New PPT bills would affect heavy equipment, solar

The House Committee on Tax Policy took testimony this week on House Bills 5778 and 5779, by Rep. Jim Ellison (D-Oakland), that would change the way rented heavy equipment is taxed in Michigan. Currently, heavy equipment is taxed as personal property (PPT) and credited to the taxing jurisdiction where it physically sits on Dec. 31 of each year.

Since this equipment is rented and movable, neither the companies paying the taxes are clear what their obligations will be on a year to year basis nor can the local tax collecting units forecast the revenue in an efficient manner. The bills seek to eliminate PPT on this equipment and instead replace it with a 2 percent tax on the rental of the equipment. This tax would be paid by the customer, collected by the company renting the equipment and submitted quarterly to the Michigan Department of Treasury.

By May 20 of each year, Treasury would be required to send 90 percent of this revenue to the local tax collecting unit where the rental transaction originated, and 10 percent of the revenue to the other counties, cities, villages and townships not receiving a share of the distribution. Within 35 days of receiving the revenue, the tax collecting unit would be required to disburse the revenue to the taxing units (counties, et al) in the same proportion as it distributes property taxes.

In addition to the equipment rental bills, bills affecting the PPT on solar energy facilities have been introduced. Senate Bill 1105, by Sen. Curt VanderWall (R-Mason) and SB 1101, by Sen. Kevin Daley (R-Tuscola), would exempt solar energy facilities and storage systems from the PPT and instead create a PILT (payment in lieu of taxes) system.

Proponents are seeking a standardized, statewide system that will provide predictability in the taxes owed, regardless of the jurisdiction; escape the variability in assessments and millage rates; and provide a flat stream of revenue for those communities that host this equipment. The legislation would create a PILT of $3,500 per megawatt maximum annual payment, as opposed to a tax based on an assessed value and depreciation schedule.

In order to qualify for PILT as opposed to a tax, the owner of the facility would be required to file for and receive an exemption certificate, which would not expire unless they permanently ceased production, received a judicial determination that they failed to make their payments, or upon the jointly agreed upon termination date. MAC is seeking clarification on the equitable amount per megawatt hour, the assumptions that brought them to that amount, the efforts of the Michigan Tax Tribunal to make recommendations on standardizing the assessment of the equipment and the overall financial impact to counties.

MAC has not yet taken a position on any of these bills. The legislation will be discussed at our September Finance and General Government Committee session.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

State launches Futures for Frontliners campaign

County frontline workers put their own health at risk during the worst of the pandemic. That’s why Michigan has created Futures for Frontliners – to offer essential workers like you the opportunity to attend school tuition-free full-time or part-time while you continue to work. MAC is pleased to partner with the state and others on this initiative.

County frontline workers put their own health at risk during the worst of the pandemic. That’s why Michigan has created Futures for Frontliners – to offer essential workers like you the opportunity to attend school tuition-free full-time or part-time while you continue to work. MAC is pleased to partner with the state and others on this initiative.

Who’s eligible? All essential workers in Michigan without college degrees or high school diplomas or equivalency who staffed our hospitals, nursing homes, and grocery stores, who cared for our children, provided critical police and fire services, delivered our food, picked up our trash, manufactured PPE, and other key jobs during the April-June period that kept our state running.

The application for seeking a college degree or certificate, attaining your high school diploma or equivalency, and additional program information are available now at Michigan.gov/Frontliners, with enrollment in classes available beginning January 2021.

Please share this information with your county employees.

NACo unveils toolkit for lobbying Congress

To help local leaders advocate for top county priorities between now and the end of the year, NACo has developed an online Advocacy Toolkit, which features in-depth information, talking points, sample advocacy emails, tweets and Facebook posts, federal legislation trackers and exclusive NACo materials to help tell the county story.

As members of Congress are in their home districts, this toolkit provides resources to communicate with them, demonstrate the impact of county programs and advocate for federal policies that support local priorities.

Water School webinars aimed at local officials

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from Michigan Sea Grant and Michigan State University Extension provides decision-makers with critical, relevant information needed to understand Michigan’s water resources in order to support sound water management decisions.

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from Michigan Sea Grant and Michigan State University Extension provides decision-makers with critical, relevant information needed to understand Michigan’s water resources in order to support sound water management decisions.

This year, Michigan Water School: Essential Resources for Local Officials will be offered for free in a series of Zoom webinars from 3 p.m. to 5 p.m. on four Thursday afternoons (Oct. 8 and 22, Nov. 5 and 19). The program will include sessions on water quantity; water quality; water finance and planning; and water policy issues. Topics to be covered include:

- The Blue Economy

- Fiscal benefits of water management

- Incorporating water into local planning and placemaking

- Resources to help address water problems

- Water policy at the federal, tribal, state, and local levels

Water School speakers will include educators and faculty from MSU and MSU Extension as well as other experts providing local perspectives.

Register to attend the free, policy-neutral, fact-based program at events.anr.msu.edu/WaterSchoolWebinarSeries2020. Not sure if you will be able to attend the live sessions? Each webinar will be recorded and all registrants will receive links to the recordings so you can watch them at a more convenient time, along with additional resources.

For more information, contact Michigan Sea Grant Extension Educator Mary Bohling at bohlingm@msu.edu. Follow on Twitter with #MIWaterSchool.

Staff picks

Staff picks

Key trial court costs bill to become law

Legislation to extend the authority of trial courts to levy costs to defendants will soon be law, after the Senate this week approved House Bill 5488 and sent it to Gov. Gretchen Whitmer for her expected signature.

Legislation to extend the authority of trial courts to levy costs to defendants will soon be law, after the Senate this week approved House Bill 5488 and sent it to Gov. Gretchen Whitmer for her expected signature.

The bill, a major priority for MAC in 2020, extends cost authority to Oct. 1, 2022. Without the legislation, by Rep. Sarah Lightner (R-Jackson), county courts would have lost this source of funding for operational needs in a few weeks. The final Senate vote on HB 5488 was 29-8, with all “no” votes from Democratic senators.

The state’s Trial Court Funding Commission has said court costs “directly account for as high as $291 million annually in support (most of the 26.2 percent generated). Additionally, approximately $127 million of the annual funds transferred from the State originate from court assessments at sentencing. When totaled, Michigan trial courts are supported, in significant part, by over $418 million assessed to criminal defendants.”

Of course, the work on this issue is far from over. The new deadline is just two years way, and the next phase will be to finally solve the long-standing problem of a stable court funding system. MAC stands ready to continue the work with the Legislature to help streamline and improve the overall system. While a variety of reforms are needed, a key one is to rebalance state and local funds in the court system, as reported by the Trial Court Funding Commission.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Nursing home report: Create more aid for staff, look to ‘recovery centers’

A new report on combating COVID-19 in Michigan’s nursing homes has 28 recommendations, including an emphasis on training and support for frontline care workers and the replacement of the state’s current regional “hubs” for COVID-positive nursing home residents with “care and recovery centers.”

A new report on combating COVID-19 in Michigan’s nursing homes has 28 recommendations, including an emphasis on training and support for frontline care workers and the replacement of the state’s current regional “hubs” for COVID-positive nursing home residents with “care and recovery centers.”

The report came from a gubernatorial task force which has been meeting twice a week this summer. Renee Beniak, executive director of the Michigan County Medical Care Facilities Council (MCMCFC), chaired the task force’s staffing work group. She called nursing assistants’ jobs, which involve the most interaction with residents, “one of the most difficult. To take good care of the residents and do the best job possible, I think the staff have to be happy and fulfilled and not overwhelmed and burn out.”

MCMCFC represents 34 county-owned facilities scattered across the state from the western Upper Peninsula to Macomb County.

Next local finance webinar is Sept. 8; register today

The seventh in an ongoing series of webinars co-sponsored by MAC and the Michigan Treasury will be held on Sept. 8, starting at 2 p.m.

The seventh in an ongoing series of webinars co-sponsored by MAC and the Michigan Treasury will be held on Sept. 8, starting at 2 p.m.

County leaders can sign up now for the webinar, which will include an update on state budget process and the CARES Act programs, information about local government unclaimed property.

Each webinar is limited to 1,000 attendees. Participants are strongly encouraged to register early.

Treasury also has developed a webpage with numbered letters, memorandums, webinars, and resources regarding COVID-19 updates for local governments and school districts. This webpage was created to ensure that Michigan communities have access to the most up-to-date guidance and is updated frequently with information and resources as they become available.

For the latest updates, please review the COVID-19 Updates for Local Governments and School Districts’ webpage.

State launches health IT input campaign

A new effort by the state Health and Human Services Department (DHHS) to create a “roadmap” for health information technology will include a series of 16 virtual engagement sessions on a variety of topics such as care coordination, racial disparities in health, coronavirus response, and behavioral health. The sessions get under way on Sept. 15 and will continue into November.

A new effort by the state Health and Human Services Department (DHHS) to create a “roadmap” for health information technology will include a series of 16 virtual engagement sessions on a variety of topics such as care coordination, racial disparities in health, coronavirus response, and behavioral health. The sessions get under way on Sept. 15 and will continue into November.

Click here for full schedule.

“These sessions will provide an opportunity to collect input from stakeholders across Michigan on using data from health IT systems to address business needs as well as the needs of individuals they serve,” the department stated.

For more information, visit the MDHHS Health IT Commission web page.

Staff picks

Staff picks

Revenue sharing replacement funds to hit accounts on Monday

Replacement dollars for the cancelled August revenue sharing payments will reach county accounts on Monday, Aug. 31 as scheduled, MAC was told this week by state officials. Although the amount listed on the SIGMA website is correct, the name of the municipality is wrong, and is a glitch that if fixed will cause more problems than it fixes.

Replacement dollars for the cancelled August revenue sharing payments will reach county accounts on Monday, Aug. 31 as scheduled, MAC was told this week by state officials. Although the amount listed on the SIGMA website is correct, the name of the municipality is wrong, and is a glitch that if fixed will cause more problems than it fixes.

For exact amount and accurate county name, please see this list from the Department of Treasury.

Hazard pay premium payments are still being processed and will not be ready for another week. Additional staff has been assigned to this division of the Treasury Department to speed up the processing of applications. Those local units that have requested advanced payment of these funds before expending them should receive the funds within the next two weeks, long before the Sept. 20 deadline to make the payments to eligible employees.

As far as the payroll reimbursement program goes, those figures are still being calculated at Treasury. As reported last week, the number of applications received will greatly exceed the amount allocated for the program. The appropriation was for $200 million, but Treasury anticipates the requests will total about $350 million.

Therefore, each payment to locals for this program will be prorated based on the amount your locality requested as a percentage of the total amount requested. Those figures are not available yet. Once the hazard pay applications have been fully processed, department resources will be redirected to the payroll reimbursement program.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Conference concludes with workshops and platform and board elections

MAC concluded its 2020 Virtual Annual Conference this week with members easily approving policy platforms for the coming year and the election of unopposed candidates for five Board positions.

MAC concluded its 2020 Virtual Annual Conference this week with members easily approving policy platforms for the coming year and the election of unopposed candidates for five Board positions.

Ingham County’s Bryan Crenshaw is the only new addition to the Board, elected to fill a vacant seat in Region 4. Incumbents Stan Ponstein (at-large), Joe Bonovetz (Region 1), Richard Schmidt (Region 2), Jim Storey (Region 3) and Veronica Klinefelt (Region 5) were re-elected without opposition at virtual caucuses held Wednesday. Ninety MAC members were eligible to vote in elections via their registration for the Annual Conference.

On Thursday, the Board members were sworn in for their new terms at a MAC Board meeting.

Due to the coronavirus pandemic, the Board voted in June to extend officer terms for one year, so for the coming year President Klinefelt, First Vice President Phil Kuyers of Ottawa and Second Vice President Ponstein will hold their positions.

Workshops during week 2 of the virtual event focused on such issues as:

“We appreciate our members’ participation, and patience, as we explored new ways to provide information and transact association business,” said Stephan Currie, MAC executive director. “It all worked pretty well and we can build on this success as needed for future events.”

All of the conference sessions were recorded. MAC will be placing video files on the micounties.org website at some point in September. Watch for alerts in future Legislative Update emails for details on this.

MAC’s next scheduled conference is the Michigan Counties Legislative Conference, set for April 27-29, 2021, in Lansing.

Urban Institute seeks upward mobility partners

The Urban Institute, with funding from the Bill and Melinda Gates Foundation, is looking to partner with up to eight counties to compose an Upward Mobility Cohort.

The Urban Institute, with funding from the Bill and Melinda Gates Foundation, is looking to partner with up to eight counties to compose an Upward Mobility Cohort.

Awardees will receive $125,000 and 18 months of tailored technical assistance from Urban Institute experts to help county leaders use a set of 25 evidence-based mobility metrics to inform decision-making and develop a “mobility action plan.” This plan will reflect a comprehensive approach to upward mobility from poverty and will identify key challenges across policy areas that inhibit local mobility. The plan will also highlight strategies to improve local conditions for mobility and outcomes for residents, as informed by data and community voices.

Interested counties should complete the Request for Information (RFI) by Sept. 16, 2020. The researchers will select up to 25 finalists who will be invited to submit a full proposal due in November 2020, ultimately inviting eight counties to participate in the Upward Mobility Cohort. The cohort and technical assistance process will launch in January 2021.

An updated list of frequently asked questions will be posted at this link on Sept. 1.

Registration is now open for the Great Lakes PFAS Summit

The Great Lakes PFAS Summit has been moved to a virtual, week-long event to be held Oct. 26-30, 2020. The goals of this conference are to provide the most current and reliable science and policy, facilitate networking and information sharing, and explore current and future research topics related to per- and polyfluoroalkyl substances (PFAS).

The Great Lakes PFAS Summit has been moved to a virtual, week-long event to be held Oct. 26-30, 2020. The goals of this conference are to provide the most current and reliable science and policy, facilitate networking and information sharing, and explore current and future research topics related to per- and polyfluoroalkyl substances (PFAS).

One of the biggest stories in chemical contamination emerging over the past several years has been PFAS. States throughout the nation, including the Great Lakes region, are finding PFAS contamination in a growing number of locations where these persistent chemicals pose a threat to people and the environment. The Great Lakes Virtual PFAS Summit will bring together environmental program managers, policy experts, researchers, and contractors from around the Great Lakes region to share the challenges of addressing this contamination and present innovative technical solutions developed to address these “forever” chemicals.

Participants may include local, state, and federal government officials; environmental consultants and vendors; academic researchers and students; industry managing PFAS contamination; and community organizations. The cost is $50 and professional development hours will be available.

Staff picks

Staff picks

Izzo charms, inspires during conference keynote

“All of us are role models,” Michigan State University basketball coach Tom Izzo told county leaders gathered for a special session Thursday of MAC’s 2020 Virtual Annual Conference. “You gotta give back some things. I look back and I see I have a responsibility, which is a privilege, not a burden.”

“All of us are role models,” Michigan State University basketball coach Tom Izzo told county leaders gathered for a special session Thursday of MAC’s 2020 Virtual Annual Conference. “You gotta give back some things. I look back and I see I have a responsibility, which is a privilege, not a burden.”

Izzo’s keynote remarks were the highlight of week 1 of the virtual conference, which resumes next Tuesday and concludes next Thursday.

The Hall of Fame coach and national championship winner (2000) expanded on the leadership theme by saying, “Greatest feeling – being a difference-maker in someone’s life.”

During a wide-ranging Q&A after his remarks, led by MAC Executive Director Stephan Currie, Izzo fielded queries on everything from the “side” of Iron Mountain he grew up on to how to bring cohesion to a group of wildly different people to the recent trend in changing team mascots. At one point, the coach seemed to be wistful as he related how, in his young adult days in the Upper Peninsula, his first big investments were trailers, culminating in a “double-wide” unit.

Izzo also engaged in some good-natured ribbing with Currie over the high expectations Spartan fans have for him and his team each year.

“Coach never fails to deliver,” Currie said after the session. “We at MAC are so appreciative of coach Izzo’s time and the kind words he had for the work of county leaders in Michigan.”

The keynote event was the final one of a week that began with a workshop on managing public facilities in a COVID-19 world and the first plenary session, which included the semi-annual “State of MAC” report from Currie and a “Legislative Update” from Governmental Affairs Director Deena Bosworth.

To keep track of conference events, visit the conferences page on the MAC website, where you can find a link to the conference program. Access to conference events is limited to registered attendees, but MAC will be posting slide decks from workshops and, in September, video files of the major sessions.

Treasury: Payroll reimbursement program requests exceed funding

The application deadline for counties to apply for public safety and public health payroll reimbursement for April and May of 2020 has passed. In conversations with the Michigan Treasury, MAC has learned the amount requested for reimbursement will exceed the supplemental budget appropriation of $200 million. This means Treasury will be prorating the reimbursements based on the amount each request bears to the total amount requested. And there will not be another a second round to apply for in August.

The application deadline for counties to apply for public safety and public health payroll reimbursement for April and May of 2020 has passed. In conversations with the Michigan Treasury, MAC has learned the amount requested for reimbursement will exceed the supplemental budget appropriation of $200 million. This means Treasury will be prorating the reimbursements based on the amount each request bears to the total amount requested. And there will not be another a second round to apply for in August.

On the bright side, the expenses that were not covered in the first round will be eligible for allocation to the CARES Act revenue sharing replacement fund. Again, these are the funds that should total approximately 1.5 times the amount of your August revenue sharing payment amount. Although the replacement is restricted to eligible expenses, public safety and public health payrolls are considered eligible.

As far as the hazard pay program goes, the appropriation of $100 million has not, as of yet, been exhausted. Applications for the program continue to come in, but the threshold is unlikely to be exceeded.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org

Report: Michigan spends more on roads, but trends aren’t promising

Michigan has devoted increasing sums to its road network in recent years, but road conditions are still projected to worsen, said a transportation funding analyst with the House Fiscal Agency (HFA) during a 2020 Annual Conference workshop on Thursday.

Michigan has devoted increasing sums to its road network in recent years, but road conditions are still projected to worsen, said a transportation funding analyst with the House Fiscal Agency (HFA) during a 2020 Annual Conference workshop on Thursday.

William Hamilton of the HFA led workshop participants through the funding mechanics for roads across the state – and the current and expected results of that work. On one slide, he noted that while about 85 percent of state “trunkline” roads were in good or fair shape five years ago, that share is projected to fall to below 50 percent by 2025.

After Thursday’s session, Hamilton followed up on a couple of questions posed by members during his talk:

Local road millages and funding levels

“There appear to be 32 county-wide road millages in 2018, with total county road millage revenue in 2018 = $69.4 million. And it looks like 554 townships have township road millages, most of which are used to support county road commission maintenance and improvement projects within the respective townships. Total township road millage revenue in 2018 = $86.6 million.

“So those two sources add up to $156 million of local funding for county road programs and projects.

“Also, some counties and townships simply provide direct General Fund (GF) support for county road commission projects, like Oakland County, which uses county GF as part of a match money program.

“And many townships use township GF as part of a match money program. And there are special assessment districts in many townships to recover the costs of certain road improvements.”

Federal COVID aid for transportation

“This document summarizes federal COVID assistance through June 8, 2020; transportation elements are on page 14.

“So far, the only transportation money is for transit and airport projects. And as we discussed, the COVID money is made available through existing federal aid programs.”

Property tax exemptions are growing problem for counties, lawyer says

The misapplication of a 2006 court decision has led to a growing number of businesses avoiding local property taxes, putting more stress on already-strained county revenues, a tax law expert told a Wednesday workshop during the 2020 Annual Conference.

The misapplication of a 2006 court decision has led to a growing number of businesses avoiding local property taxes, putting more stress on already-strained county revenues, a tax law expert told a Wednesday workshop during the 2020 Annual Conference.

Via a virtual session, Jessica Wood of the firm of Dickinson Wright showed county leaders how the 2006 Wexford has led Michigan awry. Pre-Wexford, Wood said, the state had a “common sense, relatively intuitive, straightforward test” for determining whether a business qualified as a charity and therefore received a tax break. But the Wexford decision, she said, “the truck that drove the hole through” state law.

Duo: Invest in tech to deal with COVID in facilities

In the conference’s first workshop on Tuesday, Gary Nauts of the city of Rochester Hills and Terry Van Doren of MMRMA discussed experiences and best practices on handling public facilities in the first few months of the coronavirus pandemic.

Among the points highlighted by the pair:

- Communication is key.

- Invest in technology.

- Facilities and maintenance leaders will lead the return to normal.

“We are off to a fast start with the amount of information in our workshops,” said MAC Executive Director Stephan Currie. “While we can’t meet in-person, the digital format still allows us to support continuing education for our members.”

MIDC continues plan reviews amid murky budget situation

The Michigan Indigent Defense Commission (MIDC) met this week to continue to review and approve county compliance plans and costs analysis, among other items.

The Michigan Indigent Defense Commission (MIDC) met this week to continue to review and approve county compliance plans and costs analysis, among other items.

The MIDC reviewed 98 staff recommendations for approvals and rejections of county and municipal plans. The entire list can be found on the agenda here.

Additionally, the commission approved a framework should the FY21 appropriation for compliance grants be less than the total of the approved compliance plans. In February, the governor recommended $117.5 million for plans, but as with all budgetary items, the compliance funding could be in jeopardy due to revenue effects of the COVID-19 pandemic. The latest estimates range from an FY21 shortfall of $1 billion to $1.5 billion in the General Fund. However, the final number will be approved on Aug. 24 at the Consensus Revenue Estimating Conference.

MAC supports full funding of MIDC grants and the $117.5 million proposed by the governor. Anything short of full funding would be a violation of the Headlee Amendment, and per statute, “A system’s duty of compliance with 1 or more standards within the plan under subsection (1) is contingent upon receipt of a grant in the amount sufficient to cover that particular standard or standards contained in the plan and cost analysis approved by the MIDC.”

The commission also received a letter from Orlene Hawks, director of the Department of Licensing and Regulatory Affairs (LARA), indicating Standard 5 (independence of the indigent defense system from the judiciary) is slated to be formally approved by LARA in October. Per statute, “No later than 180 days after a standard is approved by the department, each indigent criminal defense system shall submit a plan to the MIDC for the provision of indigent criminal defense services in a manner as determined by the MIDC and shall submit an annual plan for the following state fiscal year on or before Oct. 1 of each year.”

Lastly, a reminder that standards related to indigency and partial indigency determinations, required by the MIDC Act, are open for public comment until Sept. 14, 2020, and can be submitted to LARA-MIDC-Info@michigan.gov. Alternatively, comments can be sent by that date to the MIDC Office, 200 N. Washington Square, 3rd Floor, Lansing, MI 48913. All comments will be posted and available on the MIDC website.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

State to distribute $3.5M through Child Care Fund

The Michigan Department of Health and Human Services is slated to distribute the $3.5 million appropriated under the FY20 budget to cover Child Care Fund administrative costs relevant to the move of neglect/abuse payments to the “State Pays First” system in the next 30 days. As the state transitioned to the State Pays First model, the statute was not clear whether the 10 percent counties received for indirect costs must be applied to the abuse/neglect population.

The Michigan Department of Health and Human Services is slated to distribute the $3.5 million appropriated under the FY20 budget to cover Child Care Fund administrative costs relevant to the move of neglect/abuse payments to the “State Pays First” system in the next 30 days. As the state transitioned to the State Pays First model, the statute was not clear whether the 10 percent counties received for indirect costs must be applied to the abuse/neglect population.

The Legislature approved $3.5 million in FY20 to ensure counties did not see a shortfall, but due to so many unknowns during the FY20 budget process under COVID-19, payments were delayed. Since the recent completion of updates to the FY20 budget that included the $3.5 million, the state will be issuing payments as soon as possible. Per correspondence with the department, MAC expects payments within 30 days, and will stay in touch with members if that time frame changes.

A county-by-county breakdown of the $3.5 million can be found here.

For more information on this issue, contact Meghann Keit at keit@micounties.org.

Staff picks

Staff picks

FY21 budget won’t cut revenue sharing

FY21 budget won’t cut revenue sharing MAC-supported legislation that would allow remote participation in board meetings after the pandemic Executive Orders expire has been introduced in the Legislature. Rep. Luke Meerman (R-Ottawa) introduced House Bill 6207 to amend the Open Meetings Act to allow a meeting be held electronically, while ensuring transparency and promoting public participation. A similar Senate Bill, 1108 by Sen. Lana Theis (R-Livingston), will be reviewed by the Senate Local Government Committee next week.

MAC-supported legislation that would allow remote participation in board meetings after the pandemic Executive Orders expire has been introduced in the Legislature. Rep. Luke Meerman (R-Ottawa) introduced House Bill 6207 to amend the Open Meetings Act to allow a meeting be held electronically, while ensuring transparency and promoting public participation. A similar Senate Bill, 1108 by Sen. Lana Theis (R-Livingston), will be reviewed by the Senate Local Government Committee next week. The authority for trial courts to impose costs on defendants is extended to 2022 under a state law signed by Gov. Gretchen Whitmer this week. Passage of House Bill 5488 had been a top priority for MAC this year since the imposition of court costs was about to expire next month. Now that authority runs to Oct. 1, 2022.

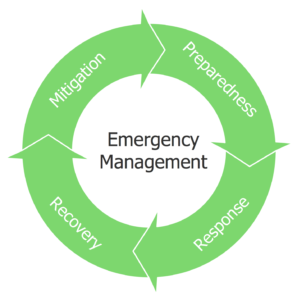

The authority for trial courts to impose costs on defendants is extended to 2022 under a state law signed by Gov. Gretchen Whitmer this week. Passage of House Bill 5488 had been a top priority for MAC this year since the imposition of court costs was about to expire next month. Now that authority runs to Oct. 1, 2022. The House committee on Military and Veterans Affairs took testimony this week from emergency managers (EM) in support of House Bill 6148, by Rep. Jack O’Malley (R-Benzie). The bill would move emergency management functions out from under the Department of State Police and into a new department that will report and communicate directly with the governor. Compelling testimony was given this week by two county emergency management coordinators indicating support for this restructuring. The reasons cited for their support include:

The House committee on Military and Veterans Affairs took testimony this week from emergency managers (EM) in support of House Bill 6148, by Rep. Jack O’Malley (R-Benzie). The bill would move emergency management functions out from under the Department of State Police and into a new department that will report and communicate directly with the governor. Compelling testimony was given this week by two county emergency management coordinators indicating support for this restructuring. The reasons cited for their support include: A MAC-opposed bill ostensibly designed to boost broadband access cleared the House Communication and Technology committee this week.

A MAC-opposed bill ostensibly designed to boost broadband access cleared the House Communication and Technology committee this week. 2020 Annual Conference videos now available

2020 Annual Conference videos now available A house bill to provide liability protections to health facilities, including Medical Care Facilities (MCFs), advanced out of the House Judiciary committee this week.

A house bill to provide liability protections to health facilities, including Medical Care Facilities (MCFs), advanced out of the House Judiciary committee this week. Michigan counties have weathered the initial fiscal crisis caused by the coronavirus pandemic, but dangers loom on the horizon, MAC Executive Director Stephan Currie said during a panel discussion at the Lansing Regional Chamber of Commerce’s Economic Club last week.

Michigan counties have weathered the initial fiscal crisis caused by the coronavirus pandemic, but dangers loom on the horizon, MAC Executive Director Stephan Currie said during a panel discussion at the Lansing Regional Chamber of Commerce’s Economic Club last week. America’s counties traditionally administer and fund elections, overseeing more than 109,000 polling places and coordinating more than 694,000 poll workers every two years. Faced with new election-related challenges due to COVID-19 and concerns over cybersecurity, foreign influence and aging technology, election administrators across the country have worked tirelessly to finalize preparations to conduct a free and fair election.

America’s counties traditionally administer and fund elections, overseeing more than 109,000 polling places and coordinating more than 694,000 poll workers every two years. Faced with new election-related challenges due to COVID-19 and concerns over cybersecurity, foreign influence and aging technology, election administrators across the country have worked tirelessly to finalize preparations to conduct a free and fair election. The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS) have announced the details of the first two virtual opioids town halls:

The Michigan Opioids Task Force and Michigan Department of Health and Human Services (MDHHS) have announced the details of the first two virtual opioids town halls: Staff picks

Staff picks

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall.

MAC’s Podcast 83 team will lead a special live edition on Monday, Sept. 21 to field questions from county leaders on the FY21 state budget and all other legislative matters coming to a head in Lansing this fall. The latest webinar in a series co-sponsored by MAC, the Michigan Department of Treasury and others reviewed the latest guidance and tips involving COVID-19 aid for local governments on Sept. 8.

The latest webinar in a series co-sponsored by MAC, the Michigan Department of Treasury and others reviewed the latest guidance and tips involving COVID-19 aid for local governments on Sept. 8.

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from

MSU Extension is offering a free online Michigan Water School webinar series for elected and appointed officials and staff. Elected and appointed officials often need to make important decisions regarding the future of shared water resources. The new online version of the Michigan Water School program from The seventh in an ongoing series of webinars co-sponsored by MAC and the Michigan Treasury will be held on Sept. 8, starting at 2 p.m.

The seventh in an ongoing series of webinars co-sponsored by MAC and the Michigan Treasury will be held on Sept. 8, starting at 2 p.m. A new effort by the state Health and Human Services Department (DHHS) to create a “roadmap” for health information technology will include a series of 16 virtual engagement sessions on a variety of topics such as care coordination, racial disparities in health, coronavirus response, and behavioral health. The sessions get under way on Sept. 15 and will continue into November.

A new effort by the state Health and Human Services Department (DHHS) to create a “roadmap” for health information technology will include a series of 16 virtual engagement sessions on a variety of topics such as care coordination, racial disparities in health, coronavirus response, and behavioral health. The sessions get under way on Sept. 15 and will continue into November. Replacement dollars for the cancelled August revenue sharing payments will reach county accounts on Monday, Aug. 31 as scheduled, MAC was told this week by state officials. Although the amount listed on the SIGMA website is correct, the name of the municipality is wrong, and is a glitch that if fixed will cause more problems than it fixes.

Replacement dollars for the cancelled August revenue sharing payments will reach county accounts on Monday, Aug. 31 as scheduled, MAC was told this week by state officials. Although the amount listed on the SIGMA website is correct, the name of the municipality is wrong, and is a glitch that if fixed will cause more problems than it fixes. MAC concluded its 2020 Virtual Annual Conference this week with members easily approving policy platforms for the coming year and the election of unopposed candidates for five Board positions.

MAC concluded its 2020 Virtual Annual Conference this week with members easily approving policy platforms for the coming year and the election of unopposed candidates for five Board positions. The Urban Institute

The Urban Institute “All of us are role models,” Michigan State University basketball coach Tom Izzo told county leaders gathered for a special session Thursday of MAC’s 2020 Virtual Annual Conference. “You gotta give back some things. I look back and I see I have a responsibility, which is a privilege, not a burden.”

“All of us are role models,” Michigan State University basketball coach Tom Izzo told county leaders gathered for a special session Thursday of MAC’s 2020 Virtual Annual Conference. “You gotta give back some things. I look back and I see I have a responsibility, which is a privilege, not a burden.” The application deadline for counties to apply for

The application deadline for counties to apply for  Michigan has devoted increasing sums to its road network in recent years, but road conditions are still projected to worsen,

Michigan has devoted increasing sums to its road network in recent years, but road conditions are still projected to worsen,  The misapplication of a 2006 court decision has led to a growing number of businesses avoiding local property taxes, putting more stress on already-strained county revenues, a tax law expert told

The misapplication of a 2006 court decision has led to a growing number of businesses avoiding local property taxes, putting more stress on already-strained county revenues, a tax law expert told  The Michigan Indigent Defense Commission (MIDC) met this week to continue to review and approve county compliance plans and costs analysis, among other items.

The Michigan Indigent Defense Commission (MIDC) met this week to continue to review and approve county compliance plans and costs analysis, among other items. The Michigan Department of Health and Human Services is slated to distribute the $3.5 million appropriated under the FY20 budget to cover Child Care Fund administrative costs relevant to the move of neglect/abuse payments to the “State Pays First” system in the next 30 days. As the state transitioned to the State Pays First model, the statute was not clear whether the 10 percent counties received for indirect costs must be applied to the abuse/neglect population.

The Michigan Department of Health and Human Services is slated to distribute the $3.5 million appropriated under the FY20 budget to cover Child Care Fund administrative costs relevant to the move of neglect/abuse payments to the “State Pays First” system in the next 30 days. As the state transitioned to the State Pays First model, the statute was not clear whether the 10 percent counties received for indirect costs must be applied to the abuse/neglect population.