Deadline is Aug. 31 for interim ARP spending reports

The U.S. Treasury is reminding counties that the deadline to submit both an Interim Report (all counties) and Recovery Plan Performance Report (counties with populations 250,000 and above) is Aug. 31. Below are some other important updates regarding ARP funding:

The U.S. Treasury is reminding counties that the deadline to submit both an Interim Report (all counties) and Recovery Plan Performance Report (counties with populations 250,000 and above) is Aug. 31. Below are some other important updates regarding ARP funding:

- Recovery Plan Performance Report Resources: U.S. Treasury has released a template for the Recovery Plan Performance Report, which is required ONLY for counties above 250,000 population.

- U.S. Treasury User Guide: U.S. Treasury released a user guide on State and Local Fiscal Recovery Fund recipient reporting portal. The guide contains step-by-step guidance for submitting the required Recovery Fund reports using Treasury’s portal, and should be used in conjunction with Treasury’s Compliance and Reporting Guidance for satisfying reporting and compliance requirements.

- Interim Report: Due by Aug. 31, 2021, the Interim Report requires all counties to report programmatic data for spending between March 3 and July 31, 2021. (This is a one-time report.) A county must submit an Interim Report even if it hasn’t obligated or spent any Recovery Funds. The county should submit a report showing no ($0) obligations or expenditures have yet been incurred. If the county received Recovery Funds AFTER July 15, 2021, the county must submit an Interim Report within 60 days of receiving funding.

- Project and Expenditure Report: These reports are also required for all counties (with two tiers, see below) and require project and expenditure data for awards and sub-awards, demographic information for each project and other programmatic data. Initial Project and Expenditure Report is due Oct. 31, 2021. For counties with awards above $5 million, project and expenditure reports are due quarterly For counties with awards under $5 million, project and expenditure reports are due annually

For any updates on ARP news and compliance, visit MAC’s ARP Resources page.

U.S. Senate approves $1T infrastructure bill; action moves to U.S. House

A $1 trillion federal infrastructure bill cleared the U.S. Senate this week in a bipartisan vote. The legislation, passed 69-30 with 19 Republicans joining all 50 Democrats, could be the nation’s biggest investment to improve infrastructure in decades. In the form now before the U.S. House of Representatives, it includes:

A $1 trillion federal infrastructure bill cleared the U.S. Senate this week in a bipartisan vote. The legislation, passed 69-30 with 19 Republicans joining all 50 Democrats, could be the nation’s biggest investment to improve infrastructure in decades. In the form now before the U.S. House of Representatives, it includes:

- $110 billion for roads and bridges

- $39 billion for public transit

- $66 billion for passenger and freight rail

- $7.5 billion for electric vehicles

- $65 billion for broadband access

- $65 billion to improve the nation’s power grid

- $25 billion for airports

- $55 billion on water infrastructure including, $15 billion to replace lead pipes and $10 billion to address PFAS contamination

However, Senate passage kicked off debate on a much larger $3.5 trillion spending bill backed by Democrats. House Speaker Nancy Pelosi intends to hold the infrastructure bill until the second bill is passed in the Senate through a process called reconciliation, which allows it to be passed by a simple majority. Work on these bills in Congress is expected to continue for some time.

Check out NACo’s resource for transportation and infrastructure: Federal Transportation & Infrastructure Policy Hub for Counties.

For more information on infrastructure polices, contact Deena Bosworth at bosworth@micounties.org.

Policy platform drafts are now ready for member review

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 28 at 9 a.m. in the Theater of the Grand Hotel during the 2021 Michigan Counties Annual Conference.

MAC’s Annual Business Meeting will be held on Tuesday, Sept. 28 at 9 a.m. in the Theater of the Grand Hotel during the 2021 Michigan Counties Annual Conference.

County commissioners who are registered for the conference may participate as voting members in the business meeting, which includes review and approval of MAC’s 2021-2022 policy platforms.

The platform process begins with MAC’s policy committees, which meet during the year to address key issues. Their drafts are then submitted to the MAC Board of Directors for review. The MAC Board then advances the drafts to the membership for final approval.

Those Board-vetted drafts are now available on the MAC website here. (Please note that this is a password-protected page. Each member county has a set of access credentials, which are shared each year with your county administrator. If you do not have your credentials, contact Hannah Sweeney at sweeney@micounties.org for them.)

According to MAC’s By-laws (Article III, Section 6):

“A member wishing to submit an amendment to the MAC Platform shall submit the amendment to MAC at least five (5) days prior to the opening day of the MAC Annual Conference. Such amendment will require a majority vote at the annual meeting to be adopted.

“An amendment to the MAC Platform may be presented from the floor during the annual meeting. Such amendment will require a 2/3 majority vote of the members at the meeting at which a quorum is initially established to be adopted.”

To submit a platform amendment in advance, draft your preferred language and email to sweeney@micounties.org no later than Sept. 21, 2021.

Taxes are topic of Podcast 83 interview with Citizens Research Council leader

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosts Eric Lupher of the Citizens Research Council.

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosts Eric Lupher of the Citizens Research Council.

MAC’s Deena Bosworth talks with Lupher about Michigan’s tax system, specifically as it relates to local government revenues, and the potential for reforms.

Click here to view the episode.

Members can view any previous episode of the podcast on the podcast webpage.

Confused on census data? NACo webinar is for you.

![]() An Aug. 18 webinar from the National Association of Counties (NACo) will address the data now coming out of the 2020 Census.

An Aug. 18 webinar from the National Association of Counties (NACo) will address the data now coming out of the 2020 Census.

“Guiding County Decisions: An Overview of Key Census Bureau Programs for Administrators, Executives and Managers” will run from 1 p.m. to 2 p.m. EST.

“County administrators, executives, and managers need reliable, accurate, and unbiased information to guide economic development, emergency management, and other decisions in their areas. The Census Bureau’s household and business programs can be a critical resource to meet this need. This session will provide an overview of key Census programs that provide data at the county level, including the American Community Survey, County Business Patterns and the Economic Census and an update on the data coming from the 2020 Decennial Census and when users can expect these data. Census experts will provide actual use cases of how these data can be used to guide decisions, including how counties can help their residents and businesses begin to recover from the Coronavirus pandemic.”

For details and registration, click here.

Still time to enroll in final 2021 cohort for Leadership Academy

Join the 1,700 counties and state associations already benefiting from the effectiveness of the NACo Leadership Academy, the 12-week, online leadership program led by General Colin Powell. Scholarships still available for you and your team.

Join the 1,700 counties and state associations already benefiting from the effectiveness of the NACo Leadership Academy, the 12-week, online leadership program led by General Colin Powell. Scholarships still available for you and your team.

MAC and NACo would like to acknowledge and congratulate the Michigan county graduates from the April cohort:

- Brian Bousley, Administrator/Controller, Dickinson County

- Sara Hough, Human Resources Manager, Muskegon County

- Jennifer Zywicki, Chief Deputy County Clerk, Leelanau County

The September cohort is right around the corner. Join us in investing in the county workforce.

To enroll or learn more, click here.

Developed by Gen. Colin Powell, the Professional Development Academy and NACo, the High Performance Leadership Academy is an online 12-week program that helps your workforce develop fundamental, practical leadership skills to deliver results for counties and our residents.

‘Fiscally Ready’ webinars resume on Aug. 25

County leaders are encouraged to attend two upcoming “Fiscally Ready Communities” webinars jointly presented by the Michigan Department of Treasury and Michigan State University Extension. Each FREE training is 90 minutes and designed to assist appointed and elected officials with entry and intermediate budgeting knowledge.

County leaders are encouraged to attend two upcoming “Fiscally Ready Communities” webinars jointly presented by the Michigan Department of Treasury and Michigan State University Extension. Each FREE training is 90 minutes and designed to assist appointed and elected officials with entry and intermediate budgeting knowledge.

Budgeting for Fiscal Sustainability*

This training will provide best practices for local governments’ fiscal health including budgeting, long-term planning, dealing with uncertainty, and financial policies and procedures.

This training will take place on Aug. 25 at 10 a.m.

Please register via the Budgeting for Fiscal Sustainability Event Registration page.

*Qualifies for MAC County Commissioner Academy credit for county commissioners.

Capital Asset Management and Planning Trainings

This will be the third and final presentation of this information and will cover the basics of a Capital Improvement Program (CIP), best practices, and give participants a chance to share techniques that have worked for their community. Additionally, the training will assist both elected and appointed local officials in outlining your policies and procedures for capital asset management and planning. This will ensure that their local government is being proactive, while discussing the interconnectivity of many local government requirements.

This training will take place on Dec. 9 at 6 p.m.

You may register via the Capital Asset Management and Planning Event Registration page.

County applications sought for new Housing Solutions Workshop

Four cities or counties with populations between 50,000 and 500,000 will be selected to attend the Housing Solutions Workshop, which has been developed by the NYU Furman Center’s Housing Solutions Lab, Abt Associates, and the Lincoln Institute of Land Policy. Each delegation will consist of 5–6 members, including senior leaders from different departments and agencies in local government and external partners that are essential to the city’s housing strategy.

The workshop is intended for cities or counties that are in the early stages of developing a comprehensive and balanced local housing strategy. The Housing Solutions Workshop will include eight 90-to-120-minute virtual training sessions and be held from Oct. 25 to Nov. 18, 2021.

Applications are due by Sept. 10, 2021.

Details and application here: https://www.localhousingsolutions.org/lab/workshop/.

Recycling grants now available; apply by Aug. 20

The Recycling Partnership and the Michigan Department of Environment, Great Lakes, and Energy (EGLE) want counties to know about an exciting grant opportunity totaling $575,000 that exists for communities statewide in 2021 to dramatically improve residential recycling.

The Recycling Partnership and the Michigan Department of Environment, Great Lakes, and Energy (EGLE) want counties to know about an exciting grant opportunity totaling $575,000 that exists for communities statewide in 2021 to dramatically improve residential recycling.

EGLE and The Partnership are encouraging elected officials and local government leaders to apply for these grants that can help Michiganders improve the quality of materials they recycle at curbside or drop-off locations, as well as reduce recycling contamination. All Michigan community recycling programs are eligible to apply for these grants from EGLE and The Partnership of up to $4 per household for curbside programs and up to $3 per household for drop-off programs.

Applications are due Aug. 20, 2021, and complete instructions can be found in the request for proposals at recyclingpartnership.org/michiganrfp.

Staff picks

Staff picks

Conference sessions to focus on leadership, budget, tourism

Darryl Ross

Keynote and plenary speakers for the 2021 Michigan Counties Annual Conference will focus on the themes of leadership, budget and tourism during the event’s largest sessions on Monday, Sept. 27.

Darryl Ross, an author and motivational speaker who speaks on leadership throughout the country, will be the Monday morning keynoter.

Ross’ fascinating career has taken him from the classrooms of James Madison University, to traveling the world as an entertainer and performer, to his singular passion of sharing his faith, knowledge and experience to motivate people to live their dreams. For the past 15 years, Ross has provided keynotes, presentations and trainings throughout the country to such groups as the Virginia Business Education Conference, the DCRA Management Expo and the Loudoun Water Leadership Conference.

Bethany Wicksall

Also speaking at the Monday morning Plenary session are two familiar faces for Michigan county leaders:

- MAC Executive Director Stephan Currie, who will provide his semi-annual “State of MAC” report

- MAC Governmental Affairs Director Deena Bosworth, who will present a “MAC Legislative Update” focused on priorities and challenges for the fall session days of the Michigan Legislature

Keynoting the Monday afternoon Plenary session will be Bethany Wicksall, who became deputy state budget director for Gov. Gretchen Whitmer in spring 2021.

A graduate of Michigan State University’s James Madison College, Wicksall oversees general operations of the State Budget Office, including direction of the budget development process. Prior to joining the State Budget Office, Wicksall worked 18 years in both the House and Senate fiscal agencies.

Dave Lorenz

Wicksall will provide county leaders an in-depth look at the state budget process, particularly as it relates to county funding.

Appropriately, considering the conference’s location at one of Michigan’s tourism capitals, the Monday sessions will close with a presentation on tourism and the Pure Michigan campaign by Dave Lorenz.

Lorenz serves as vice president of Travel Michigan where he is responsible for leading the state’s tourism branding, advertising and public relations efforts; overseeing the award-winning Pure Michigan tourism campaign; and coordinating overall statewide tourism initiatives. Prior to coming to Travel Michigan in October 2002, Lorenz was the Manager, Partnerships and Promotions, for Meijer, Inc.

Ferry discount offered for conference; early-bird, hotel deadlines loom

MAC and the Michigan County Medical Care Facilities Council are pleased to announce a deal with Shepler’s Ferry service for discounted ferry tickets for 2021 Annual Conference attendees.

MAC and the Michigan County Medical Care Facilities Council are pleased to announce a deal with Shepler’s Ferry service for discounted ferry tickets for 2021 Annual Conference attendees.

You will able to travel to Mackinac Island from either of Shepler’s locations in Mackinaw City or St. Ignace for a roundtrip price of $21 ($12 for children). You can make your reservation via Shepler’s website (www.sheplersferry.com) using the promo code MCMCFC2021 or by calling 800-828-6157 and referencing the MAC/MCMCFC conference.

County leaders who still have not registered for the conference or secured their hotel rooms are urged to do so soon, as key deadlines are approaching that significantly affect costs.

For example, the early-bird rate for the conference fee ends on Aug. 18. After that date, registrants will pay an extra $50 for the full conference member rate.

Even more important, the deadline to utilize the special conference room rates at Grand Hotel will expire on Aug. 26.

Even more important, the deadline to utilize the special conference room rates at Grand Hotel will expire on Aug. 26.

While the least expensive rooms in our block have been reserved, conference-goers can still secure a room at the historic hotel for $500 a night (double occupancy and not including taxes and fees). The room rate covers five meals and is approximately 50 percent cheaper than the regular rate for the hotel during the event dates of Sept. 26-28.

Secure your room now by going directly to Grand Hotel’s reservation portal with the special conference code already loaded.

For specific questions on conference logistics, you may contact conference@micounties.org.

County millage requests approved in August election

Voters in six Michigan counties approved all countywide millage questions placed before them in the Aug. 2, 2021, elections.

Voters in six Michigan counties approved all countywide millage questions placed before them in the Aug. 2, 2021, elections.

According to results collected by Gongwer News Services, millage proposal victories occurred in Chippewa, Houghton, Huron, Isabella, Kalkaska and Mackinac counties. Notable among the results were:

Passage in Houghton County of a millage renewal for the Canal View-Houghton County Medical Care Facility and millage increases in Isabella and Mackinac to support the 911 emergency communications system.

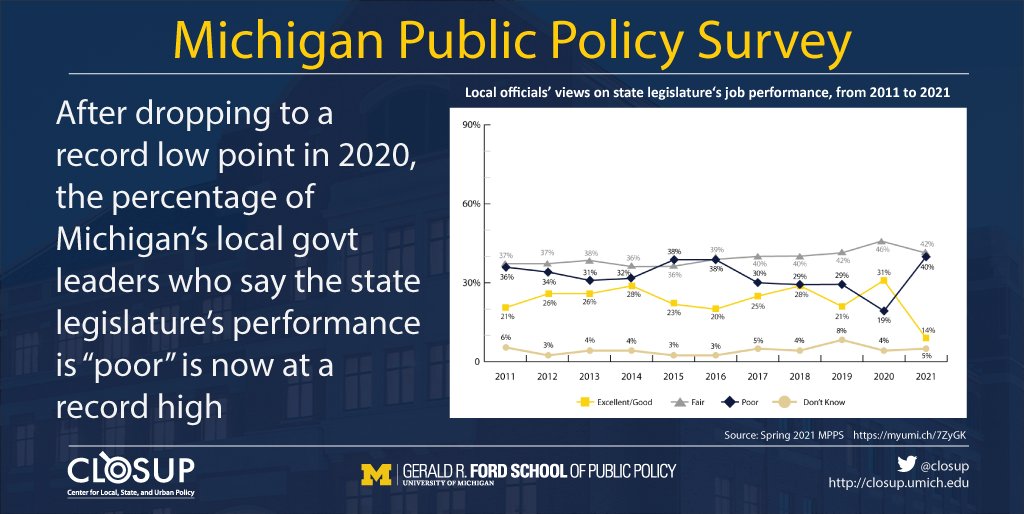

Local leaders express dim view on state trends in survey

About two out of three local government leaders responding to a recent survey said the state of Michigan has gotten on the wrong track, the highest level of pessimism reported since tracking began in 2011 said the Center for Local, State, and Urban Policy (CLOSUP) at the University of Michigan’s Gerald R. Ford School of Public Policy.

About two out of three local government leaders responding to a recent survey said the state of Michigan has gotten on the wrong track, the highest level of pessimism reported since tracking began in 2011 said the Center for Local, State, and Urban Policy (CLOSUP) at the University of Michigan’s Gerald R. Ford School of Public Policy.

Statewide, 67 percent of survey respondents said wrong track, while just 23 percent said the state is generally going in the right direction, a record low number. The past two years of surveys have seen significant swings in local leaders’ evaluations of the Legislature’s performance, first in the positive direction in 2020, but now sharply negative in April-May 2021, CLOSUP reported.

Despite the dim view of state and federal trends, local leaders tended to consistently give their local communities high marks. Statewide, 92 percent of both Republicans and Democrats say their own jurisdictions are headed in the right direction, as do 80 percent of Independents.

Staff picks

Staff picks

- What is in the new bipartisan infrastructure bill? (Governing)

- Seldom seen snapshots of American history (Governing)

- Overcrowding ‘jail emergency’ at Genesee County Jail nears one month, 94% of inmates unsentenced (MLive)

- As Alpena-area landfills fill up, leaders push for better recycling (Alpena News)

Supreme Court hands state a win over locals in Headlee case

In a blow to local governments, the Michigan Supreme Court sided with the state in a constitutional argument over what dollars should count toward the state’s mandated share of revenue spent on local governments. The ruling, in the case of Taxpayers for Michigan Constitutional Government v State of Michigan, found that post-Proposal A school funding from the state can be counted toward the state’s minimum Headlee Amendment payment to local governments.

In a blow to local governments, the Michigan Supreme Court sided with the state in a constitutional argument over what dollars should count toward the state’s mandated share of revenue spent on local governments. The ruling, in the case of Taxpayers for Michigan Constitutional Government v State of Michigan, found that post-Proposal A school funding from the state can be counted toward the state’s minimum Headlee Amendment payment to local governments.

This refers to Section 30 of the Headlee Amendment adopted by the voters in 1978:

“Section 30 provides that the proportion of state spending devoted to local governments shall not be less than the proportion in effect in FY 1978-79, the year in which the Headlee amendment passed,” explains this 2017 report from Public Sector Consultants. “That year, local aid as a share of state spending was 41.6 percent; some years later, in the aftermath of a suit brought by Oakland County, the local share was recalculated and set at 48.97 percent.”

Plaintiffs in the case had argued the state has miscalculated the payments owed by including the amount it pays school districts, which were primarily locally funded prior to Proposal A. This shift to state payments altered the formula and therefore lessened the required payments to local governments. However, the court rejected that argument.

The decision did leave one small portion of the case still open: the amount of money that is sent to public school academies. This issue has been sent back to the Michigan Court of Appeals for consideration.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

U.S. Senate votes to consider $1 trillion infrastructure plan

A $1 trillion federal infrastructure proposal cleared a key procedural hurdle on Capitol Hill this week when the U.S. Senate voted to begin formal consideration of the issue.

A $1 trillion federal infrastructure proposal cleared a key procedural hurdle on Capitol Hill this week when the U.S. Senate voted to begin formal consideration of the issue.

The 67-32 procedural vote, with 17 Republicans joining all 50 Democratic-aligned senators, occurred after a bipartisan work group hammered out the broad elements of the proposal, including:

- $110 billion for roads and bridges (the $40 billion for bridges is the single largest dedicated bridge investment since the construction of the Interstate highway system, reports the Associated Press)

- $39 billion for public transit

- $66 billion for passenger and freight rail

- $7.5 billion for electric vehicle charging stations

- $5 billion for the purchase of electric school buses and hybrids

- $17 billion for ports

- $25 billion for airports

Much more work is required in Washington, D.C., before these proposals become reality, as the actual text of a bill has yet to be written, much less approved.

For more information on infrastructure policies, contact Deena Bosworth at bosworth@micounties.org.

Regional Summits finish up with stops in Escanaba, Gaylord

The 2021 MAC Regional Summit series conclude this week with large crowds at stops in Escanaba and Gaylord, with county leaders receiving briefings on ARP funding, risk management and more.

The 2021 MAC Regional Summit series conclude this week with large crowds at stops in Escanaba and Gaylord, with county leaders receiving briefings on ARP funding, risk management and more.

In all, nearly 140 county officials attended one of the four summits, one-day events designed to give commissioners and others a quick look at key public policy topics.

Presentation slides will be posted to MAC’s website and shared with members next week, but for those who were not able to attend, you can view video feeds from two of the presentations at Thursday’s Gaylord site:

- Community Foundations: Your Partners in Economic Development

- Why Affordable Housing Should Have Your County’s Attention

“We were pleased with the turnout at all four sites, especially in light of the trends on COVID-19,” said MAC Executive Director Stephan Currie. “That’s proof our members are eager to learn more about addressing the challenges they face in their home counties.”

Courts office wants input from county leaders

County leaders are encouraged to provide feedback on court operations during the pandemic via a survey from the State Court Administrative Office (SCAO).

County leaders are encouraged to provide feedback on court operations during the pandemic via a survey from the State Court Administrative Office (SCAO).

Please read the memo requesting your comments and feedback requesting your comments and feedback regarding the report about Lessons Learned from the Pandemic of 2020-2021 and the report about Open Courts, Media, and Privacy.

“We have an opportunity now to make decisions that will shape the judiciary for a generation or more,” explained State Court Administrator Thomas P. Boyd, “and these reports are designed to spur the conversation. Your opinion matters and the time to speak up is now!”

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

Jackson County administrator picked for Indigent Defense Commission

Jackson County Deputy Administrator Debra Kubitskey will soon add another county voice to the Michigan Indigent Defense Commission (MIDC), after her nomination by Senate Majority Leader Mike Shirkey (R-Jackson) was approved by Gov. Gretchen Whitmer.

Jackson County Deputy Administrator Debra Kubitskey will soon add another county voice to the Michigan Indigent Defense Commission (MIDC), after her nomination by Senate Majority Leader Mike Shirkey (R-Jackson) was approved by Gov. Gretchen Whitmer.

Kubitskey will serve for a term running from July 22, 2021, to April 1, 2025. Kubitskey holds a bachelor’s degree from Central Michigan University and an MPA from Eastern Michigan University.

The appointment is not subject to the advice and consent of the Senate. Kubitskey’s first MIDC meeting is Aug. 17 at 9 a.m.

Other county leaders on the commission who were nominated by MAC are Margaret McAvoy, Isabella County administrator, and Andrew DeLeeuw, executive assistant to the Washtenaw County administrator.

For more information on indigent defense issues, contact Meghann Keit-Corrion at keit@micounties.org.

Staff picks

Staff picks

State reviewing $26 billion settlement offer on opioids

A bipartisan group of state attorneys general revealed a $26 billion national settlement this week with drugmaker Johnson & Johnson and three companies that distributed opioid painkillers. Michigan Attorney General Dana Nessel announced Michigan could see up to $800 million of the grand total. Nessel has 30 days to review the documents and decide to sign on to the settlement. After that, local units of government will have 150 days to do the same.

A bipartisan group of state attorneys general revealed a $26 billion national settlement this week with drugmaker Johnson & Johnson and three companies that distributed opioid painkillers. Michigan Attorney General Dana Nessel announced Michigan could see up to $800 million of the grand total. Nessel has 30 days to review the documents and decide to sign on to the settlement. After that, local units of government will have 150 days to do the same.

Details released at this point are as follows:

Funding overview

- The three distributors collectively will pay up to $21 billion over 18 years.

- Johnson & Johnson will pay up to $5 billion over nine years with up to $3.7 billion paid during the first three years.

- The total funding distributed will be determined by the overall degree of participation by both litigating and non-litigating state and local governments.

- The substantial majority of the money is to be spent on opioid treatment and prevention.

- Each state’s share of the funding has been determined by agreement among the states using a formula that takes into account the population of the state along with the impact of the crisis on the state – the number of overdose deaths, the number of residents with substance use disorder, and the number of opioids prescribed.

Injunctive relief overview

Requires Cardinal, McKesson and AmerisourceBergen, through court orders, to:

- Establish a centralized independent clearinghouse to provide all three distributors and state regulators with aggregated data and analytics about where drugs are going and how often, eliminating blind spots in the current systems used by distributors.

- Use data-driven systems to detect suspicious opioid orders from customer pharmacies.

- Terminate customer pharmacies’ ability to receive shipments, and report those companies to state regulators, when they show certain signs of diversion.

- Prohibit shipping of and report suspicious opioid orders.

- Prohibit sales staff from influencing decisions related to identifying suspicious opioid orders.

- Require senior corporate officials to engage in regular oversight of anti-diversion efforts.

Requires Johnson & Johnson, through court orders, to:

- Stop selling opioids.

- Not fund or provide grants to third parties for promoting opioids.

- Not lobby on activities related to opioids.

- Share clinical trial data under the Yale University Open Data Access Project.

While this has been a long-awaited settlement, there is still much in the process to come. MAC will continue to be a resource for counties as needed regarding this matter. Please reach out to Meghann Keit-Corrion at keit@micounties.org with any questions.

Wayne’s Bell, Shiawassee’s Webster picked for juvenile justice group

Alisha Bell of Wayne County and Marlene Webster of Shiawassee County were named this week to the state’s Task Force on Juvenile Justice Reform, Gov. Gretchen Whitmer’s office announced.

Alisha Bell of Wayne County and Marlene Webster of Shiawassee County were named this week to the state’s Task Force on Juvenile Justice Reform, Gov. Gretchen Whitmer’s office announced.

In June 2021, Whitmer signed Executive Order 2021-6 creating the Task Force on Juvenile Justice, which will be chaired by Lt. Gov. Garlin Gilchrist and “will focus on analyzing our juvenile justice system, while recommending proven practices and strategies for reform grounded in data, research, and fundamental constitutional principles.”

“Reimagining Michigan’s juvenile justice system will take collaboration, innovation, and information,” said Michigan Supreme Court Justice Elizabeth T. Clement, who will serve on the panel and who spoke on juvenile justice issues at MAC’s 2021 Legislative Conference. “We will make Michigan a national leader in providing the support children need to stay out of the criminal justice system and on a path to success.”

Bell, chair of Wayne’s commission and a board member of the National Association of Counties (NACo) has long been active in criminal justice and juvenile justice issues. In recent years, she has advocated for cash bond reform and initiated the Stepping Up resolution which diverts people with mental illness and substance abuse from jails and into treatment.

“I look forward to working with other task force members to find ways to help young people by creating reforms that will help them find better paths to success,” Bell said in a statement.

Bell and Webster, who will represent counties with fewer than 100,000 residents, will serve terms through July 2023.

For more information on MAC’s juvenile justice positions, contact Meghann Keit-Corrion at keit@micounties.org.

Podcast 83 discusses community-building with foundation leaders

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosted Kyle Caldwell of the Council of Michigan Foundations and Diana Sieger of the Grand Rapids Community Foundation.

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosted Kyle Caldwell of the Council of Michigan Foundations and Diana Sieger of the Grand Rapids Community Foundation.

MAC’s Steve Currie talked with them about foundation-county opportunities with American Rescue Plan funds.

Click here to view the episode.

Members can view any previous episode of the podcast on the podcast webpage.

Regional Summits held in Grand Rapids, Frankenmuth

MAC’s Deena Bosworth discusses legislative issues with attendees at the July 22 summit in Frankenmuth.

About 60 county leaders gathered in two locations this week as MAC resumed in-person events with its 2021 Regional Summit series.

The summits are one-day events designed to give commissioners and others a quick look at key public policy topics. This week’s sessions, in Grand Rapids and Frankenmuth, for example, focused heavily on the effects of COVID-19, both in how counties can best utilize federal aid and protect their work forces as the virus still rages.

“It was good to be able to gather county leaders again, since an important part of these sessions is the opportunity for commissioners from different counties to share concerns and tips with each other,” said Executive Director Stephan Currie.

The 2021 summit series wraps up next week with sessions in Escanaba (July 26) and Gaylord (July 29). You can still register for the July 29 session by sending an email to conference@micounties.org.

Once the summits are complete, presentation slides will be posted to MAC’s website and shared with members.

Legislature uses referendum to repeal 1945 law on emergency powers

Acting on a referendum petition from the group Unlock Michigan, the Republican-led Legislature this week completed the repeal of the Emergency Powers of Governor Act of 1945, the law Gov. Gretchen Whitmer used extensively in 2020 to issue emergency orders on COVID-19.

Acting on a referendum petition from the group Unlock Michigan, the Republican-led Legislature this week completed the repeal of the Emergency Powers of Governor Act of 1945, the law Gov. Gretchen Whitmer used extensively in 2020 to issue emergency orders on COVID-19.

The Michigan Supreme Court had previously declared the act unconstitutional.

Under Article II, Section 9 of the Michigan Constitution, residents can move a referendum petition on an act of the Legislature. The Legislature then has 40 days to act on the petition or the matter goes to the voters. The Senate supported petition’s call for repeal on a party line 20-15 vote, while the House approved it 60-48, with four Democrats voting with Republican majority. Under the referendum process, the governor cannot veto these actions. The House voted for the repeal to take effect immediately, however the Senate did not, so the official repeal of the act will occur 90 days after the Legislature formally adjourns during the current legislative session.

Staff picks

Shotwell, longtime Jackson commissioner, passes (MLive.com)

Shotwell, longtime Jackson commissioner, passes (MLive.com)

- Employee leave in the public sector: Current challenges and solutions (UKG.com)

- COVID-19 pandemic takes a bite out of state motor fuel taxes (Citizens Research Council)

- As electric vehicles take off, states test taxing options (Governing)

MAC urges counties to announce support for ARP match program

MAC is working with the state of Michigan and local government groups on a match program to earmark close to $4 billion in state American Rescue Plan (ARP) funds to invest, amplify and leverage the influx of federal funding to local governments.

MAC is working with the state of Michigan and local government groups on a match program to earmark close to $4 billion in state American Rescue Plan (ARP) funds to invest, amplify and leverage the influx of federal funding to local governments.

Michigan will receive more than $10 billion in fiscal recovery aid, with all 83 counties slated to get $1.9 billion in direct ARP funds. Cities and larger townships will receive $1.8 billion and non-entitlement communities (smaller units) will receive approximately $644 million. Michigan has a chance to leverage all levels of government to strategically invest in areas of the greatest need of improvement. By creating multi-sector partnerships, we can accelerate the impact of the one-time ARP funds.

MAC sees great potential in this situation to invest in Michigan’s future in five key areas: water infrastructure and broadband, local capacity and fiscal stability, housing and community development, comprehensive economic development, and public health and safety.

MAC asks counties to add their voices to this effort by passing resolutions of support. Please see a sample resolution here. If you pass such a resolution, please send a copy to Hannah Sweeney at sweeney@micounties.org.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Spending bill includes money for Secondary Road Patrol

The Michigan Senate this week adopted a supplemental spending bill to spend $385 million for the current budget year, which runs through Sept. 30.

The Michigan Senate this week adopted a supplemental spending bill to spend $385 million for the current budget year, which runs through Sept. 30.

Senate Bill 27, by Sen. Jim Stamas (R-Midland), includes $100 million of federal Coronavirus State Fiscal Relief funds to provide a $23 per Medicaid day increase “in reimbursement to skilled nursing facilities that have experienced a 5.0% or greater facility average daily census decline during the first three calendar quarters of 2021 as compared to the average daily census in each facility’s 2019 Medicaid cost report.”

The bill, now on its way to the governor, also includes $2.7 million to support Secondary Road Patrol and $105 million in federal funding to increase child care provider reimbursement rates for child care centers, group home providers, registered family homes and licensed exempt providers.

Lastly, the measure also draws $10 million from the state’s General Fund for emergency and disaster response to cover costs related to last month’s flooding events.

Senate leader files bills to revamp state mental health system

Bills to revamp Michigan’s public mental health system were filed this week by Senate Majority Leader Mike Shirkey (R-Jackson) which would shift Michigan’s system away from public oversight and shift responsibility for managing public services and supports to private health plans.

Bills to revamp Michigan’s public mental health system were filed this week by Senate Majority Leader Mike Shirkey (R-Jackson) which would shift Michigan’s system away from public oversight and shift responsibility for managing public services and supports to private health plans.

Senate Bills 597 and 598, by Shirkey and Sen. John Bizon (R-Calhoun) respectively, introduce “specialty integrated plans (SIPS),” defined as a managed care organization, which the state would contract with to manage services for Medicaid beneficiaries. The bill outlines a phased timeline in which enrollee would transition to the SIPs.

MAC opposes the legislation as introduced. MAC has long held the position that the public mental health system should have adequate state funding and local control and oversight by our counties to ensure quality and accessible services for all residents.

The House Appropriations Subcommittee on the Department of Health and Human Services, led by Rep. Mary Whiteford (R-Allegan), has its own unique proposal related to community mental health system redesign. Please see the May 28 Legislative Update for details on the House plan.

MAC will work with the Legislature and stakeholders to ensure county voices are heard throughout the process.

For more information on this issue, contact Meghann Keit-Corrion at keit@micounties.org.

State Rep. Calley discusses budget work, 4-year terms with Podcast 83

State Rep. Calley discusses budget work, 4-year terms with Podcast 83

MAC’s Podcast 83 team is taking a summer hiatus from live broadcasts. In the latest of a series of newsmaker interviews for the summer, Podcast 83 hosts Rep. Julie Calley (R-Ionia).

In this episode, MAC’s Deena Bosworth and Meghann Keit-Corrion talk with Calley about work on the fiscal 2022 state budget, the prospects for legislation allowing 4-year terms for county commissioners and much more.

Click here to view the episode.

Members can view any previous episode of the podcast on the podcast webpage.

MAC officers lead state delegation to NACo gathering

A delegation of Michigan commissioners led by MAC President Veronica Klinefelt of Macomb County and First Vice President Phil Kuyers of Ottawa County attended the 2021 NACo Annual Conference July 9-12 near Washington, D.C.

A delegation of Michigan commissioners led by MAC President Veronica Klinefelt of Macomb County and First Vice President Phil Kuyers of Ottawa County attended the 2021 NACo Annual Conference July 9-12 near Washington, D.C.

Michigan members joined colleagues in voting on National Association of Counties policy platforms and in various committee meetings and policy briefings. More than 1,700 county leaders attended NACo’s first major in-person gathering since the COVID-19 pandemic erupted.

During the conference, NACo also announced committee leadership appointments for the 2021-22 year. Michigan commissioners selected are:

- Stan Ponstein, Kent, vice chair, Arts and Culture Commission; vice chair, Land Management Subcommittee of Public Lands Steering Committee.

- William Miller, Oakland vice chair, Community, Economic and Workforce Development Steering Committee

- Monica Sparks, Kent, vice chair, Membership Standing Committee; vice chair, Behavioral Health Subcommittee of Health Steering Committee

- Bronwyn Asplund, Clare, vice chair, Aging Subcommittee of Human Services and Education Steering Committee

For more information on NACo committees, click here.

Marquette’s Corkin honored by colleagues

Gerry Corkin, who has served more than 30 years as the chair of the Marquette County Board of Commissioners, was honored in June with the naming of street. Gerald Corkin Drive will provide access to the local airport and the SEI Facility, among other locations.

Gerry Corkin, who has served more than 30 years as the chair of the Marquette County Board of Commissioners, was honored in June with the naming of street. Gerald Corkin Drive will provide access to the local airport and the SEI Facility, among other locations.

Corkin, who served on the MAC Board of Directors in the ’00s, first joined the Marquette board in 1985 and has been a diligent supporter of MAC’s policy work and fixture at MAC conferences and events.

Congratulations to Commissioner Corkin!

State seeks input on treating opioid use disorder

The Michigan Department of Health and Human Services (MDHHS) has launched a survey on buprenorphine prescribing practices, barriers and facilitators for the treatment of opioid use disorder. MDHHS sent a survey invitation email to all X-waivered providers in Michigan. This email includes a link to the survey along with a unique identifier code that must be entered at the beginning of the survey.

The Michigan Department of Health and Human Services (MDHHS) has launched a survey on buprenorphine prescribing practices, barriers and facilitators for the treatment of opioid use disorder. MDHHS sent a survey invitation email to all X-waivered providers in Michigan. This email includes a link to the survey along with a unique identifier code that must be entered at the beginning of the survey.

The survey can be completed in 25 minutes or less. Upon completion, you will have the option to receive a $20 gift certificate or donate $20 to a charitable organization. Your participation in this survey will be instrumental to informing revisions to the state’s Substance Use Disorder Service Program administrative rules.

You can access the survey here: https://www.surveymonkey.com/r/MDHHS-Xwaiver

For additional information, please visit this survey overview webpage. If you have any questions about the survey or did not receive a survey invitation email, please email Valencia Lyle, the survey lead, at lylev@michigan.gov.

Staff picks

Staff picks

- How one county commissioner is tackling rural vaccine hesitancy (NACo County News)

- Local tax limitations can hamper fiscal stability of cities and counties (Pew Trusts)

- Michigan Corrections and Population Data 2000-2019 (chart) (Senate Fiscal Agency)

- Yes, mosquitoes are worse in Michigan this summer. And it ain’t over (Bridge Magazine)