August Michigan Counties looks at juvenile justice, policing reforms

County commissioners and administrators will soon receive the August edition of Michigan Counties, MAC’s bimonthly magazine, in their mailboxes. The latest edition features a report on juvenile justice changes and MAC’s advocacy work around them and a briefing from the Michigan Sheriffs’ Association on policing reform bills in the Michigan Legislature.

County commissioners and administrators will soon receive the August edition of Michigan Counties, MAC’s bimonthly magazine, in their mailboxes. The latest edition features a report on juvenile justice changes and MAC’s advocacy work around them and a briefing from the Michigan Sheriffs’ Association on policing reform bills in the Michigan Legislature.

Also included in this edition are:

- A letter from MAC Board President Veronica Klinefelt as she completes her term as leader of the association

- A report from MAC Executive Director Stephan Currie

- Bios of MAC Board Directors Robert Showers and Joe Bonovetz

- A Q&A with Rep. Kevin Hertel of Macomb County

- An analysis of Michigan’s tax system by the Citizens Research Council of Michigan

- News briefs from around Michigan

To view a digital copy of the August edition or prior ones, visit the magazine page on the MAC website.

MAC offices to observe Labor Day holiday

MAC offices to observe Labor Day holiday

MAC’s Lansing offices will be closed on Monday, Sept. 6 in observance of the Labor Day holiday.

Normal office hours will resume at 8 a.m. on Tuesday, Sept. 7.

Assisted Outpatient Treatment is topic of next MDHHS webinar

A Sept. 28 webinar will feature information on “Assisted Outpatient Treatment” and its use and benefits in Genesee County.

A Sept. 28 webinar will feature information on “Assisted Outpatient Treatment” and its use and benefits in Genesee County.

The webinar, which will run from 1:30 p.m. to 3 p.m., is free for county leaders due to funding from the Michigan Department of Health and Human Services (MDHHS).

The webinar will have keynote addresses by Administrator Emeritus Milton Mack (SCAO) and Dr. Debra Pinals (medical director of behavioral health and forensic programming for MDHHS). It will be moderated by Chief Justice Bridget McCormick.

Genesee County is recognized as one of the Michigan counties that has operationalized and seen the benefits that AOT can offer. Representatives from Genesee County’s Probate Court, Law Enforcement, Natural Support, Hospital System and CMH will serve on the webinar panel to share their AOT experiences with other Michigan communities.

These trainings are co-sponsored by MAC affiliate members the Michigan Sheriffs’ Association and the Community Mental Health Association of Michigan.

For additional information, contact J. Eric Waddell at jericwaddell@thecardinalgroup2.com.

Staff picks

Staff picks

- Federal COVID assistance leads to a huge jump in Michigan personal income (Citizens Research Council of Michigan)

- Latest effort to reform Michigan’s mental-health system finds critics (Bridge magazine)

- Extreme weather events push emergency managers to the limit (Governing)

- Michigan’s boat and beach forecast: 2 days a go, 1 day forget about it (MLive)

Governor, legislators set key parameter for FY22 budget totals

In a welcome move, Gov. Gretchen Whitmer and legislative leaders resumed negotiations this week and agreed upon target numbers for each departmental budget bill for fiscal year 2022, which begins Oct. 1. Although many details still have to be worked out, the overall spending amount and the most important priorities for funds have been hashed out.

In a welcome move, Gov. Gretchen Whitmer and legislative leaders resumed negotiations this week and agreed upon target numbers for each departmental budget bill for fiscal year 2022, which begins Oct. 1. Although many details still have to be worked out, the overall spending amount and the most important priorities for funds have been hashed out.

Not included in the unspecified amount are the $6 billion in federal American Rescue Plan funds allocated to the state or the $1 billion surplus identified in the May Revenue Estimating Conference. These funds will be part of supplemental bills passed throughout the rest of calendar 2021, after all sides have had time to negotiate for the inclusion of their priorities.

The spending of the COVID-19 relief funds will be moved through a series of supplemental bills this fall. Senate Appropriations Committee Chair Jim Stamas (R-Midland) and Vice Chair Curtis Hertel (D-Ingham) are optimistic the budget will be completed and signed by the governor before the Oct. 1 start of the fiscal year.

MAC will continue to monitor the FY22 budget and supplemental bills as they move through the Legislature.

For more information on this issue, please contact Deena Bosworth at bosworth@micounties.org.

MAC-backed coalition urges legislative leaders to fund ARP matching program

A coalition that includes MAC, other government groups and representatives of the business community sent a letter this week urging legislative leaders to back a proposal for a state matching program for American Rescue Plan (ARP) funds.

A coalition that includes MAC, other government groups and representatives of the business community sent a letter this week urging legislative leaders to back a proposal for a state matching program for American Rescue Plan (ARP) funds.

The coalition, which also includes the Michigan Municipal League and the Michigan Townships Association, is asking that $3.9 billion in ARP funds sent to the state of Michigan seed a matching program to invest, leverage and amplify the influx of federal funding to leverage all levels of local government to reach our common goals.

Michigan will receive more than $10 billion in fiscal recovery aid, with all 83 counties slated to get $1.9 billion in direct aid alone. Cities and larger townships will receive $1.8 billion and non-entitlement communities approximately $644 million. The state of Michigan itself is receiving more than $6.5 billion. By working together, we can strategically invest these one-time dollars in areas of greatest need for improvement.

The ARP match program will provide Michigan with the ability to make unprecedented investments in:

- Water infrastructure and broadband

- Local capacity and fiscal stability

- Housing and community development

- Comprehensive economic development

- Public health and safety

The framework lays the foundation for a stronger recovery by creating multi-sector partnerships between communities, state leaders, interest groups, business, and philanthropy to accelerate the impact of one-time fiscal recovery funds.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

ARP message to counties: Do best you can with interim report due Aug. 31

During a Wednesday afternoon digital briefing, the National Association of Counties advised state associations that their member counties should focus on two key points as they prepare their interim ARP reports due on Aug. 31:

During a Wednesday afternoon digital briefing, the National Association of Counties advised state associations that their member counties should focus on two key points as they prepare their interim ARP reports due on Aug. 31:

- First, this is not a final report, but an interim one. Treasury is expecting changes down the line. These reports can be updated later through the quarterly or annual report.

- Second, Treasury is only asking that county leaders do the best they can in filing these reports. These reports can be updated later through the quarterly or annual report.

Resources

This week, the U.S. Treasury released a recorded presentation providing a walkthrough of the reporting portal covering both upcoming reports. This includes the one-time Interim Report, which all counties are required to submit to the U.S. Treasury by Aug.31, 2021, AND the Recovery Plan Performance Report, which only counties with populations above 250,000 residents are required to submit to the U.S. Treasury by Aug. 31, 2021.

The U.S. Treasury has released a number of other webinars covering targeted topics related to the Recovery Fund and have notified NACo that they will continue to offer such assistance in the future. The webinars can be found here.

Additionally, counties must refer to the Compliance and Reporting Guidance as well as the User Guide for a complete understanding of the information they are required to submit.

You can also visit NACo’s Recovery Fund Resource Hub for more information related to reporting. If your counties are having issues with the reporting portal, please send them to Eryn Hurley at ehurley@naco.org.

MAC’s CoProPlus subsidiary also is offering consulting services for counties seeking expert assistance in handling ARP funds. Click here to learn more.

And as always, be sure to check for updates on MAC’s ARP Resources Page.

Filing closes for MAC Board slots; contest arises for Region 2 seat

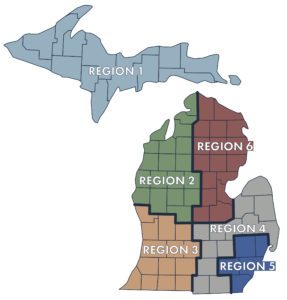

Commissioners who attend the 2021 Michigan Counties Annual Conference (Sept. 26-28 on Mackinac Island) will vote in elections to fill five seats on the MAC Board of Directors.

Commissioners who attend the 2021 Michigan Counties Annual Conference (Sept. 26-28 on Mackinac Island) will vote in elections to fill five seats on the MAC Board of Directors.

Filing for those seats closed on Thursday. The following individuals filed:

- Region 1 — Joe Stevens, Dickinson County, incumbent

- Region 2 — Neil Ahrens, Emmet County; Christian Marcus, Antrim County, incumbent

- Region 3 — Phil Kuyers, Ottawa County, incumbent

- Region 5 — Eileen Kowall, Oakland County, incumbent

- At-large — Melissa Daub, Wayne County

Seats representing regions are filled by a vote in regional caucuses at the conference. At-large seats are filled by the candidate that wins a majority of the six regional caucuses, which will be held at 2:30 p.m. on Monday, Sept. 27. Commissioners attending the conference will receive additional information on the voting process in their conference bags.

MAC will be creating a webpage with candidate information in early September. Be sure to keep an eye on www.micounties.org for it.

Staff picks

Staff picks

- New schedule for new maps: Michigan redistricting commission takes regional approach (MLive)

- Climate change on the Great Lakes has coastal communities bracing for higher water (MLive)

- Our infrastructure problem is mostly just old age (Governing)

- Defining generations: Where millennials end and generation z begins (Pew Research)

MIDC survey participants warn against premature funding changes

The Michigan Indigent Defense Commission (MIDC) has approved a local share study, required by statute to be submitted to the Legislature by October. The MIDC contracted with Public Sector Consultants to review the current local share formula and conduct stakeholder interviews.

The Michigan Indigent Defense Commission (MIDC) has approved a local share study, required by statute to be submitted to the Legislature by October. The MIDC contracted with Public Sector Consultants to review the current local share formula and conduct stakeholder interviews.

Study participants largely fell into two categories when asked about types of funding systems: support for full state funding or maintaining the current funding structure, in which funding is a combined effort between the State and local systems. MAC and county stakeholders were part of a focus group that reminded evaluators that the 1978 Headlee Amendment was the impetus behind the current formula, and it would be nearly impossible to identify any other funding structure that does not violate the Michigan Constitution.

The report makes note of the Headlee issue and, in large part, suggests any changes to the formula would be premature as implementation of the MIDC process and standards are only a few years old. The report states, “Other participants used stronger language, labeling a reevaluation and potential formula amendment as a ‘reckless’ undertaking that could ‘collapse’ the current system.”

Overall, the report recommendations were to delay formula amendments, which MAC supports. Also made were recommendations to explore further regionalization efforts, require reimbursement collection reporting and establish a reevaluation timeline. In conclusion, the report states, “Participants during all phases of this project have conceded that while the funding formula may not be perfect or final, altering it now would be a disservice to local jurisdictions and the defendants they serve.”

The full report can be found here, beginning on page 63.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Michigan AG signs on to opioid settlement

Michigan Attorney General Dana Nessel has officially signed on to a proposed multi-billion-dollar national opioid settlement with Johnson & Johnson and the three largest pharmaceutical distributors in the country: Cardinal Health, McKesson and AmerisourceBergen.

Michigan Attorney General Dana Nessel has officially signed on to a proposed multi-billion-dollar national opioid settlement with Johnson & Johnson and the three largest pharmaceutical distributors in the country: Cardinal Health, McKesson and AmerisourceBergen.

Nessel’s office called the agreement “historic” and “result of ongoing efforts to hold these companies responsible for their roles in contributing to the opioid epidemic gripping this country.”

Her office added: “Depending on the allocation metrics and participation of local units of government, Michigan stands to receive up to nearly $800 million from these defendants over the life of the settlement, with priority placed on spending for treatment and prevention. Only the 1998 national tobacco settlement has involved more dollars than this proposed settlement.

“The state deadline to join the settlement is Saturday, Aug. 21. Next, the defendants will evaluate the extent of state sign-ons and determine if they wish to continue the process. They have up to 14 days to do that. If the defendants decide enough states have signed on, then the process moves to the local government sign-on period, which is 120 days. Following that timeframe, the defendants will determine if enough local governments have signed on to move forward.”

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Don’t delay another day on registration for Annual Conference

With more than 300 people now registered to attend the 2021 Michigan Counties Annual Conference, county leaders who are not registered should do so immediately.

With more than 300 people now registered to attend the 2021 Michigan Counties Annual Conference, county leaders who are not registered should do so immediately.

Why?

First, available rooms at the historic Grand Hotel are dwindling. Also, the discounted room deal for the event will expire on Aug. 26. After that, room nights at the Grand will be substantially higher than the amounts you now can see on our conference portal.

Second, MAC has made a special extension of the early-bird conference pricing of $375 for members; this extension, though, lasts only through Aug. 31.

Also continuing is the special deal for the conference with Shepler’s Ferry service. Attendees will able to travel to Mackinac Island from either of Shepler’s locations in Mackinaw City or St. Ignace for a roundtrip price of $21 ($12 for children). You can make your reservation via Shepler’s website (www.sheplersferry.com) using the promo code MCMCFC2021 or by calling 800-828-6157 and referencing the MAC/MCMCFC conference.

Don’t delay. Get registered today.

For specific questions on conference logistics, you may contact conference@micounties.org.

Senate trio bidding to allow Medicaid benefits for jail inmates

A bipartisan trio of U.S. senators will introduce legislation to address the Medicaid Inmate Exclusion Policy (MIEP). U.S. Sens. Bill Cassidy (R-La.), Ed Markey (D-Mass.) and Jeff Merkley (D-Ore.) said they would be introducing the Due Process Continuity of Care Act, which would amend the MIEP to allow individuals who have not yet been convicted of a crime to keep their Medicaid benefits.

A bipartisan trio of U.S. senators will introduce legislation to address the Medicaid Inmate Exclusion Policy (MIEP). U.S. Sens. Bill Cassidy (R-La.), Ed Markey (D-Mass.) and Jeff Merkley (D-Ore.) said they would be introducing the Due Process Continuity of Care Act, which would amend the MIEP to allow individuals who have not yet been convicted of a crime to keep their Medicaid benefits.

Under current federal law, health benefits are denied to individuals in jail awaiting adjunction with no differentiation between other individuals who are serving time post-conviction. Nationally, local jails admit 11 million people a year, with 60 percent in the pre-trial phase and a large portion qualifying for Medicaid. The current ban on their use of Medicaid benefits puts a large administrative and financial burden on local jails and taxpayers who take on the costs of care for the inmate.

The legislation would allow for Medicaid coverage for pretrial detainees and provide $50 million in planning grants and technical assistance to state and local governments for implementation. The Due Process Continuity of Care Act will be introduced this September.

MAC supports this concept and will continue to monitor the legislation’s progress through Congress.

For more information on this issue, see this National Association of Counties report or contact Meghann Keit-Corrion at keit@micounties.org.

Staff picks

Staff picks

- What works? Evidence and evaluation key as states and localities spend aid (RouteFifty)

- The trouble with tourism: Munising’s economic and demographic challenges as a seasonal destination (Rural Insights)

- Addressing housing to improve health outcomes (NACo)

- How to have happy employees, part 1 (ICMA)

Deadline is Aug. 31 for interim ARP spending reports

The U.S. Treasury is reminding counties that the deadline to submit both an Interim Report (all counties) and Recovery Plan Performance Report (counties with populations 250,000 and above) is Aug. 31. Below are some other important updates regarding ARP funding:

The U.S. Treasury is reminding counties that the deadline to submit both an Interim Report (all counties) and Recovery Plan Performance Report (counties with populations 250,000 and above) is Aug. 31. Below are some other important updates regarding ARP funding:

- Recovery Plan Performance Report Resources: U.S. Treasury has released a template for the Recovery Plan Performance Report, which is required ONLY for counties above 250,000 population.

- U.S. Treasury User Guide: U.S. Treasury released a user guide on State and Local Fiscal Recovery Fund recipient reporting portal. The guide contains step-by-step guidance for submitting the required Recovery Fund reports using Treasury’s portal, and should be used in conjunction with Treasury’s Compliance and Reporting Guidance for satisfying reporting and compliance requirements.

- Interim Report: Due by Aug. 31, 2021, the Interim Report requires all counties to report programmatic data for spending between March 3 and July 31, 2021. (This is a one-time report.) A county must submit an Interim Report even if it hasn’t obligated or spent any Recovery Funds. The county should submit a report showing no ($0) obligations or expenditures have yet been incurred. If the county received Recovery Funds AFTER July 15, 2021, the county must submit an Interim Report within 60 days of receiving funding.

- Project and Expenditure Report: These reports are also required for all counties (with two tiers, see below) and require project and expenditure data for awards and sub-awards, demographic information for each project and other programmatic data. Initial Project and Expenditure Report is due Oct. 31, 2021. For counties with awards above $5 million, project and expenditure reports are due quarterly For counties with awards under $5 million, project and expenditure reports are due annually

For any updates on ARP news and compliance, visit MAC’s ARP Resources page.

U.S. Senate approves $1T infrastructure bill; action moves to U.S. House

A $1 trillion federal infrastructure bill cleared the U.S. Senate this week in a bipartisan vote. The legislation, passed 69-30 with 19 Republicans joining all 50 Democrats, could be the nation’s biggest investment to improve infrastructure in decades. In the form now before the U.S. House of Representatives, it includes:

A $1 trillion federal infrastructure bill cleared the U.S. Senate this week in a bipartisan vote. The legislation, passed 69-30 with 19 Republicans joining all 50 Democrats, could be the nation’s biggest investment to improve infrastructure in decades. In the form now before the U.S. House of Representatives, it includes:

- $110 billion for roads and bridges

- $39 billion for public transit

- $66 billion for passenger and freight rail

- $7.5 billion for electric vehicles

- $65 billion for broadband access

- $65 billion to improve the nation’s power grid

- $25 billion for airports

- $55 billion on water infrastructure including, $15 billion to replace lead pipes and $10 billion to address PFAS contamination

However, Senate passage kicked off debate on a much larger $3.5 trillion spending bill backed by Democrats. House Speaker Nancy Pelosi intends to hold the infrastructure bill until the second bill is passed in the Senate through a process called reconciliation, which allows it to be passed by a simple majority. Work on these bills in Congress is expected to continue for some time.

Check out NACo’s resource for transportation and infrastructure: Federal Transportation & Infrastructure Policy Hub for Counties.

For more information on infrastructure polices, contact Deena Bosworth at bosworth@micounties.org.

Policy platform drafts are now ready for member review

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 28 at 9 a.m. in the Theater of the Grand Hotel during the 2021 Michigan Counties Annual Conference.

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 28 at 9 a.m. in the Theater of the Grand Hotel during the 2021 Michigan Counties Annual Conference.

County commissioners who are registered for the conference may participate as voting members in the business meeting, which includes review and approval of MAC’s 2021-2022 policy platforms.

The platform process begins with MAC’s policy committees, which meet during the year to address key issues. Their drafts are then submitted to the MAC Board of Directors for review. The MAC Board then advances the drafts to the membership for final approval.

Those Board-vetted drafts are now available on the MAC website here. (Please note that this is a password-protected page. Each member county has a set of access credentials, which are shared each year with your county administrator. If you do not have your credentials, contact Hannah Sweeney at sweeney@micounties.org for them.)

According to MAC’s By-laws (Article III, Section 6):

“A member wishing to submit an amendment to the MAC Platform shall submit the amendment to MAC at least five (5) days prior to the opening day of the MAC Annual Conference. Such amendment will require a majority vote at the annual meeting to be adopted.

“An amendment to the MAC Platform may be presented from the floor during the annual meeting. Such amendment will require a 2/3 majority vote of the members at the meeting at which a quorum is initially established to be adopted.”

To submit a platform amendment in advance, draft your preferred language and email to sweeney@micounties.org no later than Sept. 21, 2021.

Taxes are topic of Podcast 83 interview with Citizens Research Council leader

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosts Eric Lupher of the Citizens Research Council.

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosts Eric Lupher of the Citizens Research Council.

MAC’s Deena Bosworth talks with Lupher about Michigan’s tax system, specifically as it relates to local government revenues, and the potential for reforms.

Click here to view the episode.

Members can view any previous episode of the podcast on the podcast webpage.

Confused on census data? NACo webinar is for you.

![]() An Aug. 18 webinar from the National Association of Counties (NACo) will address the data now coming out of the 2020 Census.

An Aug. 18 webinar from the National Association of Counties (NACo) will address the data now coming out of the 2020 Census.

“Guiding County Decisions: An Overview of Key Census Bureau Programs for Administrators, Executives and Managers” will run from 1 p.m. to 2 p.m. EST.

“County administrators, executives, and managers need reliable, accurate, and unbiased information to guide economic development, emergency management, and other decisions in their areas. The Census Bureau’s household and business programs can be a critical resource to meet this need. This session will provide an overview of key Census programs that provide data at the county level, including the American Community Survey, County Business Patterns and the Economic Census and an update on the data coming from the 2020 Decennial Census and when users can expect these data. Census experts will provide actual use cases of how these data can be used to guide decisions, including how counties can help their residents and businesses begin to recover from the Coronavirus pandemic.”

For details and registration, click here.

Still time to enroll in final 2021 cohort for Leadership Academy

Join the 1,700 counties and state associations already benefiting from the effectiveness of the NACo Leadership Academy, the 12-week, online leadership program led by General Colin Powell. Scholarships still available for you and your team.

Join the 1,700 counties and state associations already benefiting from the effectiveness of the NACo Leadership Academy, the 12-week, online leadership program led by General Colin Powell. Scholarships still available for you and your team.

MAC and NACo would like to acknowledge and congratulate the Michigan county graduates from the April cohort:

- Brian Bousley, Administrator/Controller, Dickinson County

- Sara Hough, Human Resources Manager, Muskegon County

- Jennifer Zywicki, Chief Deputy County Clerk, Leelanau County

The September cohort is right around the corner. Join us in investing in the county workforce.

To enroll or learn more, click here.

Developed by Gen. Colin Powell, the Professional Development Academy and NACo, the High Performance Leadership Academy is an online 12-week program that helps your workforce develop fundamental, practical leadership skills to deliver results for counties and our residents.

‘Fiscally Ready’ webinars resume on Aug. 25

County leaders are encouraged to attend two upcoming “Fiscally Ready Communities” webinars jointly presented by the Michigan Department of Treasury and Michigan State University Extension. Each FREE training is 90 minutes and designed to assist appointed and elected officials with entry and intermediate budgeting knowledge.

County leaders are encouraged to attend two upcoming “Fiscally Ready Communities” webinars jointly presented by the Michigan Department of Treasury and Michigan State University Extension. Each FREE training is 90 minutes and designed to assist appointed and elected officials with entry and intermediate budgeting knowledge.

Budgeting for Fiscal Sustainability*

This training will provide best practices for local governments’ fiscal health including budgeting, long-term planning, dealing with uncertainty, and financial policies and procedures.

This training will take place on Aug. 25 at 10 a.m.

Please register via the Budgeting for Fiscal Sustainability Event Registration page.

*Qualifies for MAC County Commissioner Academy credit for county commissioners.

Capital Asset Management and Planning Trainings

This will be the third and final presentation of this information and will cover the basics of a Capital Improvement Program (CIP), best practices, and give participants a chance to share techniques that have worked for their community. Additionally, the training will assist both elected and appointed local officials in outlining your policies and procedures for capital asset management and planning. This will ensure that their local government is being proactive, while discussing the interconnectivity of many local government requirements.

This training will take place on Dec. 9 at 6 p.m.

You may register via the Capital Asset Management and Planning Event Registration page.

County applications sought for new Housing Solutions Workshop

Four cities or counties with populations between 50,000 and 500,000 will be selected to attend the Housing Solutions Workshop, which has been developed by the NYU Furman Center’s Housing Solutions Lab, Abt Associates, and the Lincoln Institute of Land Policy. Each delegation will consist of 5–6 members, including senior leaders from different departments and agencies in local government and external partners that are essential to the city’s housing strategy.

The workshop is intended for cities or counties that are in the early stages of developing a comprehensive and balanced local housing strategy. The Housing Solutions Workshop will include eight 90-to-120-minute virtual training sessions and be held from Oct. 25 to Nov. 18, 2021.

Applications are due by Sept. 10, 2021.

Details and application here: https://www.localhousingsolutions.org/lab/workshop/.

Recycling grants now available; apply by Aug. 20

The Recycling Partnership and the Michigan Department of Environment, Great Lakes, and Energy (EGLE) want counties to know about an exciting grant opportunity totaling $575,000 that exists for communities statewide in 2021 to dramatically improve residential recycling.

The Recycling Partnership and the Michigan Department of Environment, Great Lakes, and Energy (EGLE) want counties to know about an exciting grant opportunity totaling $575,000 that exists for communities statewide in 2021 to dramatically improve residential recycling.

EGLE and The Partnership are encouraging elected officials and local government leaders to apply for these grants that can help Michiganders improve the quality of materials they recycle at curbside or drop-off locations, as well as reduce recycling contamination. All Michigan community recycling programs are eligible to apply for these grants from EGLE and The Partnership of up to $4 per household for curbside programs and up to $3 per household for drop-off programs.

Applications are due Aug. 20, 2021, and complete instructions can be found in the request for proposals at recyclingpartnership.org/michiganrfp.

Staff picks

Staff picks

Conference sessions to focus on leadership, budget, tourism

Darryl Ross

Keynote and plenary speakers for the 2021 Michigan Counties Annual Conference will focus on the themes of leadership, budget and tourism during the event’s largest sessions on Monday, Sept. 27.

Darryl Ross, an author and motivational speaker who speaks on leadership throughout the country, will be the Monday morning keynoter.

Ross’ fascinating career has taken him from the classrooms of James Madison University, to traveling the world as an entertainer and performer, to his singular passion of sharing his faith, knowledge and experience to motivate people to live their dreams. For the past 15 years, Ross has provided keynotes, presentations and trainings throughout the country to such groups as the Virginia Business Education Conference, the DCRA Management Expo and the Loudoun Water Leadership Conference.

Bethany Wicksall

Also speaking at the Monday morning Plenary session are two familiar faces for Michigan county leaders:

- MAC Executive Director Stephan Currie, who will provide his semi-annual “State of MAC” report

- MAC Governmental Affairs Director Deena Bosworth, who will present a “MAC Legislative Update” focused on priorities and challenges for the fall session days of the Michigan Legislature

Keynoting the Monday afternoon Plenary session will be Bethany Wicksall, who became deputy state budget director for Gov. Gretchen Whitmer in spring 2021.

A graduate of Michigan State University’s James Madison College, Wicksall oversees general operations of the State Budget Office, including direction of the budget development process. Prior to joining the State Budget Office, Wicksall worked 18 years in both the House and Senate fiscal agencies.

Dave Lorenz

Wicksall will provide county leaders an in-depth look at the state budget process, particularly as it relates to county funding.

Appropriately, considering the conference’s location at one of Michigan’s tourism capitals, the Monday sessions will close with a presentation on tourism and the Pure Michigan campaign by Dave Lorenz.

Lorenz serves as vice president of Travel Michigan where he is responsible for leading the state’s tourism branding, advertising and public relations efforts; overseeing the award-winning Pure Michigan tourism campaign; and coordinating overall statewide tourism initiatives. Prior to coming to Travel Michigan in October 2002, Lorenz was the Manager, Partnerships and Promotions, for Meijer, Inc.

Ferry discount offered for conference; early-bird, hotel deadlines loom

MAC and the Michigan County Medical Care Facilities Council are pleased to announce a deal with Shepler’s Ferry service for discounted ferry tickets for 2021 Annual Conference attendees.

MAC and the Michigan County Medical Care Facilities Council are pleased to announce a deal with Shepler’s Ferry service for discounted ferry tickets for 2021 Annual Conference attendees.

You will able to travel to Mackinac Island from either of Shepler’s locations in Mackinaw City or St. Ignace for a roundtrip price of $21 ($12 for children). You can make your reservation via Shepler’s website (www.sheplersferry.com) using the promo code MCMCFC2021 or by calling 800-828-6157 and referencing the MAC/MCMCFC conference.

County leaders who still have not registered for the conference or secured their hotel rooms are urged to do so soon, as key deadlines are approaching that significantly affect costs.

For example, the early-bird rate for the conference fee ends on Aug. 18. After that date, registrants will pay an extra $50 for the full conference member rate.

Even more important, the deadline to utilize the special conference room rates at Grand Hotel will expire on Aug. 26.

Even more important, the deadline to utilize the special conference room rates at Grand Hotel will expire on Aug. 26.

While the least expensive rooms in our block have been reserved, conference-goers can still secure a room at the historic hotel for $500 a night (double occupancy and not including taxes and fees). The room rate covers five meals and is approximately 50 percent cheaper than the regular rate for the hotel during the event dates of Sept. 26-28.

Secure your room now by going directly to Grand Hotel’s reservation portal with the special conference code already loaded.

For specific questions on conference logistics, you may contact conference@micounties.org.

County millage requests approved in August election

Voters in six Michigan counties approved all countywide millage questions placed before them in the Aug. 2, 2021, elections.

Voters in six Michigan counties approved all countywide millage questions placed before them in the Aug. 2, 2021, elections.

According to results collected by Gongwer News Services, millage proposal victories occurred in Chippewa, Houghton, Huron, Isabella, Kalkaska and Mackinac counties. Notable among the results were:

Passage in Houghton County of a millage renewal for the Canal View-Houghton County Medical Care Facility and millage increases in Isabella and Mackinac to support the 911 emergency communications system.

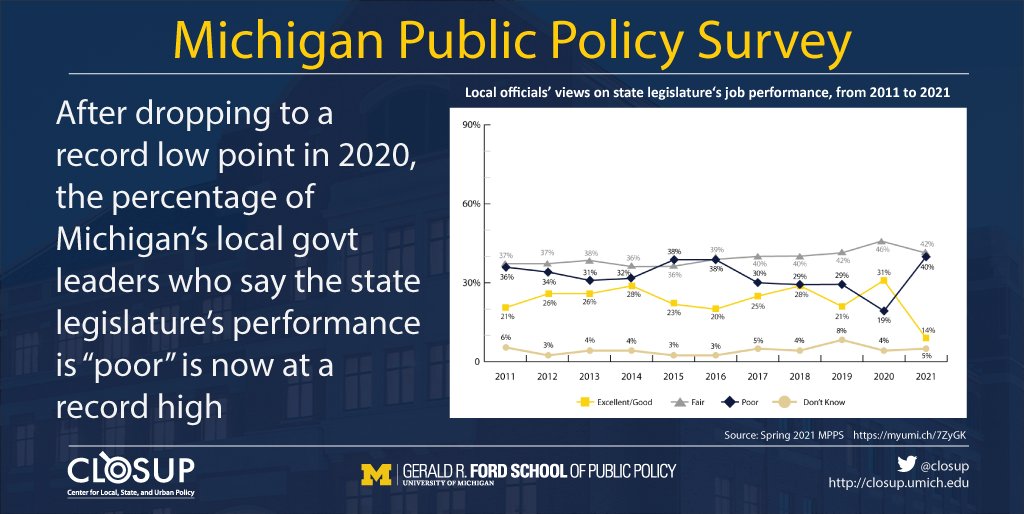

Local leaders express dim view on state trends in survey

About two out of three local government leaders responding to a recent survey said the state of Michigan has gotten on the wrong track, the highest level of pessimism reported since tracking began in 2011 said the Center for Local, State, and Urban Policy (CLOSUP) at the University of Michigan’s Gerald R. Ford School of Public Policy.

About two out of three local government leaders responding to a recent survey said the state of Michigan has gotten on the wrong track, the highest level of pessimism reported since tracking began in 2011 said the Center for Local, State, and Urban Policy (CLOSUP) at the University of Michigan’s Gerald R. Ford School of Public Policy.

Statewide, 67 percent of survey respondents said wrong track, while just 23 percent said the state is generally going in the right direction, a record low number. The past two years of surveys have seen significant swings in local leaders’ evaluations of the Legislature’s performance, first in the positive direction in 2020, but now sharply negative in April-May 2021, CLOSUP reported.

Despite the dim view of state and federal trends, local leaders tended to consistently give their local communities high marks. Statewide, 92 percent of both Republicans and Democrats say their own jurisdictions are headed in the right direction, as do 80 percent of Independents.

Staff picks

Staff picks

- What is in the new bipartisan infrastructure bill? (Governing)

- Seldom seen snapshots of American history (Governing)

- Overcrowding ‘jail emergency’ at Genesee County Jail nears one month, 94% of inmates unsentenced (MLive)

- As Alpena-area landfills fill up, leaders push for better recycling (Alpena News)