Juvenile justice reform bills would boost funds for counties

Earlier this summer, the Michigan Task Force on Juvenile Justice Reform released its report and recommendations, including a higher reimbursement rate for counties on certain juvenile justice services. New legislation filed this week in Lansing would bring that recommendation into law.

Rep. Sarah Lightner (R-Jackson) has introduced a set of bills to raise reimbursement rates and adopt the task force recommendation for a statewide juvenile public defense system. Her House Bills 6344–45 would expand the state’s indigent defense system to include juveniles, ensuring juveniles are eligible to receive these legal services. HB 6345 would expand the Michigan Indigent Defense Commission to include representatives that are experienced and knowledgeable of the juvenile justice system, making certain that the best interests of youth within the juvenile justice system are accurately and adequately represented on the commission.

MAC supports the task force’s recommendations and efforts to better care for youth in the juvenile justice system. MAC has not yet taken a position on HBs 6344-6345, as we need to ensure adequate funding is provided to counties by the state to implement the juvenile indigent defense system. Conversations between MAC, the Legislature and other stakeholders regarding these bills are expected to take place in the coming months.

For more information on this issue, contact Samantha Gibson at Gibson@micounties.org.

Podcast 83 unveils expanded MAC advocacy team; details need for immediate action on court fees

MAC’s Podcast 83 returned from its summer hiatus with an expanded team this week as newly hired Governmental Affairs Associates Madeline Fata and Samantha Gibson joined the broadcast with Executive Director Stephan Currie and Governmental Affairs Director Deena Bosworth.

MAC’s Podcast 83 returned from its summer hiatus with an expanded team this week as newly hired Governmental Affairs Associates Madeline Fata and Samantha Gibson joined the broadcast with Executive Director Stephan Currie and Governmental Affairs Director Deena Bosworth.

The team discussed a looming Oct. 1 deadline to renew the authority for trial courts to impose fees, a key funding source, and the upcoming 2022 Annual Conference in Port Huron, Sept. 18-21.

Watch a video of the session here.

Previous episodes in 2022 can be seen at MAC’s YouTube Channel.

And you always can find details about Podcast 83 on the MAC website.

NACo sets webinar on opioids settlement for Aug. 31

Join the National Association of Counties (NACo) on Aug. 31, from 3 p.m. to 4 p.m. (Eastern), for a webinar updating the latest news on the national opioid settlement.

Join the National Association of Counties (NACo) on Aug. 31, from 3 p.m. to 4 p.m. (Eastern), for a webinar updating the latest news on the national opioid settlement.

“Counties across the nation are on the front lines of the opioid and stimulant crisis providing essential public services. To enhance these efforts, refine approaches, fill gaps and help counties achieve their goals, NACo has partnered with the Opioid Response Network (ORN). ORN is a coalition of over 40 national organizations working to address the opioid crisis and stimulant use across all U.S. states and territories. ORN, funded by the Substance Abuse and Mental Health Services Administration (SAMHSA), provides free, localized education and training in evidence-based practices for the prevention, treatment and recovery of all substance use disorders. If you are in need of on-demand technical assistance, education, or training, ORN can help.

“In this webinar you will learn how ORN works and case examples of ways in which ORN has supported communities to explore, plan and implement locally designed strategies. Not sure where to begin? ORN can help. Participants will leave this webinar with an understanding of how counties can utilize this resource to support their work.”

Visit the event page for the most up-to-date information. Questions? Contact ahurley@naco.org.

Ottawa County teams up with local historian to commemorate original West Michigan highway

Local historian Blaine Knoll (left) and Ottawa County Land Use Specialist Andrew Roszkowski install a new West Michigan Pike sign in Holland earlier this month. (photo: Rich Lakeberg)

The West Michigan Pike was once the premier way to travel along Michigan’s western shores. This highway running along Lake Michigan was conceived of and built during the second decade of the 20th century to accommodate the “horseless carriage,” opening up the region to tourism and the development it would bring.

Eventually, the Pike was replaced by state and U.S. highway systems and was mostly forgotten. But now, thanks to local historian Blaine Knoll, the Ottawa County Department of Strategic Impact, and Grand Haven Area Community Foundation funds, the West Michigan Pike lives again. New signs commemorating this key piece of West Michigan tourism and automotive history are being installed along the original route.

“Beginning at the Ottawa-Allegan County line, the newly marked route stays as true to the original route as possible,” said Knoll. “It winds through the southwest side of Holland, follows a series of secondary roads, part of U.S.-31, then heads through Grand Haven and into Ferrysburg.”

The effort to recognize the original historic route doesn’t end with signs. Knoll and County staff are also developing a commemorative plaque to be placed where an original Pike marker from 1916 still stands along 152nd Avenue in Olive Township.

“The plaque recognizes the last known standing marker of the West Michigan Pike Historical Route. The installation of all the concrete pikes along the route was never completed due to the everchanging roadways. Witnessing this pike’s original location is significant to the route, and we are proud to highlight it,” said Ottawa County Land Use Specialist Andrew Roszkowski. …

Staff picks

Staff picks

- How local governments are combatting economic disadvantage with American Rescue Plan funds (Brookings Institution)

- Public employers and the COLA conundrum (Governing)

- Ottawa County eyes helping fund affordable housing developments in two cities (MLive)

- Dogs getting sick with parvo-like virus in Northern Michigan, dying within 3 days (USA Today)

Comedian to entertain at 2022 President’s Banquet; early-bird pricing continues through Sept. 2

Chris Young, a comedian who has performed across Michigan and was a finalist in Dave Coulier’s “Clean Guys of Comedy/Unbleepable Contest,” will be the after-dinner entertainer at the 2022 President’s Banquet on Sept. 20.

Chris Young, a comedian who has performed across Michigan and was a finalist in Dave Coulier’s “Clean Guys of Comedy/Unbleepable Contest,” will be the after-dinner entertainer at the 2022 President’s Banquet on Sept. 20.

The banquet is the final event of the 2022 Michigan Counties Annual Conference, to be held Sept. 18-21 at the Blue Water Convention Center in Port Huron. Registration continues for the event, which will include:

- Four plenary sessions featuring key issues now before Michigan and a MAC Legislative Update

- 12 breakout sessions for MAC members and 6 workshops for MCMCFC members

- A Welcome Reception and Strolling Dinner on the evening of Sunday, Sept. 18

- A lavish President’s Banquet on the night of Tuesday, Sept. 20

- Plenty of free time in the afternoons for attendees to enjoy sights and sounds of Port Huron, including the St. Clair River

Meanwhile, early-bird pricing of $395 for members has been extended through Sept. 2, so act fast.

To register and for complete conference details, click here.

Young

Hotel Update: There are some rooms left at the Comfort Inn (1720 Hancock St. in Port Huron) for the special room rate of $129 per night (rate is good through Sept. 4). To make a reservation, call 810-987-5999.

To meet demand, we’ve added a third hotel option for conference-goers, the Holiday Inn Express (2021 Water St. in Port Huron). Twenty-five (25) rooms are now available there for the conference rate of $129 per night (rate is good through Aug. 19). To reserve a room, click here or call 810-662-3400 and use the group name of “Michigan Association of Counties.”

A special shuttle will operate between the conference headquarters at the Blue Water Convention Center and the Comfort Inn and HI Express. Also, plenty of free and convenient parking is available outside the convention center.

FY23 county-by-county revenue sharing estimates |

Eight Michigan officials graduate from national leadership academy

Join the 1,710 county leaders already benefiting from the effectiveness of the NACo Leadership Academy, the 12-week, online leadership program led by General Colin Powell.

Join the 1,710 county leaders already benefiting from the effectiveness of the NACo Leadership Academy, the 12-week, online leadership program led by General Colin Powell.

The academy is now accepting registrations through Sept. 9 for its upcoming cohort.

MAC would like to acknowledge and congratulate the Michigan county officials who graduated in April from the academy:

- Aaron Edlefson, VA Director, Calhoun County

- TJ Fields, Chief Information Security Officer, Oakland County

- Jennifer Laymon, Infrastructure Manager, Macomb County

- Matthew Pence, IT Security Specialist, Oakland County

- Joyson Peters, Security Administrator, Macomb County

- Megan Smith, Junior Business System Analyst, Macomb County

- Jako van Blerk, Chief Information Officer, Macomb County

- Sandy Wilson, Deputy Director, Macomb County

Staff picks

Staff picks

- Westerners struggle to manage booming wild horse populations (The Daily Yonder)

- Traffic deaths are at a 16-year high; MITA is begging people to slow down (Fix MI State)

- $10B in new Midwest high-voltage lines to aid renewable energy generation (MLive)

- How capital improvement project prioritization helps secure infrastructure funding (American City and County)

Don’t lose out on early-bird registration rate for Annual Conference

County officials have just five days left to take advantage of the early-bird registration rate of $395 for the upcoming 2022 Michigan Counties Annual Conference, Sept. 18-21 in Port Huron.

County officials have just five days left to take advantage of the early-bird registration rate of $395 for the upcoming 2022 Michigan Counties Annual Conference, Sept. 18-21 in Port Huron.

The conference will be headquartered at St. Clair County’s Blue Water Convention Center in Port Huron at the southern end of Lake Huron.

The early-bird rate for members and spouses is set to expire Aug. 10.

Expiring even sooner is the special conference room rate of $129 per night at the Comfort Inn in Port Huron. (A free shuttle service will run between the Comfort Inn and the conference center and there is plenty of free parking at the conference center as well.)

The Annual Conference will feature:

- Four plenary sessions featuring key issues now before Michigan and a MAC Legislative Update (Speakers will be announced soon.)

- 12 breakout sessions for MAC members and 6 workshops for MCMCFC members (Speakers will be announced soon.)

- A Welcome Reception and Strolling Dinner on the evening of Sunday, Sept. 18.

- A reception sponsored by MAC’s CoPro+ subsidiary on Monday evening, before attendees are shuttled into downtown Port Huron for a “dinner on your own” night.

- A lavish President’s Banquet on the night of Tuesday, Sept. 20.

Members of MCMCFC will enjoy specialized breakouts designed for its members to earn Nursing and NAB Continuing Education credits. And MAC members attending the conference will receive credits in MAC’s County Commissioner Academy.

Members of MCMCFC will enjoy specialized breakouts designed for its members to earn Nursing and NAB Continuing Education credits. And MAC members attending the conference will receive credits in MAC’s County Commissioner Academy.

The early-bird conference fee of $395 provides members full access to all conference activities. (The spouse fee also provides access to any conference event, including the President’s Banquet on the evening of Sept 20.) This fee includes two dinners, two receptions, two breakfasts and two lunches. On Aug. 11, the member fee will increase to $425, while the spouse rate will rise to $175.

NOTE: The member rate is open to all county commissioners, administrators, countywide elected officials and county employees of MAC member counties, plus employees and board members of MCMCFC facilities.

Hotel details

Rooms at the Comfort Inn are $129 per night. The Comfort Inn is located at 1720 Hancock St., Port Huron, MI 48060. To book your room reservations, call 810-987-5999. Group Name: MAC.

As of Thursday, the Comfort Inn had 34 rooms still available in the conference block with the special pricing of $129 per night.

Please direct any conference registration questions or issues to conference@micounties.org.

Vast majority of county millage requests approved by voters

Voters in the Aug. 2 primary election gave broad approval to county millage requests, both renewals and increases, an analysis by the Gongwer News Service found.

Voters in the Aug. 2 primary election gave broad approval to county millage requests, both renewals and increases, an analysis by the Gongwer News Service found.

In fact, only seven out of the more than 100 such requests were denied by the approximately 2.1 million voters who participated statewide in the primary.

Voters in Benzie County approved six different millage questions, while voters in Midland and Sanilac each approved five.

For summary details on all of the county requests from Gongwer, click here.

Policy Summit presentations, videos now available

Presentations and videos from MAC’s 2022 Policy Summit are now available to members with 24/7 access.

Presentations and videos from MAC’s 2022 Policy Summit are now available to members with 24/7 access.

The Policy Summit, which replaced MAC’s Regional Summits, featured four major policy briefings on:

- Challenges in workforce housing

- Michigan’s trails system and its benefits

- Michigan’s political dynamics in 2022

- Ideas to maximize infrastructure dollars

For links to presentations and videos, visit the Policy Summit page on the MAC website.

Summit to brief community leaders on broadband developments

Join community leaders, federal representatives and staff from the Michigan High-Speed Internet Office on Aug. 18 at this free event to learn about critical programs to expand broadband infrastructure and digital equity throughout the state. During this day-long summit, discussions will include local government and community needs, legislative and program updates, working with industry, data collection and mapping, and supply chain and talent needs, among others.

Join community leaders, federal representatives and staff from the Michigan High-Speed Internet Office on Aug. 18 at this free event to learn about critical programs to expand broadband infrastructure and digital equity throughout the state. During this day-long summit, discussions will include local government and community needs, legislative and program updates, working with industry, data collection and mapping, and supply chain and talent needs, among others.

You may attend in-person or via a digital option for the event, which will run from 8:30 a.m. to 4 p.m.

Connecting all Michiganders to affordable, reliable high-speed internet is critical to our economic stability and this event will provide an opportunity for us to discuss ways we can work together to efficiently and effectively utilize broadband funds from the Bipartisan Infrastructure Law and other federal broadband dollars to the maximum extent.

Broadband policy and how counties can connect their residents also will be the focus of a Plenary Session at the 2022 Michigan Counties Annual Conference, Sept. 18-21. Registration remains open. Click here to register.

MAC includes county settlement projections on new opioids page

A new digital resource for county leaders now includes estimated county-by-county payments coming from the national opioid settlement.

In figures provided by the State Attorney General’s Office, an estimated $78 million will be assigned to Michigan counties. To see your county’s estimate, first visit MAC’s Opioid Settlement Resource Center.

Among the features of the new page are:

- An overview of the opioid crisis and the national settlement

- Numerous general resources on how counties could deploy their funds to maximize public health

- Links to Michigan Department of Health and Human Services webinar recordings

MAC will continue to add news, links and resources to the center as the distribution of the settlement advances.

Staff picks

Staff picks

- As species recover, some threaten others in more dire shape (Associated Press)

- How (Leelanau) county maps a plan for better broadband (Connected Nation)

- Ingham County opens up juvenile justice grant application (Fox 47 News)

- Public comment period open on Five-year Transportation Program (Michigan Department of Transportation)

Higher county reimbursements backed by Juvenile Justice Task Force

Michigan counties would receive a higher reimbursement rate on some juvenile services under a proposal unanimously backed by members of a state Task Force on Juvenile Justice Reform this month.

Michigan counties would receive a higher reimbursement rate on some juvenile services under a proposal unanimously backed by members of a state Task Force on Juvenile Justice Reform this month.

The panel’s report advises a boost in the community-based service/supervision reimbursement rate for counties to 75 percent, from the current 50 percent to 75 percent. The recommendation is to keep the reimbursement rate for residential services at 50 percent, however.

Wayne County’s Alisha Bell and Shiawassee County’s Marlene Webster represented MAC in the task force’s work for more than a year, along with a diverse group of representatives, to recommend reforms that improve public safety and outcomes for youth and families.

Among other key recommendations, the panel advised:

- keeping youth under 13 years old out of juvenile court

- creating a statewide juvenile public defense system

- expanding diversion opportunities for youth

- increasing funding availability for community-based prevention and intervention

- implementing screening and assessments to inform decisions about supervision and services

- developing standards for residential placements and reentry supports for youth

- investing in quality assurance mechanisms to ensure resources are used efficiently

MAC is pleased with the task force’s work and supports the key recommendations made to advance positive outcomes for Michigan’s youth. We anticipate legislation to be introduced this fall to implement the recommendations.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

Register for Annual Conference before key deadlines hit

With hotel rooms renting quickly and an early-bird registration rate soon to expire, county officials are urged to act quickly to get the best possible deals to attend the 2022 Michigan Counties Annual Conference in St. Clair County, Sept. 18-21.

With hotel rooms renting quickly and an early-bird registration rate soon to expire, county officials are urged to act quickly to get the best possible deals to attend the 2022 Michigan Counties Annual Conference in St. Clair County, Sept. 18-21.

The conference will be headquartered at St. Clair County’s Blue Water Convention Center in Port Huron at the southern end of Lake Huron.

While the adjacent DoubleTree hotel is sold out, about 40 rooms remained, as of Thursday afternoon, at the nearby Comfort Inn for a special rate of $129 per night. (A free shuttle service will run between the Comfort Inn and the conference center and there is plenty of free parking at the conference center as well.)

County officials who have not yet registered should be aware of some looming deadlines:

- Aug. 6 – End of the special room block rate of $129 at the Comfort Inn in Port Huron

- Aug. 10 – End of the early-bird conference registration rate of $395 for MAC members and affiliates

The Annual Conference will feature:

- Four plenary sessions featuring key issues now before Michigan and a MAC Legislative Update (Speakers will be announced soon.)

- 12 breakout sessions for MAC members and 6 workshops for MCMCFC members (Speakers will be announced soon.)

- A Welcome Reception and Strolling Dinner on the evening of Sunday, Sept. 18.

- A reception sponsored by MAC’s CoPro+ subsidiary on Monday evening, before attendees are shuttled into downtown Port Huron for a “dinner on your own” night.

- A lavish President’s Banquet on the night of Tuesday, Sept. 20.

Members of MCMCFC will enjoy specialized breakouts designed for its members to earn Nursing and NAB Continuing Education credits. And MAC members attending the conference will receive credits in MAC’s County Commissioner Academy.

The early-bird conference fee of $395 provides members full access to all conference activities. (The spouse fee also provides access to any conference event, including the President’s Banquet on the evening of Sept 20.) This fee includes two dinners, two receptions, two breakfasts and two lunches. On Aug. 11, the member fee will increase to $425, while the spouse rate will rise to $175.

NOTE: The member rate is open to all county commissioners, administrators, countywide elected officials and county employees of MAC member counties, plus employees and board members of MCMCFC facilities.

Hotel details

Rooms at the Comfort Inn are $129 per night. The Comfort Inn is located at 1720 Hancock St., Port Huron, MI 48060. To book your room reservations, call 810-987-5999. Group Name: MAC.

Please direct any conference registration questions or issues to conference@micounties.org.

Policy Summit tackles housing challenge, reviews trail system benefits

Dakota Hewlett of the Michigan Department of Natural Resources briefs Summit attendees on the Michigan trails system.

Dozens of county leaders came to Lansing or logged in digitally Thursday for MAC’s first Summer Policy Summit, held blocks from the Michigan State Capitol.

The Policy Summit, which replaced MAC’s Regional Summits, featured four major policy briefings on:

- Challenges in workforce housing

- Michigan’s trails system and its benefits

- Michigan’s political dynamics in 2022

- Ideas to maximize infrastructure dollars

“We’ve received great feedback from members who participated in this new version of our summer policy event,” said Executive Director Stephan Currie, who served as master of ceremonies for the event. “We look forward to honing this member service and delivering it to larger audiences.”

Tonya Joy, director of the state’s Housing Initiatives Program (joyt@michigan.gov), strongly urged attendees to engage with her office to report on their community housing needs and any local plans that have been developed to maximize state resources. “Reach out to me and I can put you in touch with the right person at MSHDA,” Joy said, adding, “I’m in the right place today because the message is going to get to the right people.”

Later in the day, Matt Grossman, director of the Institute for Public Policy and Social Research at Michigan State University, reviewed the trends of nationalization and polarization in Michigan politics: “We have nationalized elections. Whatever is happening at the national level will be reflected at the state level, too.”

Presentations from the sessions will posted to the MAC website next week. And MAC will post videos of some segments on its YouTube Channel in coming days.

MAC Board president leads Michigan delegation to NACo Annual Conference

Ottawa County’s Phil Kuyers announces the Michigan votes during the NACo second vice president election on July 24.

MAC Board President Phil Kuyers of Ottawa County led a delegation of approximately 40 county leaders from Michigan to the 2022 National Association of Counties (NACo) Annual Conference, held in Adams County, Colorado.

In addition to participating on various NACo committees and attending policy briefings, Michigan leaders voted on NACo policy platforms and in the election of NACo’s second vice president, a contest won by James Gore, supervisor of Sonoma County in California.

“A NACo conference really highlights just how many areas of American life that county governments affect,” said Stephan W. Currie, executive director of the Michigan Association of Counties. “For our commissioners, staying on top of policy changes is a full-time job in itself, which is why we encourage our members to attend every year, since NACo does such as great job on policy briefings.”

If you are interested in getting involved with a NACo committee, contact Currie at scurrie@micounties.org.

Internal controls will be subject of next ‘Fiscally Ready’ webinar

County leaders should be signing up now for the next session in the “Fiscally Ready Communities” webinar series set for Aug. 4 from 10:30 a.m. to noon.

County leaders should be signing up now for the next session in the “Fiscally Ready Communities” webinar series set for Aug. 4 from 10:30 a.m. to noon.

The Michigan Department of Treasury and Michigan State University Extension (MSU Extension) co-sponsor this free training opportunity that is designed to assist appointed AND elected officials.

The Aug. 4 session will be on “Managing Internal Controls” and will cover:

- Building a culture of fiscal sustainability

- The role of internal controls in fiscal sustainability

- Understanding internal controls and their importance

- How internal controls help strengthen your community

- Best practices for internal controls implementation

For more information about Fiscally Ready Communities, please check out the Treasury Fiscally Ready Communities webpage. This webpage includes Treasury’s 32-page Fiscally Ready Communities Best Practices document, which we encourage all local officials to review.

Staff picks

Staff picks

- PILT is no four-letter word for counties (NACo)

- Branch County Family Treatment Court established for abuse and neglect cases (Coldwater Daily Reporter)

- When’s the best time for states to adopt evidence-based budgeting? Now. (Governing)

- How States Raise Their Tax Dollars FY 2021 (Pew Trusts)

Conference hotel space filling fast for 2022 Annual; register now!

Michigan’s sunrise side is proving a popular destination for county leaders, as registration for the 2022 Michigan Counties Annual Conference in Port Huron, Sept. 18-21, is moving at a brisk pace.

Michigan’s sunrise side is proving a popular destination for county leaders, as registration for the 2022 Michigan Counties Annual Conference in Port Huron, Sept. 18-21, is moving at a brisk pace.

In fact, the primary conference hotel, the Doubletree is nearly sold out.

As of mid-day Friday, there were:

- Fewer than 10 rooms in the MAC block available for the nights of 9/18-20 at a rate of $149 per night

- Fewer than 15 rooms outside the block available for the nights of 9/18-20 at rates starting at $249 per night

If you are not able to secure a room at the Doubletree, there are plenty of rooms still available at the second conference hotel, the Comfort Inn, at a rate of $129 per night for the period of 9/18-20.

A free shuttle service will run between the Comfort Inn and the conference center and there is plenty of free parking at the conference center as well.

Running from the afternoon of Sept. 18 through the morning of Sept. 21, the 2022 Annual Conference will feature:

- Four plenary sessions featuring key issues now before Michigan and a MAC Legislative Update (Speakers will be announced soon.)

- 12 breakout sessions for MAC members and 6 workshops for MCMCFC members (Speakers will be announced soon.)

- A Welcome Reception and Strolling Dinner on the evening of Sunday, Sept. 18.

- A lavish President’s Banquet on the night of Tuesday, Sept. 20.

- Plenty of free time in the afternoons for attendees to enjoy sights and sounds of Port Huron, including the St. Clair River.

Members of MCMCFC will enjoy specialized breakouts designed for its members to earn Nursing and NAB Continuing Education credits.

MAC members attending the conference will receive credits in MAC’s County Commissioner Academy.

Conference Rates

The conference fee provides you access to all conference activities. (The spouse fee also provides access to any conference event, including the President’s Banquet on the evening of Sept 20.) This fee includes two dinners, two receptions, two breakfasts and two lunches.

|

|

|

Early bird |

Full rate |

|

Member |

Full conference |

$395 |

$425 |

|

|

Single day |

$275 |

$325 |

|

|

Spouse/guest |

$150 |

$175 |

|

Non-Member |

Full conference |

$525 |

$575 |

NOTE: The member rate is open to all county commissioners, administrators, countywide elected officials and county employees of MAC member counties, plus employees and board members of MCMCFC facilities.

Hotel Information

The DoubleTree by Hilton Hotel is attached to the Blue Water Convention Center (conference headquarters). To make your reservations, you can call the DoubleTree Hotel directly at 810/984.8000 or go online at www.porthuron.doubletree.com. GROUP CODE: MIA

Rooms at the Comfort Inn are $129 per night. The Comfort Inn is located at 1720 Hancock St., Port Huron, MI 48060. To book your room reservations, contact 810-987-5999. Group name: MAC.

Getting around: For those staying at the Comfort Inn, we will provide complimentary shuttle service via Blue Water Transit during the conference schedule. There also is plenty of free parking at the convention center.

Please direct any conference registration questions or issues to conference@micounties.org.

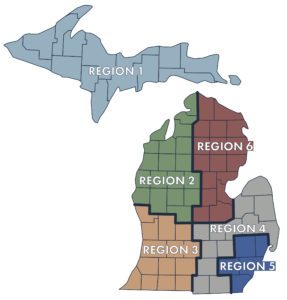

Filing period opens for MAC Board elections in September

At the 2022 Michigan Counties Annual Conference (Sept. 18-21 in Port Huron), MAC members will vote on six seats on the MAC Board of Directors. Commissioners wishing to serve on the Board, whether incumbents or new candidates, have until Aug. 18 to file official notice of their intent to run. (The application form is found here.)

At the 2022 Michigan Counties Annual Conference (Sept. 18-21 in Port Huron), MAC members will vote on six seats on the MAC Board of Directors. Commissioners wishing to serve on the Board, whether incumbents or new candidates, have until Aug. 18 to file official notice of their intent to run. (The application form is found here.)

Seats representing regions are filled by a vote in regional caucuses at the conference. At-large seats are filled by the candidate that wins a majority of the six regional caucuses.

The MAC Board of Directors is the key body in guiding the legislative and organizational strategies of MAC. Board terms are three years in length and individuals may serve up to three terms.

2022 Board seats

- At-large Seat B – open

- Region 4 Seat A – open

- Region 4 Seat B – open (to fill 1 year of unexpired term; winner is still eligible to serve 3 full 3-year terms after first year)

- Region 5 Seat A – open (to fill 1 year of unexpired term; winner is still eligible to serve 3 full 3-year terms after first year)

- Region 6 Seat A – Vaughn Begick of Bay is the incumbent

- Region 6 Seat B – Scott Noesen of Midland is the incumbent

Any member wishing to run in the election must download the application form and return it by Aug. 18, 2022, at 5 p.m. to be eligible. Candidates are also encouraged to submit a statement of up to 400 words on why members should support them. These statements will be posted to the MAC website in late August.

If you have any questions about Board duties, please contact Executive Director Stephan W. Currie at 517-372-5374.

Governor signs FY23 state budget with revenue sharing increase

The FY 2023 budget was signed by Gov. Whitmer this week, which is set to begin on Oct. 1. The signing of the bipartisan state budget comes after months of negotiations between the legislature and the governor’s office.

The FY 2023 budget was signed by Gov. Whitmer this week, which is set to begin on Oct. 1. The signing of the bipartisan state budget comes after months of negotiations between the legislature and the governor’s office.

Click here to read the major highlights of the budget, which includes a 6 percent (5% ongoing and 1% one-time) increase in county revenue sharing.

For more information on this issue, contact Deena Bosworth at Bosworth@micounties.org.

U.S. Treasury releases P&E Report update on ARP funds

The U.S. Treasury has released updated compliance and reporting guidance for counties ahead of the July 31 deadline that includes additional information that will be required as part of the reporting process and other clarifying items. Included below, you can find a comprehensive overview of updated compliance and reporting requirements, helpful information on specific sections of the reporting portal and an explanation of the difference between a subrecipient and beneficiary, and how counties can ensure they are complying with reporting requirements for these entities.

The U.S. Treasury has released updated compliance and reporting guidance for counties ahead of the July 31 deadline that includes additional information that will be required as part of the reporting process and other clarifying items. Included below, you can find a comprehensive overview of updated compliance and reporting requirements, helpful information on specific sections of the reporting portal and an explanation of the difference between a subrecipient and beneficiary, and how counties can ensure they are complying with reporting requirements for these entities.

As a reminder, counties that are required to submit reports to Treasury by July 31, 2022, are those with populations above 250,000 residents and/or received $10 million or more in total ARPA Recovery Funds.

P&E Report Updates & Other Helpful Information

- Revenue replacement: Counties had the option to make a one-time election to either calculate revenue loss according to Treasury’s formula outlined in the Final Rule OR elect a “Standard Allowance” of up to $10 million, not to exceed the award allocation. Treasury has decided to keep this portion of the reporting portal open for recipients in the upcoming P&E reporting cycle, which will allow counties to update their prior revenue loss election.

- Once update, the prior revenue loss election will be replaced. Treasury expects to keep this portion of the reporting portal open through the April 2023 reporting period in order to provide an opportunity for annual reporters to take advantage of this flexibility.

- Interested/principal received from loans: Any interest received on loans made with Recovery Funds should be tracked as program income in the P&E Report.

- If a county uses revenue loss funds to fund a loan, repayments to loans are not subject to program income rules.

- DUNS and UEI Numbers: As of April 2022, the federal government switched service providers and stopped using the DUNS number and began using the Unique Entity ID (UEI) – All counties are required to switch from a DUNS number to a UEI moving forward.

- If your SAM.gov registration/DUNS number expired prior to April 2022, the county will be required to obtain a UEI before receiving its second tranche payment.

- Population threshold: A county’s population threshold is determined by Treasury at the award date and will NOT change during the reporting period. You can find your county’s reporting tier here.

- Edit and/or update previous report submissions: Counties can reopen and provide edits to submitted P&E Reports any time before the reporting deadline and will be required to re-certify the report to reflect any edits. After the reporting deadline, counties will be able to reflect changes in the next P&E Report.

- Additional programmatic data for capital expenditures: When using Recovery Funds for capital expenditures projects, counties need to report the type of expenditure based on a list of enumerated uses. Examples of enumerated uses are COVID-19 vaccination sites, job and workforce training centers, and public health data systems. A full list of enumerated uses is available on pages 27 to 28 of the updated guidance.

- Written justification for capital expenditures: Counties are required to provide a written justification for capital projects of any category that cost at least $10 million and for projects in the “other” (i.e., project not explicitly enumerated by Treasury) category that cost at least $1 million. Previously, counties needed to create a written justification for these projects but were not required to submit them as part of regular reporting.

- Description of labor requirements for capital expenditures: Counties are required to provide additional labor reporting. For projects that cost at least $10 million, counties will need to report on the strength of the project’s labor standards, including information on the presence of a project labor agreement, community benefits agreement, prevailing wage requirement, or local hiring. This new required information is outlined under Infrastructure Project on pages 30-31 of the updated guidance.

- Project information for broadband projects: The updated guidance requires counties to provide detailed project information for broadband infrastructure investments. Counties need to report what kind of technology is involved in the project (i.e., fiber optic cables, coaxial cables, etc.), the total miles of fiber deployed over the project, and the total number of funded locations served broken out by both speed of connection and type of location (i.e., residential, business, or community). This new required information is outlined under Broadband Projects on pages 32-33 of the updated guidance.

- Moving of Recovery Plan Performance Report data into P&E Report: Under the updated guidance, some of the data that was previously only required for the Recovery Plan Performance Report (Recovery Plan) is now required for large counties (i.e., populations above 250,000 and/or above $10 million in awards) on their quarterly P&E Report. For example, large counties investing in housing security programs must now report the number of households receiving eviction prevention services. A full list of changes to programmatic data requirements for large counties is available on page 33 of the compliance and reporting guidance.

- Updated template for Recovery Plan: The updated guidance also provides a template for the Recovery Plan due for large counties on July 31, 2022, reflecting the expenditure categories and other changes made by the Final Rule.

Overview of Subrecipients vs. Beneficiaries – Definitions and Reporting Requirements

The distinction between a subrecipient and beneficiary is contingent upon the rationale for why a recipient is providing funds to the individual or entity.

Definition

- Subrecipient: An entity that receives a subaward to carry out a project funded by Recovery Funds on behalf of the recipient (i.e. county).

- If a county is providing funds to the individual or entity for the purpose of carrying out an SLFRF-funded program or project on behalf of the county, the individual or entity is acting as a subrecipient.

- Beneficiary: If a county is providing funds to the individual or entity for the purpose of directly benefitting the individual or entity as a result of experiencing a public health impact or negative economic impact of the pandemic, the individual or entity is acting as a beneficiary.

- Individuals or entities that experienced the negative economic impact and are the recipients of a project funded by Recovery Funds. In other words, the households, small businesses, nonprofits, or impacted industries that experienced the negative economic impact.

Reporting requirements

- Subrecipients: All subrecipients are required to comply with all requirements of recipients such as treatment of eligible uses of funds, procurement and reporting requirements.

- Subrecipients are required to have an active SAM.gov registration and UEI number OR Taxpayer Identification Number (TIN), if unable to obtain a UEI

- Beneficiary: A beneficiary are not subject to subrecipient monitoring and reporting requirements.

- Beneficiaries are NOT required to register in SAM.gov and are not required to provide a UEI

Marijuana regulation is focus of webinar co-sponsored by MAC

County leaders are encouraged to register for the 17th session of a series of webinars co-sponsored by MAC, the Michigan Department of Treasury and other local government groups.

County leaders are encouraged to register for the 17th session of a series of webinars co-sponsored by MAC, the Michigan Department of Treasury and other local government groups.

“Updates and Resources for Local Governments” will focus this session, set to start at 2 p.m. on July 26, on:

- Marijuana Regulation and Planning– State and Local Requirements

- Strategic Planning

Participants can register and submit questions prior to the webinar by clicking here.

Presentations and recordings from this webinar, along with previous webinars, can be found at TREASURY – Webinars (michigan.gov). Utilize TREASURY – Contact Information (michigan.gov) for support related to Treasury’s local government services.

>div id=”naco”>

Big discount offered on NACo leadership training for county employees

The NACo High Performance Leadership Academy is offering a special, but brief, discount option for counties to enroll employees in upcoming classes.

The NACo High Performance Leadership Academy is offering a special, but brief, discount option for counties to enroll employees in upcoming classes.

This “5-for-$5,000” attendee benefit is offered for the length of NACo’s Annual Conference, which ends July 24 in Adams County, Colorado, and allows five employees of a county to enroll at $1,000 each.

The Professional Development Academy, which partners with NACo on this training, is tailoring sessions to help counties meet trending challenges, such as:

- employee retention

- talent attraction

- succession planning

- leadership development

Act fast, though, as the discount ends on July 24.

Staff picks

Staff picks

- This federal committee is watching over your pandemic funds spending (RouteFifty)

- Report: Local governments are satisfied with current hybrid work arrangement (American City and County)

- The simmering GOP criticism of state and local ARPA spending (RouteFifty)

- Detroit to put $10M toward open-access fiber network (Govtech.com)