Locals waiting at starting line on road funding

Gov. Gretchen Whitmer’s road bonding plan, highlighted in her State of the State address Wednesday night, will leave counties without the additional resources they need.

Gov. Gretchen Whitmer’s road bonding plan, highlighted in her State of the State address Wednesday night, will leave counties without the additional resources they need.

“We’re disappointed it’s not a comprehensive plan to deal with infrastructure,” said Stephan Currie, executive director. “Counties are responsible for 74 percent of the road miles in our state, yet the proceeds from her bonding proposal would go only to state roads.”

Counties are responsible for the lion’s share of Michigan’s 120,000 miles of paved roads – 74.4 percent. In Kalkaska, Lake and Montmorency counties, more than 90 percent of road miles are under county control.

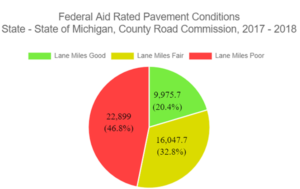

And the most acute needs for road repair are local roads. As of 2018, 47 percent of county lane miles were in poor condition, compared to 27 percent in poor condition for state trunklines, says the Transportation Asset Management Council.

And in a recent poll, far more Michigan residents trusted their local governments to spend any new road dollars (59%) than the state (23%).

“We recognize the governor’s options are limited, but this option leaves locals out of the equation entirely,” Currie noted.

On Thursday, the State Transportation Commission voted to authorize the Michigan Department of Transportation to issue $3.5 billion in bonds for state road work.

Infrastructure investments, from roads to water control, are among MAC’s legislative priorities in 2020.

“Our members stand ready to work with Gov. Whitmer and legislators of both parties to identify best practices and secure funding so county governments can do the work that Michigan residents expect,” Currie said. “We have a great deal of work ahead of us.”

For more information on MAC’s infrastructure advocacy, contact Deena Bosworth at bosworth@micounties.org.

MAC joins coalition against mining bill that guts local control

MAC has joined with six other organizations representing local governments, environmental causes and schools to urge defeat of a bill that guts local oversight over the location and operations of sand and gravel mining in Michigan.

MAC has joined with six other organizations representing local governments, environmental causes and schools to urge defeat of a bill that guts local oversight over the location and operations of sand and gravel mining in Michigan.

The Senate Transportation and Infrastructure Committee held its second hearing on Wednesday on Senate Bill 431, which would allow sand and gravel pits to operate essentially whenever and wherever they would like. The unnecessary and overreaching bill, sponsored by Sen. Adam Hollier (D-Wayne), would eliminate zoning authority and oversight capability from local governments—regardless of where the operation is located or its impact to nearby residents, schools, businesses, hospitals or others.

“The bill has two fundamental problems,” explained Deena Bosworth, director of governmental affairs with the Michigan Association of Counties. “It engages in pre-emption of local control, so that’s a ‘no’ right there. Also, it’s built on a dubious market study purporting to show a looming gravel shortage. We don’t know where all the different types of aggregate are in the state and where they would be needed. You don’t usurp local authority if you don’t even know there is a crisis.”

Bosworth’s remarks were echoed by leaders of other opposition groups.

“Senate Bill 431 is a wholly unwarranted piece of legislation that eliminates local officials’ ability to have any say in the impact of sand and gravel mines in their communities,” said Neil Sheridan, executive director of the Michigan Townships Association. “While MTA supports access to materials necessary to fix Michigan’s roads, the existing process allows for local governments to balance those needs, along with those of their residents and the impact of mining operations in their borders. This bill, however, removes local authority and all safeguards to ensure that balance.”

The legislation would essentially allow the aggregate industry to operate unfettered, with virtually zero oversight at any level of government, unfairly favoring the industry over our residents, students and the environment. It places profit before people, requiring only that an applicant for mining operations prove the operation would be profitable and the extraction will not pose a risk to public health, safety or welfare that cannot be avoided.

“This bill would have a devastating impact on our cities and villages,” said Jennifer Rigterink, legislative associate for the Michigan Municipal League. “SB 431 is all about profit for the industry and has no regard for people, communities or the environment.” See the complete coalition statement.

The bill remains in committee.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

MAC testifies for tweaks to competency process

County Commissioners across the state have been hearing for years of the backlog at the state’s Center for Forensic Psychiatry. Defendants are sitting in county jails waiting to be evaluated to determine competency to stand trial, and even if they are deemed incompetent, they could then be sitting in jail for long periods of time before they are moved somewhere to get treatment. Not only does this strain county jail resources, it can lead to defendants’ further mental health deterioration and delays the process for victims.

County Commissioners across the state have been hearing for years of the backlog at the state’s Center for Forensic Psychiatry. Defendants are sitting in county jails waiting to be evaluated to determine competency to stand trial, and even if they are deemed incompetent, they could then be sitting in jail for long periods of time before they are moved somewhere to get treatment. Not only does this strain county jail resources, it can lead to defendants’ further mental health deterioration and delays the process for victims.

House Bill 5325, by Rep. Julie Calley (R-Ionia and a former county commissioner), would require a competency exam to be scheduled within 30 days if the defendant is being held in jail. If the exam is not completed in 30 days, the court could appoint independent qualified personnel to complete the exam. MAC is supportive of the bill in concept, but a workable funding mechanism must be identified. The county would pay for an independent evaluation under the current language and then deduct that cost from money it sends to the state through court fine and fee transmittals.

However, MAC testified in the Judiciary and Public Safety Committee this week that while a deduction process is well-intended and preferred by counties over waiting on payments from the state, the transmittal money it sends to the state is already spoken for in a variety of fine/fee statutes. Deduction of dollars from the transmittals would violate the statutory fee/assessment designations and would affect funding for those designated purposes.

MAC appreciates Rep. Calley’s willingness to find a resolution to the funding language in order to move this good policy forward. The bill is also supported in concept by the Michigan Sheriffs’ Association and the Prosecuting Attorneys Association of Michigan.

For more information on this issue, contact Meghann Keit at Keit@micounties.org.

Let us know if you are coming to Lansing

Few actions can be as effective for county advocacy as local officials coming to Lansing to talk with legislators or testify before legislative committees. MAC encourages county commissioners and administrators to use every opportunity they can to participate this way in the policy-making process.

Few actions can be as effective for county advocacy as local officials coming to Lansing to talk with legislators or testify before legislative committees. MAC encourages county commissioners and administrators to use every opportunity they can to participate this way in the policy-making process.

In those situations where you decide to testify or are invited to do so by a legislator, please contact the MAC offices in advance of your committee date. Such notice allows MAC to:

- provide details on the current state of legislation;

- promote the appearance, thereby encouraging your colleagues to be more involved; and

- offer suggested talking points or themes from a multi-county perspective.

As soon as you know you are coming to Lansing, please contact Governmental Affairs Assistant Michael Ruddock at 517-372-5374 or ruddock@micounties.org.

Learn about county’s responsibilities under E911 law

On Jan. 1, 2021, counties must have a plan and changes in place to comply with the law on E911 (Enhanced 911 services).

On Jan. 1, 2021, counties must have a plan and changes in place to comply with the law on E911 (Enhanced 911 services).

A March 24 webinar, sponsored by MAC and Abilita, will help answer your questions concerning E911 compliance.

Consider this: An employee at your office has a medical emergency after normal working hours with nobody around. He or she dials 911 from a desk phone and the ambulance arrives at your location. However, since it is after hours and the building is more than 20,000 square feet on multiple floors. The first responders are delayed finding the individual that dialed 911. This is a possibility; and the situation can be even more complicated if there are multiple buildings tied to one phone system through VoIP technology.

The E911 law was enacted to change this.

Among questions explored in the 45-minute webinar will be:

- What is E911 and why a new law in Michigan?

- What is required for compliance?

- Who does this apply to?

- Is there any ongoing maintenance involved with this?

- What if we don’t do anything?

The webinar will run from 11 a.m. to noon on March 24. It is free and open to staffers at any MAC member county. To register, click here.

After the March 24 presentation, a recorded version will be placed on the MAC website for 24/7 viewing through the rest of 2020.

National news from NACo

National news from NACo

Michigan counties would see a $5.7 million boost to state revenue sharing payments under spending plans released today by Gov. Gretchen Whitmer for fiscal year 2021.

Michigan counties would see a $5.7 million boost to state revenue sharing payments under spending plans released today by Gov. Gretchen Whitmer for fiscal year 2021.

Gov. Gretchen Whitmer’s road bonding plan, highlighted in her

Gov. Gretchen Whitmer’s road bonding plan, highlighted in her  MAC has joined with six other organizations representing local governments, environmental causes and schools to urge defeat of a bill that guts local oversight over the location and operations of sand and gravel mining in Michigan.

MAC has joined with six other organizations representing local governments, environmental causes and schools to urge defeat of a bill that guts local oversight over the location and operations of sand and gravel mining in Michigan. County Commissioners across the state have been hearing for years of the backlog at the state’s Center for Forensic Psychiatry. Defendants are sitting in county jails waiting to be evaluated to determine competency to stand trial, and even if they are deemed incompetent, they could then be sitting in jail for long periods of time before they are moved somewhere to get treatment. Not only does this strain county jail resources, it can lead to defendants’ further mental health deterioration and delays the process for victims.

County Commissioners across the state have been hearing for years of the backlog at the state’s Center for Forensic Psychiatry. Defendants are sitting in county jails waiting to be evaluated to determine competency to stand trial, and even if they are deemed incompetent, they could then be sitting in jail for long periods of time before they are moved somewhere to get treatment. Not only does this strain county jail resources, it can lead to defendants’ further mental health deterioration and delays the process for victims. Few actions can be as effective for county advocacy as local officials coming to Lansing to talk with legislators or testify before legislative committees. MAC encourages county commissioners and administrators to use every opportunity they can to participate this way in the policy-making process.

Few actions can be as effective for county advocacy as local officials coming to Lansing to talk with legislators or testify before legislative committees. MAC encourages county commissioners and administrators to use every opportunity they can to participate this way in the policy-making process. On Jan. 1, 2021, counties must have a plan and changes in place to comply with the law on E911 (Enhanced 911 services).

On Jan. 1, 2021, counties must have a plan and changes in place to comply with the law on E911 (Enhanced 911 services). National news from NACo

National news from NACo