FY22 budget deal announced; 2% boost on revenue sharing expected

A fiscal 2022 state budget deal is in hand, Gov. Gretchen Whitmer and Republican legislative leaders announced this week, just days before the start of the fiscal year on Oct. 1.

A fiscal 2022 state budget deal is in hand, Gov. Gretchen Whitmer and Republican legislative leaders announced this week, just days before the start of the fiscal year on Oct. 1.

The Legislature is set to push through a single omnibus spending bill covering the funding for all state departments for FY22. The House and Senate Conference Committee could take up the bill as soon as Tuesday, Sept. 21, with a floor vote expected within the week. Although, details have yet to be released as to what’s inside this budget, MAC is expecting a 2 percent increase in county revenue sharing.

Not included in the omnibus budget bill will be the $6 billion in federal American Rescue Plan funds allocated to the state or the $1 billion surplus identified in the May Revenue Estimating Conference. These funds will be part of supplemental bills passed throughout the rest of calendar 2021, after all sides have had time to negotiate for the inclusion of their priorities.

MAC will continue to monitor the FY22 budget and supplemental bills as they move through the Legislature.

For more information on this issue, please contact Deena Bosworth at bosworth@micounties.org.

MAC-opposed mental health bills get hearing in Senate

Two bills to revamp the state’s mental health system in ways opposed by MAC received their first hearing before the Senate Government Operations Committee this week.

Two bills to revamp the state’s mental health system in ways opposed by MAC received their first hearing before the Senate Government Operations Committee this week.

Senate Bills 597-598 would shift administration of Medicaid mental health services to private health plans through the creation of specialty integrated plans. Senate Majority Leader Mike Shirkey (R- Jackson) sponsored SB 597 and also chairs the committee; SB 598 is sponsored by Sen. John Bizon (R-Calhoun).

In testimony before the committee, the Community Mental Health Association of Michigan (CMHAM) outlined opposition and major areas of concern, including higher costs and lack of public accountability and oversight. Rather than dismantling the current system, CMHAM urged legislators to build from the point of service delivery, rather than taking a top-down financial approach these bills seek to integrate.

Nearly all testimony this week encouraged lawmakers to focus on improving access and staffing shortages across the workforce. Representatives from the Michigan Association of Health Plans testified in support for the bills. A full video of testimony can be found here.

MAC has long opposed a shift to a private health plans and supports local governance and accountability rooted in the mental health code. This structure allows partnerships across county-based services, including responding to those who come in contact with the county sheriff department and/or jail, local court system, juvenile justice system, health department or local hospital.

Another committee hearing is expected to be held on Sept. 21 at 1 p.m.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Regional meetings set for ARP local government funding

On March 11, President Biden signed the $1.9 trillion American Rescue Plan Act (ARP) of 2021 establishing the $350 billion Coronavirus State and Local Fiscal Recovery Fund, $130 billion of which is earmarked for distribution to local governments. Generally, allowable uses of the fund include (but are not limited to):

On March 11, President Biden signed the $1.9 trillion American Rescue Plan Act (ARP) of 2021 establishing the $350 billion Coronavirus State and Local Fiscal Recovery Fund, $130 billion of which is earmarked for distribution to local governments. Generally, allowable uses of the fund include (but are not limited to):

- Responding to or mitigating the COVID-19 public health emergency

- Providing government services to the extent of a reduction in revenue

- Making necessary investments in water, sewer, or broadband infrastructure

- Responding to workers performing essential work during the COVID-19 public health emergency by providing premium pay to eligible workers

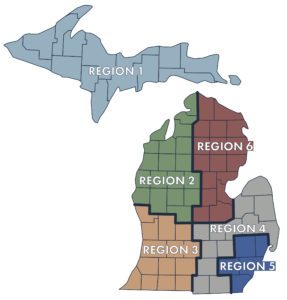

Member regions of the Michigan Association of Regions will host Michigan State University (MSU) Extension faculty and local and tribal government officials to explore Local Fiscal Recovery Fund spending opportunities in a regional context. Join other local leaders to learn about:

- ARP Local Fiscal Recovery Fund Basic Rules

- Best Practices for Local Fiscal Recovery Fund Spending

- Practical Considerations for Contracts, Accounting, and Project Management

- Group Discussions Related to Regional Collaboration

- Leveraging Other State and Federal Funding and Priorities

The workshops are intended for regional planning and development board members, other local elected and appointed officials, tribal government officials, economic development practitioners and other public and nonprofit community development organization staff.

Program details

All workshops run 9:30 a.m. to 12:30 p.m. (registration opens at 9 a.m. for in-person programs). Format varies by region: virtual (exclusive Zoom), hybrid (choice of in-person or Zoom attendance) or in-person.

All events are free.

The first session is set for Sept. 23 in Traverse City. To see the full list of dates, locations and registration information, click here.

Staff picks

Staff picks

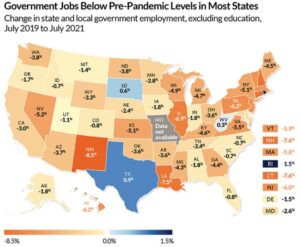

- State and local government job growth lags as economy recovers (Pew Trusts)

- Meeting schedule of the Michigan Independent Redistricting Commission (State of Michigan)

- The state pension funding gap: Plans have stabilized in wake of pandemic (Pew Trusts)

- USDA releases resource guide for rural disaster resiliency and recovery (NACo)

Counties would be well served to wait and see how

Counties would be well served to wait and see how  Summer is over, which means legislators are returning to Lansing – AND MAC’s Podcast 83 team will be back to weekly live sessions to give you all the inside info on what’s happening at the Michigan State Capitol and in Washington, D.C.

Summer is over, which means legislators are returning to Lansing – AND MAC’s Podcast 83 team will be back to weekly live sessions to give you all the inside info on what’s happening at the Michigan State Capitol and in Washington, D.C.

Supreme Court sets Sept. 22 hearing on court rules

Supreme Court sets Sept. 22 hearing on court rules Staff picks

Staff picks County commissioners and administrators will soon receive the

County commissioners and administrators will soon receive the  MAC offices to observe Labor Day holiday

MAC offices to observe Labor Day holiday A Sept. 28 webinar will feature information on “Assisted Outpatient Treatment” and its use and benefits in Genesee County.

A Sept. 28 webinar will feature information on “Assisted Outpatient Treatment” and its use and benefits in Genesee County. In a welcome move, Gov. Gretchen Whitmer and legislative leaders resumed negotiations this week and agreed upon target numbers for each departmental budget bill for fiscal year 2022, which begins Oct. 1. Although many details still have to be worked out, the overall spending amount and the most important priorities for funds have been hashed out.

In a welcome move, Gov. Gretchen Whitmer and legislative leaders resumed negotiations this week and agreed upon target numbers for each departmental budget bill for fiscal year 2022, which begins Oct. 1. Although many details still have to be worked out, the overall spending amount and the most important priorities for funds have been hashed out. During a Wednesday afternoon digital briefing, the National Association of Counties advised state associations that their member counties should focus on two key points as they prepare their interim ARP reports due on Aug. 31:

During a Wednesday afternoon digital briefing, the National Association of Counties advised state associations that their member counties should focus on two key points as they prepare their interim ARP reports due on Aug. 31: Commissioners who attend the 2021 Michigan Counties Annual Conference (Sept. 26-28 on Mackinac Island) will vote in elections to fill five seats on the

Commissioners who attend the 2021 Michigan Counties Annual Conference (Sept. 26-28 on Mackinac Island) will vote in elections to fill five seats on the  The Michigan Indigent Defense Commission (MIDC) has approved a local share study, required by statute to be submitted to the Legislature by October. The MIDC contracted with Public Sector Consultants to review the current local share formula and conduct stakeholder interviews.

The Michigan Indigent Defense Commission (MIDC) has approved a local share study, required by statute to be submitted to the Legislature by October. The MIDC contracted with Public Sector Consultants to review the current local share formula and conduct stakeholder interviews. Michigan Attorney General Dana Nessel has officially signed on to a proposed multi-billion-dollar national opioid settlement with Johnson & Johnson and the three largest pharmaceutical distributors in the country: Cardinal Health, McKesson and AmerisourceBergen.

Michigan Attorney General Dana Nessel has officially signed on to a proposed multi-billion-dollar national opioid settlement with Johnson & Johnson and the three largest pharmaceutical distributors in the country: Cardinal Health, McKesson and AmerisourceBergen.  With more than 300 people now registered to attend the 2021 Michigan Counties

With more than 300 people now registered to attend the 2021 Michigan Counties  A bipartisan trio of U.S. senators will introduce legislation to address the Medicaid Inmate Exclusion Policy (MIEP). U.S. Sens. Bill Cassidy (R-La.), Ed Markey (D-Mass.) and Jeff Merkley (D-Ore.) said they would be introducing the

A bipartisan trio of U.S. senators will introduce legislation to address the Medicaid Inmate Exclusion Policy (MIEP). U.S. Sens. Bill Cassidy (R-La.), Ed Markey (D-Mass.) and Jeff Merkley (D-Ore.) said they would be introducing the