of Counties.

For additional information or technical assistance with monitoring investments, contact Amy Dolinky at dolinky@micounties.org.

Legislative Update 4-5-24

Blog, Events, Legislative, MAC news, Marketing, NACo

Time grows short to register for 2024 Legislative Conference

The 2024 Michigan Counties Legislative Conference starts April 29, but MAC’s special room rate at the DoubleTree Hotel expires today. Attendees may be able to still obtain lodging there, but they will be paying the full retail rate.

The next nearest hotel is the Courtyard Marriott (see map). Their room rates are $159 for the night of April 29 and $189 for the night of April 30. Click here for more information or to book a room there.

Digital conference registration continues until April 19 for the event. Leading in times of crisis and change will be the theme of its keynote address.

Retired Adm. Peter Cressy, director of Executive Leadership Programs at the Washington Leadership Institute, will speak on:

Cressy

“Washington, Lincoln, Roosevelt, Churchill: A Strategic Approach to Leading in Times of Crisis and Change: Washington and these other great leaders manifested eight common characteristics in leading during times of crisis and change, ranging from visibility and communication to planning and collaboration. This popular session will explore examples of these traits during the times of crisis each of these outstanding leaders faced, which remain relevant today.”

Additional plenary sessions will feature:

Breakout sessions on current challenges for county leaders, including broadband funding updates, lessons learned from the opioid settlements, impact of renewable energy siting legislation, options for infrastructure funding to address the expansion of electric vehicles and much more!

For any conference-related question, send an email to connell@micounties.org.

New law expands hotel/motel tax authority for 8 counties

House Bill 5048, by Rep. John Fitzgerald (D-Kent), uses population thresholds that qualify these counties to increase what they can charge on hotel and motel rooms. The counties are Calhoun, Genesee, Ingham, Kalamazoo, Kent, Muskegon, Saginaw and Washtenaw.

MAC had backed a bid for this option for all 83 counties to give them another economic development tool. Leaders in Kent County, in particular, pushed hard for change as they are seeking revenue for a new sports complex and an aquarium.

MAC’s broader efforts were opposed by the Restaurant and Lodging Association and convention and visitors bureaus, leading to this more restricted law.

These projects hold immense promise for Kent County, not only in terms of providing recreational and cultural amenities but also in driving economic growth through increased tourism and job creation. The sports complex promises to be a hub for sports enthusiasts, attracting both local fans and visitors from afar. Similarly, the aquarium offers an immersive experience for residents and tourists alike, showcasing the region’s aquatic biodiversity and educational opportunities.

Under the law, an increase will require a vote of the people to increase the excise tax from 5 percent to 8 percent for eligible counties. A separate provision for an additional 2 percent excise tax by local governments is limited to Kent County.

MAC will continue to advocate for the ability of all counties to raise revenue to fund economic growth and to provide for the public safety needs that come along with increased tourism and recreation in this state.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Legislation introduced to return local control on tobacco sales

SBs 647–654 would ban all sales of flavored tobacco products, require tobacco retailers to be licensed and create an excise tax on e-cigarettes and vapes with nicotine. The package would also repeal current statutory penalties on youth for possessing tobacco products.

MAC has taken a position of support for SB 647 due to its focus on returning control to counties for the regulation of tobacco sales.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

CoPro+ program can be ally in procurement work

MAC’s CoProPlus subsidiary, now entering its second decade of service to public entities, stands ready to assist MAC members in expansive ways, explained CoPro+ staffers in a new episode of MAC’s Podcast 83.

“One thing that makes us unique is that we will go into an entity that needs our services and offer a full range of end-to-end procurement services,” said Penny Saites of CoPro+. “(We offer) everything from writing bid specs, to writing the bid document, to assisting through the procurement process and all the way to evaluation and contract execution.”

“Any public agency is eligible to participate in the program,” added Chuck Wolford. “And that could be a county, a city, a township, a public school, a college or a university. And you can use the contracts at absolutely no cost to you and save you the time for procuring it again, we’ve already done the work for you. It’s already been vetted. And you’re always going have something that’s done the right way through this program.”

While the figure changes regularly, CoPro+ has about 150 contracts in place. About 20 counties have made use of at least one such contract.

“We have contracts in commodities, IT professional services and maintenance and repair type contracts. So, if you’re a facility guy, you’re going want to look at some of those building services contracts that we have, like we have a really nice overhead door contract where those vendors also do HVAC and other building services,” Saites explained.

“We are looking at some of the professional services contracts; grant writing I know is one of them. We get a lot of questions from MAC (on that issue),” Saites added. “There’s also compensation studies available on there, if folks would like to engage with that group.”

View the full episode, recorded on Feb. 28, by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

EGLE event will focus on environmental compliance challenges

Get up-to-date information on regulatory topics, environmental requirements, best practices, EGLE hot topics and more.

Network with regulators, clients, and potential customers from around the state.

Choose from more than 70 concurrent technical presentations delivered by program experts on topics related to air quality, hazardous waste and materials management, drinking water requirements, water quality regulations, remediation, and emergency planning.

Take advantage of opportunities for specialized one-on-one assistance from EGLE staff and get your questions answered.

A full conference registration is $200. The deadline to register is May 27. See more details at Michigan.gov/EGLEevents.

Legislative Update 3-29-24

Blog, Events, Legislative, MAC news, MACSC, Marketing, NACo

Lenawee commissioner explains beginnings of ballot campaign on energy sites

So explained Lenawee County Commissioner Kevon Martis about the ballot campaign he and other concerned citizens formed now to contest Public Act 233, the controversial state law adopted in 2023 on the siting of renewable energy facilities.

“Public Act 233 has really taken away any meaningful local control of wind, solar and battery storage regulation,” Martis explained to Podcast 83 host Stephan Currie in a new special episode. “We’ve taken the approach that people should have a vote on this, and we’re trying to place the repeal of that local zoning preemption on the ballot this November.”

Under the name “Citizens for Local Choice,” this group wants voters to have a chance to modify the law to protect local control.

“We introduced this as initiated legislation and that legislation targets only the local zoning preemption (in the law),” Martis explained. “We’re not touching any of the energy policy side of this.”

“My strong recommendation to (Michigan’s county commissioners) is if each of you go out and collect one or two pages of signatures ― and each page has 12 signatures ― that will make a meaningful difference in our efforts,” Martis said.

View the full episode, recorded on March 22, by clicking here.

Previous episodes can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

Use new portal to help state direct broadband investments

The maps were initially built using data from internet service providers, state, and federal entities. The challenge process is meant to fact-check that data and ensure funds are being allocated accurately. The challenge began on March 25 and will run through April 23.

Residents are unable to submit challenge results directly to the state, however, Merit has generated a portal for this purpose. Merit is a nonprofit regional research and education network which will gather residential data from the portal and submit it to the state on behalf of individuals. Community leaders should refer their constituents to the Merit platform to participate in the challenge.

For more information on MAC’s advocacy on broadband, contact Madeline Fata at fata@micounties.org.

MAC-backed bill to expand drug courts awaits House vote

House Bill 4525, by Rep. Graham Filler (R-Clinton), would amend state law to allow certain offenders to be admitted to a drug treatment court with the approval of the judge, prosecutor and any known victim.

HB 4525 is part of a three-bill package, including HBs 4523 and 4524, by Reps. Kara Hope (D-Ingham) and Joey Andrews (D-Berrien), respectively. The package would expand the use of mental health and drug treatment courts, which are currently limited to nonviolent offenders, to include certain violent offenders ― but again only with approval from a judge and prosecutor and consent of any victim.

The bills were voted out of the Senate; however, they were sent back to the House, as they are required to provide a concurrence vote due to amendments made in the Senate. Despite prior approval in the House, HBs 4523 and 4525 failed to move, and likely will not receive another vote until later this spring.

MAC supports this legislation.

For more information on this issue, contact Samantha Gibson at gibson@micounties.org.

NACo webinar to give update on ‘elective pay’ under federal IRA

An April 16 webinar from the National Association of Counties is designed to answer county questions about the “elective pay” portion of the Inflation Reduction Act (IRA).

On March 5, the U.S. Department of the Treasury (Treasury) issued final regulations for the elective pay mechanism established in the Inflation Reduction Act (IRA). Using elective pay, also known as direct pay, counties and other tax-exempt entities can monetize certain clean energy tax credits that they have previously been unable to access due to their lack of tax liability. Treasury also unveiled a new proposed rule to provide criteria regarding the eligibility of certain ownership structures to claim elective pay. During this webinar, counties will hear from Treasury and the U.S. Department of Energy (DOE) on these new regulations and other funding opportunities available under IRA.

To register for the webinar on April 16, which will run from 3 p.m. to 4 p.m. Eastern, click here.

County efforts earn Hometown Health Hero awards

This year marks the 20th anniversary of the award, which is presented to individuals and/or organizations that have made significant and measurable contributions to preserve and improve their community’s health. Awardees are selected solely from nominations received.

Washtenaw County’s Community Voices for Health Equity will receive one of 10 awards this year.

Honorable Mentions will be awarded to:

All the awards will be presented on April 10 at 11:30 a.m. in the Atrium of Heritage Hall in the State Capitol. The event is open to the public. The event is held during Michigan Public Health Week, whose theme this year is f “Protecting, Connecting and Thriving: We Are All Public Health.”